Forex Brokers with Strong Profit Potential in 2026

Abstract:As global markets enter 2026 amid shifting interest-rate cycles, AI-driven trading tools, and rising retail participation, choosing the right forex broker has become more critical than ever. While no broker can guarantee profits, some platforms offer better trading conditions, stronger regulation, and lower execution costs, which significantly improve a trader’s long-term profitability potential.

As global markets enter 2026 amid shifting interest-rate cycles, AI-driven trading tools, and rising retail participation, choosing the right forex broker has become more critical than ever. While no broker can guarantee profits, some platforms offer better trading conditions, stronger regulation, and lower execution costs, which significantly improve a traders long-term profitability potential.

This article reviews forex brokers with strong profit potential in 2026, evaluated through execution quality, spreads, regulation, platform stability, and WikiFX risk scores.

What Makes a Forex Broker “Profitable” in 2026?

A brokers profit potential depends on trading conditions, not promises. Key factors include:

- Strong regulation (FCA, ASIC, CySEC, CFTC)

- Low spreads & commissions

- Fast execution & deep liquidity

- Reliable trading platforms

- Transparent fund handling

WikiFX scores combine these elements into a single risk reference indicator.

Top Forex Brokers with Profit Potential in 2026 (WikiFX Scores)

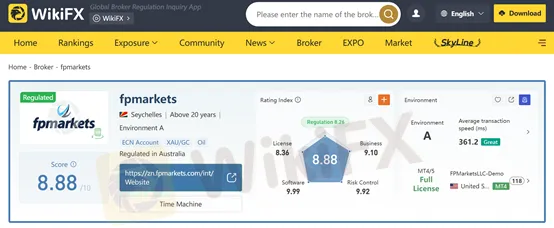

WikiFX Score: 8.88 / 10

FP Markets continues to gain attention for its consistency and competitive pricing.

Key Advantages

- Raw ECN spreads

- MT4 & MT5 support

- ASIC & CySEC regulation

- Stable execution environment

Best For: Cost-sensitive traders

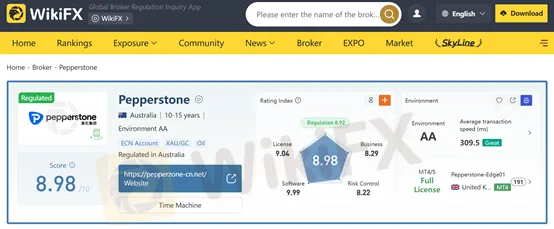

WikiFX Score: 8.98 / 10

Pepperstone balances professional trading infrastructure with user-friendly execution.

Key Advantages

- Fast order execution

- TradingView, cTrader integration

- Strong regulation (FCA, ASIC, DFSA)

- No dealing desk intervention

Best For: Technical traders, swing traders

WikiFX Score: 9.02 / 10

Exness remains one of the most competitive brokers globally, particularly for high-frequency and short-term traders.

Key Advantages

- Ultra-low spreads (from 0.0 pips)

- Instant withdrawals

- High execution speed

- Multiple global regulations (FCA, CySEC, FSCA)

Best For: Scalpers, day traders, high-volume traders

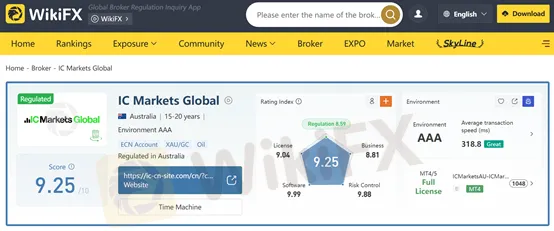

WikiFX Score: 9.25 / 10

IC Markets is widely recognized for its true ECN environment, offering institutional-grade liquidity.

Key Advantages

- Raw spreads with low commissions

- MT4, MT5, cTrader support

- Excellent for automated trading

- ASIC & CySEC regulation

Best For: Algorithmic traders, EA users

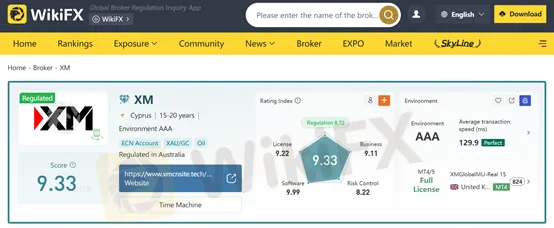

WikiFX Score: 9.33 / 10

XM remains popular among beginners due to its accessibility and education support.

Key Advantages

- Low minimum deposit

- Multiple account types

- Strong educational resources

- Regulated by ASIC & CySEC

Best For: Beginner to intermediate traders

Comparison Table: Forex Brokers With Profit Potential in 2026

| Broker | WikiFX Score | Regulation Strength | Spread Type | Best For |

| Exness | 9.05 | Very Strong | Raw / Standard | Scalping |

| IC Markets | 9.01 | Very Strong | Raw ECN | Algo Trading |

| Pepperstone | 8.95 | Strong | ECN | Technical Trading |

| IG Group | 9.12 | Very Strong | Standard | Long-term |

| OANDA | 8.88 | Very Strong | Variable | System Trading |

| Saxo Bank | 9.20 | Bank-Level | Tiered | Professionals |

| XM | 8.65 | Strong | Standard | Beginners |

| FP Markets | 8.90 | Strong | Raw ECN | Cost Control |

Final Thoughts: Profit Comes from Conditions, Not Promises

In 2026, profitable trading is less about broker marketing and more about execution quality and regulation. Brokers with high WikiFX scores typically offer:

- Better fund safety

- Lower trading friction

- Fewer withdrawal disputes

- More transparent operations

Risk Warning: Forex trading involves high risk. Even the best broker cannot eliminate market losses. Always trade with risk controls and avoid unregulated platforms.

Read more

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

FIBO Group has grabbed attention from traders for mostly the wrong reasons, as traders have accused the broker of causing financial losses using malicious tactics. Whether it is about withdrawal access, deposit disappearance, trade manipulation, or awful customer support service, the broker is receiving flak from traders on all aspects online. Our team accumulated a list of complaints against the FIBO Group broker. Let’s screen these with us in this FIBO Group review article.

GMO-Z.com Review: Do Traders Face Unfair Tax Payment on Withdrawals?

Do you have to pay taxes or margin when seeking fund withdrawals from GMO-Z.com, a Thailand-based forex broker? Do you witness heavy slippage when trading on the broker’s platform? These are some complaints traders have made against the broker. In this GMO-Z.com review article, we have explained these complaints. Take a look!

EO Broker Review: Why You Should Avoid It

EOBroker Review shows a low WikiFX score of 1.33/10. No regulation, fake license, and unsafe trading make this broker dangerous.

Pocket Broker Review: Why Traders Should Avoid It

Pocket Broker review highlights user complaints of blocked accounts, rejected withdrawals, and fraudulent practices.

WikiFX Broker

Latest News

BlackBull Markets Regulation: A Complete 2026 Guide to Their Licenses

Forex Brokers with Strong Profit Potential in 2026

Gold's Structural Shift: Central Bank Buying Meets 'Peak Production'

CAD Slides as Venezuelan Supply Threat Weighs on Oil Markets\n\nThe Canadian Dollar (

ATFX Partners with AFA in Strategic Sponsorship

TEMO Review 2025: Institutional Audit & Risk Assessment

FIBO Group Under the Lens: Disappearing Deposits & Withdrawal Problems Explained

Is GMG Safe or a Scam? A 2026 Deep Dive

FBS Review: The "Balance Fixed" Trap and the $30,000 Ghost Candle

Pocket Broker Review: Why Traders Should Avoid It

Rate Calc