ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Abstract:The question "Is ZarVista legit?" is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations. To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informe

The question “Is ZarVista legit?” is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations.

To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informed and safe decision.

Analyzing Regulatory Red Flags

The most important factor in deciding a brokers legitimacy is knowing its regulatory status. This is not about reputation but about real investor protection. A broker's license determines the rules it must follow, the capital it must keep on hand, and the legal options available to you if something goes wrong.

ZarVista's Official Claims

ZarVista, previously called Zara FX until it changed its name in September 2024, is registered in Comoros. Its company, Zarvista Capital Markets (MU) Ltd, has a license from the Financial Services Commission (FSC) of Mauritius. The specific license number it mentions is GB23202450. On the surface, this might sound official, but the location of these licenses is the main problem.

The Risk of Offshore Regulation

Regulators such as the Mauritius FSC and the Mwali International Services Authority (MISA) in Comoros are widely considered to be “offshore.” This classification is important for traders to understand because it carries specific and serious risks for their capital.

· Limited Investor Protection: Unlike top-level regulators in places such as the UK (FCA) or Australia (ASIC), offshore zones typically do not have strong investor compensation programs. This means if the broker goes bankrupt or commits fraud, there is often no fund to pay you back for your losses.

· Lower Operational Standards: The capital requirements, anti-money laundering (AML) rules, and daily operational oversight in these regions are not that strict. This creates an environment where bad practices can go unnoticed.

· Difficult Legal Recourse: If you have a dispute with an offshore-regulated broker, pursuing legal action is very challenging. It can be extremely expensive and complicated for an international client to navigate the legal system of a small island nation.

Independent Verification and Warnings

Independent verification platforms are essential tools for seeing through marketing claims. Our review of ZarVista on WikiFX, a global broker inquiry app, shows a very low score and several clear warnings that cannot be ignored. As of 2026, the platform flags ZarVista for “High potential risk” and clearly warns users, “Low score, please stay away!” The main reason given is its status as an “Offshore Regulated” entity, confirming the risks we have outlined. The large number of user complaints has also negatively affected its score.

For a real-time view of ZarVista's current regulatory status and to see these warnings for yourself, it's important to check its detailed profile on a broker verification platform such as WikiFX. This allows you to see the most up-to-date information before making any decisions.

Voice of the Trader

Beyond regulatory data, a broker's true nature is often revealed in the unfiltered experiences of its users. When we analyze the user complaints and “scam” allegations surrounding ZarVista, a troubling pattern emerges, particularly concerning the most important function of a broker: allowing clients to withdraw their funds.

Severe Withdrawal Problems

ZarVista emerges as a broker that does not process withdrawals smoothly and fairly fails at its most basic duty. Multiple user reports document serious issues in this aspect. One trader reported that, after making a legitimate profit through manual trading, their withdrawal request was rejected without any valid evidence of wrongdoing.

Another user faced a similar roadblock when their credit card refund was declined, with the broker allegedly blaming the user's bank.

The situation got worse for another client who, after experiencing withdrawal issues, found themselves completely locked out of the website, unable to even access their account or view their funds.

These are not minor delays; they are fundamental breaks of trust.

Allegations of Fund Theft

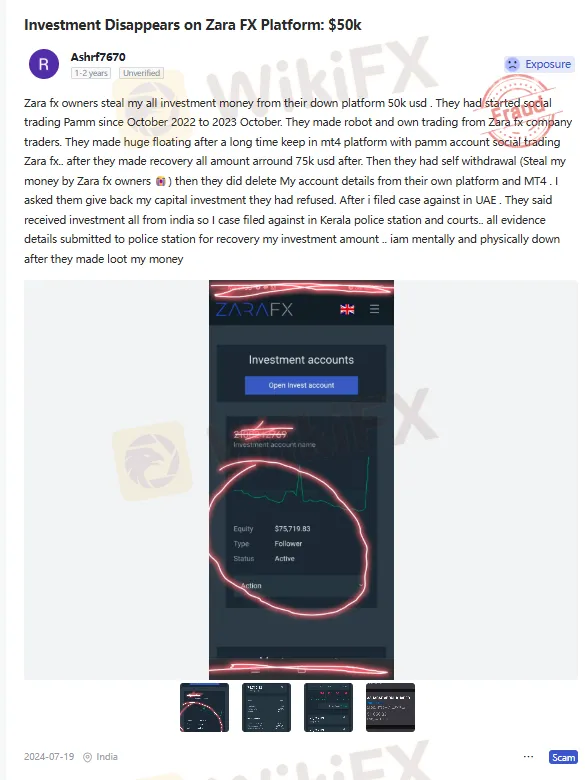

The most serious allegations go beyond withdrawal problems and into claims of outright theft and account manipulation. One user from India has filed a detailed exposure report alleging that $50,000 USD was stolen by the company owners through their PAMM social trading system. According to the user, after a period of trading, the account balance, which had recovered to around $75,000, was emptied by the company itself. To hide this, the user claims their account details and MT4 history were completely deleted. This user has taken the significant step of filing police reports in India, adding a layer of legal seriousness to the accusation. This is not an isolated incident; the same user has posted multiple times, detailing how the company's social trading system was allegedly used to steal investor funds.

Contextualizing Positive Reviews

To maintain an objective view, we must acknowledge that a few positive and neutral reviews for ZarVista exist. Some users praise the MT5 platform's speed, the availability of useful tools, and the occasional trading bonus. Others note the low spreads are a genuine benefit. However, this positive feedback is heavily outweighed by the severity and volume of negative reports. Importantly, even some neutral reviews confirm the core issue, with one user stating, “Low spreads is true, but when withdrawing you may come across a couple of decline withdrawals.” The positive aspects of a trading platform become meaningless if you cannot access your profits or even your initial capital.

The volume and nature of these complaints are alarming. We strongly advise you to read these user exposure reports in full and check for any new ones that may have been posted by visiting the ZarVista page on WikiFX.

Marketing vs Reality

Brokers create a specific image through their marketing, promising security, reliability, and ease of use. It is our job as analysts to break down these promises and compare them against the evidence. Below is a side-by-side comparison of ZarVista's claims versus the reality we have uncovered.

| ZarVista's Promise (What It Claims) | The Reality (Based on Evidence) |

| Secure and Regulated Trading Partner | Regulated in offshore jurisdictions (Comoros, Mauritius) with low investor protection. Carries a “High potential risk” warning from independent auditors. |

| Lightning-Fast Withdrawals & Control | Multiple, documented user complaints of rejected withdrawals, declined refunds, and total inability to access funds. |

| Reliable, State-of-the-Art MT5 Platform | Users allege platform manipulation that goes against MT5's terms, and others report being locked out of the website entirely. One user claims their entire MT4 history was deleted. |

| Trustworthy Global Operation | On-site investigations in Canada and Cyprus found no physical office, raising serious questions about the company's operational substance and accountability. |

| Helpful 24/7 Customer Support | The severity of complaints, including users filing police reports, indicates that customer support is failing to resolve critical issues such as missing funds. |

This table provides a clear, at-a-glance summary of the contradictions between ZarVista's marketing story and the documented experiences of its users and independent investigators.

Checking the Physical Footprint

A legitimate global financial services firm should have a verifiable physical presence. It is a sign of substance, accountability, and a commitment to operating within a real legal framework. Virtual offices or P.O. box addresses are common red flags in the world of high-risk brokers.

On-Site Investigation Results

As part of a comprehensive due diligence process, WikiFX conducted field surveys to verify the physical office locations claimed by ZarVista (under its previous name, Zara FX). The results are definitive and concerning:

· Investigation in Canada: The result of the on-site visit was “No Office Found.”

· Investigation in Cyprus: The result of the on-site visit was also “No Office Found.”

The significance of these findings cannot be overstated. A company that claims to operate globally but has no verifiable physical presence at its listed addresses is, for all practical purposes, a “virtual” entity. This lack of a physical footprint makes accountability nearly impossible. If a serious issue arises, there is no front door to knock on, no local management to hold responsible, and no physical location in a reputable jurisdiction to seek legal action. This aligns perfectly with the profile of an operation designed to minimize accountability.

The Verdict: A High-Risk Gamble

After a thorough review of ZarVista's regulatory status, user feedback, operational transparency and physical presence, a clear and consistent picture emerges. We are now prepared to deliver a definitive verdict on the question, “Is ZarVista legit?”

To summarize our findings, these are the critical red flags that define ZarVista's operational profile:

· Weak Offshore Regulation: The broker is licensed in Mauritius and registered in Comoros, a jurisdiction that offers minimal investor protection and weak regulatory oversight.

· Overwhelming Negative Feedback: There is a significant volume of severe user complaints, including credible and detailed allegations of withdrawal blocks, account manipulation, and outright fund theft.

· No Verifiable Physical Offices: Independent, on-site investigations in both Canada and Cyprus confirmed that the company has no physical presence at its claimed addresses.

· Explicit Third-Party Warnings: Broker verification services have assigned ZarVista a very low trust score and issued a direct warning to “stay away” due to its high-risk profile.

While ZarVista is a technically registered entity, its operational characteristics overwhelmingly align with those of a high-risk, unreliable broker. The question is less “Is ZarVista legit?” and more “Is trading with ZarVista safe?”. Based on the mountain of evidence, the answer to that second question is a resounding NO. Engaging with this broker poses a significant and unacceptable danger to your capital.

The financial markets are complex enough without having to worry about the trustworthiness of your broker. This investigation of ZarVista highlights why independent verification is not optional—it's essential. Before depositing with *any* broker, take a moment to perform your own due diligence on a comprehensive verification platform.

You can view the full, detailed report on ZarVista, including all user reviews and regulatory updates, on WikiFX. This is a non-negotiable safety step to maintain your financial well-being.

Read more

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

ZarVista Regulatory Status: A Complete Guide to Its Licenses and Company Information

When choosing a trading broker, every trader asks the same important question: "Will my capital be safe?" To answer this question about ZarVista, we need to look at the facts carefully. While the broker does have licenses, our first look shows that all of its regulation comes from offshore locations. This fact alone creates serious concerns about how well traders are protected. When we look deeper into ZarVista regulation and license details, we find a complicated situation with many warning signs. Read on for more updates.

PFD Broker Review: Reliable Forex Broker or Risk?

PFD is a regulated forex broker based in New Zealand, operating under the name Pacific Financial Derivatives Limited. This PFD review examines its regulation, trading conditions, and potential risks so you can decide whether this broker fits your Forex trading needs.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc