PFD Broker Review: Reliable Forex Broker or Risk?

Abstract:PFD is a regulated forex broker based in New Zealand, operating under the name Pacific Financial Derivatives Limited. This PFD review examines its regulation, trading conditions, and potential risks so you can decide whether this broker fits your Forex trading needs.

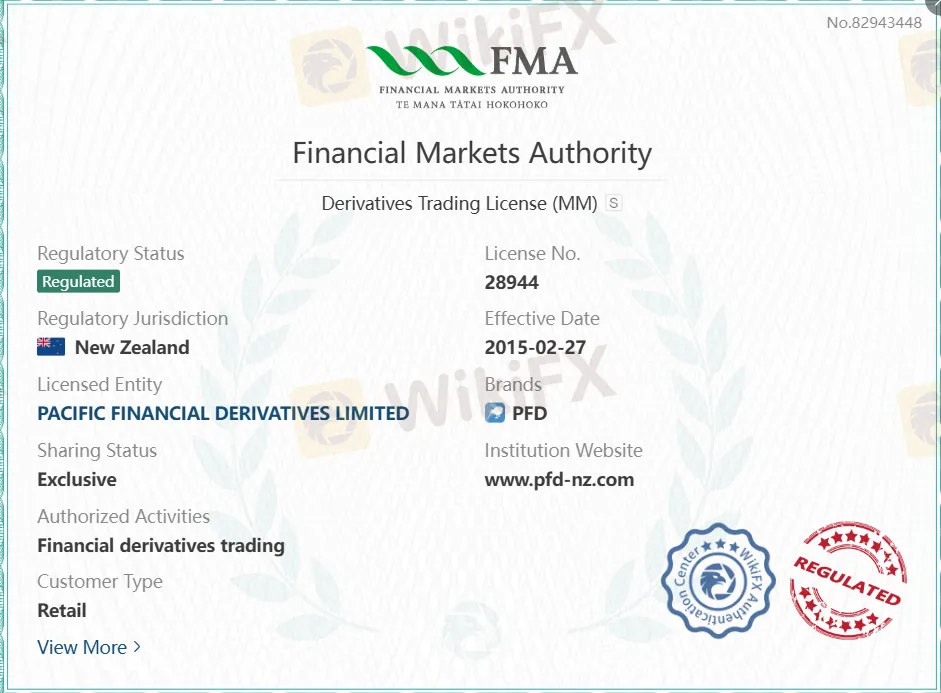

PFD Regulation and Safety

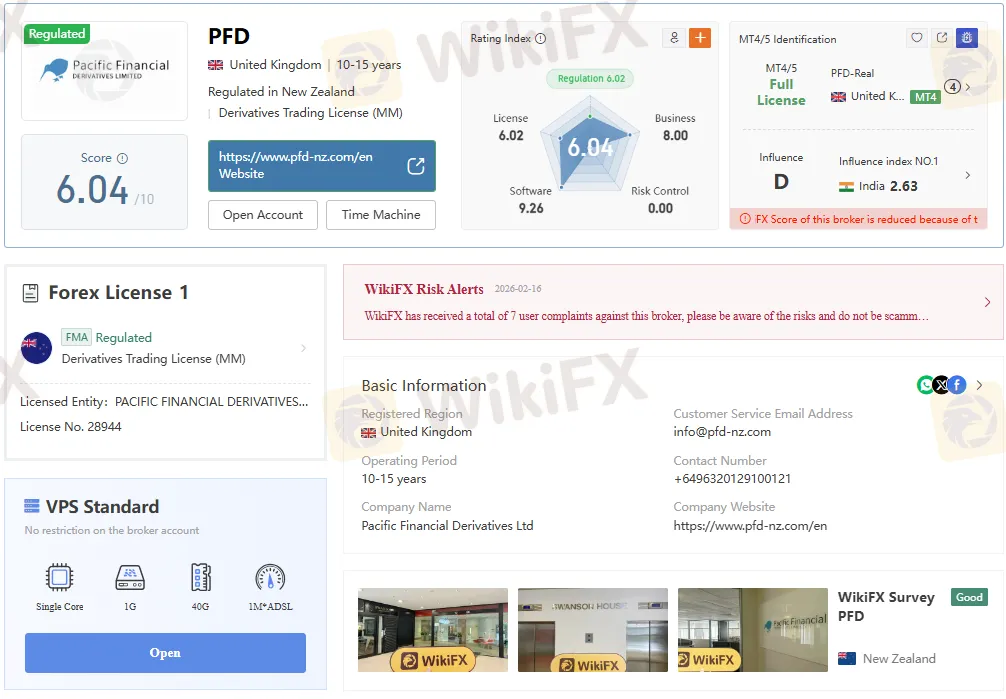

PFD holds a regulated status with the Financial Markets Authority (FMA) of New Zealand under license number 28944. The broker operates as a Straight Through Processing (STP) firm, which means client orders are passed to liquidity providers rather than internal dealing desks.

Being regulated by the FMA adds a layer of oversight to PFD, including requirements on client fund handling and business conduct. However, regulation alone does not remove all trading risks, so traders should still approach any Forex broker with caution and proper risk management.

The WikiFX App profiles PFD as a regulated broker and highlights its FMA license information in an accessible format for traders. Using the WikiFX App, you can verify the brokers license details and keep track of any regulatory updates or changes.

Company Background and Overview

PFD was founded in 2011 and is registered in New Zealand, with its office located at Level 8, Swanson House, 12–26 Swanson Street, Auckland Central 1010. The broker focuses on online trading services for global clients, subject to regional restrictions, including no service to residents of the United States.

The company offers comprehensive client support via live chat, phone, and email to help resolve account or platform issues. For traders who value local regulation and a known operating history, PFDs more than a decade in business may be a point in its favor.

Trading Instruments and Markets

PFD provides access to a broad range of markets, including Forex currency pairs, metals, oil, commodities, indices, CFDs, and futures. This mix allows traders to diversify across different asset classes while staying with a single broker account.

Forex PFD trading includes major, minor, and selected exotic pairs, with EUR/USD spreads starting from 0.2 pips according to the brokers data. Beyond Forex, traders can speculate on indices and commodities, or use metals and oil contracts to hedge exposure in other markets.

For traders searching for “PFD Forex” or “PFD broker,” this instrument list shows that PFD is positioned as a multi‑market provider rather than a Forex‑only firm. The WikiFX App also lists these tradable instruments, helping you quickly compare PFDs offering with other regulated brokers.

Account Types and Trading Conditions

PFD currently offers three main account types: PFDTrader, PFDPro, and PFDProPlus. Both PFDTrader and PFDPro accounts have a minimum deposit of 0 USD, while PFDProPlus requires a minimum deposit of 1,000 USD.

Leverage on the PFDTrader and PFDPro accounts goes up to 1:300, which can magnify both profits and losses. The PFDProPlus account offers a lower maximum leverage of 1:100 but is tailored for traders who want tighter spreads and are comfortable with higher capital requirements.

In terms of costs, the PFDTrader account charges no commission and offers competitive spreads, while the PFDPro and PFDProPlus accounts charge a 1 USD commission per lot in exchange for tighter spreads. Stop‑out levels differ as well: PFDTrader and PFDPro are set to 100%, while PFDProPlus is set to 50%, which affects how quickly positions are closed when margin is insufficient.

These variations allow traders to choose between a simpler spread‑only structure and a commission‑plus‑tight‑spread model. When you review PFD account types, consider whether your strategy favors lower upfront capital, higher leverage, or more professional conditions with narrower spreads.

Platforms and Tools

PFD supports the MetaTrader 4 (MT4) platform for desktop, web, and mobile devices. MT4 is widely used in the Forex industry and supports advanced charting, custom indicators, and automated trading via Expert Advisors.

The broker does not currently provide MetaTrader 5 (MT5), so traders who rely on MT5‑specific features may find this limiting. For most retail traders, MT4 remains sufficient for technical analysis, order execution, and basic algorithmic strategies.

The WikiFX App includes information on PFD‘s platform support, helping traders quickly see whether MT4 is available and how it compares with other brokers’ platform offerings. Checking these details inside the WikiFX App can save time when you are screening multiple Forex brokers.

Deposits, Withdrawals, and Fees

PFD allows deposits and withdrawals via wire transfer, debit or credit cards, and various e‑wallets. This multi‑channel funding model can be convenient for traders who want flexibility in moving funds in and out of their accounts.

However, deposit fees apply to card transactions: 2.7% plus 0.30 NZD for domestic customers and 3.7% plus 0.30 NZD for international customers. These charges can add up, especially for frequent deposits, so it is important to factor them into the overall cost of trading with PFD.

The broker also lists commission fees on certain account types, which impact your effective trading cost per lot. When you conduct a PFD review for your own use, compare these deposit and commission charges with alternative brokers to see whether the pricing structure suits your budget.

Pros of Trading with PFD

One advantage of PFD is its FMA regulation, which provides a degree of regulatory oversight and may enhance client confidence. The broker also offers a wide selection of trading instruments and supports the familiar MT4 platform.

Another plus is the low minimum deposit of 0 USD for PFDTrader and PFDPro accounts, allowing new traders to test live markets with smaller capital. The availability of a demo account further helps beginners practice strategies before trading real funds.

Customer support via live chat, phone, and email can be valuable when technical or funding problems arise. Traders focused on “PFD Forex” and “PFD broker” queries will also appreciate that the WikiFX App centralizes many of these details in one place, making basic due diligence easier.

Cons and Risks to Consider

Despite its regulated status, PFD does present certain drawbacks and risks that traders should weigh carefully. Regional restrictions, such as the exclusion of U.S. clients, may limit who can open an account and indicate the brokers focus on specific markets.

Deposit fees on card transactions are relatively high compared with some competitors, which can erode profit margins for active traders. In addition, the lack of MT5 and more advanced platform options might not appeal to traders who require multi‑asset depth or modern interface features.

High leverage up to 1:300, while attractive, can quickly amplify losses, especially for inexperienced traders. A cautious approach and strict risk management are essential when trading leveraged products with PFD or any other Forex broker.

The WikiFX App encourages traders to look beyond marketing claims and examine both pros and cons before making a decision. Using the app, you can compare PFD with other regulated brokers and review user feedback to better understand potential issues.

Final Verdict: Is PFD Reliable?

PFD is a regulated Forex broker with an FMA license, competitive spreads, and flexible account types, which may appeal to both new and intermediate traders. Its long operating history and support for MT4 add to its profile as a mainstream STP broker in the New Zealand market.

At the same time, traders should stay alert to the risks posed by high leverage, deposit fees, and the absence of MT5 or more advanced tools. Before choosing PFD, it is sensible to test the demo account, review fee structures, and compare conditions with other brokers featured in the WikiFX App.

If you are searching for a “PFD broker review” or want to understand “PFD regulation” in depth, this analysis shows that PFD can be considered, but requires careful evaluation of costs and risk levels. Use the information from the WikiFX App, together with your own trading plan, to decide whether PFD is a reliable fit for your Forex trading goals.

Read more

SEVEN STAR FX Exposure: Do Traders Face Account Blocks & Withdrawal Denials?

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

The question "Is ZarVista legit?" is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations. To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informe

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Rate Calc