Beware Multibank Group Scams: Real Trader Complaints

Abstract:Multibank Group scams warning: denied withdrawals & fake trading profits. Don’t fall victim—read the latest scam cases today!

Multibank Group scams have become a growing concern among traders worldwide, with mounting evidence pointing to denied withdrawals, fake trading profits, and questionable practices that leave clients financially stranded. The term Forex scam has increasingly been associated with this broker, as traders report suspicious account restrictions, unexplained losses, and manipulative tactics designed to prevent them from accessing their own funds. While the company promotes itself as a globally regulated entity with licenses across multiple jurisdictions, the reality, as evidenced by real trader complaints, paints a troubling picture of misconduct. This article investigates the latest cases, regulatory inconsistencies, and operational red flags surrounding Multibank Group, exposing the risks traders face when engaging with this platform. The urgency of this issue cannot be overstated: investors must remain vigilant to avoid falling victim to practices that compromise both trust and financial security.

Multibank Group Denied Withdrawals

Traders attempting to withdraw funds from Multibank Group often run into roadblocks, with their requests ignored or outright rejected. One user deposited $750 but never traded after spotting bad reviews; 15 days later, the withdrawal was denied, and emails went unanswered. The account manager promised help if the negative review was deleted, but silence followed even after compliance.

Another case involved a deposit refund request in early October, account ID 860, withdrawal code 364806992. Support conditioned assistance on removing prior complaints, raising red flags about coercive tactics. These incidents suggest a pattern where easy deposits contrast sharply with impossible exits, trapping capital.

Profitable accounts face extra hurdles. Profits show in balances but fail to transfer, labeled as “virtual” until trading resumes—then they evaporate. Withdrawal functions lock on both personal and IB accounts, turning quick sign-ups into prolonged battles for access.

Fake Trading Profits Exposed

Multibank Group platforms display enticing profits that prove illusory upon withdrawal attempts. Users report balances inflating to lure continued trading, only for funds to “burn out” when cashing out becomes the goal. This bait-and-switch erodes trust in a name once endorsed by celebrities.

In one detailed account, promotional hype drew investors, but reality hit when bonus-abuse accusations surfaced against winners. Platforms deleted trade histories to dodge accountability, shifting blame from losing clients (ignored) to profitable ones (targeted). Such erasure tactics point to systematic fund retention.

A six-year client saw a confirmed $100 bonus (20% offer) yanked, branded “gambling” despite consistent daily closes yielding profits. The account manager dismissed it arrogantly, claiming the bonus was a favor—highlighting how success triggers penalties.

Account Suspensions Without Warning

Sudden account restrictions plague Multibank Group users, often without prior notice or valid cause. An MT4 trader found their platform suspended; support cited “dormancy” and regulatory scrutiny, demanding a new application that vanished into limbo. Infrequent trading was equated to license revocation—unreasonable by any legal standard.

Backend logins fail post-suspension, stranding funds and trades. No advance alerts violate basic procedure, leaving clients in the dark. This mirrors broader complaints where low-activity accounts face unexplained locks, prioritizing broker control over user rights.

Long-term loyalty offers no shield. After years, profitable traders get hit with retroactive rules, like minimum holding periods, that turn gains into confiscations. These moves smack of profit protection at client expense.

Trading Delays Costing Traders

Execution glitches on Multibank Group platforms have wiped out gains, with delays contradicting “millisecond” claims. On January 20, 2025, a 20-second lag in order matching at profit levels caused heavy losses—echoing a prior incident two years earlier, now ignored.

Evidence showed instant fills elsewhere, yet the Head of Dealing Desk, Mr. Bilal, called it “normal.” Two weeks of support silence followed reports, breaching execution standards for experienced forex users. Such discrepancies fuel doubts about platform integrity.

Unexplained trades amplify risks. A new depositor returned to a massive gold position exceeding the balance, blaming it on “hacking” despite server logs showing foreign IPs. The CEO promised a review, then ghosted, exemplifying evasion.

Manipulative Account Managers

Relationship managers (RMs) at Multibank Group push aggressive deposits under VIP guises, starting at $1,000. One trader lost $2,000 as RMs induced bad trades, then urged more funds despite pleas to stop. “Too little” pressure persists until deposits dry up.

Promises tie to review deletions, as seen in withdrawal cases. RMs prioritize retention over resolution, convincing drained accounts to reload. This high-pressure sales mirrors pyramid schemes more than legitimate brokerage.

Arrogance defines interactions. Bonus disputes draw sneers about “favors,” while hacks get shrugged off. Managers serve broker interests, not clients, turning support into sales pitches.

Bonus Abuse Claims Unmasked

Multibank Group wields “bonus abuse” as a weapon against winners. A $100 bonus triggered gambling labels after profitable daily trades—unchanged from six years prior. Systems “detect” issues retroactively, ignoring user risk with their own capital.

Rules demand 900-second holds (15 minutes), voiding early closes and seizing profits. Pretexts shift when leverage use remains low (1/10th of what's claimed), exposing arbitrary enforcement. Promos encourage large positions, then punish them.

History deletions follow accusations, shielding from scrutiny. Losing traders get radio silence; winners face audits. This selective justice reeks of designed losses for the house.

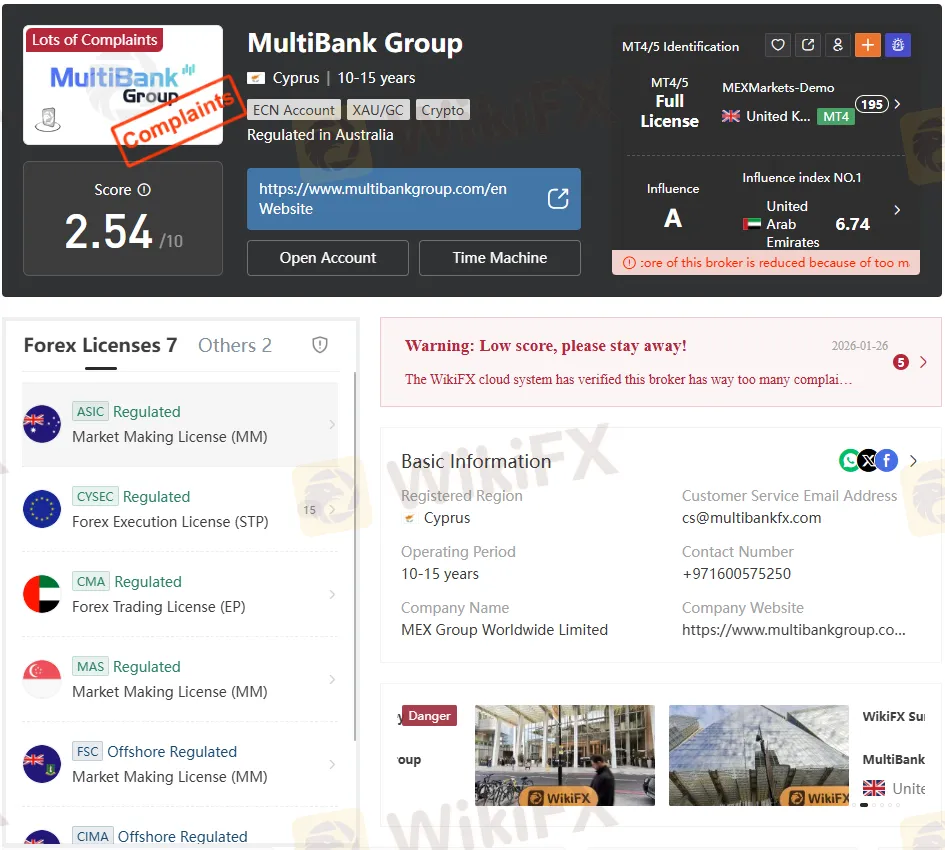

Regulatory Licenses Questioned

Multibank Group holds licenses from ASIC (No. 416279, 2012), CySEC (43023, 2023), SCA UAE (20200000031, 2022), and others, including MAS Singapore and the BVI FSC (SIBAL141068). Yet offshore nods (Vanuatu VFSC 700443, Cayman 1811316) carry light oversight and, in some cases, do not authorize full forex.

BaFin Germany (10119375) bars forex; physical offices lack verification in Cyprus, the UK, and Hong Kong—recently flagged as “danger.” Singapore has an operational spot, and Malaysia has one older visit.

Regulated status offers false security amid complaints. Offshore leans enable lax practices, with cross-border EU services unproven. Traders cite the BVI license in vain for recourse.

Domains and Online Presence

Multibank Group operates multiple domains, including multibankgroup.com, mexeurope.com, mexmarkets.com, and others. Several domains are hosted on shared servers, raising questions about operational transparency. The proliferation of websites may serve to confuse clients or redirect them to different entities, complicating accountability. Traders must exercise caution when engaging with brokers that operate under numerous domains with overlapping branding.

Pattern of Complaints

Across all cases, a clear pattern emerges:

- Deposits are accepted quickly, but withdrawals are obstructed.

- Profitable clients are accused of abuse or gambling.

- Account histories are deleted to erase evidence.

- Customer service responses are dismissive or coercive.

This pattern suggests deliberate strategies to retain client funds while avoiding accountability.

Bottom Line

Multibank Group scams center on denied withdrawals, fake profits, and manipulative tactics that strip traders bare. Real cases show $2,000 losses, ignored $750 refunds, and bonus seizures—patterns prioritizing house wins over fair play. Verify broker terms rigorously: check physical offices, test small deposits/withdrawals first, scour recent reviews beyond polished sites. Report to regulators such as ASIC or CySEC immediately if issues arise; avoid offshore-heavy firms that promise VIP perks. Steer clear of Multibank Group—your capital deserves better protection in forex trading.

Read more

HTFX Exits Cyprus Market as Regulator Confirms License Withdrawal

Cyprus regulator CySEC confirms HTFX’s decision to abandon its investment firm license, joining other brokers reshaping the island’s financial sector.

Sucden Review 2026 — Is the Sucden Broker Worth Your Trust?

If you are researching Sucden review or looking into Sucden Forex trading, this in-depth article will help you understand the strengths and weaknesses of Sucden Financial, its regulatory standing, trading services, and whether it’s the right choice for you.

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

WikiFX Broker

Latest News

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

Bitget Review: A Regulatory Ghost Running a Phishing Playground

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Rate Calc