Is ROCK-WEST Legit or Fake? A Simple Guide for Traders

Abstract:The question of whether ROCK-WEST is legit doesn't have a simple "yes" or "no" answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry. First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

A Quick Answer

The question of whether ROCK-WEST is legit doesn't have a simple “yes” or “no” answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry.

First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

Breaking Down Regulatory Status

A broker's regulatory status is the foundation of its legitimacy and your financial safety. For ROCK-WEST, this is a point of serious weakness. The broker is run by MAIV LIMITED, which holds a license from the Seychelles Financial Services Authority (FSA). This immediately puts it in the offshore broker category.

So, what does offshore regulation by the Seychelles FSA really mean for you? Unlike top-level regulators such as the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC), offshore authorities provide much lower levels of oversight. Key differences include:

· Weaker Rule Enforcement: Offshore regulators often have less power and fewer resources to enforce rules or punish non-compliant brokers.

· No Safety Programs: If an offshore-regulated broker becomes bankrupt or commits fraud, there is typically no investor safety fund to help you recover your losses. With a top-level regulator, programs like the FSCS (UK) or ICF (Cyprus) offer a crucial safety net.

· Easier Operating Requirements: The funding requirements and operating standards for getting an offshore license are not that demanding, making it easier for firms with questionable practices to enter the market.

Here is a summary of ROCK-WEST's regulatory profile:

| Regulatory Detail | Information |

| Regulated Entity | MAIV LIMITED |

| Regulatory Body | Seychelles Financial Services Authority (FSA) |

| License Number | SD044 |

| Status | Offshore Regulated |

| Key Result | Lack of strong investor protection. |

Further complicating the picture is the broker's history. Research shows an associated company in the United Kingdom, MAIV LTD (Registration No. 07291053). Importantly, public records show this entity's status as “Deregistered” since 2010. While companies can be deregistered for various reasons, the connection to a defunct entity in a major financial area raises significant red flags about the operational transparency and historical continuity of the people behind the ROCK-WEST brand. This lack of a clear, continuous, and well-regulated company history is a serious concern for background checks.

Looking at Trader Feedback

The most direct way to assess a broker's real-world performance is to look at the experiences of its users. In the case of ROCK-WEST, the feedback is sharply divided and paints a troubling picture. The WikiFX platform has issued a specific risk alert stating, “The number of complaints received by WikiFX has reached four for this broker. Please be aware of the risk!”

When we look into the details of these negative reports, several repeating and serious themes emerge:

· Withdrawal & Deposit Issues: This is the most common and alarming complaint. One user from Malaysia reported strategic deposit delays, claiming, “Deposit Money Delay when you are floating -ve... they target users to lose money first and deposit will be added after you lose all money.” Another user from South Africa was completely unable to access funds: “This broker doesn't want to issue my profit and deposit... They even went as far as blocking my account from making further withdrawals.”

· Claims of Manipulation: A trader from Vietnam made a serious accusation of platform interference, stating, “I trade with profit and was scammed by Rock West, they automatically withdrew my profits... Their platform can interfere with your money.” This suggests a basic breach of trust between the broker and client.

· Poor or Unresponsive Support: A user from Venezuela, facing a significant loss, reported a complete breakdown in communication: “Nadien gives me an answer, and everything is a disaster on their platform.”

To provide a balanced view, we've looked at the interactions where the broker has officially replied to these public complaints.

| User Complaint Summary | Broker's Official Reply (Summary) | Our Analysis of the Interaction |

| “Deposit Money Delay when you floating -ve... target user to losing money” | Apologized for the inconvenience, blamed the delay on a third-party issue, and offered support. | While the reply is a standard customer service response, the user's main accusation of strategic delays during a negative float is a severe operational concern that goes beyond a simple “third-party issue.” |

| “scammed by Rock West, they automatically withdrew my profits” | Thanked the user for their collaboration in resolving the issue. | The reply suggests a resolution was reached. However, the initial accusation of unauthorized fund withdrawal is a major violation of trust and a significant red flag for any potential trader. |

| “Unable to withdraw... blocking my account” | Apologized and stated that account blocks are done according to Terms & Conditions for security. | This is a generic, policy-based response. It may not satisfy a user who feels their account was unfairly blocked, and it highlights the broker's power to restrict access to funds based on its own terms. |

On the other side of the spectrum, there are positive reviews. These users praise ROCK-WEST for its low minimum deposit, with one trader from Colombia noting, “Starting trading with just $25 is a huge plus.” Others report “easy to deposit and withdraw money” and “good client service,” which stands in stark, direct contradiction to the negative reports.

This extreme difference is, in itself, a warning sign. A reliable broker should offer a consistent and predictable experience, especially for core functions like deposits and withdrawals. The fact that some users report smooth transactions while others claim their funds are blocked or delayed suggests operational instability or, more worryingly, selective treatment of clients.

To see these user reviews in real-time, read the broker's full replies, and check for new ones, you can view the full, unedited report on ROCK-WEST's WikiFX page.

Looking at Trading Conditions

Beyond regulation and user feedback, a broker's trading conditions can reveal its business model and target audience. ROCK-WEST offers a range of features, some of which align with industry standards, while others are characteristic of high-risk brokers.

The broker provides two primary account types, Standard and Raw, catering to different trading styles.

| Feature | Standard Account | Raw Account |

| Minimum Deposit | $50 | $250 |

| Spreads | From 1.4 pips | From 0.0 pips |

| Commission | $0 | $8 per lot |

| Max Leverage (Forex) | 1:2000 | 1:1000 |

The most striking feature here is the maximum leverage of 1:2000. While this might appear attractive to traders seeking to maximize their market exposure with minimal capital, it is an extremely dangerous tool for retail clients. Top-level regulators in major areas like Europe, the UK, and Australia have banned such high leverage levels precisely because they dramatically increase risk. Leverage of 1:2000 means that a tiny market movement of just 0.05% against your position can wipe out your entire account balance. Offering this level of leverage is widely considered an irresponsible practice that prioritizes attracting high-risk traders over client protection.

In terms of platforms, ROCK-WEST offers the industry-standard MetaTrader 5 (MT5) and its own mobile app. The availability of a full MT5 license is a technical positive, as it's a strong and familiar platform for many traders.

The broker lists common deposit and withdrawal methods, including VISA, Mastercard, and cryptocurrencies like USDT. However, the value of these options is undermined by the user complaints previously discussed. The existence of a payment method is irrelevant if the process of using it to withdraw profits is unreliable or filled with delays and disputes. The pattern of complaints suggests a significant disconnect between the advertised payment infrastructure and the actual user experience.

For a complete and interactive breakdown of these trading conditions, including available instruments and server details, visit the detailed ROCK-WEST profile on WikiFX.

Final Decision: Warning vs Good Signs

To summarize our findings, we can categorize the attributes of ROCK-WEST into clear warning signs (red flags) and good signs (green flags). This framework provides a final, easy-to-scan summary to help you weigh the risks.

🚩 Warning Signs: Major Red Flags to Consider

· Critical Risk: Offshore Regulation: The Seychelles FSA license provides minimal investor protection and leaves you with little to no financial help in the event of a dispute or broker bankruptcy. This is the single most significant risk factor.

· High Volume of Complaints: A clear pattern of serious user complaints on WikiFX, focused on basic issues, such as withdrawal failures, deposit delays and arbitrary account blocking, indicates potential operational or ethical problems.

· Associated Deregistered Company: The historical link to a “Deregistered” UK entity (MAIV LTD) raises serious questions about the firm's company transparency, stability, and background.

· Extremely High Leverage: Offering leverage up to 1:2000 is a hallmark of high-risk, offshore brokers. It is a practice banned by responsible regulators as it encourages over-leveraging and dramatically increases the risk of total capital loss for retail traders.

· Inconsistent User Experience: The stark contrast between positive and negative reviews, especially concerning withdrawals, suggests an unstable and unreliable operational environment where your experience may be unpredictable.

✅ Good Signs: Potential Positive Attributes

· Established Operating Period: Having been in operation for 5-10 years is longer than many fly-by-night fraudulent operations, suggesting some level of business continuity.

· Industry-Standard Platform: The provision of the full MetaTrader 5 (MT5) platform is a positive technical feature, offering traders a powerful and familiar trading environment.

· Low Entry Barrier: A low minimum deposit of $50 on the Standard account makes the platform accessible for traders who want to start with a small capital.

· Some Positive Feedback: The existence of positive reviews indicates that not every user journey ends in disaster, though this must be weighed against the severity of the negative reports.

Conclusion: Protect Yourself

Our comprehensive investigation reveals that while ROCK-WEST is an officially registered company, its legitimacy as a trustworthy trading partner is severely undermined by major warning signs. The combination of offshore regulation, a high volume of serious user complaints about fund withdrawals, an unclear company history, and the offering of excessively high leverage places it firmly in a high-risk category. These answer your question - Is ROCK-WEST legit - in NO.

The decision to trade with any broker ultimately rests on an individual's risk tolerance. However, the evidence strongly suggests that engaging with ROCK-WEST requires accepting a substantial level of risk, particularly concerning the safety and accessibility of your funds. The potential for encountering the same withdrawal and account-blocking issues reported by other users is a real danger that cannot be ignored. The good signs, such as a low minimum deposit and MT5 support, do little to reduce these basic risks.

Before engaging with any broker, especially one with as many mixed signals as ROCK-WEST, performing your own background check is absolutely necessary. We strongly advise using a comprehensive third-party verification tool to check the latest regulatory status, user reviews, and risk alerts. You can find the complete, up-to-date file for this broker on the ROCK-WEST page at WikiFX.

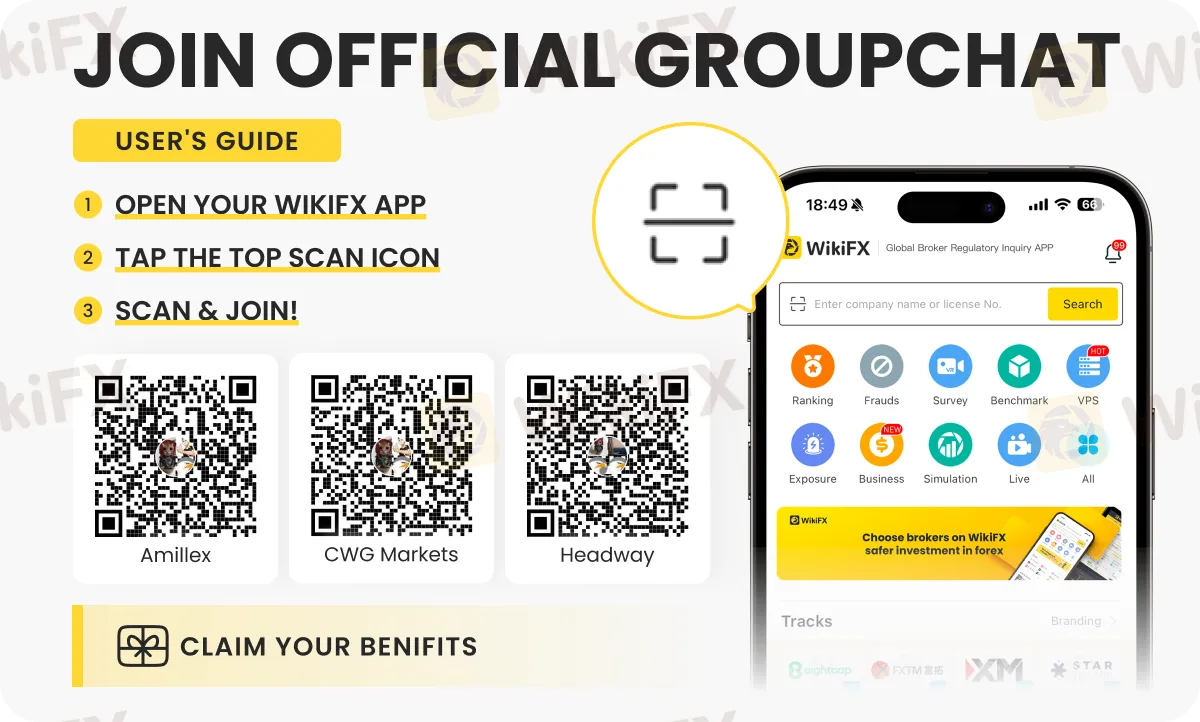

Want to navigate the forex market through its ups and downs with confidence? Heres the secret! Join our special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - where industry experts take you through to the top with exclusive strategies and insights. Follow the instructions below to get started.

Read more

ROCK-WEST User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences. This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

ROCK-WEST Regulation: Understanding Its License and Company Information

For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand. The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before inves

Alpari Review: Reputation Under Scrutiny Amid Fund Scams & Withdrawal Complaints

Have you been subject to intense manipulation by the chart provided on the Alpari forex trading platform? Have you faced losses due to inefficient stop-loss and take-profit executions by the broker? Does the forex broker constantly reject your withdrawal applications? Is the Alpari customer support too slow to respond to your withdrawal queries? Is your deposit not reflecting or showing less than your invested capital on the trading platform? These issues are trending on many review platforms. In this Alpari review article, we have investigated these complaints. Take a look!

NinjaTrader Launches Futures Trading in Europe via MiFID Broker

NinjaTrader launches futures trading in Europe through MiFID‑regulated Payward Europe Digital Solutions (CY) Limited, starting in the Netherlands and Germany, with plans for France and Italy.

WikiFX Broker

Latest News

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Rate Calc