User Reviews

More

User comment

1

CommentsWrite a review

2026-01-21 02:05

2026-01-21 02:05

Score

2-5 years

2-5 yearsSuspicious Regulatory License

MT5 Full License

Regional Brokers

High potential risk

Influence

Add brokers

Comparison

Quantity 1

Exposure

Score

Regulatory Index0.00

Business Index5.89

Risk Management Index0.00

Software Index9.01

License Index0.00

No valid regulatory information, please be aware of the risk

Single Core

1G

40G

More

Company Name

PM Financials Ltd

Company Abbreviation

PM Financials

Platform registered country and region

Mauritius

Company website

X

YouTube

Company summary

Pyramid scheme complaint

Expose

| PM Financials Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Mauritius |

| Regulation | No regulation |

| Market Instruments | Forex, Metals, Energies, Indices, Shares, Commodities |

| Account Type | Standard Account, Professional Account, Corporate Account |

| Demo Account | ✔ |

| Leverage | Up to 1:400 |

| Spread | 0.6-1.6 pips |

| Commission | No |

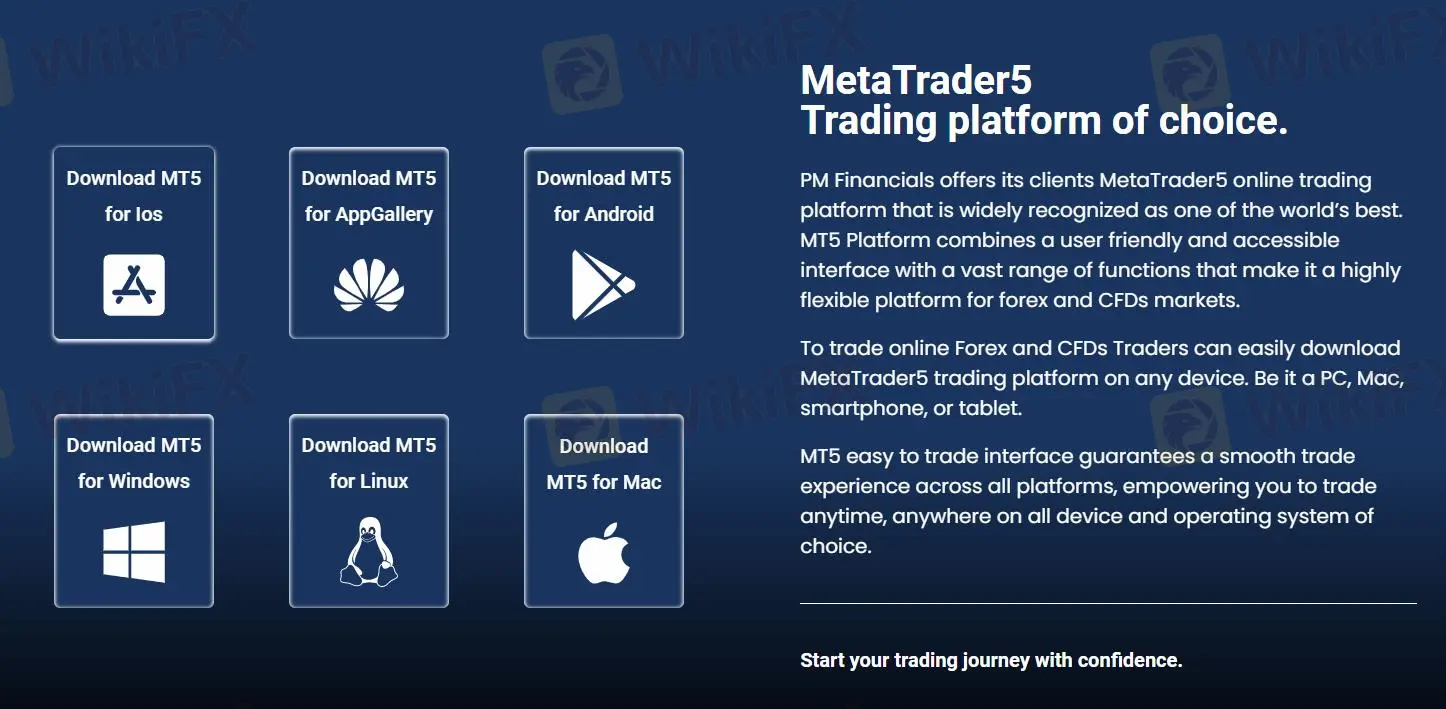

| Trading Platform | MT5 |

| Min Deposit | $5000 |

| Payment Method | Visa, Bank Transfer, Mastercard, Perfect Money |

| Customer Support | Phone: Mauritius: +23046720005Dubai: +971 44268300 |

| Email: info@pmfinancials.mu | |

| Physical Address: Silicon Avenue, 40 Cybercity the Cyberati Lounge, Ground Floor, The Cataylist 72201 Ebene, Mauritius.705 & 706, Aspect Tower(Zone-B), Business Bay, Dubai UAE. | |

PM Financials, founded in 2023, is a brokerage registered in Mauritius. It provides 500+ types of instruments - Forex, Metals, Energies, Indices, Shares, Commodities. It charges no commissions. But it is unregulated.

| Pros | Cons |

| Wide range of trading instruments | Unregulated |

| No commission | High min deposit of $5000 |

| MT5 supported | No Islamic account |

| Demo account available |

It is clear that PM Financials is currently unregulated.

PM Financials offers traders more than 500 types of instruments - forex, metals, energies, indices, shares, commodities.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Shares | ✔ |

| Metals | ✔ |

| Indices | ✔ |

| Energies | ✔ |

| Futures | ❌ |

| Options | ❌ |

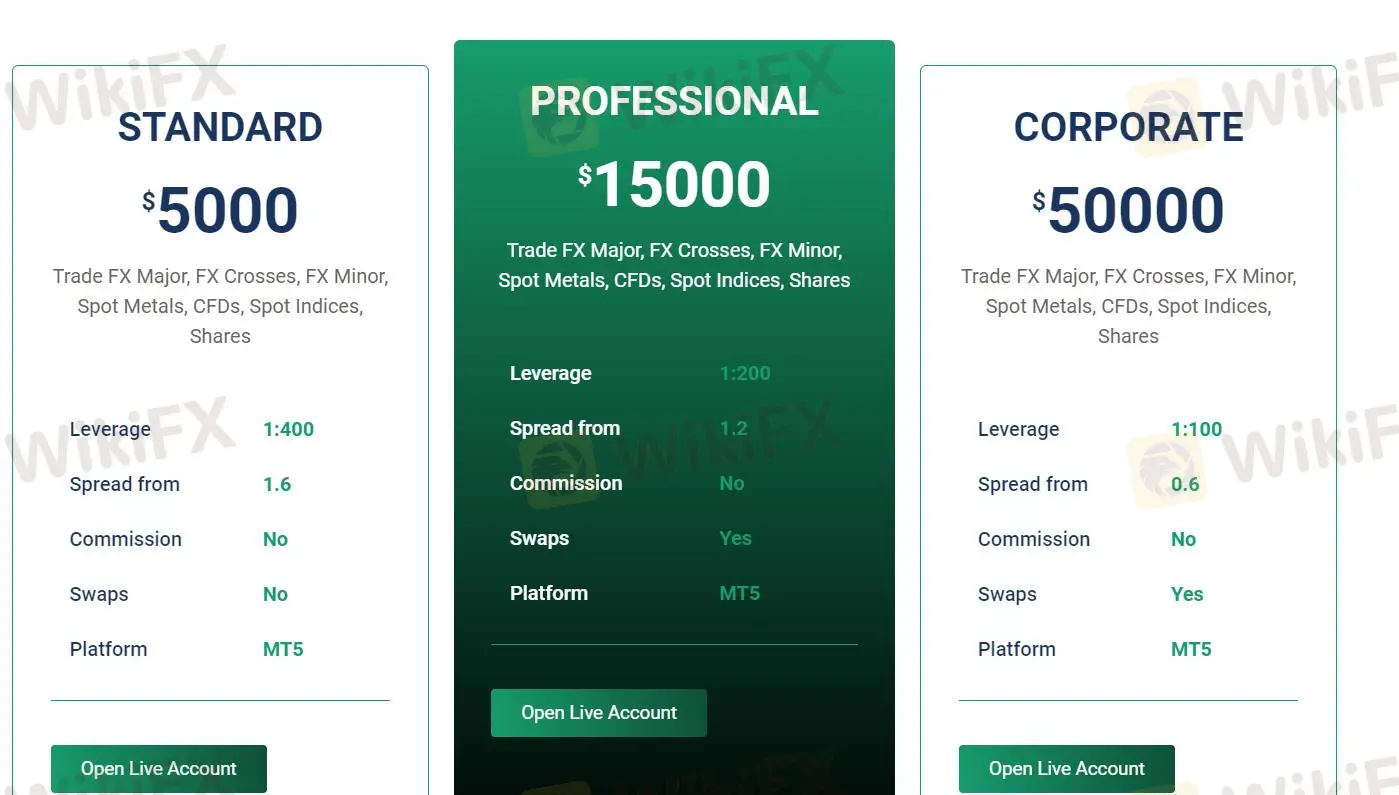

PM Financials offers 3 different types of accounts to traders - Standard Account, Professional Account, Corporate Account.

| Account Type | Standard Account | Professional Account | Corporate Account |

| Leverage | 1:400 | 1:200 | 1:100 |

| Spreads | 1.6 pips | 1.2 pips | 0.6 pips |

| Commission | No | No | No |

| Swaps | No | No | No |

| Platform | MT5 | MT5 | MT5 |

| Min deposit | $5,000 | $15,000 | $5,0000 |

PM Financials charges no commissions. Its spread is 1.6 pips for Standard Account, 1.2 pips for Professional Account, 0.6pips for Corporate Account.

PM Financials's trading platform is MT5, which support traders on PC, Mac, iPhone and Android.

| Trading Platform | Supported | Available Devices |

| MT5 Margin WebTrader | ✔ | Web, Mobile |

| MT4 | ❌ |

The broker supports 4 deposit and withdrawal methods - Visa, Bank Transfer, Mastercard, Perfect Money.

More

User comment

1

CommentsWrite a review

2026-01-21 02:05

2026-01-21 02:05