HTFX Under Scrutiny: CySEC License Pulled, WikiFX Flags Scam Risks

Abstract:Growing warnings surround HTFX after losing its European licenses and being flagged by WikiFX as a Ponzi-style platform, with repeated reports of withdrawal problems.

HTFX, a CFD and forex broker that previously claimed multiple regulatory approvals, is now facing intensified scrutiny after Cyprus regulator CySEC confirmed the withdrawal of its investment firm license. At the same time, third-party risk platforms including WikiFX have classified HTFX as a high-risk broker, citing expired licenses, offshore regulation, and a growing number of unresolved withdrawal complaints. Together, these developments raise serious concerns about fund safety and operational transparency for retail traders.

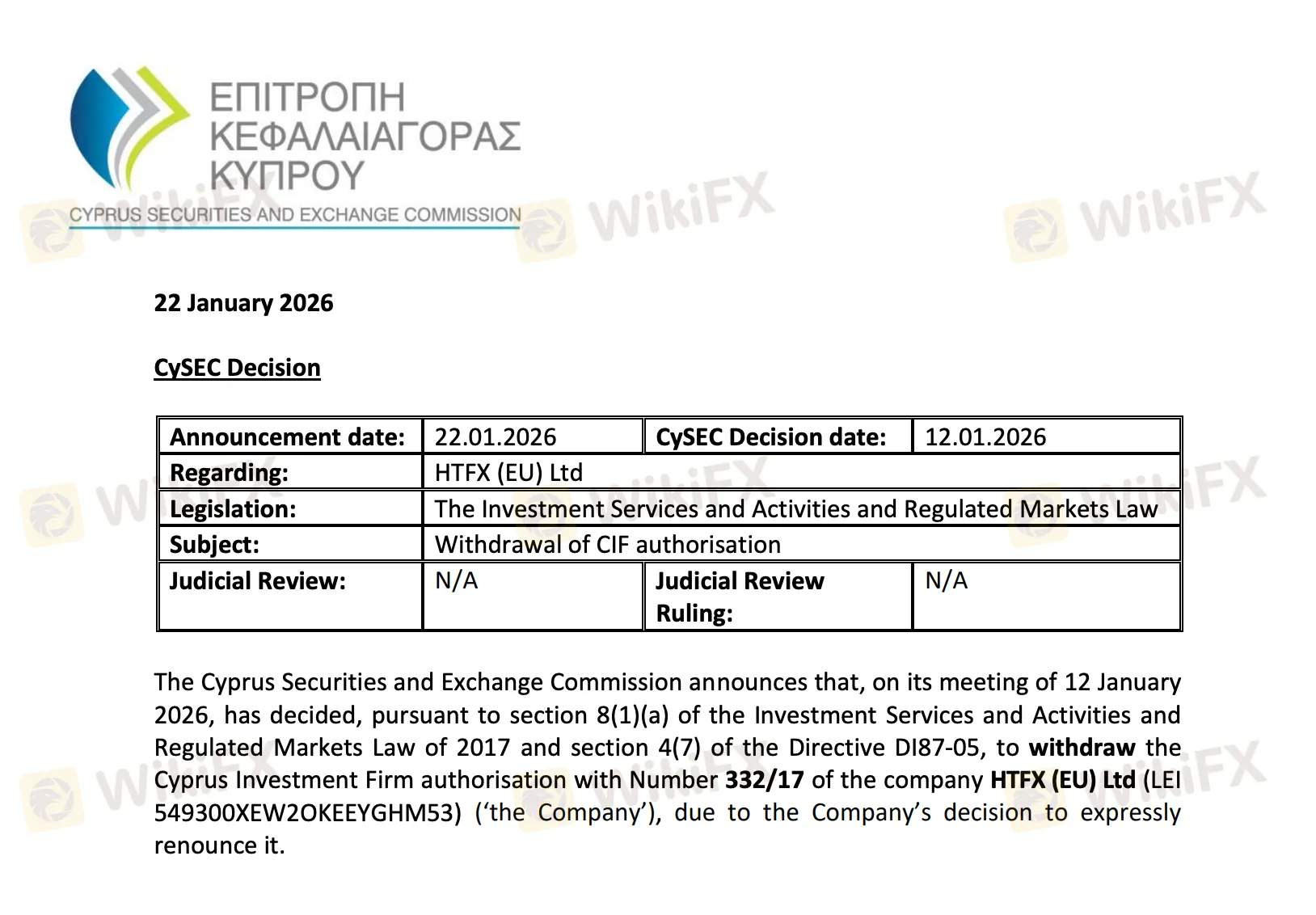

CySEC Confirms License Withdrawal as HTFX Exits EU Regulatory Regime

Cyprus Securities and Exchange Commission (CySEC) has confirmed that HTFX (EU) Ltd has formally relinquished its Cyprus Investment Firm (CIF) authorization, ending its ability to provide regulated investment services within or from Cyprus. This step finalizes the companys own decision to walk away from the EU regulatory framework and removes its status as a CySEC-supervised firm.

Once a CIF license is withdrawn, the firm must cease regulated activities and follow wind-down obligations, including notifying clients and addressing any remaining liabilities linked to its former licensed operations. HTFX now joins a growing list of brokers that have exited the Cyprus regime over the past year, reflecting broader shifts in compliance costs and regulatory expectations across the EU financial sector.

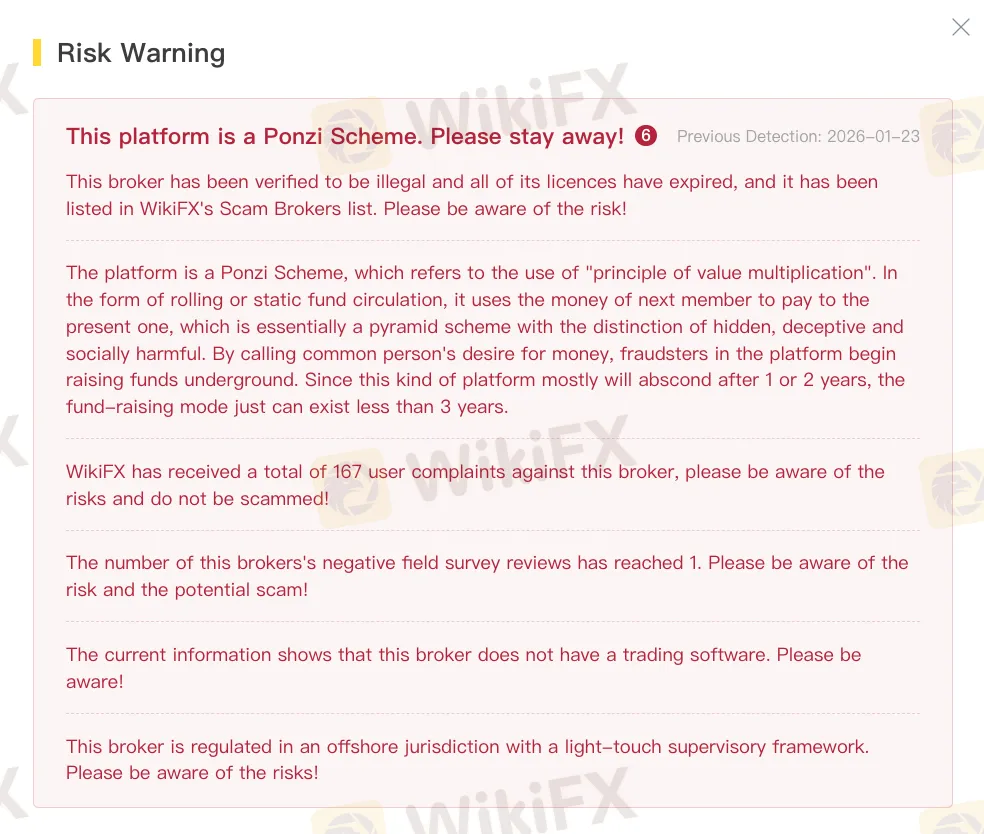

WikiFX Classification: Expired Licenses and Offshore Regulation Only

According to WikiFX records, HTFX no longer holds any valid major onshore regulatory licenses. Previous claims of FCA and CySEC regulation are now listed as expired, leaving only an offshore Vanuatu VFSC license, which operates under a light-touch supervisory framework with limited investor protection mechanisms.

WikiFX has explicitly labeled HTFX as a “Scam Broker” and issued warnings that the platform shows characteristics consistent with high-risk or Ponzi-style fund circulation models, especially where new deposits may be used to meet earlier withdrawal requests.

More details can be found on the WikiFX broker page: https://www.wikifx.com/en/dealer/9814677820.html

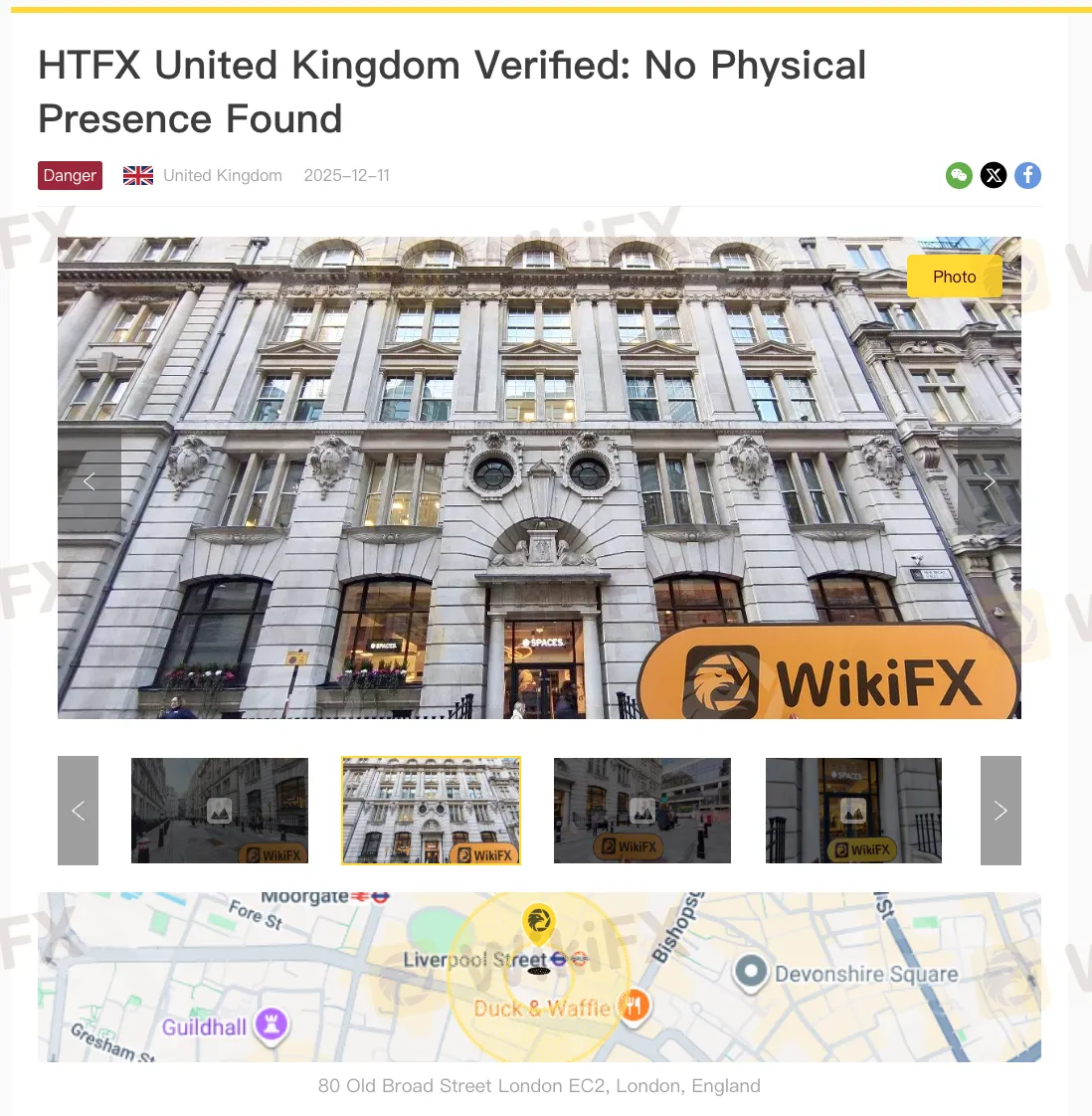

UK Address Verification Raises Further Questions

As part of its field investigation program, WikiFX conducted an on-site visit to HTFX‘s publicly listed UK office address at 35 New Broad Street, EC2M 1NH, located in London’s financial district. While investigators were able to reach the building, no signage, office listing, or physical indication of HTFX operations was found at the location.

This type of discrepancy between registered addresses and physical presence is often viewed by compliance professionals as a potential red flag, particularly when combined with regulatory exits and customer fund disputes.

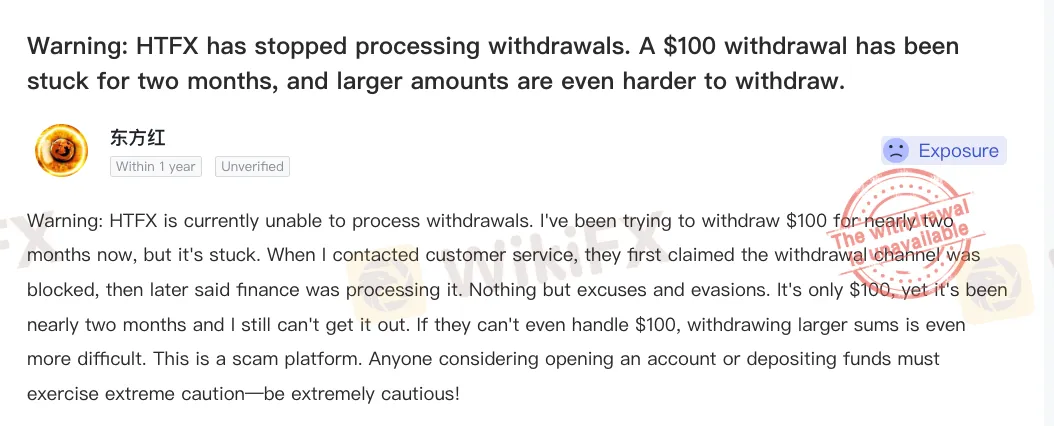

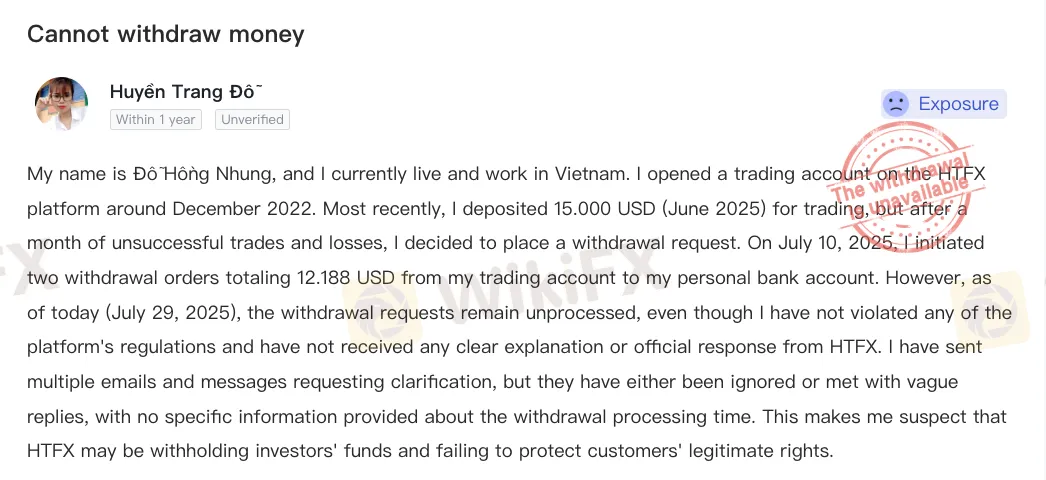

User Complaints Focus on Withdrawals and Additional Payment Requests

Beyond regulatory status, user feedback patterns provide another critical risk signal. WikiFX exposure records and user submissions show repeated complaints where withdrawal requests are marked as “completed” on the platform but funds never reach the clients account.

In multiple cases, users report being told by customer service that delays are caused by “payment channel issues,” with waiting periods extending beyond one month. Other complaints describe being asked to pay additional fees, taxes, or activation charges before withdrawals can be processed, only to face further delays afterward.

Such patterns are commonly associated with high-risk platforms where withdrawal conditions change after deposits are made, limiting clients ability to recover funds once trading has begun.

Risk Outlook: Regulatory Exit and Fund Access Issues Converge

Individually, the loss of a regulatory license, offshore supervision, or customer complaints may not always be decisive. However, when these factors appear simultaneously, they form a consistent risk profile that traders should not ignore.

HTFX‘s withdrawal from CySEC oversight removes EU-level investor protections. WikiFX’s classification highlights expired licenses and structural risks. Meanwhile, user reports consistently point to difficulties accessing funds after deposits are made.

For retail traders, these overlapping signals significantly increase uncertainty around capital safety, dispute resolution, and operational accountability. In such conditions, caution is not only advisable but necessary.

About WikiFX

WikiFX is a global broker information and risk monitoring platform focused on regulatory verification, exposure tracking, and on-site inspections. By aggregating official licensing data and real user reports, WikiFX helps traders identify potential risks before opening accounts or depositing funds, especially when brokers undergo regulatory changes or operate under offshore frameworks.

Read more

Belgian Investors Lost €23M to Scams in 2025 Surge

Belgian consumers lost over €23M to crypto and WhatsApp investment scams in late 2025, financial regulator warns amid rising fraud cases.

RM91,000 Gone: Fake Telegram Investment Traps Kuching Woman

A Kuching woman lost RM91,000 after being lured into a fake investment scheme advertised on Telegram, where scammers promised high returns but disappeared after receiving multiple bank transfers. Police are investigating the case under Section 420 for cheating and have warned the public to stay alert to online investment scams.

NaFa Markets User Reputation: A Deep Look into Complaints and Scam Claims

Let's answer the important question right away: Is NaFa Markets safe or a scam? After carefully studying all available evidence, NaFa Markets shows all the typical signs of a fake financial company. We strongly recommend not putting any money with this company. You should avoid it completely. Read on for more revelation about the broker.

Core Prime Exposure: Traders Report Illegitimate Account Blocks & Manipulated Trade Executions

Was your Core Prime forex trading account disabled after generating profits through a scalping EA on its trading platform? Have you witnessed losses due to manipulated trades by the broker? Does the broker’s customer support team fail to clear your pending withdrawal queries? Traders label the forex broker as an expert in deceiving its clients. In this Core Prime review article, we have investigated some complaints against the Saint Lucia-based forex broker. Read on!

WikiFX Broker

Latest News

Binomo Review: Is This Broker Safe or a High-Risk Trap?

South African Rand on Edge Ahead of Divisive Reserve Bank Meeting

Copper Supply Alarm: AI and Green Tech Boom Threatens Global Shortage

ThinkMarkets Review 2026: Comprehensive Safety Assessment

Bitget Review: A Regulatory Ghost Running a Phishing Playground

Yen Surges on Talk of Joint US-Japan Intervention; PM Takaichi Gambles on Snap Election

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Rate Calc