Binomo Review: Is This Broker Safe or a High-Risk Trap?

Abstract:Regulatory blacklists meet financial ruin: Binomo (Bangyao) is officially flagged as unauthorized by CySEC, while traders report devastating losses up to $15,000. Investigations confirm a pattern of permanent account blocks and denied withdrawals immediately following deposit, signaling a critical risk to client funds.

“I lost nearly $15,000 and went bankrupt. Do not be fooled.” This visceral warning comes from a trader in Mexico, just one of dozens of victims who have come forward in recent months. While the polished website of Binomo broker promises easy access to the Forex markets, our investigation exposes a much darker reality lurking behind the login screen.

With a perilous WikiFX Score of just 1.57 and confirmed regulatory blacklists, the question isn't just about poor service—it is about the safety of your principal capital.

The $15,000 Nightmare: Real User Complaints

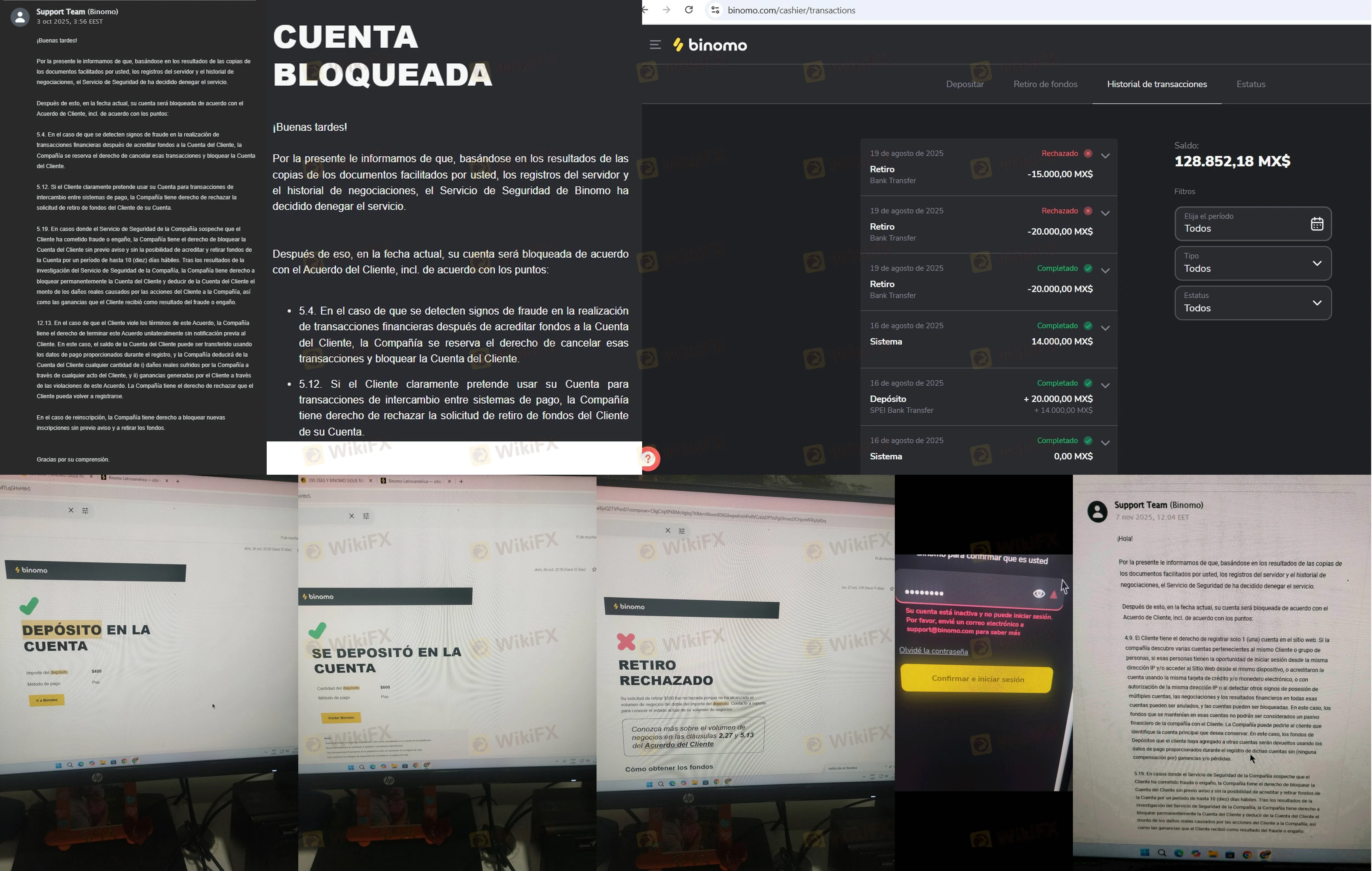

Our investigation begins with the traders themselves. In October 2025, a user from Mexico detailed a harrowing experience in a Binomo review that should stop any potential investor in their tracks. After successfully depositing funds and validating their account, the trap reportedly snapped shut when they attempted to withdraw profits.

The user describes a progression of stalling tactics:

1. Withdrawal Denial: A pop-up claiming “withdrawals suspended.”

2. Support Silence: Customer service switched to automatic replies.

3. The Kill Switch: The account was permanently blocked over alleged “suspicious actions,” confiscating both the invested capital and profits.

This is not an isolated incident. Just weeks later, on November 22, 2025, a Colombian trader deposited $1,000. The moment they requested a withdrawal, their access was cut. These stories reveal a systemic issue: Binomo appears to welcome deposits with open arms but treats withdrawals as hostile acts.

Binomo Regulation Audit: The Unauthorized Reality

Why can this broker seize funds without consequence? The answer lies in its regulatory status. Our audit confirms that Binomo regulation is effectively non-existent, leaving traders with no legal recourse when things go wrong.

The broker operates out of St. Vincent and the Grenadines, a jurisdiction that does not police Forex trading malpractice. Even more alarming is the official stance from European watchdogs.

| Regulator | License Type | REAL STATUS |

|---|---|---|

| CySEC (Cyprus) | Warning / Blacklist | Unauthorized / Danger |

| St. Vincent | Registration Only | No Forex Authority |

| Global Status | None | Unregulated |

The Cyprus Securities and Exchange Commission (CySEC) issued a specific warning regarding unauthorized domains associated with this entity as recently as August 2025. When a Tier-1 or Tier-2 regulator blacklists a platform, it is a definitive signal to stay away.

Binomo Login Issues and Withdrawal Blockades

A disturbing pattern in the complaints data involves the weaponization of the Binomo login process. Investors are not just losing money trading; they are losing access to the platform entirely.

Data from late 2025 shows that users who persist in asking for their money often find their accounts disabled. A Brazilian trader reported being locked out for 295 days, with the broker holding their remaining balance hostage. In Indonesia, another user reported that their account interface was manipulated to hide transaction history, making it impossible to track the lost funds.

Key Red Flags Identified:

- Regulatory Unauthorized: Explicit warnings from CySEC against the entity.

- Withdrawal Paralysis: Multiple reports of “withdrawals suspended” messages.

- Account Termination: Users blocked immediately after requesting payouts.

- Recharge Traps: Agents demanding “tax” or “top-up” fees (e.g., asking for 20 million IDR) to release existing funds.

From the latest evidence collected, look at the documentation provided by victims in late 2025:

Final Verdict on Binomo Broker

The evidence is overwhelming. Binomo combines the classic traits of a high-risk platform: lack of valid regulation, blacklists from reputable authorities like CySEC, and a flood of current complaints alleging fund misappropriation.

We strongly advise all Forex traders to avoid depositing funds here. The risk of blocking, login denial, and capital loss is severe. Protect your wallet and choose a fully regulated provider instead.

WikiFX Broker

Latest News

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Bitget Review: A Regulatory Ghost Running a Phishing Playground

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Yen Surges on Talk of Joint US-Japan Intervention; PM Takaichi Gambles on Snap Election

RM91,000 Gone: Fake Telegram Investment Traps Kuching Woman

Global Bond Shift: India Dumps US Treasuries Amid ‘Sell America’ Narratives

Rate Calc