Trive Scam Warning: Cases in Mexico, India, Hong Kong

Abstract:Trive scam warning: clients in Mexico, India & Hong Kong report stolen funds and blocked withdrawals. Protect yourself—read exposure cases now.

Trive is a regulated forex broker, but multiple recent client complaints from Mexico, India, and Hong Kong show patterns that look like classic forex trading scam behavior, especially around profit deductions and blocked withdrawals. This exposure article highlights those red flags so traders searching for “forex scams” and “forex investment scam” can better protect their funds.

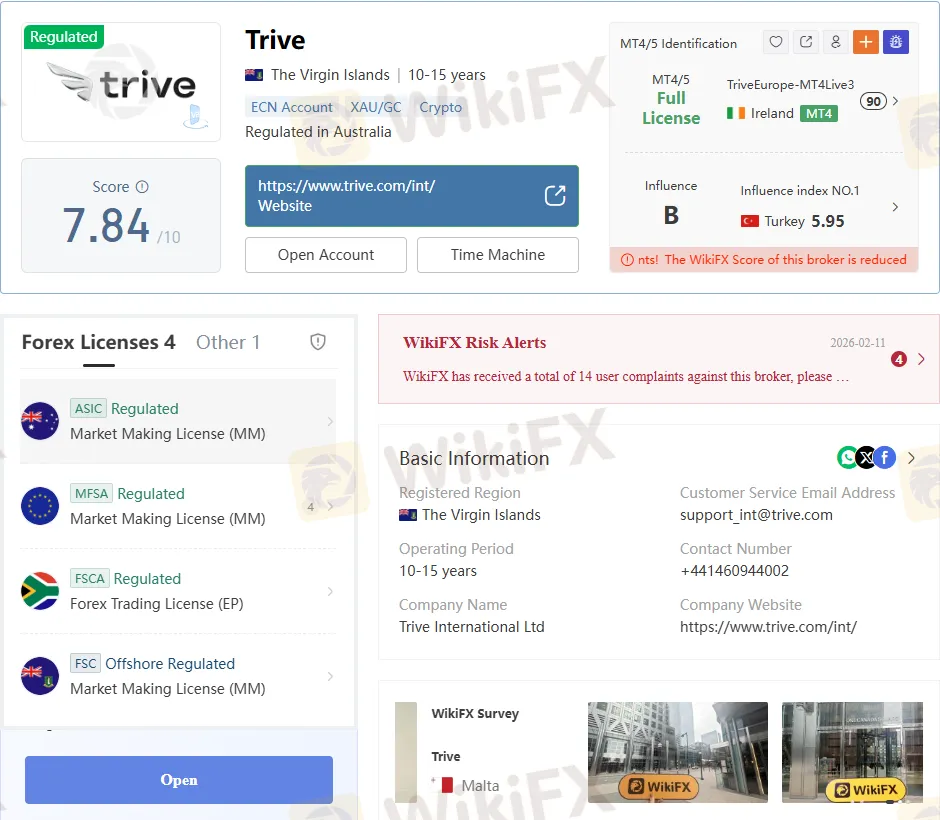

Trive Overview and Regulatory Status

Trive operates as a multi‑asset broker offering forex, CFDs and other instruments through several entities holding licenses from authorities such as the MFSA in Malta, ASIC in Australia, the FCA in the UK, and other regulators. Public listings and third‑party reviews confirm that Trive‑branded entities also reference oversight or registration with bodies such as FINRA, BaFin, CNMV, FSCA, BVI FSC, and others, giving the group a strong image of formal regulation.

Regulation, however, does not automatically prevent scam‑like practices such as unfair profit cancellation or unexplained withdrawal blocks, especially when brokers operate through multiple regional entities with varying levels of protection for retail traders. Some assessments already warn that, while Trive‘s licenses look solid on paper, client protection can depend heavily on which specific entity holds a trader’s account and on the local rules that apply.

The WikiFX App provides a centralized way for traders to verify Trive‘s displayed licenses, check the broker’s WikiFX score, and review newly reported risks, instead of relying solely on the brokers own marketing pages. By checking Trive on the WikiFX App before depositing, users can see both the regulatory profile and the rising number of dispute cases, which may signal a forex trading scam.

Why a Regulated Broker Can Still Feel Like a Scam

Several industry reports describe a sharp contradiction between Trives regulatory status and recent client experiences involving profit confiscation and delayed withdrawals. Investigations show a pattern where profitable trades are later labelled “abusive” or “fraudulent” without transparent evidence, while losing trades remain fully enforced—an imbalance that strongly resembles a forex investment scam tactic.

At the same time, Trive markets high leverage (up to around 1:2000 via some entities), which can rapidly magnify both gains and losses, already placing clients in a fragile position before any dispute arises. When high‑risk leverage is combined with opaque profit voiding and withdrawal restrictions, even a formally regulated broker can create outcomes similar to an outright forex scam.

Checking the Trive profile on the WikiFX App allows users to compare the broker‘s advertised regulations with actual complaint trends, commentary on profit disputes, and risk tags that may not be visible on the broker’s own site. This kind of independent verification is crucial for traders who want to avoid becoming the next victim of a forex trading scam disguised as a fully compliant broker.

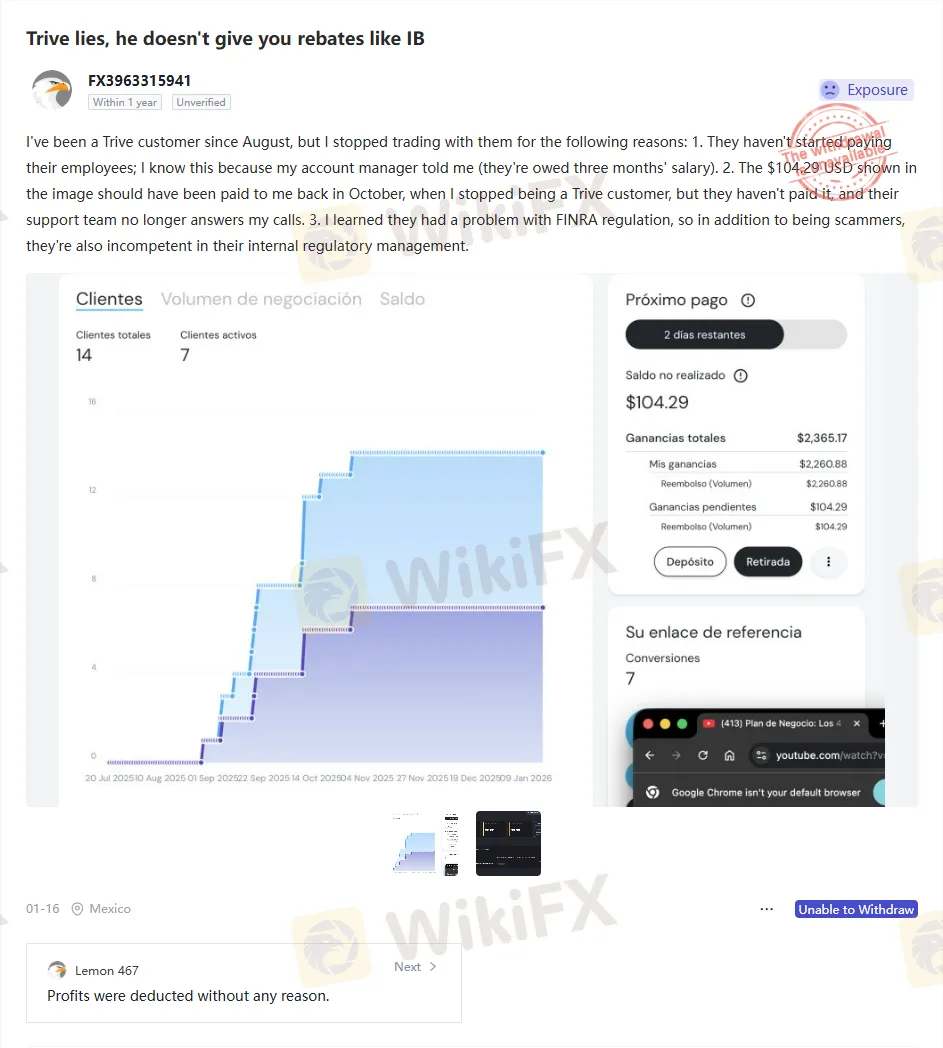

Case: Unpaid Balance and Staff Salary Issues (Mexico)

One long‑term Trive customer from Mexico reports that they stopped trading with Trive in October after a series of alarming internal and financial issues. First, the client‘s account manager allegedly admitted that Trive had not paid staff salaries for three months, suggesting serious internal cash flow or governance problems despite the broker’s regulated status.

Second, the client states that a balance of 104.29 USD, visible on their account, should have been paid out when they closed their relationship with Trive, yet the broker never processed this withdrawal and stopped responding to support calls. Third, the same customer later learned of problems around Trives FINRA‑related regulatory arrangements, reinforcing their impression that the company was both incompetent in compliance and acting like a scam by withholding legitimate funds.

Even though 104.29 USD is small compared with other reported losses, refusal to pay such a clear balance is a strong early indicator of a forex scam pattern, because a reputable broker usually settles all remaining funds when a client exits. Traders in Mexico and elsewhere should see this as a warning sign: if minor balances are blocked without explanation, larger withdrawals may be at much higher risk.

Cases from Hong Kong: Profit Stealing and “Abuse” Accusations

Multiple traders from Hong Kong describe nearly identical experiences in which Trive allegedly “stole” profits after successful trading. One client reports that when they made around 955 USD in profit, the broker refused to pay out and claimed “abuse,” but when the client asked for specific abuse details, Trive refused to provide any evidence.

Another Hong Kong case states that about 5,000 USD in profit was removed from the account, again with vague references to “abuse” and no transparent documentation of what rule was supposedly broken. External reviews echo this pattern, with some traders alleging that once they became consistently profitable, profits were cancelled or accounts were restricted under broad, unsubstantiated accusations of fraud or strategy abuse.

This behavior—allowing clients to lose money freely while retroactively voiding profits—is a common feature of many forex scams and abusive broker practices. For anyone in Hong Kong searching terms like “forex scam” or “scam alert,” these cases strongly suggest that trading with Trive may expose profits to arbitrary confiscation rather than fair market risk.

Cases from India: Blocked Withdrawals and Fake Bonus Risks.

Traders from India also report serious issues that align with patterns of forex investment scams. One Indian client warns others bluntly, “dont withdraw profits,” indicating that profit withdrawals face obstacles that are not clearly stated in advance.

Another review claims that Trives promotional bonus is “fake,” alleging that the platform can close orders at any time under the guise of bonus terms and that the platform's publicly displayed rating is misleading. Bonus schemes are a common tool in forex scams: terms hidden in the fine print allow the broker to restrict withdrawals or close positions, effectively trapping client funds.

When you combine bonus‑related restrictions, inaccessible profits, and the warning not to attempt withdrawals, the environment described by Indian users resembles a forex trading scam rather than a transparent, client‑focused broker. For traders in India, these reports should serve as a strong scam alert and a reason to check independent risk assessments on the WikiFX App before depositing with Trive or any similar platform.

How to Protect Yourself from Forex Scams Like These

Even with a regulated broker, you should treat repeated complaints about stolen profits and blocked withdrawals as serious red flags that often precede larger losses. Always verify the exact entity you are opening an account with, confirm which regulator covers that entity, and understand what real protections (such as compensation schemes or negative balance protection) are actually available to you.

Before depositing or scaling up your trading, search for “Trive forex scam,” “forex trading scam,” or “forex investment scam” and read recent user experiences, paying special attention to countries and regions similar to your own. Using the WikiFX App, traders can track Trives regulatory licenses, monitor new complaints from Mexico, India, Hong Kong and other regions, and compare Trive with alternative brokers that show fewer scam alerts and a cleaner withdrawal record.

If you already trade with Trive and notice unexplained balance changes, profit deductions, or ignored withdrawal requests, collect screenshots, account statements, and communication logs immediately, then escalate to the relevant regulator and seek independent legal or financial advice. In many documented forex scams, acting early when the first small irregularities appear is what prevents a manageable issue from turning into a total loss of your trading capital.

Read more

Wingo Markets Exposure: Alleged Profit Deletions and Forced Account Closures

Has Wingo Markets deducted all your profits from the trading platform? Did it illegitimately close your forex trading account and burn all your hard-earned capital? Have you been denied withdrawals all the time? Maybe your issues align with many of its clients who have reported these incidents online. In this Wingo review article, we will check out the complaints, the broker’s regulation status, and some other events it is linked to. Keep reading!

Pemaxx Legitimacy Check: An Evidence-Based Review of Scam Allegations

If you are asking "Is Pemaxx Legit" or are worried about a possible "Pemaxx Scam," you are asking the right questions. Choosing where to put your trading capital is the most important decision you will make. In a market with many choices, telling the difference between trustworthy brokers and risky ones is crucial. Our complete review of available information, user experiences, and regulatory details shows major warning signs and high risk with Pemaxx. The evidence we found shows a clear pattern of problems that should make any potential investor very careful. This article will look at these concerns in detail, focusing on three important areas: questionable regulatory status, an extremely low safety score from independent reviewers, and a troubling number of user complaints about not being able to withdraw funds. Before trusting any broker, you must do your own research. This means looking beyond the broker's own advertising and checking its status using independent regulatory datab

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

Is Pemaxx a safe broker for your capital? This is the most important question for anyone thinking about trading, and the facts suggest this is a high-risk situation. On its website, Pemaxx looks like a worldwide trading company that offers many different investment options and good account deals. But when we look deeper into how it is regulated and what real users say, we find some very worrying problems. Information from independent checking websites and many user complaints show us a broker that doesn't live up to what it promises in its advertising. Government watchdog groups say its license looks fake, and checking services, such as WikiFX, give it a very low trust rating and tell people to stay away. Users report serious problems, especially not being able to take their capital out. These mixed signals—between what Pemaxx advertises and what users actually experience—make it absolutely necessary to do your own research before investing. Websites that collect this information, suc

Is GLOBAL GOLD & CURRENCY CORPORATION Safe or Scam: Looking at Real User Reviews and Common Problems

When people who trade want to know if a broker is safe, they want a straight answer. Based on many user reviews, GLOBAL GOLD & CURRENCY CORPORATION (GGCC) looks very risky for people thinking about using it. This company works as a broker without proper rules watching over it and has a very low trust score of 1.36 out of 10 on WikiFX, a website that checks brokers. This low score isn't random. It comes from many real user complaints and serious warning signs about how the company works. The biggest problems users report pertain to how trades work, including huge price differences from what they expected, and major trouble getting their capital back. These aren't small problems - they're big issues that can put a trader's capital at serious risk. This article will look at these problems closely, checking the facts and real experiences of traders who have used this platform.

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Amaraa Capital Scam Alert: Forex Fraud Exposure

Vebson Scam Exposure: Forex Withdrawal Failures & Fake Regulation Warning

EGM Securities Review: Investigating Multiple Withdrawal-related Complaints

Galileo FX Exposure: Allegations of Fund Losses Due to Trading Bot-related Issues

Fed Balance Sheet Mechanics: The Silent Risk to Liquidity

Gold Eclipses $5,070 as China Treasury Shift Hammers the Dollar

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

Rate Calc