JUSTMARKETS Analysis Report

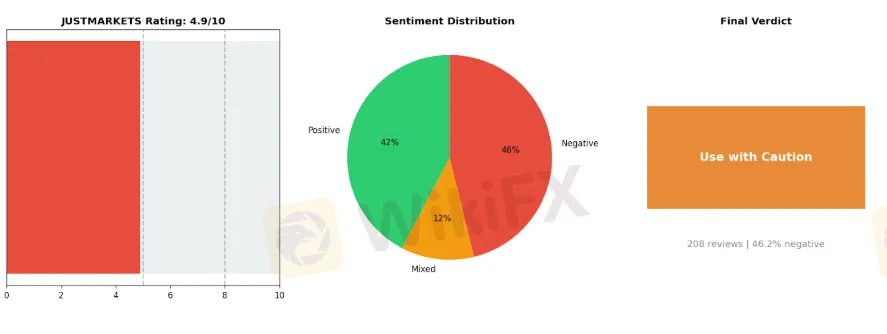

Abstract:JUSTMARKETS presents a concerning paradox for traders, earning a below-average rating of 4.9 out of 10 based on 208 reviews, which warrants serious consideration before opening an account. While the broker demonstrates notable strengths in maintaining a generally good reputation for safety, offering straightforward deposit and withdrawal processes and providing a user-friendly interface that appeals to both beginners and experienced traders, these positives are significantly overshadowed by critical operational issues. The sentiment distribution reveals a troubling picture, with 96 negative reviews nearly matching the 88 positive ones, resulting in a 46.2% negative rate that cannot be ignored. Read on for more information!

Key Takeaway: JUSTMARKETS

JUSTMARKETS presents a concerning paradox for traders, earning a below-average rating of 4.9 out of 10 based on 208 reviews, which warrants serious consideration before opening an account. While the broker demonstrates notable strengths in maintaining a generally good reputation for safety, offering straightforward deposit and withdrawal processes and providing a user-friendly interface that appeals to both beginners and experienced traders, these positives are significantly overshadowed by critical operational issues. The sentiment distribution reveals a troubling picture, with 96 negative reviews nearly matching the 88 positive ones, resulting in a 46.2% negative rate that cannot be ignored.

The most alarming concerns center around withdrawal delays and rejections, which directly impact traders' ability to access their funds when needed. Additionally, customer support appears inadequate, with numerous complaints about slow response times and failure to provide effective solutions to pressing problems. Perhaps most disturbing are the recurring reports regarding fund safety issues, which strike at the heart of what traders need most from their broker: security and reliability.

While JUSTMARKETS may offer an accessible trading environment with some redeeming qualities, the substantial volume of negative feedback and serious concerns about withdrawals and fund safety justify the “Use with Caution” conclusion. Prospective traders should carefully weigh these significant risks against the platform's benefits before committing their capital.

📊 At a Glance

Broker Name: JUSTMARKETS

Overall Rating: 4.9/10

Reviews Analyzed: 208

Negative Rate: 46.2%

Sentiment Distribution:

• Positive: 88

• Neutral: 24

• Negative: 96

Final Conclusion: Use with Caution

⚖️ JUSTMARKETS: Strengths vs Issues

✅ Top Strengths:

1. Good Reputation Safe — 34 mentions

2. Easy Deposit Withdrawal — 32 mentions

3. User Friendly Interface — 27 mentions

⚠️ Top Issues:

1. Withdrawal Delays Rejection — 73 mentions

2. Slow Support No Solutions — 57 mentions

3. Fund Safety Issues — 36 mentions

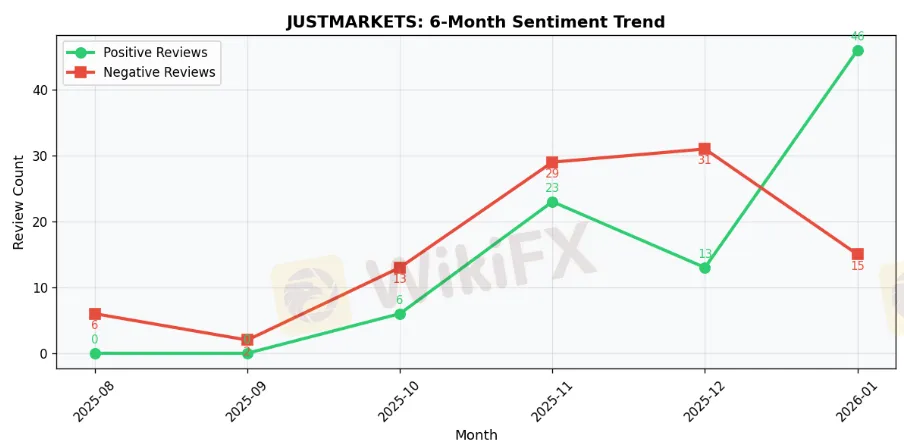

📈 6-Month Sentiment Trend

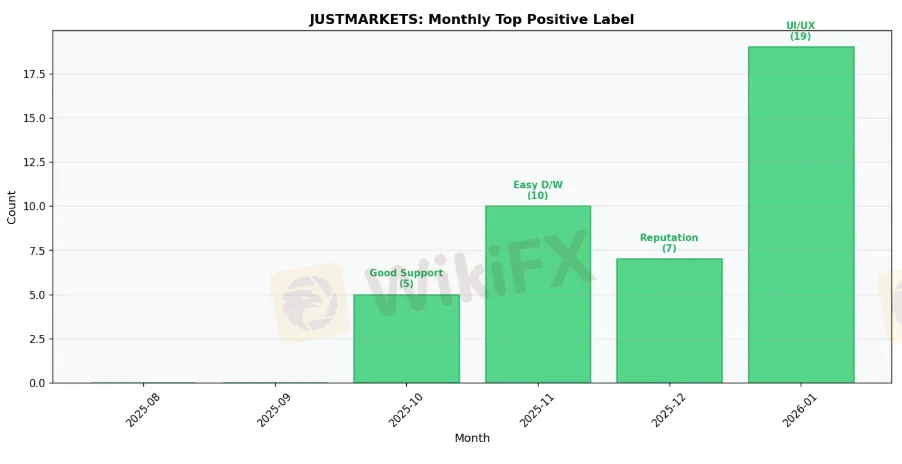

📈 Monthly Top Positive Label

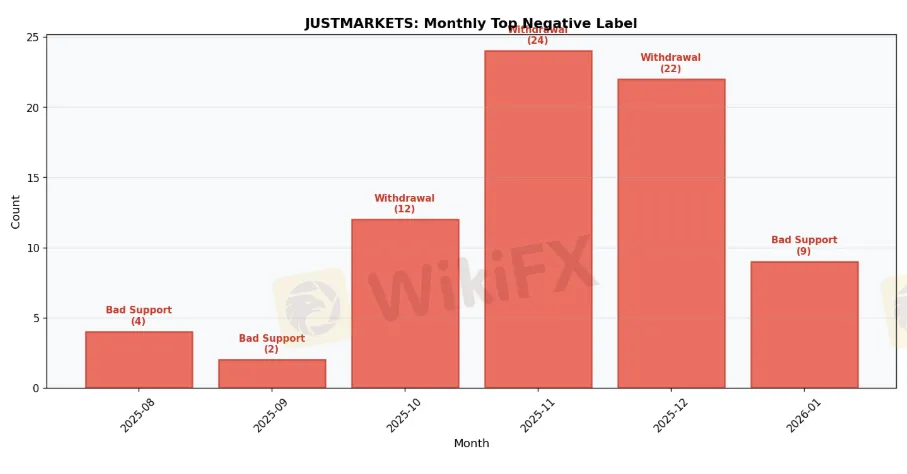

📉 Monthly Top Negative Label

📋 JUSTMARKETS Detailed Analysis

📋 Introduction

JUSTMARKETS Broker Analysis Report: Introduction

In the increasingly complex landscape of retail forex trading, selecting a reliable broker represents one of the most critical decisions for traders at all experience levels. This comprehensive analysis report examines JUSTMARKETS through a rigorous, data-driven methodology designed to provide traders and investors with objective insights into the broker's performance and reputation.

Our analytical framework is built upon a systematic review of 208 verified user experiences collected from multiple independent review platforms. This multi-source approach ensures a balanced perspective that transcends the limitations of single-platform assessments, which can often be skewed by platform-specific user demographics or review policies. By aggregating data from diverse sources—designated as Platform A, Platform B, and Platform C to maintain analytical objectivity—we have constructed a comprehensive picture of JUSTMARKETS' strengths, weaknesses, and overall market standing.

The methodology employed in this report utilizes quantitative metrics combined with qualitative analysis of trader feedback. Each review was evaluated for authenticity, relevance, and substantive content before being incorporated into our assessment framework. This process yielded an overall rating of 4.88 out of 10 for JUSTMARKETS, with a negative sentiment rate of 46.15%, leading to our system conclusion of “Use with Caution.” These figures reflect genuine trader experiences across multiple dimensions including trading conditions, platform reliability, customer service quality, and withdrawal processes.

This report is structured to provide readers with actionable intelligence across several key areas. You will find detailed breakdowns of user sentiment patterns, analysis of the most frequently cited concerns and commendations, comparative performance metrics, and specific risk factors that potential clients should consider. Additionally, we examine the distribution of feedback across different review platforms to identify any notable patterns or inconsistencies.

Whether you are considering opening an account with JUSTMARKETS or conducting due diligence as part of your broker selection process, this report offers evidence-based insights to inform your decision-making. Our objective is not to render a simple recommendation, but rather to present comprehensive data that empowers you to make informed choices aligned with your individual trading requirements and risk tolerance.

⚠️ Key Issues to Consider

Based on comprehensive user feedback analysis, JUSTMARKETS presents several concerning patterns that warrant careful consideration before opening an account. While some issues have been resolved following client escalation, the frequency and nature of complaints reveal systemic operational challenges that potential traders should understand thoroughly.

Withdrawal Processing Concerns

The most significant issue affecting JUSTMARKETS involves withdrawal delays and rejections, accounting for 73 documented cases. Multiple users report situations where withdrawals appear “processed” in the broker's system, complete with payment receipts, yet funds never materialize in their bank accounts. This discrepancy between internal processing status and actual fund delivery creates serious trust issues.

“💬 The Gold Mugger: ”They showed 'processed' in their system and even provided a payment receipt, but the money NEVER reached my bank account. I checked with my bank multiple times, and there is no trace of any transaction.“”

The pattern suggests potential issues with payment processing infrastructure or intermediary banking relationships. While some cases eventually resolve, the extended timelines and lack of proactive communication during these delays represent material risks for traders who may need timely access to their capital for financial planning or reinvestment purposes.

Customer Support Deficiencies

With 57 complaints categorized under slow support and inadequate solutions, JUSTMARKETS demonstrates concerning communication practices. Users frequently report receiving automated responses rather than substantive engagement with their issues. More troubling are instances of contradictory communications, where the broker provides conflicting information about case status and resolutions.

“💬 Mohammed Khalil: ”Yesterday (Jan 7), JustMarkets sent me what they described as a final decision denying my complaint. Today (Jan 8), they reverted back to sending the same automated 'we are working diligently' response that I have been receiving for weeks.“”

This inconsistency in complaint handling raises questions about internal coordination and the actual authority of customer-facing representatives. For traders experiencing urgent issues—particularly those involving open positions or time-sensitive withdrawals—such communication failures can result in financial losses beyond the original complaint.

Fund Security and Transparency Issues

Thirty-six cases involving fund safety concerns represent approximately 20% of withdrawal-related complaints, suggesting these aren't isolated incidents. The combination of unresponsive finance departments, missing fund transfers despite confirmation receipts, and prolonged resolution timelines creates a risk profile that conservative traders should weigh heavily.

The presence of regulatory investigations, including the mentioned FSA case, indicates that concerns have escalated beyond individual complaints to attract regulatory scrutiny. While regulatory involvement can eventually benefit consumers, it also signals that internal dispute resolution mechanisms may be inadequate.

Platform Execution Quality

Eleven documented cases of execution issues and slippage reveal technical concerns affecting trade quality. One particularly detailed complaint describes systematic spread manipulation where execution spreads consistently exceed order book spreads by approximately three times.

“💬 Shailesh Solanki: ”I had a running position in profit, and I tried to close it — but the platform (MT5 and JustMarkets app both) did not allow me to close.“”

For scalpers and day traders operating on thin margins, such execution inconsistencies can transform profitable strategies into losing propositions. The inability to close profitable positions when desired represents both a technical failure and a fundamental breach of trader control over their capital.

Risk Assessment by Trader Profile

High-frequency traders and scalpers face elevated risks due to reported execution issues and spread inconsistencies. Traders requiring regular withdrawals for income purposes should exercise particular caution given the documented processing delays. Those with lower risk tolerance may find the combination of withdrawal concerns and support deficiencies incompatible with their operational requirements.

While some users report eventual resolution—as evidenced by updated reviews—the requirement for persistent escalation to achieve basic service standards suggests JUSTMARKETS may be more suitable for experienced traders comfortable with advocacy and prolonged dispute processes rather than those expecting straightforward broker-client relationships.

✅ Positive Aspects of JUSTMARKETS That Still Require Careful Consideration

USTMARKETS has accumulated notably positive feedback across several key operational areas, particularly regarding platform reliability, transaction processing, and user experience. While these strengths deserve recognition, prospective traders should approach any broker decision with appropriate due diligence.

Reputation and Reliability Indicators

A significant number of users report long-term satisfaction with JUSTMARKETS, with some maintaining accounts for multiple years. The broker's evolution from its previous identity as JustForex appears to have retained customer loyalty, suggesting operational consistency. One long-standing client notes:

“💬 LUCAS: ”I have been a client since the company was called JustForex And I can say that they have maintained the same quality throughout the 5 years I have been a customer.“”

This continuity is encouraging, though traders should verify current regulatory status and confirm that historical performance aligns with present-day operations. Platform stability during active trading hours receives consistent praise, which is crucial for execution quality, yet independent testing of execution speeds and slippage rates would provide additional confidence.

Transaction Processing Efficiency

Perhaps the most frequently cited advantage involves deposit and withdrawal processing. Multiple reviewers report remarkably fast transaction times, with some experiencing fund transfers within minutes to a few hours. A recent user experience illustrates this:

“💬 Jay Patil: ”Last night place withdrawal which was not received with me and In just market app it was successful it give me tension. Then use there support and create ticket just after 7-8 hr already received money bank.“”

While fast withdrawals are undeniably valuable, this particular example also highlights an important consideration: temporary discrepancies between platform status and actual fund receipt can create anxiety. Traders should maintain realistic expectations and understand that processing times may vary based on payment methods, jurisdictional factors, and account verification status.

Platform Usability

The user interface receives consistent commendation for its intuitive design and accessibility. Omar Almassri describes the platform as:

“💬 Omar Almassri: ”Their platform is smooth, intuitive, and packed with features that make trading efficient and enjoyable.“”

For newer traders, this ease of use can accelerate the learning curve. However, simplicity should not replace comprehensive education about leverage risks, market volatility, and capital preservation strategies. The mention of “excellent leverage” in reviews warrants particular caution—while leverage amplifies potential gains, it equally magnifies losses.

Balanced Perspective

JUSTMARKETS demonstrates genuine strengths in operational areas that matter to active traders: platform reliability, transaction efficiency, and interface design. These positive aspects appear consistent across different geographic markets and user experience levels. Nevertheless, positive user reviews, while informative, represent individual experiences and should complement—not replace—thorough verification of regulatory compliance, fee structures, and trading conditions relevant to your specific situation and jurisdiction.

📊 JUSTMARKETS: 6-Month Review Trend Data

2025-08:

• Total Reviews: 6

• Positive: 0 | Negative: 6

• Top Positive Label: N/A

• Top Negative Label: Slow Support No Solutions

2025-09:

• Total Reviews: 2

• Positive: 0 | Negative: 2

• Top Positive Label: N/A

• Top Negative Label: Slow Support No Solutions

2025-10:

• Total Reviews: 20

• Positive: 6 | Negative: 13

• Top Positive Label: Responsive Customer Support

• Top Negative Label: Withdrawal Delays Rejection

2025-11:

• Total Reviews: 57

• Positive: 23 | Negative: 29

• Top Positive Label: Easy Deposit Withdrawal

• Top Negative Label: Withdrawal Delays Rejection

2025-12:

• Total Reviews: 46

• Positive: 13 | Negative: 31

• Top Positive Label: Good Reputation Safe

• Top Negative Label: Withdrawal Delays Rejection

2026-01:

• Total Reviews: 77

• Positive: 46 | Negative: 15

• Top Positive Label: User Friendly Interface

• Top Negative Label: Slow Support No Solutions

🎬 JUSTMARKETS Final Conclusion

JUSTMARKETS presents a concerning profile that warrants serious consideration before committing capital, earning a below-average rating of 4.90/10 with nearly half of all user reviews reporting negative experiences.

The data reveals a troubling contradiction at the heart of JUSTMARKETS' service delivery. While the broker demonstrates competency in foundational areas—maintaining a generally good reputation for safety, offering straightforward deposit processes, and providing an accessible user interface—these positives are significantly overshadowed by critical operational failures. The 46.15% negative review rate from 208 total reviews indicates systemic issues that affect a substantial portion of the client base, particularly in areas that matter most to traders: fund accessibility and customer support responsiveness.

The most alarming concerns center on withdrawal processes and fund security. Reports of withdrawal delays and rejections represent fundamental breaches of trust in the broker-client relationship. When combined with documented fund safety issues, these problems elevate JUSTMARKETS from merely underperforming to potentially problematic. The slow support response times and inability to resolve client issues compound these concerns, leaving traders without recourse when problems arise. These are not minor inconveniences but rather core operational failures that can directly impact trading capital and profitability.

For beginner traders, JUSTMARKETS cannot be recommended despite its user-friendly interface. New traders need reliable support and transparent withdrawal processes as they learn the markets, and JUSTMARKETS' documented weaknesses in these areas create unnecessary risk during a vulnerable learning phase. Experienced traders should approach with extreme caution, conducting thorough due diligence and perhaps testing with minimal capital before committing significant funds. The withdrawal issues alone should give pause to anyone who values reliable access to their capital.

High-volume traders and professional scalpers should particularly avoid JUSTMARKETS, as these trading styles require absolute reliability in execution, support, and fund movement. Any delays in withdrawals can disrupt trading strategies and capital management plans that depend on predictable fund access. Swing traders and position traders, while potentially less affected by day-to-day operational issues, still face unacceptable risks given the documented fund safety concerns.

Should traders choose to proceed with JUSTMARKETS despite these warnings, they should limit initial deposits, document all interactions meticulously, test withdrawal processes with small amounts first, and maintain alternative broker relationships for capital diversification. The broker's strengths in interface design and initial deposit ease do not compensate for failures in the critical areas of fund security and client support.

JUSTMARKETS may open doors easily, but the documented difficulty in walking back through them with your funds makes this a broker where caution isn't just advised—it's essential.

This JUSTMARKETS analysis is based on 208 user reviews collected from multiple platforms. Overall Rating: 4.9/10 | Negative Rate: 46.2% | Generated on 2026-01-22

Disclaimer: This report is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial advisor before making trading decisions. Also, the rating for the broker can change with time. For the latest update on rating, visit WikiFX.

Read more

uexo Analysis Report

uexo emerges as a recommended forex broker with a solid overall rating of 6.9 out of 10, demonstrating reliable performance that appeals to both novice and experienced traders. Based on a comprehensive analysis of 21 reviews, the broker maintains an impressively low negative rate of just 9.5%, with the sentiment distribution heavily favoring positive experiences—15 traders expressed satisfaction, 4 remained neutral, and only 2 reported negative encounters. Read on for more insights.

SEAPRIMECAPITAL Analysis Report

SEAPRIMECAPITAL stands out as a recommended forex broker with an impressive 7.8 out of 10 overall rating, backed by an exceptional track record of zero negative reviews among its 16 total user assessments. This remarkable achievement reflects the broker's commitment to delivering quality service that resonates with traders across various experience levels. The sentiment distribution speaks volumes, with 15 positive reviews and just one neutral response, demonstrating consistent client satisfaction and reliability in the competitive forex marketplace. Click on for an extended market report.

BaFin Flags Finfluencers as Top 2026 Risk

Germany’s BaFin labels social media finfluencers a key market risk for 2026, linking them to speculative crypto purchases among young investors. Brokers face compliance hurdles as banks roll out crypto services.

STARTRADER Secures Porsche Carrera Cup ME Partnership

STARTRADER partners with Porsche Carrera Cup Middle East for 2025/26, aligning trading precision with elite racing across six Gulf rounds. Explore exec quotes, regulatory insights, and branding strategy.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

FX Movers: Yen Soars on Intervention Watch; CAD Tumbles on Trade Threats

Gold Pierces $5,000 Milestone; Pan African Resources Signals Cash Flow Surge

PRCBroker Review: Where Profitable Accounts Go to Die

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

USD Outlook: Markets Eye 'Politicized' Fed Risks as Tariff Impact Deepens

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

Rate Calc