LHCM Under Scrutiny: FCA Agreement Limits New Business as Exante Group Links Surface

Abstract:LHCM enters an FCA voluntary agreement, pausing new clients and deposits, while its role as Exante’s UK operating entity draws closer attention from WikiFX.

LHCM (also known as London HCM or LHCM Ltd) has recently drawn attention after announcing a voluntary arrangement with the UK Financial Conduct Authority (FCA), raising concerns among traders about its current operating status, funding activity, and broader risk exposure.

Combined with a low safety score on WikiFX and its operational connection with Exante, LHCM now presents several risk signals that traders should carefully evaluate before engaging with the platform.

FCA Voluntary Agreement: New Clients and Deposits Suspended

LHCM has publicly stated that it has reached a voluntary agreement with the FCA, under which the company will temporarily stop accepting new clients and suspend deposit activities from existing clients starting December 22, 2025.

This type of voluntary arrangement typically indicates that a firm is under regulatory review or operational adjustment, and it directly affects the brokers ability to expand or continue normal business operations.

While this does not automatically imply wrongdoing, it is a serious regulatory development that directly impacts client onboarding and fund inflows. For traders, any suspension of deposit activity is a critical operational signal, especially when combined with other risk indicators.

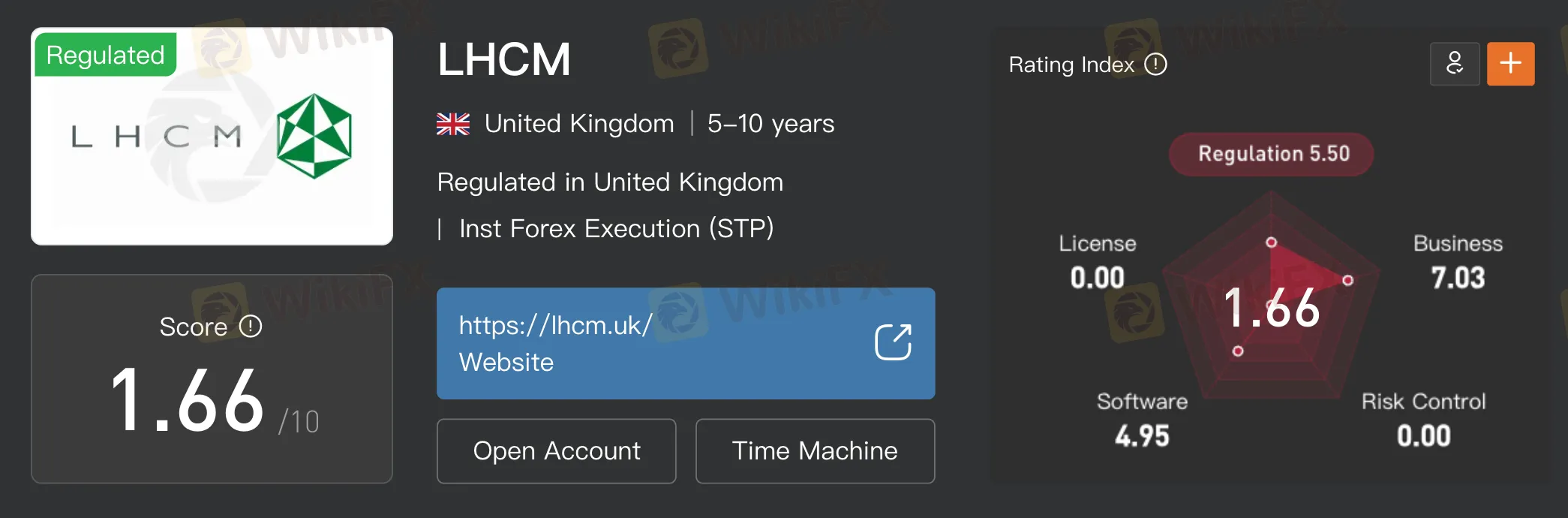

WikiFX Assessment: Low Score and Weak Risk Control Indicators

According to WikiFX data, LHCM currently holds a very low overall safety score, reflecting weaknesses across several key evaluation categories such as risk control and operational transparency.

Although LHCM is registered in the UK and previously held regulatory approval, WikiFXs scoring system weighs not only licensing, but also business behavior, platform stability, and exposure history.

WikiFX also flags areas related to risk control and software reliability, which are critical factors when assessing a brokers ability to safeguard client funds and maintain fair trading conditions.

For traders, a low WikiFX score does not rely on marketing claims, but on verifiable data, regulatory scope, and reported platform behavior.

More detailed broker information can be found here:

https://www.wikifx.com/en/dealer/5928160122.html

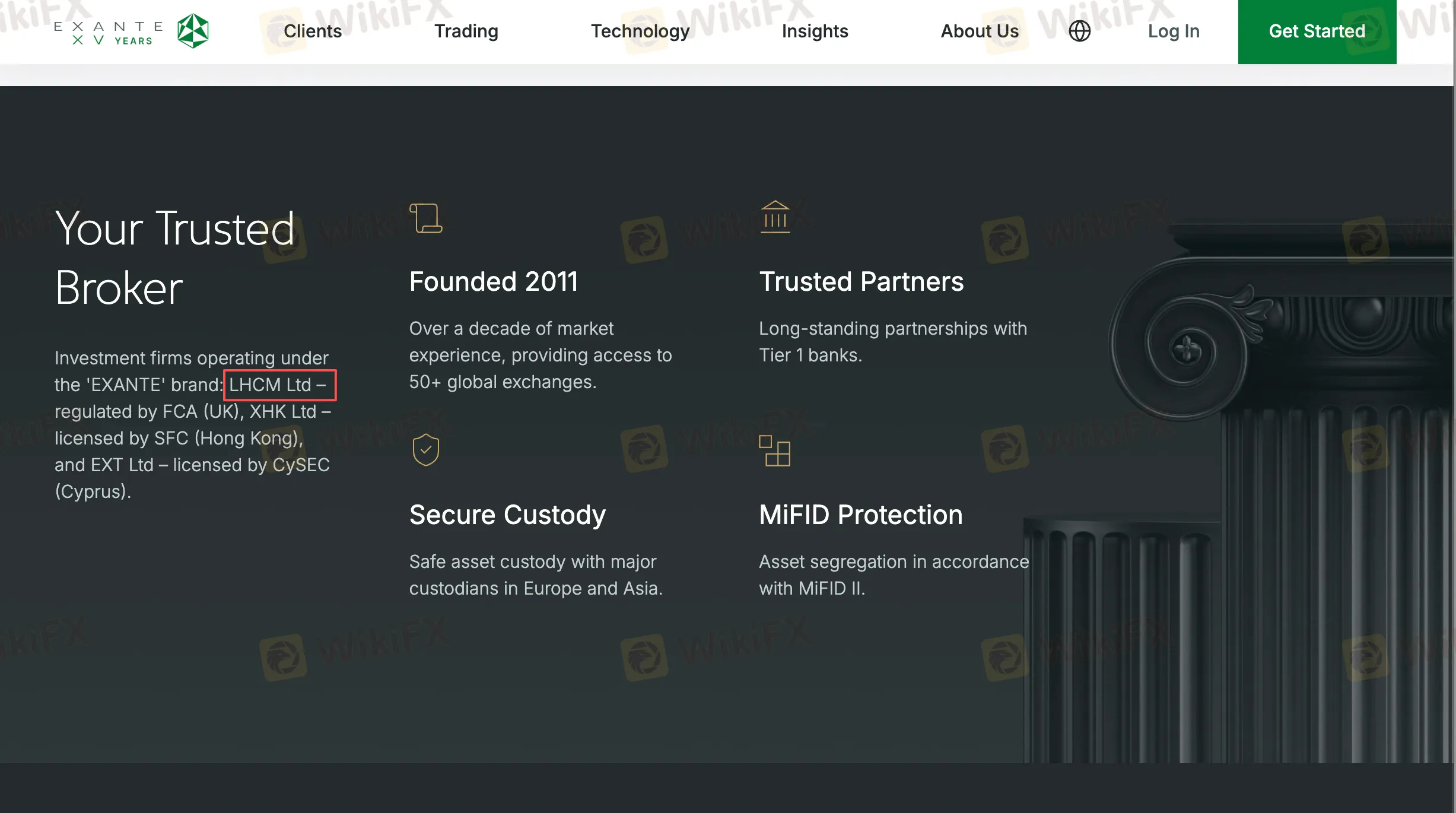

LHCM and Exante: A Direct Group Relationship

LHCM Ltd. is the UK-regulated operating entity of the Exante Group, not a standalone brokerage. It is authorised by the FCA to provide UK clients with access to the EXANTE trading platform, using the same proprietary system and market infrastructure operated by Exantes global entities.

Under this structure, client trading, order execution, and account operations on LHCM are conducted within Exantes platform environment rather than through systems developed independently by LHCM.

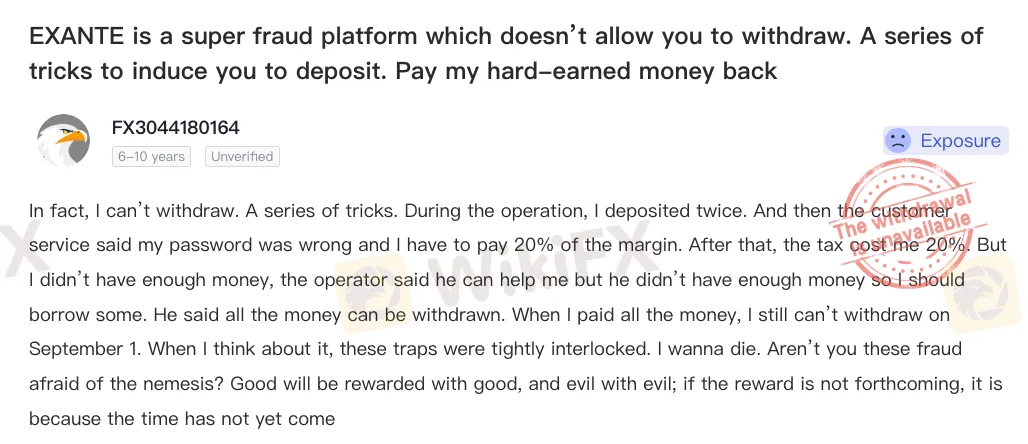

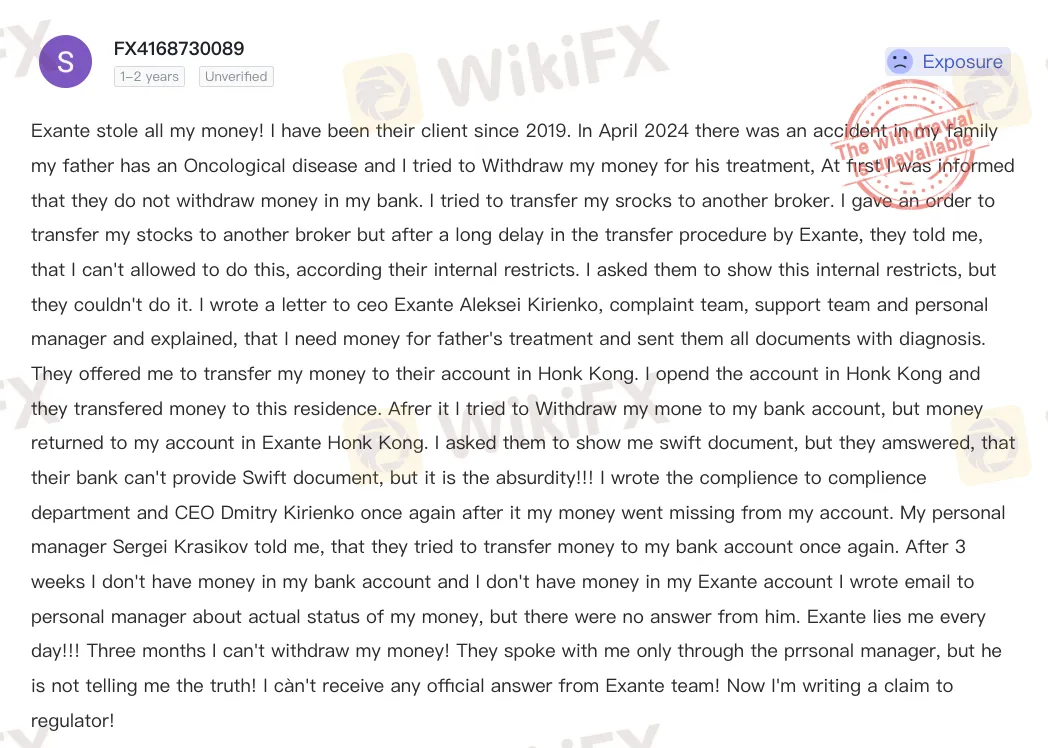

User feedback records aggregated by WikiFX also include reports related to Exante platform usage, with recurring references to withdrawal delays and account access issues. These submissions suggest that some operational concerns experienced on Exantes systems may be reflected in the user experience of LHCM clients as well.

As a result, any operational or procedural issues affecting Exantes trading systems may also directly impact LHCM clients, particularly in areas such as fund access and account controls.

Risk Perspective: Multiple Signals Converging

Individually, regulatory adjustments, low third-party safety scores, or platform partnerships may not always be decisive. However, when these factors appear together, they form a broader pattern of elevated risk:

LHCMs voluntary agreement with the FCA restricts normal business operations.

WikiFX scoring highlights weaknesses in risk control and stability.

The brokers trading infrastructure depends on Exante, which itself has attracted a notable volume of negative user exposure related to withdrawals and internal handling.

For traders, these overlapping signals significantly increase uncertainty around fund security, operational continuity, and dispute resolution effectiveness.

About WikiFX

WikiFX is a global broker information platform focused on regulatory verification, risk alerts, and exposure tracking. By aggregating official license data, operational indicators, and verified user submissions, WikiFX helps traders identify potential risks before opening accounts or depositing funds.

Checking regulatory scope, monitoring exposure history, and understanding platform relationships are essential steps in managing trading risk—especially when brokers undergo regulatory adjustments or operate through third-party infrastructures.

Read more

PURE MARKET Review: Investigating Deposit Credit Failures & Withdrawal Complaints

Did PURE MARKET stop processing payments after receiving deposits on the trading platform? Do you get a sense of a Ponzi scheme when trading with PURE MARKET? Does the broker intentionally delay your fund withdrawals? Have you faced a profit deduction on account of a wrong, arbitrary claim by the broker? Does the broker change the spread frequently to cause you losses? In this PURE MARKET review article, we have investigated these complaints against the Vanuatu-based forex broker. Keep reading!

24Five Scam Alert: No License, High Risk Trading

24Five Scam Alert exposes suspicious practices, a lack of a license broker, and hidden risks. Protect your money with key insights today.

PM Financials Scam Alert: Withdrawal Issues Exposed

PM Financials Scam Alert: Broker lacks a valid license, ignores withdrawal requests, and scams traders. Don’t get trapped — stay away.

Fortrade Secures DFSA License in Dubai

Fortrade gains DFSA approval for its Dubai entity, strengthening compliance and expanding presence in the DIFC financial hub.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Rate Calc