User Reviews

More

User comment

3

CommentsWrite a review

2024-03-22 17:57

2024-03-22 17:57

Score

5-10 years

5-10 yearsRegulated in United Kingdom

Market Making License (MM)

Global Business

High potential risk

Influence

Add brokers

Comparison

Quantity 9

Exposure

Score

Regulatory Index8.06

Business Index7.60

Risk Management Index0.00

Software Index7.25

License Index8.07

Single Core

1G

40G

More

Company Name

Santander UK plc

Company Abbreviation

Santander

Platform registered country and region

United Kingdom

Company website

Company summary

Pyramid scheme complaint

Expose

I deposited $146 on this platform and transferred $4030 from suouesta. But my account was blocked.

Xiao Peng began to gain the trust of members through lectures, and step by step induced everyone to register for the fake Santander website: https://www.santanderfx.com. Starting from depositing money, he induced everyone to buy gold and crude oil, and finally directly controlled the platform to liquidate their positions! They lied about a hacker attack and no one can withdraw money. The website is currently unavailable! This is pure fraud. Please be sure to unite and contact me on WeChat to wipe out the Xiao Peng gang together to prevent more people from being deceived!

I first deposited money into this broker and made some money at the beginning. I tried to withdraw 200u, I was still able to withdraw money smoothly. Later, they operated the K-line, I lost money directly, leaving only a little bit of principal. Then they induced me to deposit money again until I ran out of money, and directly controlled the K-line. Crude oil fell directly from 72 to single digits, and gold was cut in half. I hope no one will be scammed again.

Can only find the genuine to send exposure information, this site is fake, can not withdraw. Has burst the position to obtain the user's assets, now can not withdraw, everyone should keep our own rights, join the following group, more people power big rights, do not let go of the Xiao Peng, this gang.

I was also deceived by Xiao Peng, fake Santander, now has a burst position, has been unable to withdraw funds, Santander has been unable to log in.

I registered this account using the code given to me by the recommender. Now I don't know if it's the platform policy or what. Originally, the reason why I couldn't withdraw money was because I hadn't paid taxes on my profits. I need to pay 20% of the profit to withdraw money. But I still can't withdraw money after paying the taxes. The platform also said that the money associated with the account was not paid. What kind of policy is this? My own taxes and my account have been paid, but I cannot withdraw funds yet. I can't understand. The person who recommended me now is always saying that he has no money to pay and has been out of contact. I couldn't withdraw my principal, and I paid another 20563 usd in taxes!

Xiao Peng's fraud team uses lectures to deceive our trust and induces us to download the mt5 platform. He persuades us to choose the Santander trader and conduct copy trading! The malicious marking caused us to liquidate our positions. The trading platform was hacked last Thursday and we were unable to withdraw cash. Furthermore, the chat group was suddenly disbanded and blacklisted! Withdrawal is currently unavailable! I have called the police. The police has accepted the case and has been sorting out relevant information.

I can only post the exposure information under the official ones. The ones marked below are official. The platform I deposited is fake. The address of the fraudulent and fake platform: is https://www.santanderfx.com It has been liquidated to obtain the user's assets. I am now unable to withdraw funds.

| Santander Review Summary | |

| Founded | 2003 |

| Registered Country/Region | United Kingdom |

| Regulation | Exceeded |

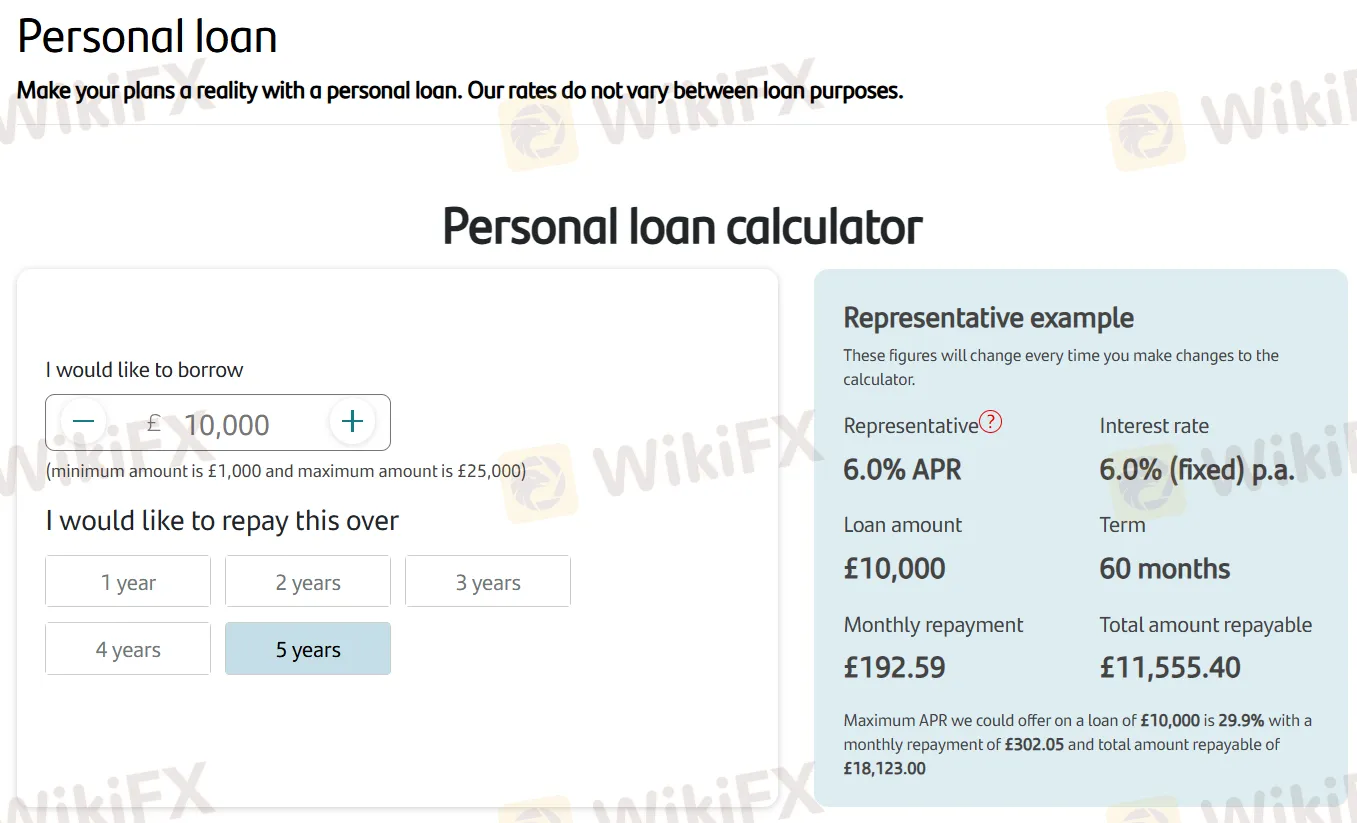

| Products and Services | Mortgages, Credit Cards, Savings and ISAs, Investments, Insurance, Personal Loans, Current Accounts |

| Trading Platform | Online Banking, Mobile Banking app |

| Min Deposit | Not mentioned |

| Customer Support | 24/7 Live chat |

Santander, founded in 2003 and registered in the UK, is an online trading platform that offers many financial services accessible through online and mobile banking. While the Investment Advisory License is now exceeded, this platform provides diverse products including mortgages, credit cards, savings, ISAs, investments, insurance, and personal loans, alongside various current account options.

| Pros | Cons |

|

|

|

|

Santander once had an Investment Advisory License regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 106054, but now it is exceeded. The WHOIS search shows the domain santander.co.uk was registered on August 14, 2003.

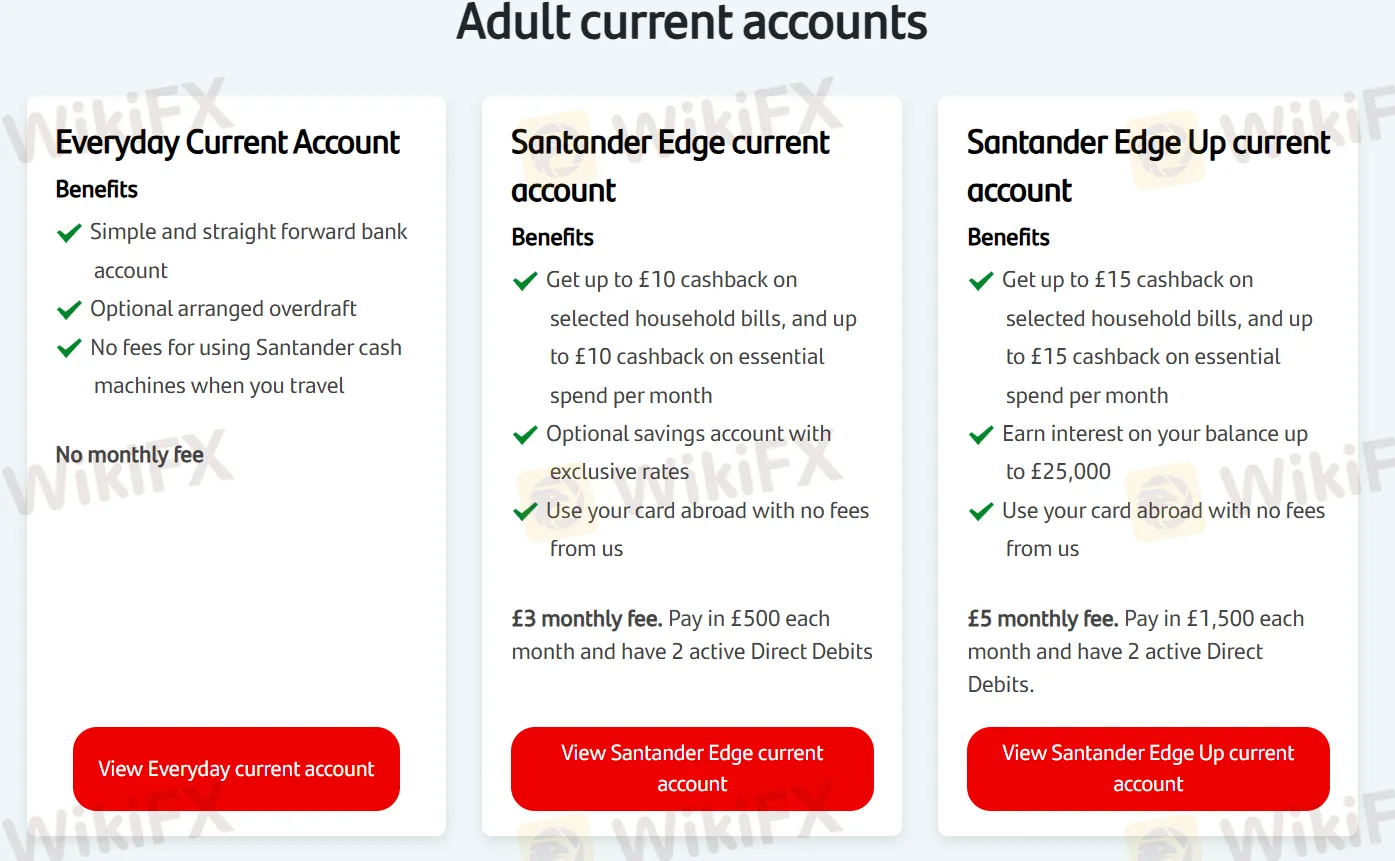

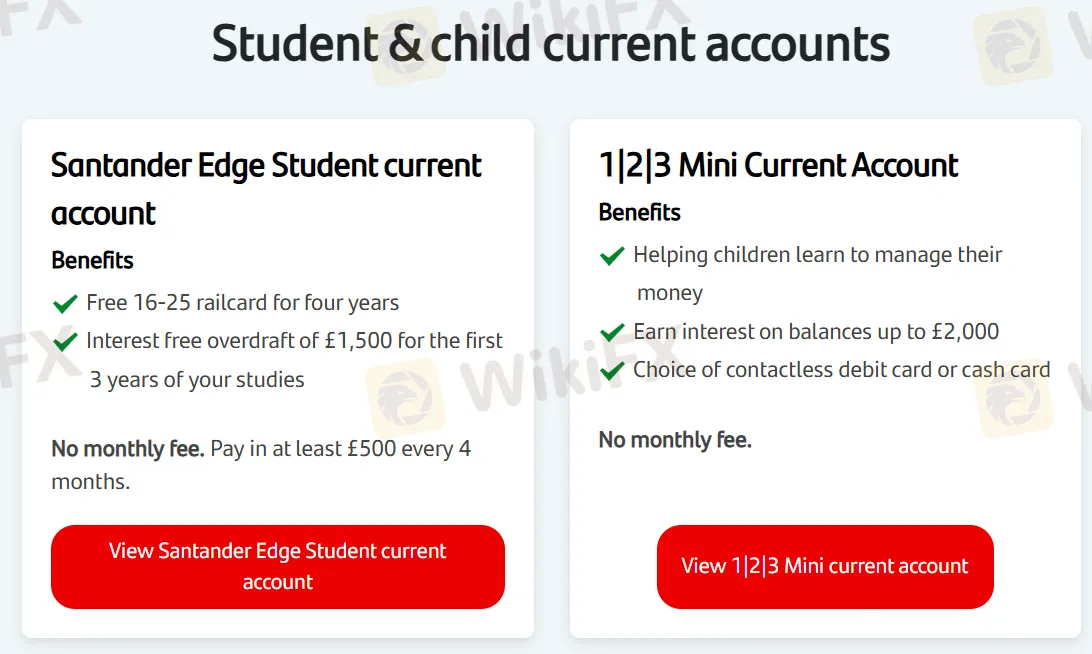

| Account Name | Benefits | Monthly Fee | Key Requirements |

| Everyday Current Account | Simple bank account, optional overdraft, no fees at Santander ATMs abroad. | No fee | None explicitly stated. |

| Santander Edge current account | Up to £10 cashback on bills & essential spend, optional savings account with exclusive rates, no card usage fees abroad from Santander. | £3 | Pay in £500/month and have 2 active Direct Debits. |

| Santander Edge Up current account | Up to £15 cashback on bills & essential spend, earn interest on balances up to £25,000, no card usage fees abroad from Santander. | £5 | Pay in £1,500/month and have 2 active Direct Debits. |

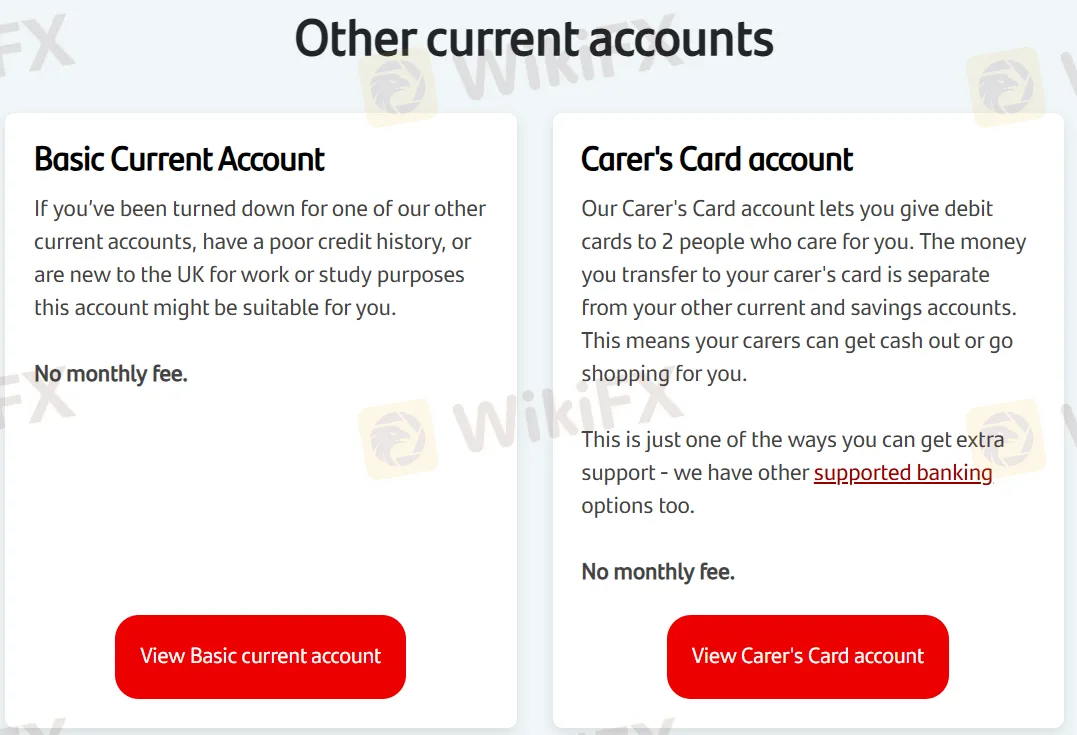

Other current accounts

| Trading Platform | Supported | Available Devices | Suitable for |

| Online Banking | ✔ | PC and Mobile | Investors of all experience levels |

| Mobile Banking app | ✔ | IOS and Android | Investors of all experience levels |

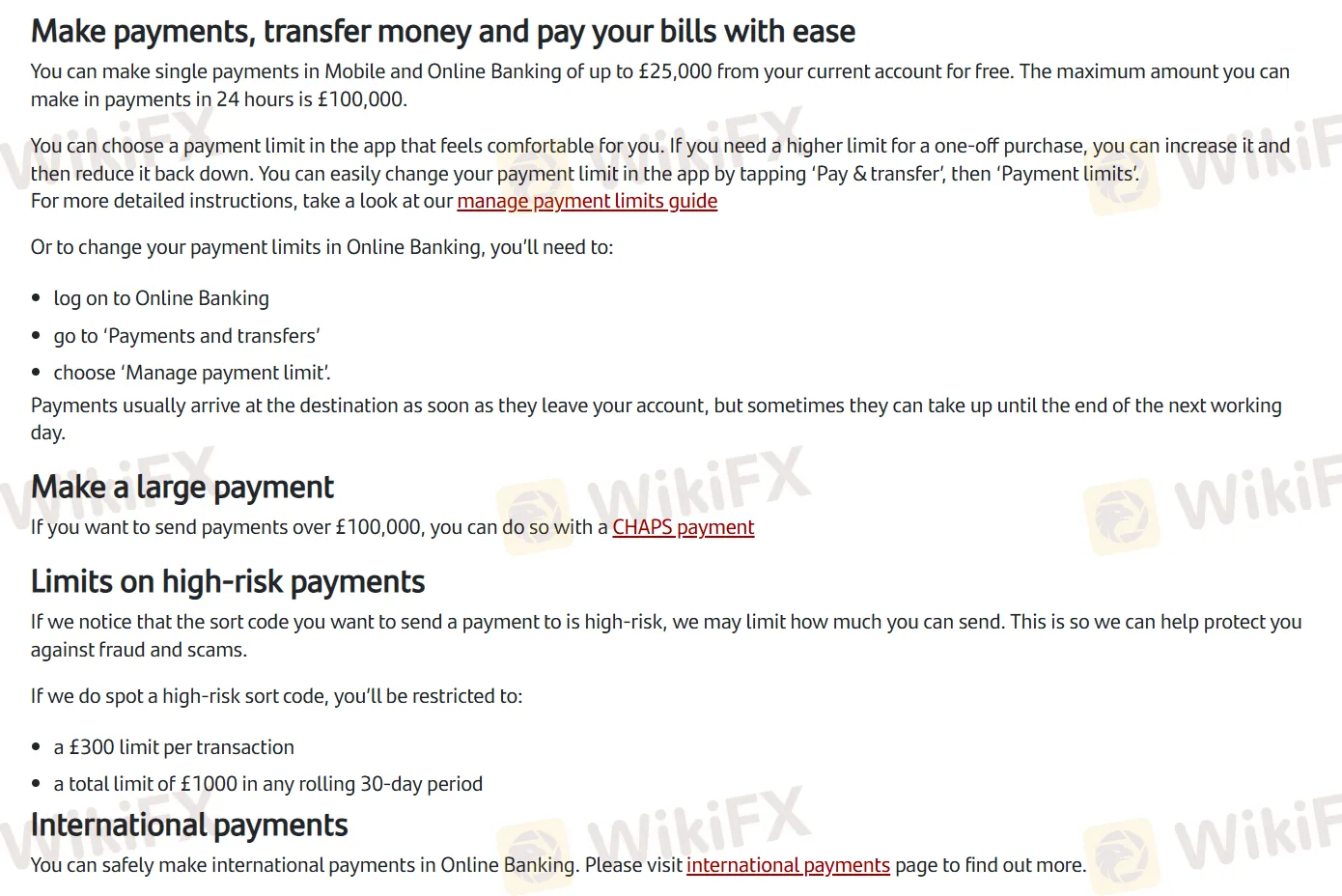

Deposit/Withdrawal Fees and Minimum Deposit are not mentioned on the website. But you should pay attention to:

Scam allegations never stop for Santander, a UK-based forex broker. According to traders, its officials work in unity to trick them into investing and dupe them later. The cases of withdrawal delays and poor customer support service have been highlighted by traders on various broker review platforms. So, if you wish to partner with Santander for forex trading, think again! In this article, we will highlight the comments made by the traders here. Read on!

WikiFX

WikiFX

Santander unveils a substantial €1.46B share buyback scheme and dividend hike. Discover how these strategic moves aim to fortify investor trust and drive shareholder value.

WikiFX

WikiFX

Santander Asserts Compliance Amid Financial Times' Claims on Iran-Linked Accounts: Get the latest updates on the bank's stance and commitment to international financial regulations.

WikiFX

WikiFX

Santander's Q4 net profit soars 28% to €2.93B, driven by robust lending in Europe and Brazil, surpassing analyst expectations and highlighting strategic growth.

WikiFX

WikiFX

More

User comment

3

CommentsWrite a review

2024-03-22 17:57

2024-03-22 17:57