ROYAL TRADES Spreads, leverage, minimum deposit Revealed

Abstract:Royal Trades is allegedly a forex broker registered in the United Kingdom that claims to provide its clients with flexible leverage up to 1:1000 and floating spreads from 0.8 pips on the MT4 and Webtrader trading platforms via four different live account types.

Note: Royal Trades is to operate via the website - https://royal-trades.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No Regulation |

| Market Instrument | forex currency pairs |

| Account Type | Standard, Gold, Premium and Platinum |

| Demo Account | N/A |

| Maximum Leverage | Standard & Gold & Premium: 1:1000 | Platinum: 1:500 |

| Spread | Standard: from 1.8 pips | Gold: from 1.6 pips | Premium: from 1.2 pips | Platinum: from 0.8 pips | EUR/USD: 3 pips |

| Commission | N/A |

| Trading Platform | MT4 & Webtrader |

| Minimum Deposit | €1,000 |

| Deposit & Withdrawal Method | Credit/Debit cards, Fluterware, Interkassa, OAcquiring, MPSPay and Crypto converter |

Royal Trades is allegedly a forex broker registered in the United Kingdom that claims to provide its clients with flexible leverage up to 1:1000 and floating spreads from 0.8 pips on the MT4 and Webtrader trading platforms via four different live account types. Here is the home page of this brokers official site:

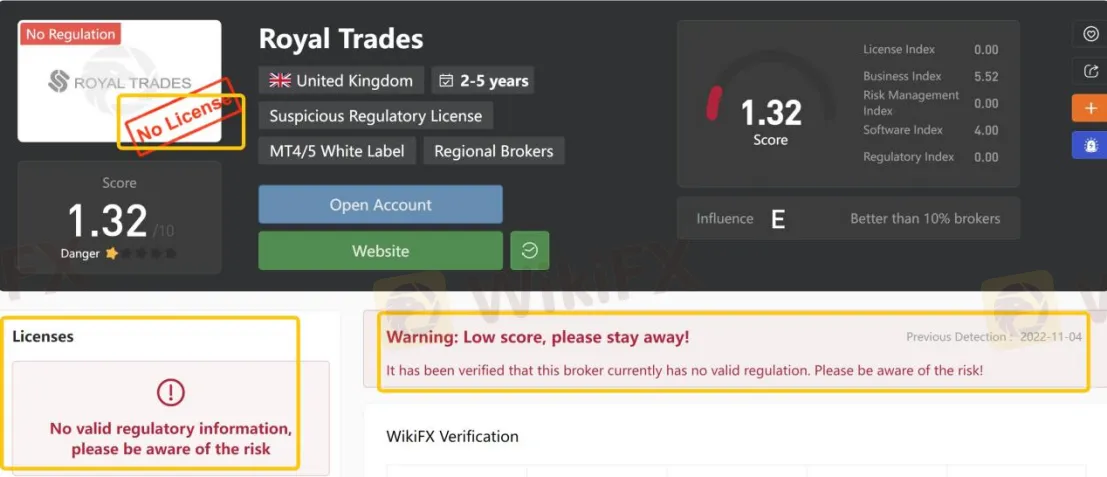

As for regulation, it has been verified that Royal Trades currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.32/10. Please be aware of the risk.

Market Instruments

Royal Trades advertises that it is a forex broker that mainly offers forex currency pairs trading. However, more specific information about tradable assets cannot be found on the Internet.

Account Types

Royal Trades claims to offer four types of trading accounts - Standard, Gold, Premium and Platinum, with minimum initial deposit requirements of €1,000, €5,000, €10,000 and €25,000 respectively. In comparison, licensed brokers allow setting up a starter account with a minimum deposit of $100 or even less.

Leverage

The leverage provided by Royal Trades is adjusted based on the account type. For example, clients on the Standard, Gold and Premium accounts can enjoy the maximum leverage of 1:1000, while the Platinum account can experience a leverage of 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads

All spreads with Royal Trades are a floating type and scaled with the accounts offered. Specifically, the spread starts from 1.8 pips on the Standard account, from 1.6 pips on the Gold account, from 1.2 pips on the Premium account and 0.8 pips on the Platinum account. However, as tested on its platform, the EUR/USD spread is 3 pips, while the industry average is only 1.5 pips.

Trading Platform Available

The platform available for trading at Royal Trades is one of the most notable and preferred trading platforms the market offers - MetaTrader4 and Webtrader. This trading terminal is highly praised by traders and brokers alike due to its ease of use and great functionality. The MT4 offers top-notch charting and flexible customization options. It is especially popular for its automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

The funding methods available at Royal Trades are Credit/Debit cards, Fluterware, Interkassa, OAcquiring, MPSPay and Crypto converter. The minimum initial deposit requirement is extremely high - up to €1,000.

Bonuses

Royal Trades claims to offer bonuses of 50% on the deposit for each account opened. In any case, you should be very cautious if you receive a bonus. Bonuses aren't client funds, they're company funds, and fulfilling the heavy requirements that are usually attached to them can prove a very daunting and difficult task. Note that brokers are prohibited from using bonuses and promotions by all leading regulators.

Customer Support

Royal Trades customer support can be reached by telephone: +44 2030976438, email: support@royal-trades.com. Company address: 30 St. Mary Axe, London Great Britain, United Kingdom Postcode EC3A 8BF.

Pros & Cons

| Pros | Cons |

| • Multiple account types offered | • No regulation |

| • MT4 supported | • Website inaccessible |

| • Uncompetitive EUR/USD spread (3 pips) | |

| • Extremely high minimum initial deposit requirement |

Frequently Asked Questions (FAQs)

| Q 1: | Is Royal Trades regulated? |

| A 1: | No. It has been verified that Royal Trades currently has no valid regulation. |

| Q 2: | Does Royal Trades offer the industry-standard MT4 & MT5? |

| A 2: | Yes. Royal Trades offers the MT4 and Webtrader. |

| Q 3: | What is the minimum deposit for Royal Trades? |

| A 3: | The minimum initial deposit to open a Standard account is €1,000, while €5,000, €10,000 and €25,000 for the Gold, Premium and Platinum accounts. |

| Q 4: | Does Royal Trades charge a fee? |

| A 4: | Yes. Like every forex broker, Royal Trades charges a spread fee. While the information on other fees like commissions, deposit & withdrawal processing fees are missing. |

| Q 5: | Is Royal Trades a good broker for beginners? |

| A 5: | No. Royal Trades is not a good choice for beginners. Although it offers a state-of-the-art MT4 trading platform, it lacks legal regulation is the truth and its initial capital requirement is quite high, which is unfriendly for beginners. |

Latest News

BlackBull Markets Regulation: A Complete 2026 Guide to Their Licenses

ATFX Partners with AFA in Strategic Sponsorship

Forex Brokers with Strong Profit Potential in 2026

Gold's Structural Shift: Central Bank Buying Meets 'Peak Production'

CAD Slides as Venezuelan Supply Threat Weighs on Oil Markets\n\nThe Canadian Dollar (

Unitex Review (2025): Is it Safe or a Scam?

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

JP Markets Regulation Review: Legit or Fraud?

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Treasury Secretary Bessent says more Fed rate cuts are 'only ingredient missing' for stronger economy

Rate Calc