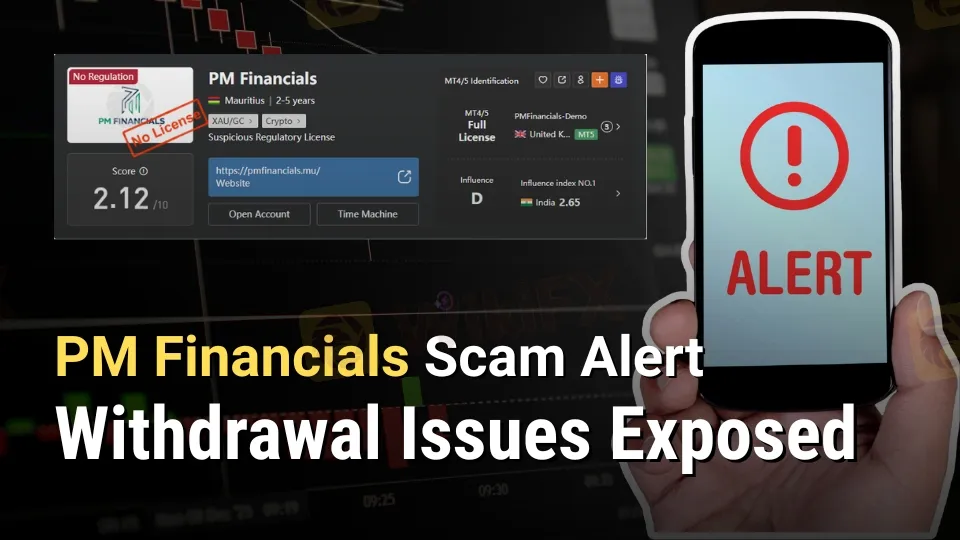

PM Financials Scam Alert: Withdrawal Issues Exposed

Abstract:PM Financials Scam Alert: Broker lacks a valid license, ignores withdrawal requests, and scams traders. Don’t get trapped — stay away.

PM Financials scam alert demands immediate attention as this unregulated broker ignores withdrawal requests and traps traders funds. Operating without a valid forex license, PM Financials lures victims with promises of high leverage and wide instrument ranges, only to vanish when profits are due. Traders face urgent risks from PM Financials withdrawal issues, suspicious crypto trades such as XAUGC, and a WikiFX score of just 2.1210, signaling great danger. This exposé uncovers fraudulent practices at PM Financials, including lax regulation, delayed payouts, and trader complaints, to protect potential investors from financial ruin.

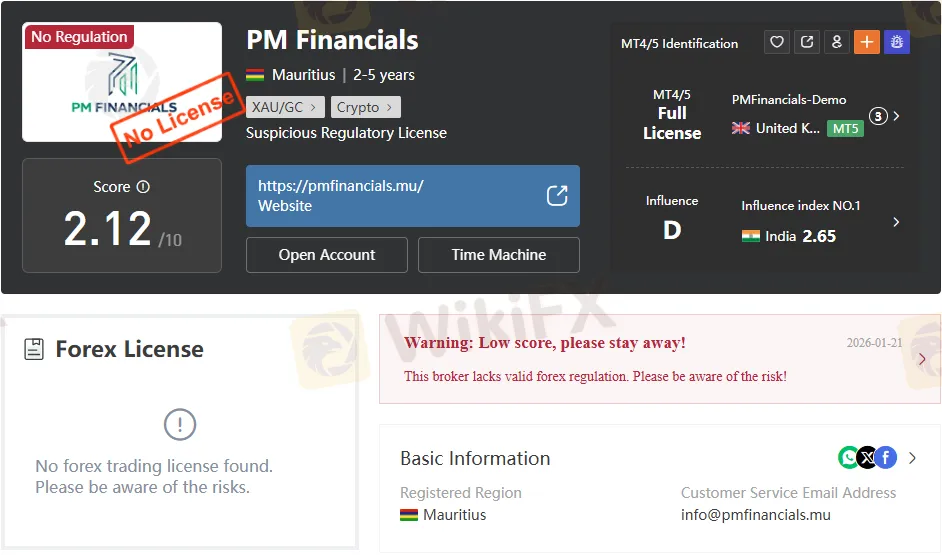

Unregulated Status Confirmed

PM Financials, founded in 2023 and registered in Mauritius, operates without any valid regulatory oversight for forex trading. Independent assessments, such as WikiFX, label it “No Regulation” and give it a low score of 2.1210, warning traders to stay away due to high potential risk. The broker claims addresses in Ebene, Mauritius, at Silicon Avenue, 40 Cybercity, and Dubais Aspect Tower, but no verifiable forex license exists, leaving clients exposed to manipulation.

Because there are no regulations, no authority enforces fair practices or protects deposits. Mauritius registration offers few investor safeguards. Traders send money to a company with no accountability, so scams are more likely.

Trader Complaint Details Emerge

A detailed trader report from India highlights PM Financials scam tactics. The victim deposited into a fully verified account after the account manager, Neeraj, urged them to deposit more funds, generating about $5,000 in profits. Withdrawal requests received approval emails, but funds never arrived after 40 days, with a “vice president” pressuring for additional deposits instead.

The complaint, logged within the last year under reference FX2056021633, includes proof of unfulfilled payouts. The trader contacted Mauritius FSC regulator but received no response and plans to pursue civil action. Such patterns suggest systemic refusal to release profits, trapping users in a cycle of false promises.

Withdrawal Delays Exposed

PM Financials sent a confirmation email on December 10, 2025, for a $7,215.97 USD withdrawal, noting that the request was being processed and that the funds would be transferred to “bankname-last4digits” within 1-3 business days. Despite this assurance, the trader waited over 40 days for funds to be deposited into the registered bank account, leading to eroded trust when no delivery occurred.

These delays align with common indicators of broker scams, including approvals that mask permanent holds and withdrawals that are routinely delayed or blocked. While deposits using Visa, Mastercard, Bank Transfer, and Perfect Money are seamless, withdrawal processes are opaque and often subject to sudden restrictions or unclear requirements. Urgent action is needed, as similar unresolved cases are piling up.

Trading Offers Hide Risks

PM Financials advertises over 500 instruments, including forex majors, metals, energies, indices, shares, and commodities, to attract traders. Platforms run on MT5 across PC, Mac, iOS, and Android, with demo accounts available for testing. High leverage of up to 1:1400 on standard accounts promises quick gains, but the lack of an Islamic swaps option limits accessibility.

Account tiers—Standard ($5,000 min), Professional ($15,000), Corporate ($50,000)—feature spreads from 0.6-1.6 pips with no commissions. Suspicious crypto like XAUGC raises red flags amid unregulated operations. These features mask the core issue: the inability to withdraw legitimate profits.

High Minimum Deposits Trap Users

Entry barriers start at $5,000 for Standard accounts and rise to $50,000 for Corporate accounts, far above industry norms for retail traders. This high threshold commits significant capital before suspicions arise. Combined with a no-regulation status, it creates a high-stakes gamble where losses are permanent.

Support channels include Mauritius phone (230-46720005) and Dubai (971-44268300), and email infopmfinancials.mu, but responsiveness is poor during payout crises. Pros like wide instruments and MT5 pale in comparison to the cons of zero oversight and payout blocks.

Regulatory Warnings Amplify Danger

WikiFXs Time Machine and influence index rate PM Financials are low at 2.65 for India, urging avoidance. Alerts scream “Low score, please stay away!” due to the absence of forex licenses. No office verification and suspicious crypto trading heighten scam alert status.

Broader implications suggest that PM Financials fits the profiles of offshore frauds preying on global traders. Mauritius lax environment enables such operations, with no swift FSC intervention reported. Investors must heed these signals before engaging.

Implications for Global Traders

Unregulated brokers like PM Financials exploit the allure of high leverage to harvest deposits without paying out. Victims from regions like India face cross-border recovery nightmares, with civil suits rarely effective. The $7,215.97 case exemplifies how approvals lure further deposits while stalling releases.

There are reports of account managers encouraging clients to add more funds after establishing initial confidence. The absence of regulatory recourse may limit dispute-resolution options. Publicizing these experiences may help prevent others from experiencing similar issues.

Bottom Line

PM Financials operates as an unregulated Mauritius broker with confirmed withdrawal failures, no forex license, and a WikiFX score of 2.1210 signaling extreme risk. Trader reports $5,000 in profits withheld after 40+ days despite approvals, with managers pushing for more deposits. Scam tactics trap high minimum investments up to $50,000 across MT5 platforms offering 500+ instruments.

Risks include permanent fund loss, unresponsive support, and zero regulatory protection. Verify all brokers with top-tier regulators such as the FCA or ASIC before depositing. Avoid unregulated platforms, start with demos only on licensed firms, and never exceed affordable losses to safeguard your capital.

Read more

PURE MARKET Review: Investigating Deposit Credit Failures & Withdrawal Complaints

Did PURE MARKET stop processing payments after receiving deposits on the trading platform? Do you get a sense of a Ponzi scheme when trading with PURE MARKET? Does the broker intentionally delay your fund withdrawals? Have you faced a profit deduction on account of a wrong, arbitrary claim by the broker? Does the broker change the spread frequently to cause you losses? In this PURE MARKET review article, we have investigated these complaints against the Vanuatu-based forex broker. Keep reading!

24Five Scam Alert: No License, High Risk Trading

24Five Scam Alert exposes suspicious practices, a lack of a license broker, and hidden risks. Protect your money with key insights today.

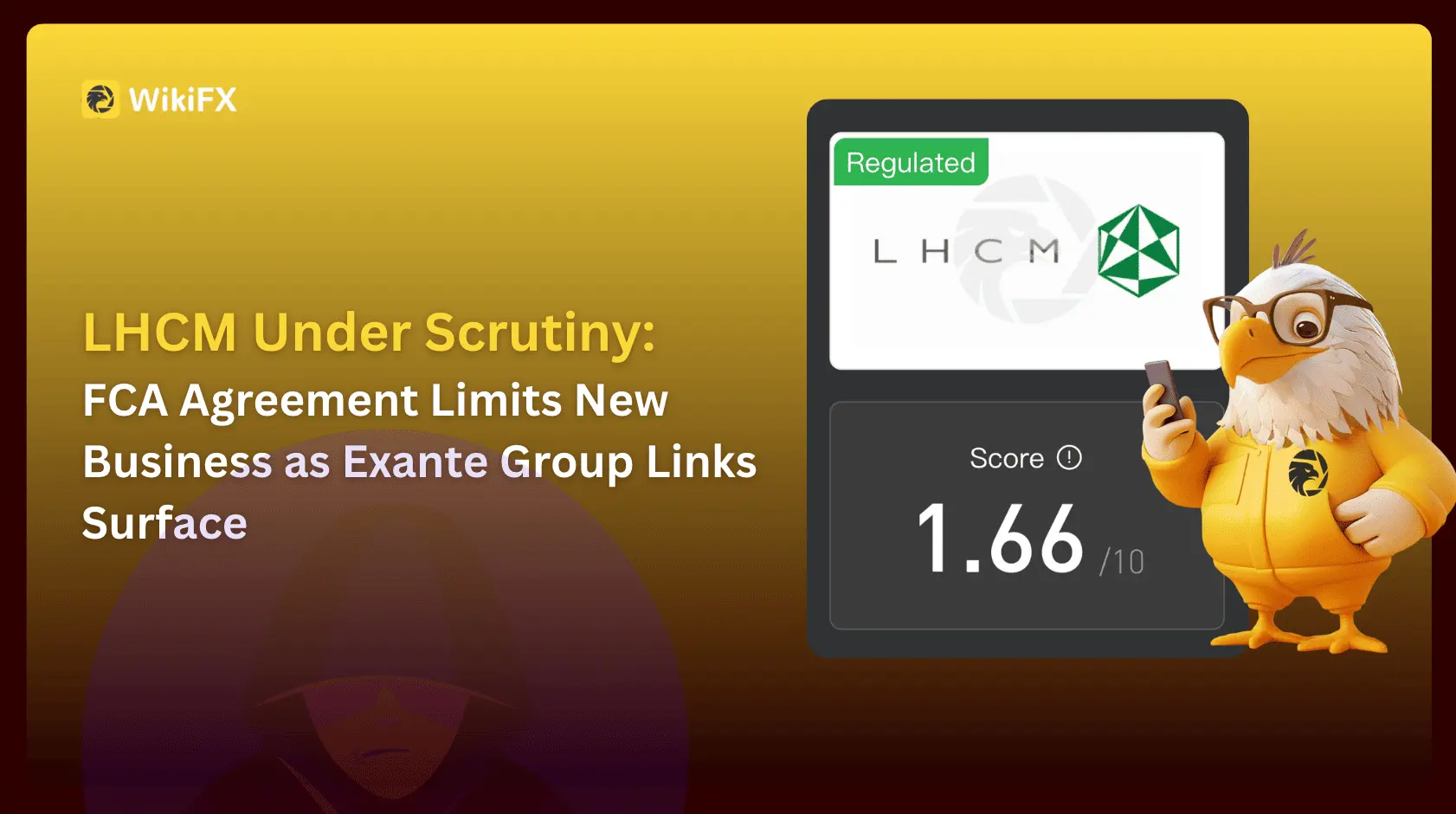

LHCM Under Scrutiny: FCA Agreement Limits New Business as Exante Group Links Surface

LHCM enters an FCA voluntary agreement, pausing new clients and deposits, while its role as Exante’s UK operating entity draws closer attention from WikiFX.

Fortrade Secures DFSA License in Dubai

Fortrade gains DFSA approval for its Dubai entity, strengthening compliance and expanding presence in the DIFC financial hub.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc