User Reviews

More

User comment

10

CommentsWrite a review

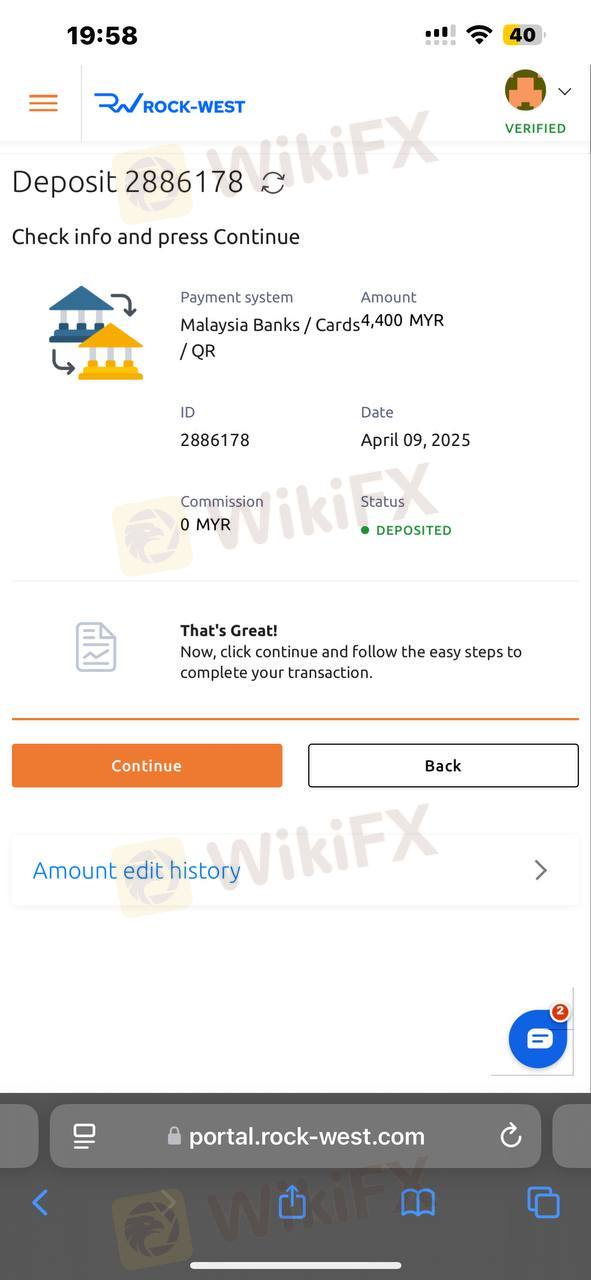

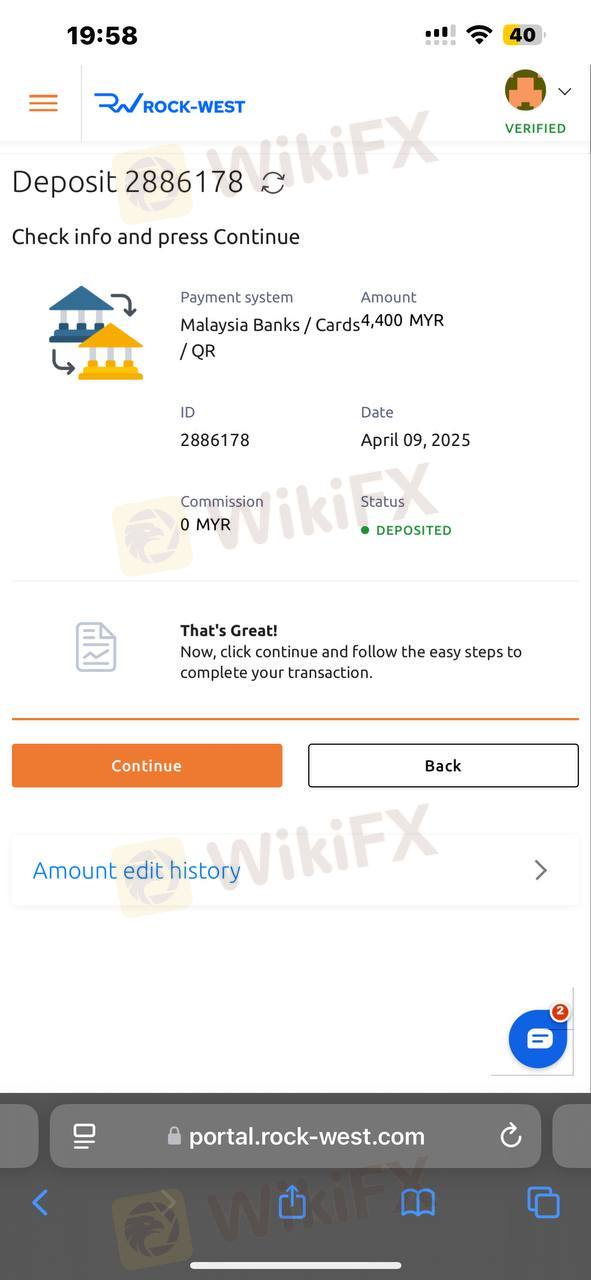

2025-04-09 20:00

2025-04-09 20:00

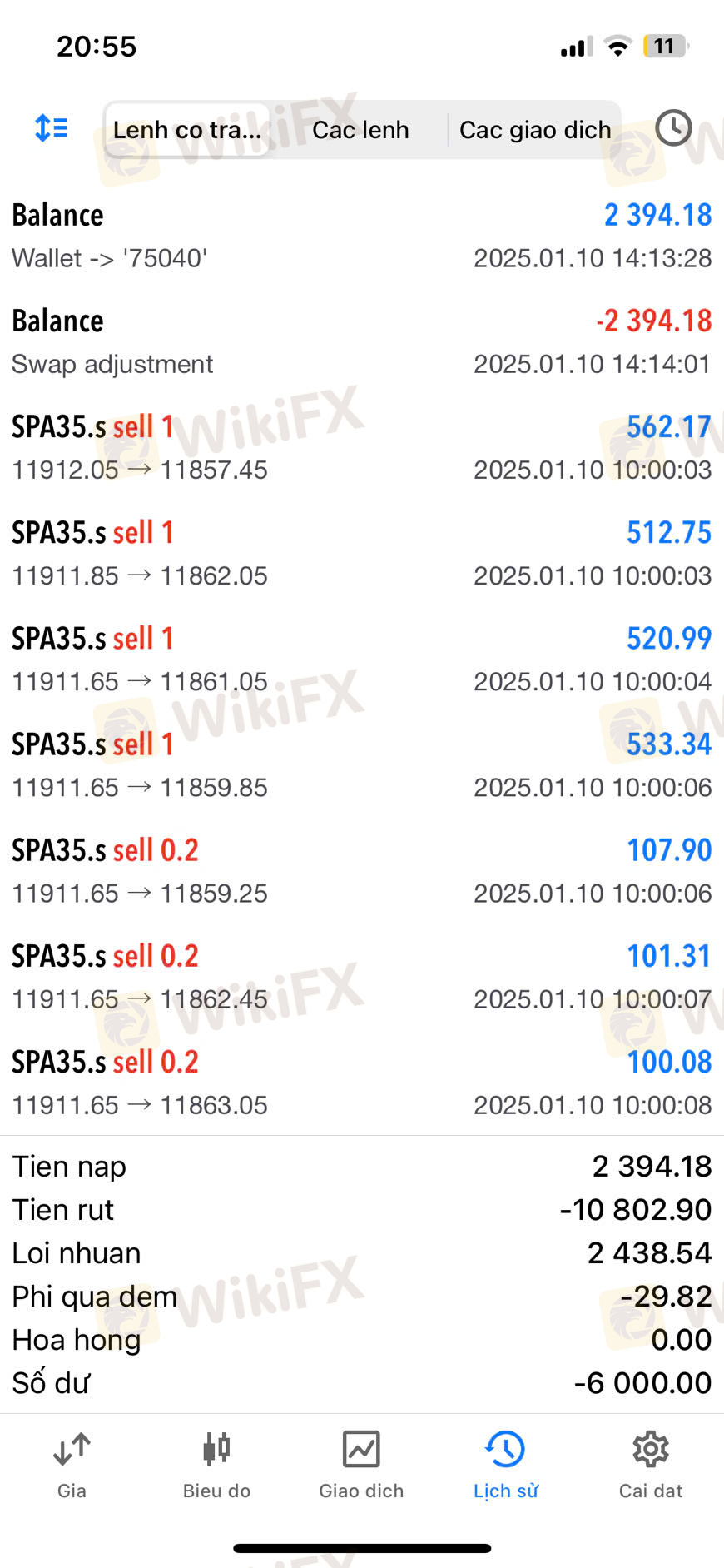

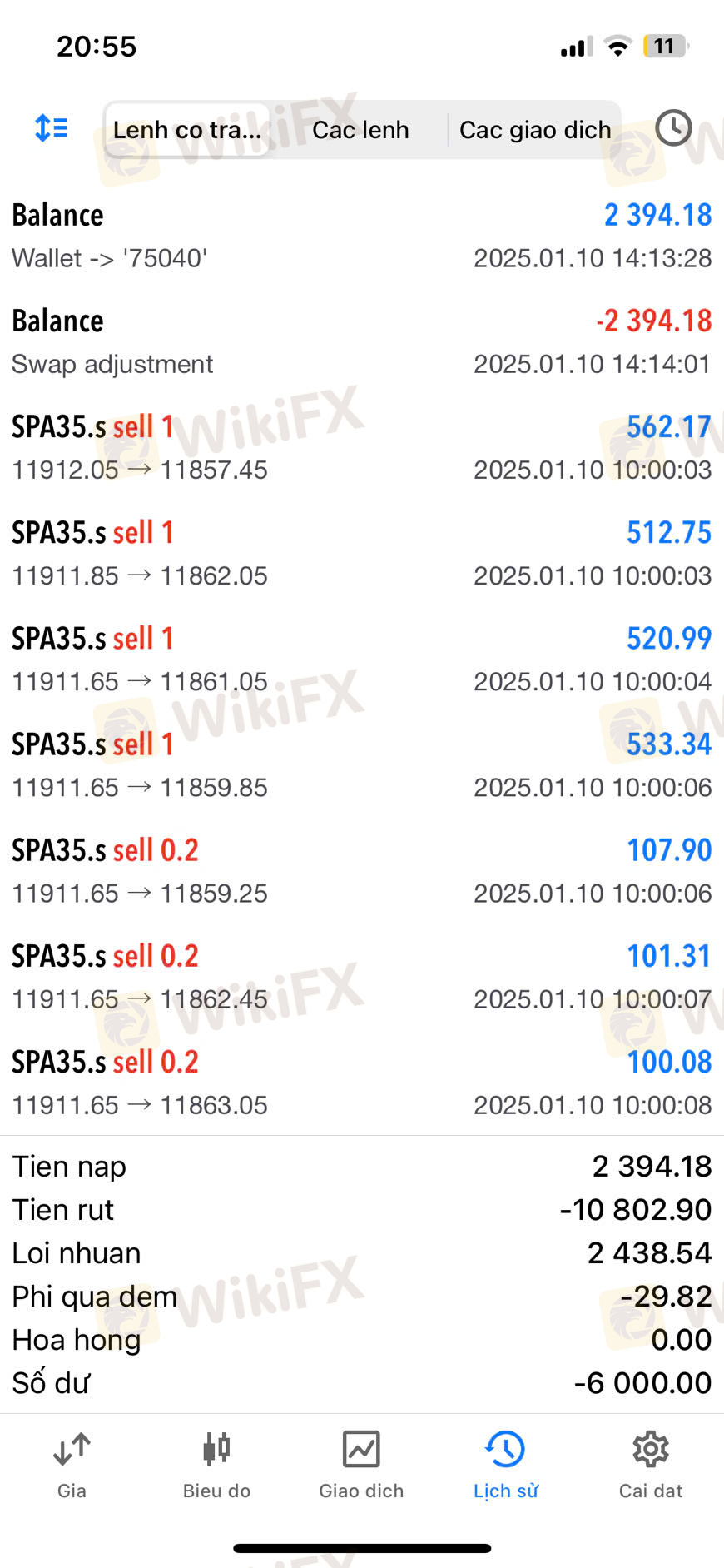

2025-01-13 09:33

2025-01-13 09:33

Score

5-10 years

5-10 yearsRegulated in Seychelles

Derivatives Trading License (EP)

MT5 Full License

Global Business

Medium potential risk

Offshore Regulated

Influence

Add brokers

Comparison

Quantity 5

Exposure

Score

Regulatory Index1.76

Business Index6.89

Risk Management Index8.22

Software Index9.17

License Index1.76

Single Core

1G

40G

More

Company Name

MAIV LIMITED

Company Abbreviation

ROCK-WEST

Platform registered country and region

Seychelles

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| Rock-West Review Summary | |

| Founded | 2019 |

| Registered Country/Region | Seychelles |

| Regulation | Offshore regulated by FSA |

| Market Instruments | Forex, Indices, Commodities, Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | Up to 1:2000 |

| Spread | From 1.4 pips (Standard account) |

| Trading Platform | MT5, RW Mobile App, RW Trade |

| Copy Trading | ✅ |

| Minimum Deposit | $50 |

| Customer Support | Live Chat |

| Social Media: LinkedIn, Facebook, Instagram, Telegram, TikTok, YouTube, X | |

| Regional Restrictions | Albania, Bosnia, Belarus, Burma (Myanmar), Burundi, Canada, CAR, Crimea, Congo, Cuba, Dem. Rep. of Ethiopia, Russia, Iran, Iraq, Israel, Lebanon, Libya, Kosovo, Somalia, North Korea, South Sudan, Syria, Venezuela, Yemen, the USA, Zimbabwe |

Rock-West operates as an online broker based in Seychelles, offering a wide array of trading assets, including forex, indices, commodities, and cryptocurrencies. Rock-West provides traders with the popular MT5 and its proprietary Rock-West platform. On this platform, the spread starts from 0 pips, and leverage is up to 1:2000. However, Rock-West doesn't offer its service to residents from certain areas.

| Pros | Cons |

| MT5 supported | Offshore regulated |

| Three account types | Commission charged |

| Demo accounts available | Limited contact channels |

Not exactly. Rock-West operates under offshore regulation, meaning traders using this platform lack the investor protections typically provided by major financial authorities.

| Regulated Country | Regulated Authority | Regulatory Status | Regulated Entity | License Type | License Number |

| The Seychelles Financial Services Authority (FSA) | Offshore Regulated | MAIV LIMITED | Retail Forex License | SD044 |

Traders on Rock-West get access to market instruments including forex, indices, commodities, and 170+ cryptocurrencies.

| Trading Asset | Available |

| forex | ✔ |

| cryptocurrencies | ✔ |

| commodities | ✔ |

| indices | ✔ |

| stocks | ❌ |

| bonds | ❌ |

| options | ❌ |

| funds | ❌ |

| ETFs | ❌ |

Rock-West offers Standard, Raw, and an additional VIP Raw accounts on the Rock-West native platform and MT5 for trading CFDs.

Furthermore, Rock-West maintains regular accounts alongside additional account services.

This table provides a clear comparison of the features and specifications for Standard and Raw account types.

Account Type | Standard | Raw |

| Minimum Deposit | $50 | $250 |

| Maximum Leverage | 1:2000 | 1:1000 |

| Spread | From 1.4 pips | From 0.0 pips |

| Commission | $0 | $8 per lot |

| Bonus | 100% | / |

| Maximum Bonus | $10,000 | / |

| Withdrawable Bonus | $2 per Lot upon hitting target | / |

| Copy Trading | ✔ | ❌ |

| Swap Free | Upon request | / |

| Minimum Lots | 0.01 | |

| Stop Out Level | 30% | |

| Suitable for | Traders of all experience levels | High frequency traders & Scalpers |

Leverage on this platform is up to 1:2000 and varies based on the account and the asset class.

| Leverage | Standard | RAW |

| Forex | 1:2000 | 1:1000 |

| Metals | 1:800 | 1:400 |

| Indices | 1:100 | |

| Commodities | ||

| Cryptos | 1:10 | |

Standard accounts feature spreads from 1.4 pips, while Raw accounts offer raw spreads (from 0 pips + commission).

Rock-West charges 0% commission for standard accounts. However, when it comes to Raw accounts, the commission is $8 per lot.

Account Type | Standard | Raw |

| Spread | From 1.4 pips | From 0.0 pips |

| Commission | $0 | $8 per lot |

Rock-West offers both MT5 and its proprietary Rock-West platform.

| Trading Platform | Supported | Available Devices | Suitable for |

| Rock-West platform | ✔ | Desktop, Mobile, Web | / |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

| MT4 | ❌ | Desktop, Mobile, Web | Beginners |

| Trading View | ❌ | Desktop, Mobile, Tablets, Web | Beginners |

Traders looking for unbiased information about ROCK-WEST often find mixed messages. The broker offers some appealing features: you can start with just $50, use the popular MetaTrader 5 trading platform, and get very high leverage. These features are meant to attract both new and experienced traders who want easy access to potentially profitable trading. However, as you look deeper, there are serious problems. The good features are overshadowed by the broker's weak regulation and many serious complaints from users, especially about not being able to withdraw their capital. This complete 2025 ROCK-WEST Review will examine every important aspect of how it works—from regulation and trading rules to real user experiences—to give traders clear, fact-based information for making smart decisions.

WikiFX

WikiFX

Empowering Communities to Invest in Their Future: A New Vision for Collective ActionMarch 24, 2025 – Rock-West, a global CFD Broker dedicated to sustainable solutions, proudly announces the launch of

WikiFX

WikiFX

Rock-West, founded in Seychelles, offers a wide array of trading assets, including Forex, indices, commodities, and cryptocurrencies. It offers MetaTrader 5 and Rock-West Trader. Rock-West is regulated by the FSA, offering a sense of security and assurance.

WikiFX

WikiFX

More

User comment

10

CommentsWrite a review

2025-04-09 20:00

2025-04-09 20:00

2025-01-13 09:33

2025-01-13 09:33