Alpari Review: Reputation Under Scrutiny Amid Fund Scams & Withdrawal Complaints

Abstract:Have you been subject to intense manipulation by the chart provided on the Alpari forex trading platform? Have you faced losses due to inefficient stop-loss and take-profit executions by the broker? Does the forex broker constantly reject your withdrawal applications? Is the Alpari customer support too slow to respond to your withdrawal queries? Is your deposit not reflecting or showing less than your invested capital on the trading platform? These issues are trending on many review platforms. In this Alpari review article, we have investigated these complaints. Take a look!

Have you been subject to intense manipulation by the chart provided on the Alpari forex trading platform? Have you faced losses due to inefficient stop-loss and take-profit executions by the broker? Does the forex broker constantly reject your withdrawal applications? Is the Alpari customer support too slow to respond to your withdrawal queries? Is your deposit not reflecting or showing less than your invested capital on the trading platform? These issues are trending on many review platforms. In this Alpari review article, we have investigated these complaints. Take a look!

Elaborating on the Top Forex Trading Complaints Against Alpari

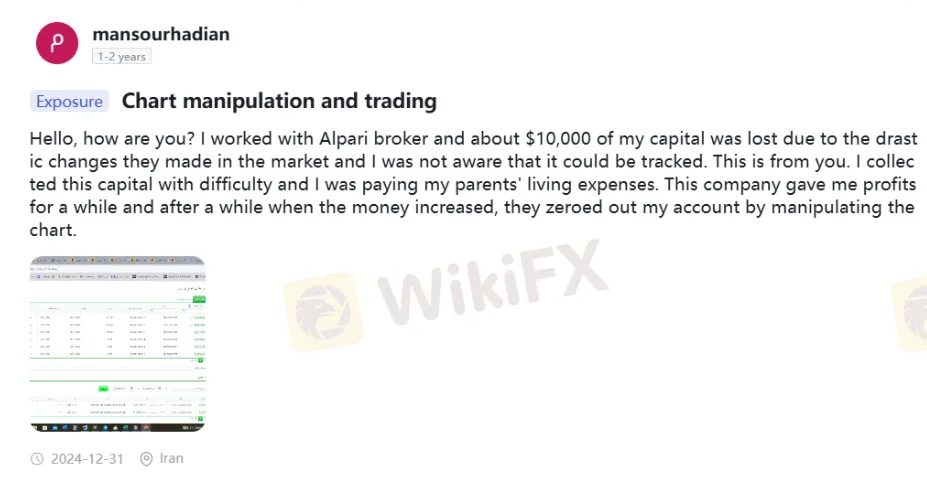

The $10,000 Loss Due to Chart Manipulation

An Iran-based trader recently reported on WikiFX, the worlds leading forex regulation inquiry app, about the $10,000 loss on the Alpari login due to chart manipulation. Because of the drastic changes made to the chart, the trader lost all the funds. As per the complaint, Alpari allowed the trader to withdraw profits for a while. However, as the trading account balance rose, the broker manipulated the chart to make it zero. Check out what the trader said while sharing the Alpari review.

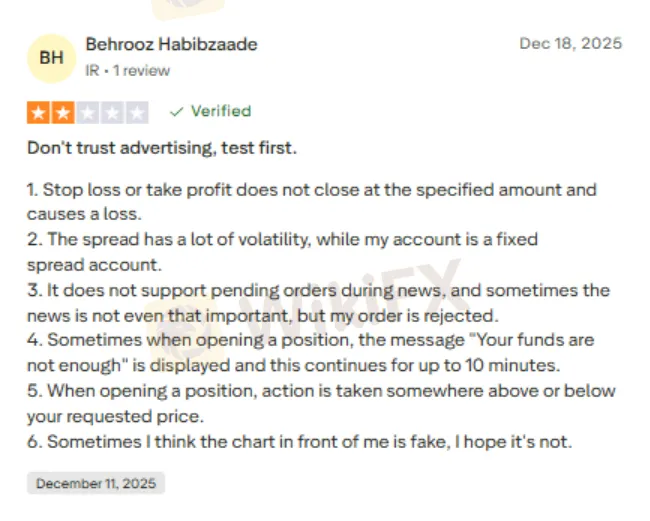

Stop-loss and Take-profit Order Manipulation Hit Alpari Traders

Disclosing a series of trading violations, a trader recounted an incident that caused losses due to the poor execution of stop-loss and take-profit orders. According to the trader, Alpari did not execute these orders at the specified level. The trader further revealed that the spread continued to remain volatile despite holding a fixed spread account. Even worse is the lack of support for pending orders, the trader alleged. Concerned by the overall trading experience, the trader shared this negative Alpari broker review online.

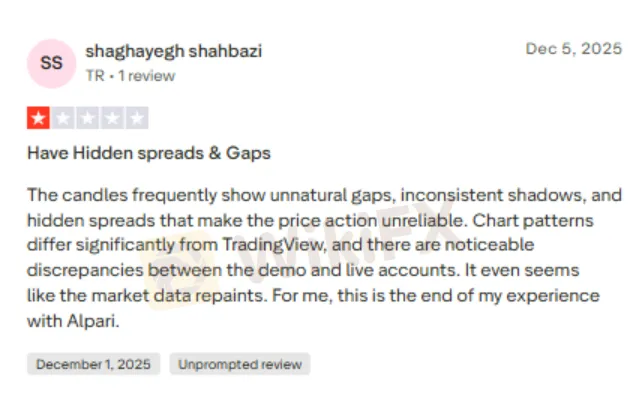

Hidden Spreads & Gaps

Offering extensive insights into the trading manipulation, a trader alleged that Alpari‘s candles demonstrate unnatural gaps, inconsistent shadows and hidden spreads, contributing to unreliable price action. While chart patterns differ from the globally-accepted TradingView, there have been significant discrepancies between demo and live accounts, the trader alleged. To know more, read the trader’s Alpari review in full.

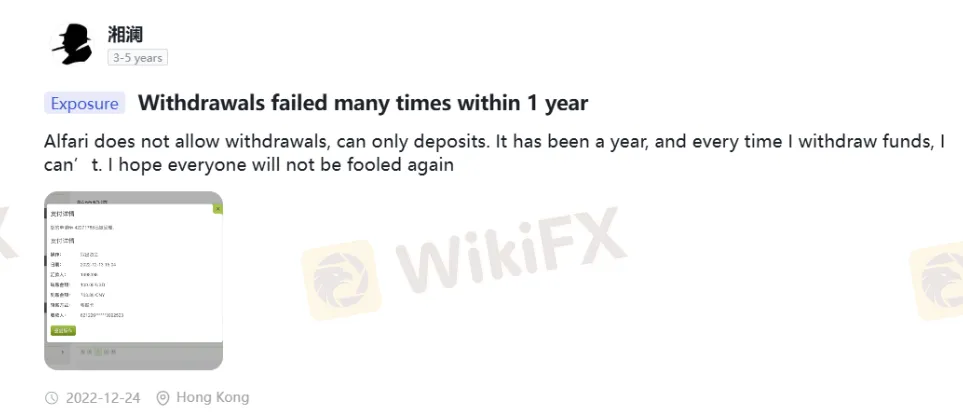

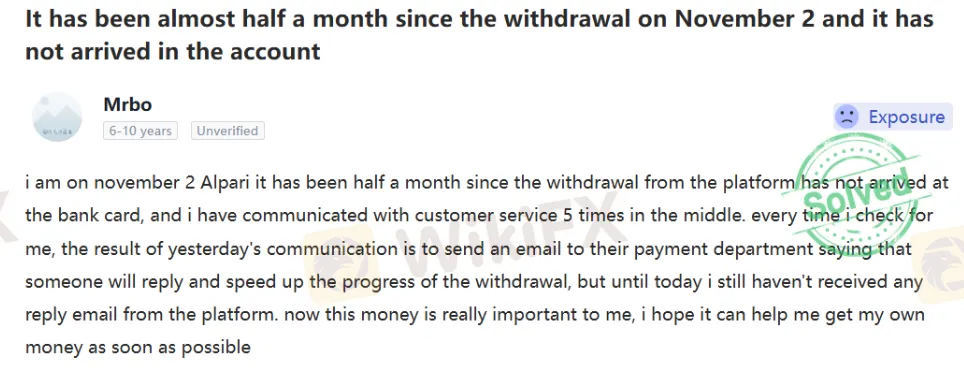

A Long List of Withdrawal Denials by Alpari

Traders are visibly upset by Alpari's poor withdrawal process, with some traders waiting for the fund release for as long as a year. Despite contacting the brokers official numerous times, traders have not been able to access funds. Here are multiple screenshots supporting withdrawal complaints.

Allegation on the Alpari Customer Support Service

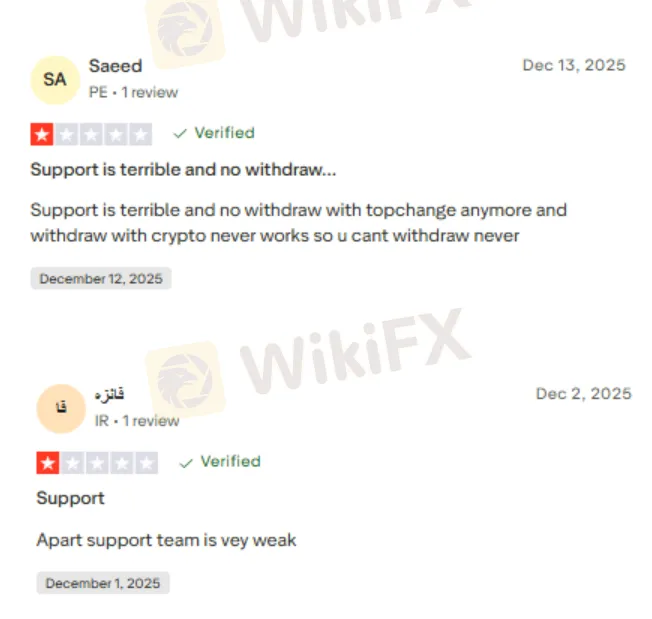

The Alpari customer support team has been under fire from many of its clients for its lack of efficiency, especially concerning fund withdrawals. Many complaints suggest that Alpari‘s customer support service is unresponsive to trading queries regarding withdrawals. With no timely updates, the customer support team has allegedly been equally responsible for traders’ discomfort. Here are multiple screenshots putting the customer support team under the scanner.

Multiple Deposit Credit Failure Complaints

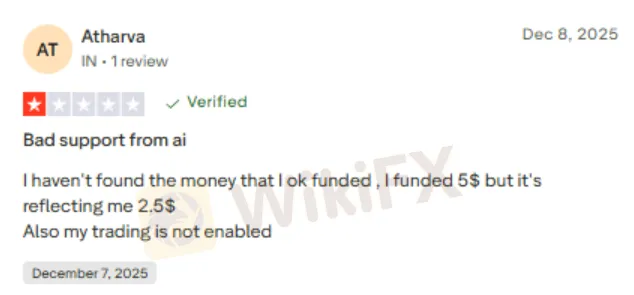

Multiple traders have complained about the deposits not getting credited to their forex trading account. While accessing the Alpari login, traders fail to find their deposits. In some cases, the reflected deposit amount is less than the deposit made. This only indicates an investment scam by the broker. Lets examine the multiple deposit credit failure complaint screenshots.

Alpari WikiFX Review: Check Out the Broker‘s Regulatory Status

After examining the complaints, the WikiFX team conducted a thorough inquiry into Alpari’s regulation. The team found the broker to be regulated in Belarus. However, given the surging complaints, the team gave it a score of just 2.52 out of 10.

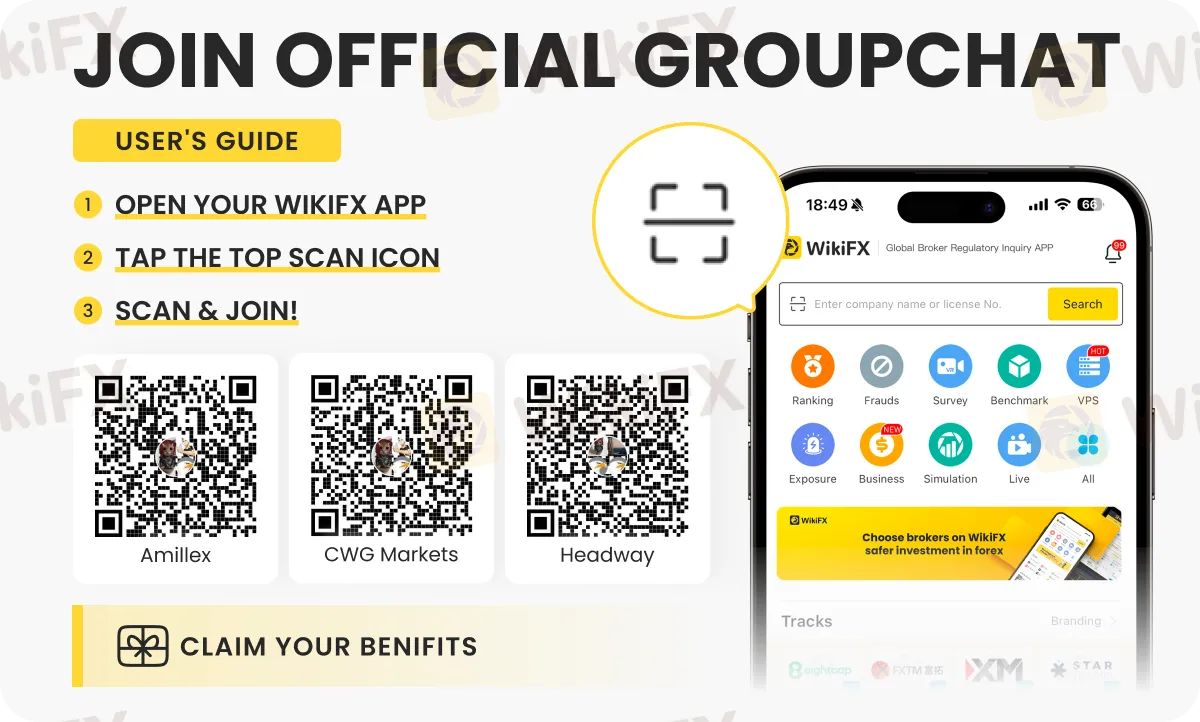

For more forex broker updates, join these expert-led chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - by following the instructions shown below.

Read more

ROCK-WEST User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences. This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

ROCK-WEST Regulation: Understanding Its License and Company Information

For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand. The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before inves

Is ROCK-WEST Legit or Fake? A Simple Guide for Traders

The question of whether ROCK-WEST is legit doesn't have a simple "yes" or "no" answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry. First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

NinjaTrader Launches Futures Trading in Europe via MiFID Broker

NinjaTrader launches futures trading in Europe through MiFID‑regulated Payward Europe Digital Solutions (CY) Limited, starting in the Netherlands and Germany, with plans for France and Italy.

WikiFX Broker

Latest News

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Geopolitical Risk: Iran Accuses West of Inciting Domestic Unrest

Geopolitical Risk: US Carrier Deploys as Iran Eyes Hormuz

Rate Calc