JP Markets Regulation Review: Legit or Fraud?

Abstract:JP Markets SA (Pty) Ltd holds FSCA License No.46855. Learn about its regulation, derivatives trading license, and MT4/MT5 platform compliance.

JP Markets Review: Regulatory Standing

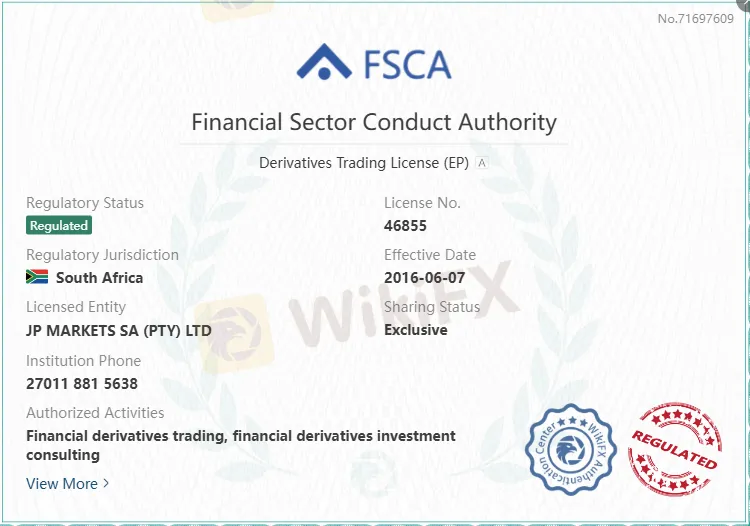

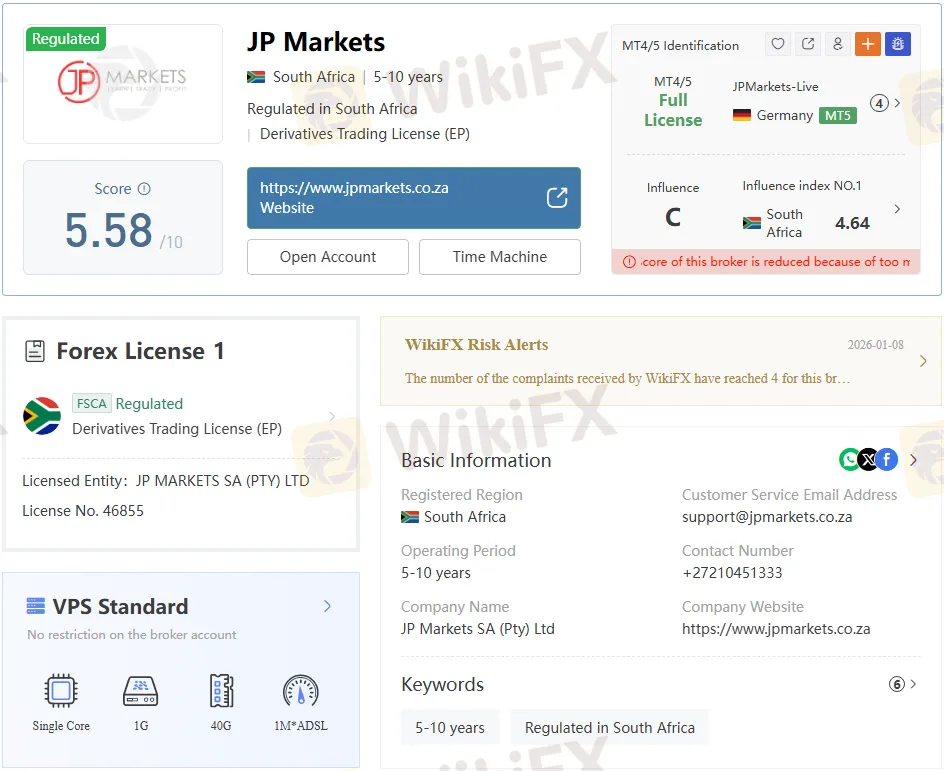

JP Markets SA (Pty) Ltd is a South African broker founded in 2016. It operates under the Financial Sector Conduct Authority (FSCA) with license number 46855, authorizing it to provide financial derivatives trading and investment consulting. The firm holds a Derivatives Trading License (EP) and is registered exclusively in South Africa.

The brokers regulatory status is marked as “Exceeded” in some references, which suggests that while the license remains valid, certain compliance thresholds may have been surpassed. This nuance is important for traders evaluating whether JP Markets is fully aligned with FSCA oversight.

Domain and Licensing Transparency

- Company Website: jpmarkets.co.za

- Registered Entity: JP Markets SA (Pty) Ltd

- Effective Date of License: 7 June 2016

- Regulatory Jurisdiction: South Africa

- Contact Numbers: +27 21 045 1333 / +27 11 881 5638

- Customer Service Email: support@jpmarkets.co.za

- Office Address: No.4 Century Falls Road, Century City, Cape Town, 7441

This transparency in licensing and contact details is a positive indicator compared to offshore brokers that often obscure their registration data.

Trading Platforms and Technology

JP Markets provides access to MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

- MT5: Full license, available on PC, web, and mobile. Suitable for experienced traders.

- MT4: Supported, with one server, positioned as beginner-friendly.

- Execution Speed: Average of 256.75 ms.

- Server Location: South Africa, with a ping of around 163 ms.

The broker emphasizes MT5 as its flagship platform, offering advanced technical and fundamental analysis tools.

JP Markets Instruments

JP Markets offers a broad range of tradable instruments:

- Forex

- Stocks

- Indices

- Commodities

- Cryptocurrencies

- Bonds

- Options

- ETFs

This multi-asset coverage is wider than many regional competitors, positioning JP Markets as a full-service broker within South Africas retail trading landscape.

Account Types and Features

JP Markets provides several account structures tailored to different trading styles:

| Account Type | Minimum Deposit | Leverage | Spread | Commission | Notes |

| VIP | R5,000 | Up to 1:500 | From 0.5 pips | $3 | Tight spreads, professional conditions |

| JPM Micro 300 | R100 | Up to 1:500 | From 3 pips | None | 300% bonus, higher spreads |

| Premium | R100 | Up to 1:2000 | From 1 pip | None | High leverage, no commission |

| Islamic | R100 | Up to 1:500 | From 1.5 pips | None | Swap-free, Shariah compliant |

| Zero Stop-Out | R100 | Up to 1:500 | From 3 pips | None | Stop-out at 0%, riskier conditions |

| JPM Bonus 300 | R100 | Up to 1:500 | From 2 pips | None | 300% deposit bonus |

| 25% Drawdown Bonus | R100 | Up to 1:500 | From 2 pips | None | Cushion against drawdowns |

The Premium account stands out with leverage up to 1:2000, far higher than most regulated brokers. While attractive to aggressive traders, such leverage significantly increases risk.

Fees and Spreads

- VIP Account: Spreads from 0.5 pips, $3 commission.

- Premium Account: Spreads from 1 pip, no commission.

- Islamic Account: Spreads from 1.5 pips, swap-free.

- Zero Stop-Out: Spreads from 3 pips.

- JPM Bonus 300: Spreads from 2 pips.

Compared to competitors, JP Markets offers competitive spreads on VIP accounts but less favorable conditions on bonus-linked accounts.

Deposit and Withdrawal Options

JP Markets supports payments through:

- Capitec Pay

- OZOW

- Paystack

- Skrill

- Alphapo

However, the broker does not disclose processing times or fees, which may concern traders seeking clarity on transaction costs. Competitors often provide detailed timelines and fee structures, giving them an edge in transparency.

Customer Support and Accessibility

- Support Channels: Live chat, contact form, email, phone.

- Availability: 24/5.

- Social Media Presence: Facebook, X (Twitter), Instagram, LinkedIn, WhatsApp, YouTube, TikTok.

- Regional Restrictions: Services limited to South Africa, Namibia, Swaziland, and Lesotho.

This regional focus narrows JP Markets global reach but strengthens its positioning as a domestic broker.

Pros and Cons

Pros

- FSCA-regulated with license number 46855

- MT5 platform with full license

- Wide range of instruments including forex, stocks, and commodities

- Multiple account types including Islamic account

- Minimum deposit as low as R100

- Strong local presence and transparency in contact details

Cons

- Regulatory status marked as “Exceeded”

- Limited regional availability

- Lack of detailed payment processing information

- Higher spreads on bonus accounts

- Limited global competitiveness compared to international brokers

Competitor Context

Compared with larger global brokers, JP Markets offers higher leverage (up to 1:2000) but less international coverage. Competitors such as IG or Saxo Bank provide broader regulatory footprints across multiple jurisdictions, while JP Markets remains confined to South Africa and neighboring regions.

For traders seeking ultra-high leverage and localized support, JP Markets may be appealing. For those prioritizing global access and multi-jurisdictional regulation, competitors may offer stronger safeguards.

Bottom Line

JP Markets SA (Pty) Ltd is a licensed FSCA broker with a derivatives trading license and a clear regulatory footprint in South Africa. Its offering includes MT4/MT5 platforms, multiple account types, and leverage options up to 1:2000.

While the broker demonstrates legitimacy through its FSCA license and transparent contact details, traders should weigh the risks of high leverage and the limitations of regional restrictions. The “Exceeded” regulatory status also warrants careful consideration.

Verdict: JP Markets is legitimately regulated but best suited for traders comfortable with high leverage and operating within Southern Africa. Those seeking broader international protections may find stronger alternatives elsewhere.

Read more

LONG ASIA Exposure: Traders Report Fund Losses & Long Withdrawal Blocks

Long Asia Group, a Saint Vincent and the Grenadines-based forex broker, has come under increasing scrutiny as a growing number of traders report troubling experiences with the broker’s operations. User feedback highlights recurring issues such as delayed or blocked withdrawals, sudden communication breakdowns, and a lack of clear accountability once funds are deposited. Several traders claim that while small withdrawals may initially go through, larger payout requests often face unexplained obstacles. More concerning are allegations suggesting that the broker may no longer be operating transparently, with users reporting prolonged silence, unresolved complaints and suspected fund mishandling. These patterns have raised serious questions about Long Asia Group’s reliability and overall legitimacy, prompting traders to exercise extreme caution before engaging with the broker. For more details, keep reading this LONG ASIA review article, where we have elaborated on the traders’ pain wit

MY MAA MARKETS Review: Are Withdrawal Blocks and Regulation Gaps Real?

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

AssetsFX Scam Alert: 5 Warning Signs Traders Should Know

AssetsFX exposure reveals 5 scam‑like warning signs: unregulated operations, shaky fund safety, and alarming trader complaints you can’t afford to ignore.

PRCBroker Exposed: Hong Kong Traders Say Profits Blocked, Withdrawals Refused

PRCBroker is accused of withholding $1.13M in profits and freezing withdrawals. Read the details and decide if this broker is right for you.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Rate Calc