Zenstox Review: Is This Offshore Forex Broker Safe?

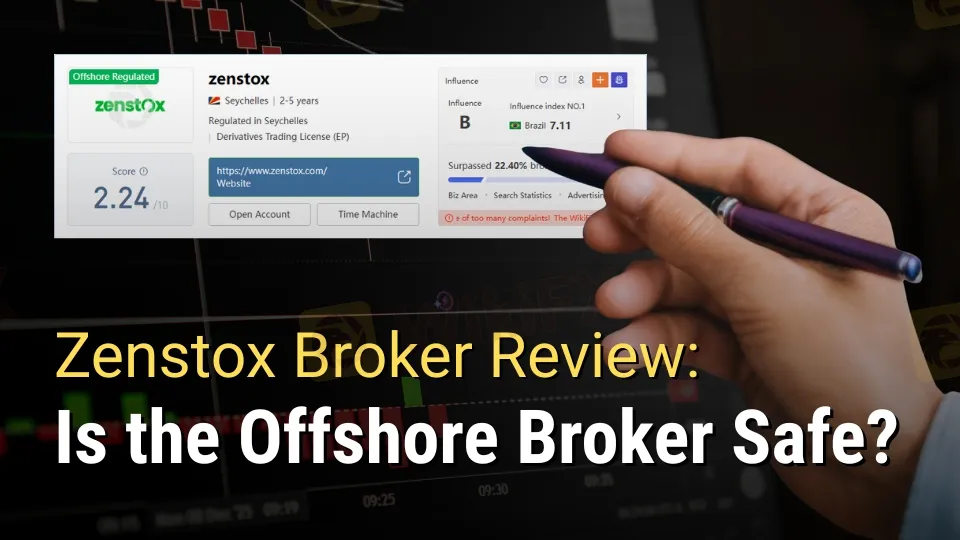

Abstract:Is Zenstox safe or a scam? Learn about its 2.24/10 WikiFX rating, offshore regulation, bonus tactics, and trader reports of blocked or delayed withdrawals.

Zenstox draws traders with promises of high leverage and diverse CFDs, but its offshore setup raises immediate red flags. A WikiFX rating of 2.24/10 underscores persistent doubts about its reliability. Trader complaints paint a grim picture of bonus traps and stalled payouts.

Offshore Regulation Risks

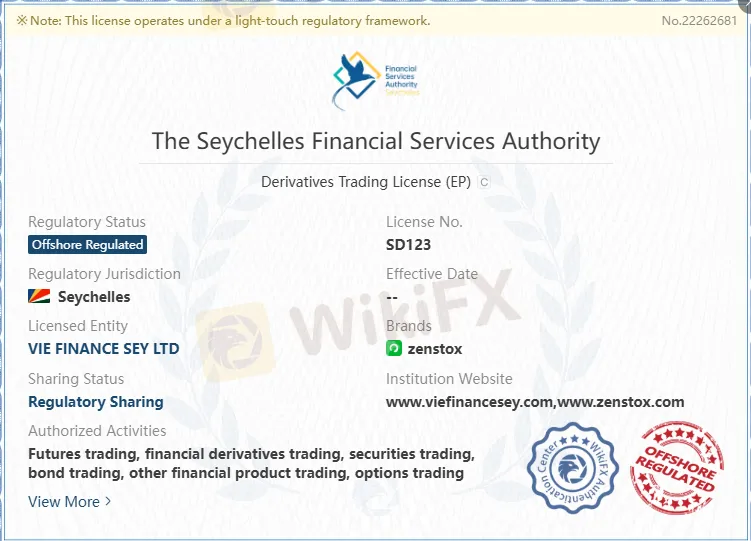

Zenstox operates under a Seychelles FSA retail forex license numbered SD123. This offshore authority offers scant investor safeguards compared to top-tier regulators like the FCA or ASIC. Founded in 2022 and registered in Seychelles, the broker lacks transparency on domain age or office locations, fueling skepticism.

Seychelles oversight demands minimal capital reserves and rarely enforces strict compliance. Traders face elevated risks of fund mismanagement without segregated accounts or negative balance protection details. Offshore brokers like Zenstox often attract scrutiny for prioritizing volume over client security.

Zenstox Review: Bonus Tactics Exposed

Bonuses emerge as a core lure, matching deposits like $180 for $180 or $200 for $650 additions. These incentives come with hidden strings—traders report aggressive advisors pushing risky trades to trigger margin calls. One account spiraled from $180 to demands for $1,980 more, threatening $10,000 in “profits.”

Such tactics mirror patterns in dubious offshore operations, where bonuses lock funds until impossible volume targets. Zenstoxs approach prioritizes deposits over sustainable trading, eroding trust. Beginners fall hardest, mistaking advisor pressure for guidance.

Withdrawal Delays and Blocks

Multiple 2025 cases detail failed payouts despite shown profits. Traders deposited thousands—up to $23,000 in 20 days—only to see requests rejected for “new trades” or outright account closures. Platforms allegedly manipulated balances to display gains, then denied access.

Withdrawal via bank transfer takes 1-3 days, but real-world execution falters. No minimum withdrawal specified, yet complaints highlight systemic barriers. Compared to reliable brokers like IG or OANDA, Zenstoxs process lacks guarantees.

Trading Instruments Offered

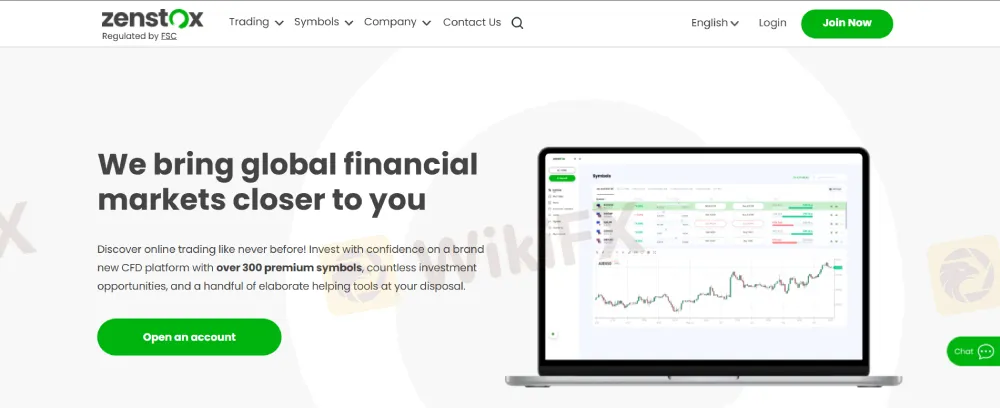

Zenstox lists over 300 CFDs across forex, stocks, indices, commodities, and cryptocurrencies. Leverage peaks at 1:1200 for major forex pairs, gold, silver, and crude oil, dropping to 1:1100 for indices and 1:12 for cryptos. Shares cap at 1:110, exposing users to amplified losses.

Fixed spreads start at 0.50 on crypto CFDs, higher than industry norms. No demo account details confirm accessibility for testing. Variety tempts, but volatility paired with low crypto leverage disadvantages speculators.

Account Types Breakdown

Two main accounts cater to different needs, though specifics remain vague. Minimum deposit hits $200 via bank transfer or card, both free and quick. USD-denominated setups simplify for global users, but inactivity fees bite hard.

After 3 months dormant, $500 quarterly charges apply, plus a credit-out rule post-45 days. This punishes casual traders more than established platforms like Pepperstone. No tiered VIP options mentioned, limiting appeal for high-volume players.

Zenstox Fees Analyzed

Trading costs exceed averages, especially inactivity and crypto swaps. Rollover fees hit 0.02% overnight for most CFDs, ballooning to 0.50 for cryptos. Fixed spreads provide predictability, yet markups inflate during volatility.

Deposits incur no fees, but withdrawals lack clarity on charges. High non-trading penalties deter long-term holding, unlike low-fee rivals such as XM. Overall structure burdens small accounts the most.

| Fee Type | Zenstox Rate | Industry Average | Notes |

| Inactivity (after 3 months) | $500/quarter | $10-50/month | Excessive for offshore |

| Crypto CFD Swap | 0.50 overnight | 0.01-0.20 | Volatility premium |

| Forex CFD Leverage | Up to 1:1200 | 1:30-500 (tiered) | Risk amplifier |

| Deposit (Card/Bank) | Free | Free | Min $200 |

Platforms and Usability

Zenstox Custom Platform runs web-based and desktop, suiting intuitive traders. XCITE Mobile App supports iOS and Android for on-the-go access. Features emphasize simplicity over advanced tools like those in MT4/MT5.

No custom indicators or automation noted, limiting the pros. Mobile flexibility helps beginners, but lags behind cTraders depth at competitors. Reliability is unproven amid complaint volumes.

Customer Support Channels

Support spans email (customer.service@zenstox.com), phone (+97365003849), WhatsApp (+97143118110), and live chat. Multi-channel access beats some peers, yet response quality draws fire. Advisors like Rafael Montoya pushed deposits over resolutions.

Offshore hours may delay aid, contrasting with 24/7 services elsewhere. No verified satisfaction metrics available.

Pros and Cons of Zenstox

Pros remain limited amid glaring weaknesses.

- Regulated by Seychelles FSA (SD123).

- 300+ CFD instruments with high forex leverage.

- Custom platform and mobile app available.

- Free deposits from $200.

Cons dominate, echoing trader woes.

- WikiFX score 2.24/10 signals high risk.

- Bonus schemes lead to deposit traps.

- Frequent withdrawal blocks reported.

- Steep inactivity fees ($500/quarter).

- Offshore regulation lacks robust protections.

- Elevated swap fees on cryptos.

Comparisons to Competitors

Zenstox trails established brokers. IC Markets offers ASIC regulation, MT4/5, and spreads from 0.0 pips with $200 min—far safer. XM provides CySEC oversight, no inactivity fees under 90 days, and true ECN execution.

Offshore peer FP Markets at least discloses segregated funds, absent here. High leverage tempts, but without Tier-1 status, Zenstox exposes more.

| Feature | Zenstox | IC Markets | XM |

| Regulation | Seychelles FSA | ASIC | CySEC |

| Min Deposit | $200 | $200 | $5 |

| Inactivity Fee | $500/quarter | None | €10/month after 90 days |

| Platforms | Custom/XCITE | MT4/5/cTrader | MT4/5 |

| Withdrawal Issues | Frequent complaints | Rare | Minimal |

Reported Trader Cases

2025 incidents spotlight patterns. Case 1: Initial $180 deposit ballooned via bonuses and advisor pressure to $1,980 demand, risking $10k “gains.” Case 2: Profits blocked post-deposits.

Case 3: Profit promises led to non-withdrawable funds. Case 4: $23k deposited, balances faked, account shut after rejections. These align with offshore scam hallmarks—aggressive upselling and exit barriers.

Safety Concerns: Is Zenstox Legit?

While Zenstox holds a Seychelles FSA license, the offshore framework provides minimal investor protection. The combination of:

- Low WikiFX score

- High non-trading fees

- Aggressive bonus schemes

- Documented withdrawal issues

…makes Zenstox a high-risk broker. Traders should exercise caution and consider alternatives with stronger regulatory oversight.

Bottom Line: Should You Trade with Zenstox?

Zenstox presents itself as a modern CFD broker with over 300 instruments and mobile accessibility. However, the negative trader reports, punitive fees, and offshore regulation overshadow its offerings.

- Strengths: Range of instruments, custom platform, mobile app.

- Weaknesses: Offshore license, blocked withdrawals, high inactivity fees, low WikiFX score.

Final Verdict: Zenstox is not a safe choice for traders seeking reliability. The evidence points to systemic issues that compromise trust. Investors should prioritize brokers with Tier-1 regulation and proven track records.

Read more

Investing24.com Review – Can Traders Trust the App Data for Trading?

Does trading on Investing24.com data cause you losses? Do you frequently encounter interface-related issues on the Investing24.com app? Did you witness an annual subscription charge at one point and see it non-existent upon checking your forex trading account? Did the app mislead you by charging fees for strong buy ratings and causing you losses? You are not alone! Traders frequently oppose Investing24.com for these and more issues. In this Investing24.com review article, we have examined many such complaints against the forex broker. Have a look!

Markets.com Regulation: What Traders Should Know

Markets.com is regulated by CySEC under license 092/08 and FSC offshore, offering forex and derivatives trading, though some users report delays in withdrawals.

24option Review: Is it Legit or a Scam? Find Out in This In-depth Investigation

Contemplating 24option as your forex trading companion? Want to explore its trading platforms? We appreciate your interest! But how about knowing the Hong Kong-based forex broker and its different aspects, such as withdrawals and deposits. More specifically, if we have to say, what’s the feedback of traders concerning 24option? Are they happy trading with the broker? From a healthy collection of over 200 reviews, the broker is found to be a SCAM! Many traders have expressed concerns over the illegitimate trading approach adopted by the broker. In the 24option review article, we have explored many complaints against the broker.

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Did your forex trading experience with FXNovus become bad after a short profitable spell on small trades? Did you make tax payments on your failed withdrawal request, as the funds did not arrive? Did the customer support team fail to return your hard-earned profits on the FXNovus trading platform? Feel that the South Africa-based forex broker debited illegitimate fees from your trading account? You are not alone! Many traders have voiced these trading concerns while sharing the FXNovus review. In this article, we have highlighted these concerns in greater detail. Read on!

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

Forex 101: Welcome to the $7.5 Trillion Beast

Oil Surge: WTI Reclaims $60 as Middle East Tensions Override Venezuela Deadlock

ThinkMarkets Regulation: Safe Trading or Risky Broker?

ehamarkets Review 2026: Regulation, Score and Reliability

8xTrade Review 2025: Safety, Features, and Reliability

VEBSON Review 2025: Is This Broker Safe or a Potential Scam?

Rate Calc