ZFX User Reputation: Is ZFX Safe or a Scam? A Complete Review

Abstract:When traders research a broker, they always ask the same important question: Will my capital be safe? When looking into ZFX, this question becomes complicated because there are serious scam accusations floating around. This review aims to give you a clear, fact-based answer. Read on!

Understanding the ZFX Question

When traders research a broker, they always ask the same important question: Will my capital be safe? When looking into ZFX, this question becomes complicated because there are serious scam accusations floating around. This review aims to give you a clear, fact-based answer.

Our research shows that ZFX is an officially licensed broker, not a complete scam. However, whether it's safe for traders is more complex and depends on understanding how the company works. The brand operates under two different regulators, which means clients get very different levels of protection depending on where they live. Also, many complaints and scam reports are actually about fake copycats, not the real broker. This article will break down ZFX's licensing status, look at real user reviews, and show you how to tell the difference between the real broker and fake ones. Our goal is to give you the facts you need to make a safe and smart choice.

ZFX's Licensing and Regulation

A broker's trustworthiness starts with proper licensing. To figure out if ZFX is safe, we need to look at how the company is set up and what licenses it has. This factual information is essential for understanding how much trust and protection the broker offers.

ZFX Company Background

ZFX is the brand name for the Zeal Group, a financial company that began operating in 2017. The group works through several legal companies, with its main global website at `www.zfx.com`. The group does more than just retail trading - it also works in financial technology and provides liquidity, showing it has a significant presence in the financial space.

Two Different Regulatory Systems

ZFX's regulatory setup is split between two main companies, each controlled by different authorities with very different levels of oversight and protection.

· Zeal Capital Market (UK) Limited is authorized and regulated by the Financial Conduct Authority (FCA) in the United Kingdom, with a license number 768451.

· Zeal Capital Market (Seychelles) Limited is authorized and regulated by the Financial Services Authority (FSA) in Seychelles, with a license number SD027.

The difference between these two regulators isn't just a small detail - it's the most important factor in determining how safe a trader will be. The table below shows the major differences.

| Feature | FCA (United Kingdom) | FSA (Seychelles) |

| Regulatory Level | Top-Tier (Highest Trust) | Offshore |

| Investor Protection | Financial Services Compensation Scheme (up to £85,000) | None |

| Typical Clients | UK / European Residents | Most International & Asian Clients |

| Maximum Leverage | Strictly Limited (e.g., 1:30) | High (e.g., up to 1:2000) |

The Regulatory Risk

This two-license setup creates an important risk. While the ZFX brand gets a lot of credibility and trust from its top-tier FCA license, the reality for most retail traders outside of the UK and Europe is different. Most international clients are signed up through the Seychelles (FSA) company.

This is done to offer more competitive trading conditions, such as extremely high leverage, which are not allowed under strict FCA rules. However, this comes at a high cost to trader security. If you are a client under the FSA company, your capital is not protected by the UK's Financial Services Compensation Scheme (FSCS), which guarantees deposits up to £85,000 if the broker goes bankrupt. This means that while the broker itself is legitimate, your funds don't have the ultimate safety net provided by a top-tier regulator.

To ensure your own financial safety, checking a broker's regulatory license for your specific region is absolutely necessary. Before depositing, it's smart to use an independent verification platform. A service like WikiFX can help you check the regulations and specific protections, if any, applying to your account.

What Real Users Say

Moving beyond official information, we now look at real user experiences. By reviewing feedback from platforms like Trustpilot, where ZFX has a rating of 3.1, we can build a realistic picture of how the broker actually performs, including both its strengths and ongoing problems.

What Users Like

Many users report positive experiences with ZFX, often pointing out specific operational benefits. These positive themes appear consistently across many reviews.

· Quick and Easy Account Setup: Many traders note that opening an account and completing identity verification is remarkably fast, often finished within the same day. This allows for quick access to trading.

· Helpful Customer Support: Positive mentions of customer service are common. Users frequently praise the support team for being helpful, professional, and quick to respond, with support in multiple languages being a key advantage for global clients.

· Competitive ECN Trading Conditions: More experienced traders who choose the ECN account often praise the low raw spreads. They find these conditions suitable for high-frequency trading and scalping strategies where tight spreads are essential for making profits.

· Fast Withdrawals: Many reports confirm quick withdrawal processing. Many users, particularly those trading during Asian business hours, say that withdrawal requests are often completed on the same day, which is crucial for building trader trust.

Common ZFX Complaints

Despite the positive feedback, a pattern of complaints reveals several operational warning signs that potential traders must know about. These issues aren't necessarily signs of a scam, but can lead to significant and unexpected financial losses if not understood.

· Complaint Case 1: Severe Price Slippage

Many ZFX complaints focus on severe slippage, especially during high-volatility news events like the U.S. Non-Farm Payrolls report. Users report that their stop-loss orders were executed at a price significantly worse than the one they set, leading to larger-than-expected losses. As an STP/ECN broker, ZFX passes orders directly to liquidity providers. During intense market volatility, liquidity can disappear, causing price gaps and slippage. While this is a known risk with any true market-execution broker, traders must be prepared for its potential impact on their risk management strategy.

· Complaint Case 2: The Dynamic Leverage Problem

Perhaps the most dangerous and misunderstood aspect of ZFX is its dynamic leverage system. Many traders have complained about their accounts being suddenly liquidated after the broker automatically reduced their leverage. The advertised leverage of up to 1:2000 is only available for accounts with very small amounts. As your account balance grows, either through deposits or trading profits, the leverage is automatically and drastically reduced in steps. For example, an account's leverage might drop from 1:2000 to 1:1000 or 1:500. This sudden change dramatically increases the margin requirement for open positions, which can lead to an instant margin call and forced liquidation if the account does not have enough capital.

· Complaint Case 3: Withdrawal Fees

A less common but notable complaint involves a specific withdrawal condition. According to ZFX's terms, if a client deposits capital and then requests a withdrawal without any trading, the broker may charge an administrative fee of 3% to 5% on the withdrawal amount. While this policy is likely in place to prevent money laundering, it has surprised some users.

The “Is ZFX Safe or Scam” Confusion

A search for ZFX online will inevitably show many “scam” reports, which can be worrying. It's important to address this issue directly to understand where these accusations come from and separate fact from fiction.

Why So Many Scam Reports?

The high number of “ZFX scam” reports is not a direct criticism of the official broker. Instead, it's a result of its brand recognition. ZFX's established name has made it a prime target for criminals who create fraudulent copycat operations to deceive unsuspecting victims.

These scammers build fake websites with similar web addresses and develop fake mobile apps that look like real trading platforms. These fraudulent tools are often used in “pig-butchering” scams, where a scammer builds trust with a victim over time before convincing them to deposit into a fake investment platform. The capital is then stolen, and the victim has no way to get it back. These criminal activities, which have no connection with the official Zeal Group, are the main reason for the “ZFX is a scam” story online, causing significant damage to the real company's reputation.

A 3-Step Verification Guide

Protecting yourself from these fake scams is extremely important. Before working with any platform claiming to be ZFX, you must do a thorough verification. Follow these three steps to make sure you are dealing with a legitimate broker.

1. Verify the Official Website

The only legitimate global website for the broker is `www.zfx.com`. Scammers often use slightly different web addresses (e.g., zfx-trade, zfx-global, etc.). Never trust links sent to you by unknown people on social media or messaging apps like WhatsApp or Telegram. Always type the official website address directly into your browser.

2. Use Official App Stores Only

Never install a trading app from a third-party link or an APK file sent to you. The official MetaTrader 4 (MT4) or MetaTrader 5 (MT5) apps should only be downloaded from the official Google Play Store for Android or the Apple App Store for iOS. After installation, you connect to the broker's server from within the official app.

3. Cross-Check with an Independent Verifier

This step is crucial and should be done before you even create an account. Use a third-party broker verification service, such as WikiFX, to check the details of the platform you are considering. Such services maintain databases of regulated brokers and their official websites. This process can help you confirm that you are on the correct website and, more importantly, expose known fakes and fraudulent copycat sites that have been flagged by other users or regulatory bodies.

ZFX Account Types and Costs

To determine if ZFX fits your trading style and budget, it's important to understand its account types and associated costs. The broker offers different account levels designed for traders with different experience levels and capital.

Comparing Account Types

ZFX provides three main account types, each with a different cost structure and target audience. The choice between them depends largely on your initial deposit size and trading strategy.

| Account Feature | Mini (Cent) | Standard (STP) | ECN (Professional) |

| Best For | Beginners, small-fund testing | General retail traders | Scalpers, high-volume traders |

| Minimum Deposit | $50 | $200 | $1,000 |

| Spreads (EUR/USD) | From 1.5 pips | From 1.3 pips | From 0.2 pips |

| Commission | None | None | $7 per standard lot |

| Max Leverage | Up to 1:2000 | Up to 1:2000 | Up to 1:2000 |

Key Trading Conditions

The main trading platform offered across all account types is the industry-standard MetaTrader 4 (MT4), available on PC, web, and mobile devices.

To give a concrete cost example, a trader on a Standard (STP) account can expect the spread for Gold (XAU/USD) to typically be around 2.0 to 3.0 pips during normal market hours. In contrast, an ECN account user would see a much lower spread on Gold but would pay a commission of $7 for every standard lot traded (a complete buy and sell transaction). For active or large-volume traders, the ECN account almost always results in lower overall trading costs.

The Final Decision on ZFX

After a thorough analysis of its regulatory status, user feedback and operational risks, we can now provide a final, complete verdict on ZFX's reputation and safety.

ZFX Reputation: Strengths and Weaknesses

· Strengths:

· Strong Group Regulation: The parent group's top-tier FCA license provides significant credibility and shows a commitment to high regulatory standards.

· Low Starting Amount: With a minimum deposit of just $50 for a Micro account, the platform is very accessible to beginners and those wanting to test with small amounts of money.

· Flexible Account Options: The availability of commission-free STP accounts and low-spread ECN accounts allows the broker to serve a wide range of trading styles.

· Weaknesses:

· Offshore Account Risk: The fact that most international clients are signed up under the FSA (Seychelles) company means they don't have any form of investor compensation fund protection.

· High-Risk Leverage: The dynamic leverage system, while attractive, poses a significant risk of sudden liquidation for traders who do not fully understand how it works.

· High Fake Website Problem: The brand is heavily targeted by scammers, creating a confusing and dangerous environment for prospective users who may fall victim to fraudulent copies.

Final Safety Assessment

In conclusion, the official ZFX broker is a legitimate and regulated company, not a scam. It has been operating since 2017 under a recognized corporate structure with a top-tier license in its portfolio.

However, a trader's “safety” with ZFX depends on several conditions. The main risks don't come from the broker being fraudulent. Instead, they come from three key areas: (1) the limited protection and lack of a compensation scheme when trading under the offshore FSA company, (2) the potential for unexpected losses due to the poorly understood dynamic leverage system, and (3) the very real danger of falling victim to an unrelated fake scam that is using the ZFX name.

Ultimately, your security is your responsibility. Whether you are considering ZFX or any other broker, careful research is extremely important. Always use trusted, independent platforms, such as WikiFX, to verify regulatory claims, check for official warnings or fake alerts, and review the latest user feedback before investing.

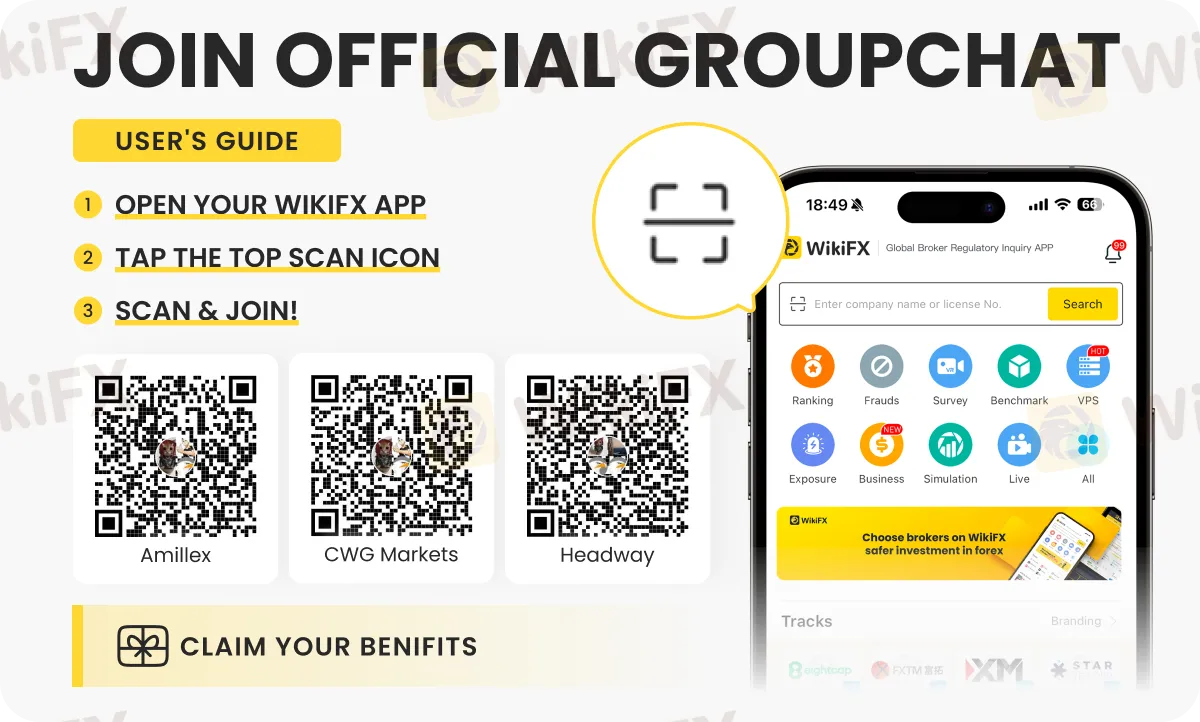

Do not miss important forex updates on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. These updates can help you elevate your forex trading game. Join the group/s by following the instructions shown below.

Read more

Is SGFX Legit? A 2026 Deep Dive Investigation

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

SGFX Review 2026: A Trader's Warning on Spectra Global

If you are looking for an "SGFX Review" or want to know the "SGFX Pros and Cons," you have found an important resource. You probably want to know, "Is SGFX a safe and trustworthy broker?" Based on our detailed research, the answer is clearly no. While SGFX (also called Spectra Global) looks modern and professional, we have found serious warning signs that every potential investor needs to know about before investing. This review will get straight to the point. We will immediately discuss the main problems that make this broker extremely risky. These include weak and misleading regulation from offshore locations, questionable trading rules designed to get large deposits, and a worrying pattern of serious complaints from users, especially about not being able to withdraw. This article will give you a complete, fact-based analysis of how SGFX operates to help you make a smart and safe decision.

ZFX Review 2026: A Complete Guide to Trading Conditions, Costs & Safety

When traders look for trustworthy brokers in today's busy market, ZFX stands out as a major global company backed by the Zeal Group. The main question for anyone thinking about using them is simple: What is ZFX, and can you trust it? This broker has an interesting but important split personality. It works under a parent company that follows strict UK financial rules, but most regular customers actually sign up through a different offshore company. This creates a gap between how safe people think it is and how much protection traders actually get. The goal of this 2026 review is to give you a complete, fair look at ZFX's safety, costs, and features. We'll give you an honest view of what's good and bad about it, so you can make a smart choice based on facts, not advertising. Our analysis will look at its regulations, trading conditions, fees, and the important risks you need to know about.

TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc