Plus500 Scam Alert: Withdrawal Issues Exposed

Abstract:Plus500 forex trading scam alert: multiple cases of blocked withdrawals. Read the warnings and safeguard your money!

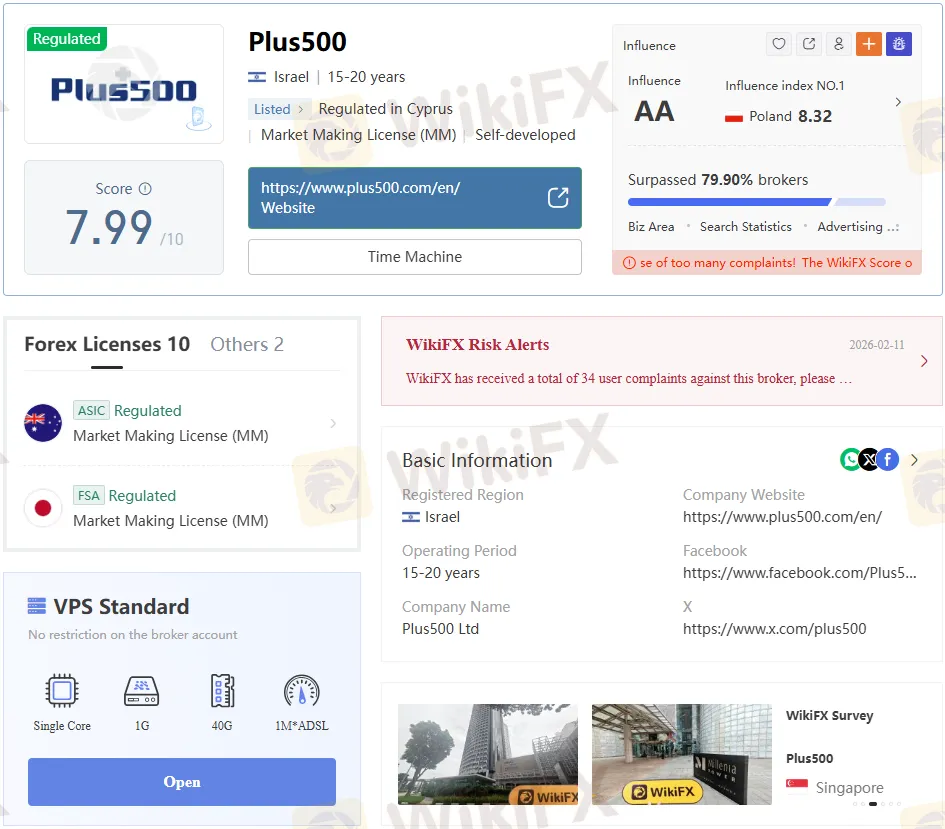

Plus500 presents itself as a regulated forex and CFD broker, but numerous traders report severe withdrawal problems that raise red flags. Despite its licenses from top regulators like FCA and ASIC, user complaints about frozen funds and deceptive tactics suggest deeper issues. Download the WikiFX App to check broker legitimacy before trading.

Broker Overview

Plus500 was founded in 2008 and has headquarters in Israel and offices worldwide. It offers over 2,800 CFDs on forex, stocks, indices, commodities, and cryptos via its proprietary platform. The broker claims tight spreads around 0.5 pips on EUR/USD and no commissions, with a $100 minimum deposit.

Traders can access leverage up to 1:30 for retail clients, plus demo accounts and risk tools such as stop-losses. Payments include Visa, PayPal, and Skrill, with no deposit fees but potential inactivity charges after three months. Still, these features dont shield users from the withdrawal nightmares detailed ahead.

Regulatory Status

Plus500 holds multiple licenses, including FCA (UK, #509909), ASIC (Australia, #417727), CYSEC (Cyprus, #250/14), and ISA (Israel). Its publicly traded on the London Stock Exchange, adding some transparency. Client funds are segregated, protected by SSL encryption, and eligible for investor compensation.

Regulation doesnt mean flawless operations, as scam alerts on WikiFX highlight persistent complaints. Even top-tier oversight fails when brokers allegedly manipulate balances or delay payouts. Use the WikiFX App for real-time exposure on regulated scams.

Trader Complaints Surge

Recent cases expose Plus500s withdrawal blocks, starting with a Belgian trader on December 5, 2025. He held 58.76 USDT but faced a maximum withdrawal limit of 33.76, which rejected withdrawals above that limit even though he had available funds. This forex scam tactic traps capital during shifts in unsupported countries.

Another Belgian user on December 4 couldnt withdraw without explanation, questioning the sudden “protection” after smooth prior payouts. German traders echoed this on the same day, citing unexplained cancellations after years of hassle-free trading. These patterns scream forex investment scam.

Bonus Deception Tactics

German complaints from December 2 reveal sketchy bonuses to hook newbies. One trader received an email promising a 750 SR (~$200) deposit, but only 450 SR was credited, with support dodging queries. This bait-and-switch draws in victims, then blocks exits—classic forex trading scam.

US users repeated this on November 18 and 6, 2025, with £280 or similar balances frozen post-verification, and no responses to statements. Owners labelled “assholes” for personal ethics aside, evidence points to deliberate trader rollback. WikiFX App users spot these red flags early.

Endless Verification Loops

A Hong Kong trader waited over a month for approval of a withdrawal on September 18, 2025. After submitting income proof and address docs, review stalled indefinitely—no timeline given. Such delays erode trust, mimicking the hallmarks of scam brokers despite regulation.

These arent isolated; they form a pattern of stalling tactics post-deposit. Traders pass KYC yet hit invisible walls on payouts. Stay safe—scan with the WikiFX App before funding any platform.

Common Scam Red Flags

| Red Flag | Description | User Impact |

| Balance Manipulation | Max withdrawal shown below actual funds (e.g., 33.76 vs 58.76 USDT) | Prevents full access to profits |

| Sudden Country Blocks | Unsupported regions halt USDT transfers to exchanges | Traps funds during moves |

| Bonus Shortfalls | Promised deposits undelivered (750 SR vs 450 SR) | Baits with false incentives |

| Verification Hell | Endless doc requests, no resolution | Delays payouts indefinitely |

| Ghost Support | No replies to statements or queries | Leaves traders stranded |

This table summarises exposures from global users. Patterns match forex scams: easy deposits, hard withdrawals. Regulated or not, these violate fair trading norms.

Why Withdrawals Fail

Plus500 mandates same-method withdrawals up to deposit amounts, with spreads funding operations. Yet complaints show arbitrary caps and “protection” excuses emerging suddenly. Even verified accounts face £280+ freezes, hinting at liquidity grabs or compliance dodges.

Inactivity fees kick in after three months, but active traders hit walls first. Overnight fees and leverage amplify losses, priming excuses for holds. WikiFX App logs confirm this as a serial issue.

Platform Pros and Pitfalls

Plus500 shines with user-friendly web/mobile apps, 24/7 chat, and multilingual support. Demo accounts help beginners test 2,800 instruments commission-free. Tight spreads and no MT4 needed suit casual CFD traders.

But cons bite hard: no MetaTrader, limited support channels, and now rampant withdrawal woes. Inactivity fees of up to $10/month add insult to injury. For pros seeking reliability, these gaps spell danger—especially amid scam alerts.

Protect Yourself Now

Verify brokers via the WikiFX App before depositing—its your shield against forex scams. Spot withdrawal glitches early, like manipulated max amounts or bonus lies. Demand timelines on requests; escalate to regulators if stalled.

Report issues on WikiFX to expose more cases. Avoid high-leverage CFDs without exit proof. Your funds deserve better than the alleged traps at Plus500.

Final Scam Warning

Plus500s regulation masks user torment from blocked USDT, ghosted verifications, and bonus fraud. Traders worldwide—from Belgium to Hong Kong—cry scam after smooth deposits turn sour. Heed this exposure: withdraw early, check the WikiFX App often, and dodge forex trading scams.

Read more

Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

Is GLOBAL GOLD & CURRENCY CORPORATION Safe or Scam: Looking at Real User Reviews and Common Problems

When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers. This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc