NEWTON GLOBAL Regulatory Status: A Complete Guide to Its Licenses and Company Registration

Abstract:When choosing a financial services company, the most important question is about its regulatory status. For traders looking at NEWTON GLOBAL, this question is extremely important. A basic investigation using third-party verification platforms shows a worrying picture: The broker is marked for having no valid regulation. This article provides a detailed, fact-based analysis of NEWTON GLOBAL's regulatory claims, company registration, and the major risks with how it operates. We will examine the data provided by global broker inquiry apps and public records to present a clear and objective report. For any trader, an important first step before investing in any broker is to do a basic check on such a platform. This simple action can be the most important part of your research process.

When choosing a financial services company, the most important question is about its regulatory status. For traders looking at NEWTON GLOBAL, this question is extremely important. A basic investigation using third-party verification platforms shows a worrying picture: The broker is marked for having no valid regulation. This article provides a detailed, fact-based analysis of NEWTON GLOBAL's regulatory claims, company registration, and the major risks with how it operates. We will examine the data provided by global broker inquiry apps and public records to present a clear and objective report. For any trader, an important first step before investing in any broker is to do a basic check on such a platform. This simple action can be the most important part of your research process.

The Main Question

The primary concern for any potential investor is simple: Is NEWTON GLOBAL a regulated broker? Based on publicly available data and analyses from investigative platforms, the answer is clearly no. These platforms give the company an extremely low trust score and clearly mark it for lacking any valid, recognized financial regulation. This lack of oversight is the biggest red flag a trader can see.

Our Investigation Method

This report will break down the information available through regulatory watchdogs and public data collectors to provide a complete picture of NEWTON GLOBAL. We will examine what it means to be unregulated, explain the difference between company registration and financial licensing, and analyze the specific warnings and user-reported issues associated with this broker. We emphasize doing your research; complete platforms, such as WikiFX, are essential tools for traders to verify a broker's claims before investing in a broker.

Understanding “No Regulation” Status

The term “unregulated” is not just a label; it means a basic absence of the safety nets that protect traders in the financial markets. Understanding these missing protections is key to understanding the level of risk involved. Top-level regulators, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), enforce strict rules on brokers to ensure fair practices and financial stability. An unregulated company operates completely outside of this framework.

What “Unregulated” Means

Working with an unregulated broker means you are exposed to severe risks with little to no way to get help. The key protections you give up include:

· No Separated Funds: Regulated brokers are required to keep client funds in accounts separate from their own operational funds. Without this rule, your funds can be mixed with the company's capital and used for its business expenses. As a result, your capital can be exposed to high risks should the company face financial trouble.

· No Investor Protection Program: In the event that a regulated broker becomes bankrupt, traders are often protected by an investor protection fund that can pay them back up to a certain limit. With an unregulated broker, if the company goes bankrupt, your funds are very likely lost forever.

· No Dispute Resolution Body: If you have a dispute with a regulated broker over trade execution, pricing, or withdrawals, you can appeal to an independent ombudsman or regulatory body. Unregulated brokers offer no such independent authority, leaving you to resolve disputes directly with the company that you are in conflict with.

· Lack of Operational Oversight: Regulatory bodies conduct regular audits and monitor brokers to ensure they maintain enough capital, follow fair pricing models, and operate transparently. An unregulated broker lacks any such external supervision.

Specific License Findings

A thorough search for a valid forex license for NEWTON GLOBAL on verification platforms shows no positive results. Instead, it triggers direct warnings. One of the most prominent alerts states, “This broker lacks valid forex regulation. Please be aware of the risk!” This is a clear statement indicating that the broker is not authorized to provide the financial services it offers.

Further investigation reveals specific flags that add more detail to this assessment. The broker is marked with a “Suspicious Regulatory License” and a “Suspicious Scope of Business.” A “Suspicious Regulatory License” flag typically means that even if the broker claims to have some form of license, it is either from a very weak offshore location with no real oversight, has expired, or is not valid for services (like forex and CFD trading) being offered to a global retail audience. The “Suspicious Scope of Business” flag indicates that the company's official registration may not allow the financial activities it is conducting.

Company Registration vs Regulation

A common trick used by high-risk brokers is to confuse its business registration with a financial license. It is critical for traders to understand the difference. Registering a company is an administrative formality; obtaining a financial services license is a rigorous, demanding process. NEWTON GLOBAL's company details illustrate this point perfectly.

NEWTON GLOBAL's Company Information

Public records show the company's registered information, which provides a physical footprint but offers no assurance of financial safety.

| Detail | Information |

| Company Name | NEWTON GLOBAL Commercial Business (NGCB) LTD |

| Registered Region | Mauritius |

| Registered Address | Suite 101, 10th Floor, Premier Business Centre, Sterling Tower, 14 Poudriere Street, Port Louis, Mauritius |

| Operating Period | 3-5 years |

Mauritius Registration Explained

While NEWTON GLOBAL Commercial Business (NGCB) LTD is registered as a company in Mauritius, this does not mean it is regulated to offer forex trading services. Mauritius does have a financial regulator, the Financial Services Commission (FSC). However, according to data from third-party verification services, NEWTON GLOBAL does not appear to hold a relevant forex license from the FSC.

Registering a business in many offshore locations, including Mauritius, can be a relatively simple and inexpensive process. It proves the company legally exists but says nothing about its financial health, ethical practices, or the security of client funds. In contrast, obtaining a license from a reputable regulator, such as the FSC (or a top-tier one like the FCA or ASIC), requires meeting strict minimum capital requirements, implementing strong internal compliance systems, undergoing regular audits, and following strict codes of conduct. This simple company registration offers none of such protections.

Analyzing the Red Flags

Beyond the primary issue of non-regulation, a pattern of high-risk indicators surrounds NEWTON GLOBAL. When these red flags are viewed together, they paint a complete picture of a company that traders should approach with extreme caution. This complete risk profile is crucial for making an informed decision.

The Low Trust Score

Investigation platforms measure a broker's reliability using a score. NEWTON GLOBAL receives an extremely low score of 1.41 out of 10. Scores in this range are typically reserved for brokers with the most severe and basic problems. The primary driver for such a low rating is the complete lack of verifiable, credible regulation. It serves as a summary of all the associated risks, signaling to potential users that the platform has failed basic safety and legitimacy checks.

Reported Withdrawal Issues

Perhaps the most alarming red flags are the first-hand accounts from users who have encountered serious problems with core functions, particularly withdrawals. Summaries of user complaints filed in 2025 on public forums describe significant issues:

· One user reported being unable to withdraw funds for nearly two days, a critical failure for any financial service.

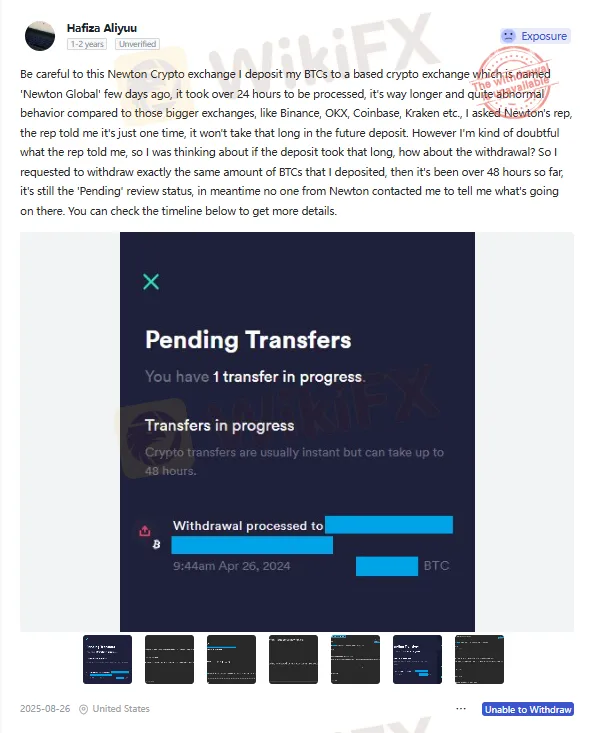

· Another detailed an abnormal deposit experience, where a BTC deposit took over 24 hours to process. Wary of this delay, the user attempted a withdrawal, only to find the request stuck in a “pending” status for more than 48 hours with no communication from the company.

These reports of delayed or failed withdrawals are a classic sign of high-risk, unregulated brokers and suggest severe issues with liquidity or integrity.

Official Platform Alerts

In addition to the low score, verification platforms issue clear, plain-language warnings about NEWTON GLOBAL. These alerts are designed to be impossible to misinterpret:

· “Warning: Low score, please stay away!” This is the most direct advice a platform can give, urging users to avoid the broker entirely.

· “High potential risk.” This serves as a summary assessment, confirming that the combination of factors points to a dangerous environment for traders' money.

A Troubling Domain Status

A more technical but still noteworthy red flag is the broker's domain status, which is flagged as “client transferring is prohibited.” While this can sometimes be a standard technical setting to prevent unauthorized domain transfers, in the context of numerous other severe warnings, it adds to the overall picture of instability or non-standard operation. It's another piece of data that deviates from the norm of a well-established, transparent company.

These are the types of details that traders must look for. We encourage users to see the full, up-to-date report on NEWTON GLOBAL's WikiFX page to assess these risks for themselves.

A Look at Advertised Services

To provide a complete overview, it is useful to acknowledge the services and trading conditions that NEWTON GLOBAL advertises. This helps confirm that we are analyzing the correct company. However, it is vital to view these offerings through the lens of the extreme risk posed by the broker's unregulated status. An attractive spread or low minimum deposit is meaningless if your funds are not safe.

Account Types and Conditions

The broker advertises a tiered account structure, seemingly to cater to different levels of traders.

| Account Type | Minimum Deposit | Advertised Spread (from) |

| Silver | $500 | 1.5 pips |

| Gold | $2,000 | 0.8 pips |

| Platinum | $10,000 | 0.5 pips |

Alongside these accounts, NEWTON GLOBAL offers leverage of up to 1:500. It is crucial to note that such high leverage is exceptionally risky. While it can amplify profits, it can also lead to catastrophic and rapid losses. This danger is magnified exponentially when dealing with an unregulated broker that has no obligation to provide negative balance protection or ensure fair market conditions.

Deposits and Withdrawals

The advertised payment methods include Korapay, B2B in PAY, Bank Transfer, and STICPAY. While the broker lists these options, potential users must weigh this against the documented user complaints. The availability of a payment channel does not guarantee a successful or timely withdrawal, as the user reports of funds being stuck in a “pending” status for days clearly demonstrate it.

Conclusion: A Clear Verdict

The evidence gathered from independent verification platforms and public records leads to a clear conclusion. NEWTON GLOBAL presents a high-risk proposition for any trader due to its lack of NEWTON GLOBAL regulation, a multitude of warning flags, and troubling user reports regarding the most critical of broker functions: the withdrawal of funds.

Summary of Findings

The investigation into NEWTON GLOBAL can be summarized by these key points:

· Status: Unregulated. The broker does not hold a valid NEWTON GLOBAL License from any reputable financial authority.

· Risks: High. This is confirmed by an extremely low trust score, direct warnings to “stay away,” and flags for suspicious business practices.

· User Experience: Since mid-2025, there have been documented reports of severe withdrawal delays and failures, indicating a potential inability or unwillingness to return client funds.

· Verdict: Engaging with this company carries a significant and unacceptable risk of partial or total financial loss.

The Golden Rule

The issues identified with NEWTON GLOBAL highlight a universal and non-negotiable rule in online trading: never deposit funds with a broker without first verifying its regulatory status on a trusted, independent platform. The promises of high leverage or low spreads are irrelevant if the broker operates outside the law and can withhold your capital without consequence.

We strongly recommend that all traders make it a standard practice to use a global broker inquiry app, such as WikiFX, before opening an account. These tools allow you to check every broker's license in real-time, review unfiltered user feedback, and assess a comprehensive list of risk warnings. This simple step of verification is your best defense against unregulated and high-risk operations. You can view the full and most current investigative report on NEWTON GLOBAL by searching for it on the WikiFX platform.

Read more

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Phyntex Markets Forex Scam: $58K Blocked After $50K

Phyntex Markets forex scam: $50K withdrawal approved, $58K blocked on “toxic trading.” Unregulated Comoros broker scams Malaysian traders. Read exposure & protect funds!

Exfor Forex Scam Cases: Withdrawal Issues Exposed

Exfor clients face blocked withdrawals and no support response. Scam cases exposed—protect your funds and avoid this unregulated forex broker.

Valutrades Review: Reliable Choice or Risky Move?

Valutrades is FCA & FSA regulated, offers MT4/5 and leverage up to 1:500. Read pros, cons & full awareness review to decide if it’s right for you.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

FxPro Broker Analysis Report

The Deriv Review: A Masterclass in Regulatory Smoke and Mirrors

Swissquote Scam Alert: 53/64 Negative Cases Exposed

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

Rate Calc