BaFin Flags Finfluencers as Top 2026 Risk

Abstract:Germany’s BaFin labels social media finfluencers a key market risk for 2026, linking them to speculative crypto purchases among young investors. Brokers face compliance hurdles as banks roll out crypto services.

Regulators Stark Warning Emerges

Germanys Federal Financial Supervisory Authority (BaFin) has identified social media and finfluencers as the primary market risks heading into 2026. These platforms drive retail investors, especially those aged 18 to 45, toward high-risk crypto assets like meme coins. The annual risk assessment underscores a surge in hasty decisions fueled by fear of missing out (FOMO).

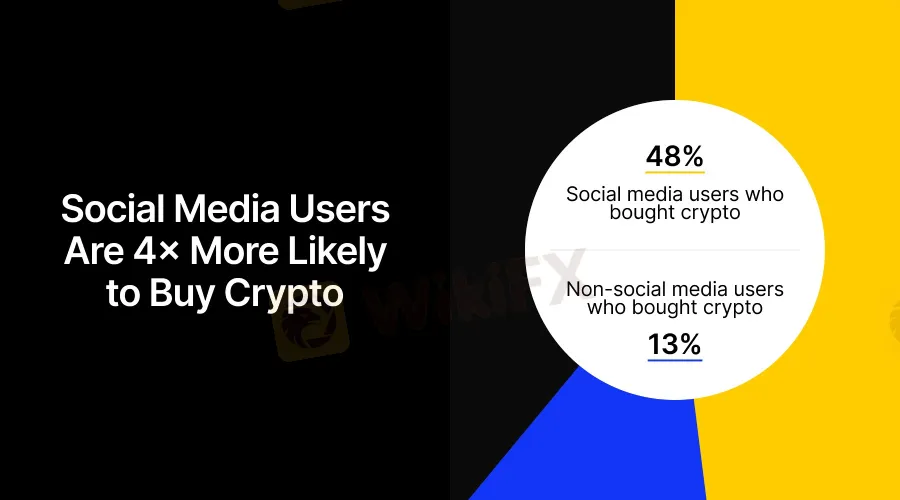

BaFins consumer survey reveals stark disparities. Followers of finfluencers are nearly four times more likely to purchase crypto (48% versus 13% for non-followers). Private chat groups show even higher exposure, with 50% of members reporting crypto investments.

This trend builds on prior BaFin findings. Earlier studies confirmed that social media users invest in crypto at much higher rates than others, amplifying the influence of online hype.

Social Media Fuels Crypto Surge

Finfluencers exploit viral trends to promote speculative products. Dubious actors hype meme coins, prompting impulsive trades among inexperienced users. BaFin notes that this dynamic exploits emotional triggers, heightening systemic vulnerabilities.

Younger demographics lead this shift. Coinbase data indicates that 73% of them view traditional wealth strategies as outdated, favoring peer advice on digital platforms over that of advisors. This preference empowers unregulated voices in a fragmented info ecosystem.

Brokers Compliance Dilemma Intensifies

German savings and cooperative banks gear up for crypto trading launches in 2026. Social media offers the best route to attract these next-gen clients, yet it collides with BaFins conduct rules. Firms must balance growth ambitions against regulatory scrutiny.

The MiCA regulation adds layers of oversight. It is effective across the EU and mandates investor protections for crypto promotions, regardless of channel. BaFin will enforce these requirements on authorized Crypto-Asset Service Providers (CASPs) to target market abuse by any party, including influencers.

National peers like France‘s AMF and Italy’s CONSOB echo these concerns. ESMA stresses uniform standards for social media ads, treating them akin to conventional promotions.

Strategic Implications for Industry

Regulated entities bear heightened responsibility. BaFin won't police unlicensed influencers directly, but will hold firms accountable for client onboarding and product suitability. This stance could spur stricter vetting amid the mainstreaming of crypto.

Financially, non-compliance risks fines and reputational damage. Recent BaFin penalties, such as a 560k-euro fine against flatexDEGIRO for misleading ads, signal zero tolerance. Banks may invest in compliance tech to monitor indirect influences.

Strategically, firms might pivot to educational content. Emphasizing risk disclosures could differentiate them from hype-driven narratives, fostering trust in Germanys €2 trillion banking sector.

Broader EU Regulatory Landscape

MiCA unifies crypto rules, with BaFin issuing guidance on licensing and notifications since late 2024. Credit institutions can offer select services post-notification, easing entry for incumbents. Yet, full CASP authorization demands robust governance.

Dark patterns in apps draw separate scrutiny. BaFin deems manipulative designs unlawful and urges firms to audit interfaces for fairness. This holistic approach safeguards retail participants.

As Europe‘s largest economy integrates crypto, BaFin’s vigilance tempers innovation. Banks navigate a tightrope: harnessing social media's reach while upholding investor safeguards under evolving EU frameworks.

Read more

Jetafx Review: Allegations of Fund Scams and Withdrawal Blocks Using Unfair VPS Trading Rule

Did Jetafx allow you to withdraw initially to gain your trust and later disallow you from using this privilege? Were you prevented from withdrawing funds due to a seemingly inexplicable new VPS trading rule? Have you witnessed a complete fund scam experience with the forex broker? Does the Jetafx support team fail to address your trading queries? You are not alone! Many traders have complained about these issues on broker review platforms. In this Jetafx review article, we have shared some of their complaints. Read on!

uexo Analysis Report

uexo emerges as a recommended forex broker with a solid overall rating of 6.9 out of 10, demonstrating reliable performance that appeals to both novice and experienced traders. Based on a comprehensive analysis of 21 reviews, the broker maintains an impressively low negative rate of just 9.5%, with the sentiment distribution heavily favoring positive experiences—15 traders expressed satisfaction, 4 remained neutral, and only 2 reported negative encounters. Read on for more insights.

SEAPRIMECAPITAL Analysis Report

SEAPRIMECAPITAL stands out as a recommended forex broker with an impressive 7.8 out of 10 overall rating, backed by an exceptional track record of zero negative reviews among its 16 total user assessments. This remarkable achievement reflects the broker's commitment to delivering quality service that resonates with traders across various experience levels. The sentiment distribution speaks volumes, with 15 positive reviews and just one neutral response, demonstrating consistent client satisfaction and reliability in the competitive forex marketplace. Click on for an extended market report.

STARTRADER Secures Porsche Carrera Cup ME Partnership

STARTRADER partners with Porsche Carrera Cup Middle East for 2025/26, aligning trading precision with elite racing across six Gulf rounds. Explore exec quotes, regulatory insights, and branding strategy.

WikiFX Broker

Latest News

Solitaire PRIME Regulatory Status: Understanding Their Licenses and Company Information

Asia FX & Rates: JGB Yields Spike vs. China Capital Inflows

USD Crisis: Capital Flight Accelerates as Europe Pivots Away from 'Political Risk'

FX Movers: Yen Soars on Intervention Watch; CAD Tumbles on Trade Threats

Gold Pierces $5,000 Milestone; Pan African Resources Signals Cash Flow Surge

PRCBroker Review: Where Profitable Accounts Go to Die

Gold Breaches $5,110: 'Fear Trade' Dominates as Dollar Wavers

USD Outlook: Markets Eye 'Politicized' Fed Risks as Tariff Impact Deepens

Italian Regulator Moves to Block Multiple Unauthorised Investment Platforms

Yen Awakening: Intervention Risks and Real Rates Signal Structural Turn

Rate Calc