Gold Fun Corporation Ltd Review: Scam or Legit?

Abstract:Gold Fun Corporation Ltd is CGSE‑licensed in Hong Kong, offering gold services, but investor reports cite frozen funds and alleged fraud concerns.

Introduction

Gold Fun Corporation Ltd, founded in 2016, presents itself as a Hong Kong–based broker specializing in precious metals trading. Licensed under the Chinese Gold and Silver Exchange Society (CGSE), the firm promotes services ranging from gold futures to physical bullion. On paper, this regulatory framework should inspire confidence. Yet, numerous investor reports reveal troubling allegations of frozen accounts, withheld withdrawals, and suspected fraud. This review investigates whether Gold Fun is a legitimate broker or a potential scam.

Regulation and Licensing

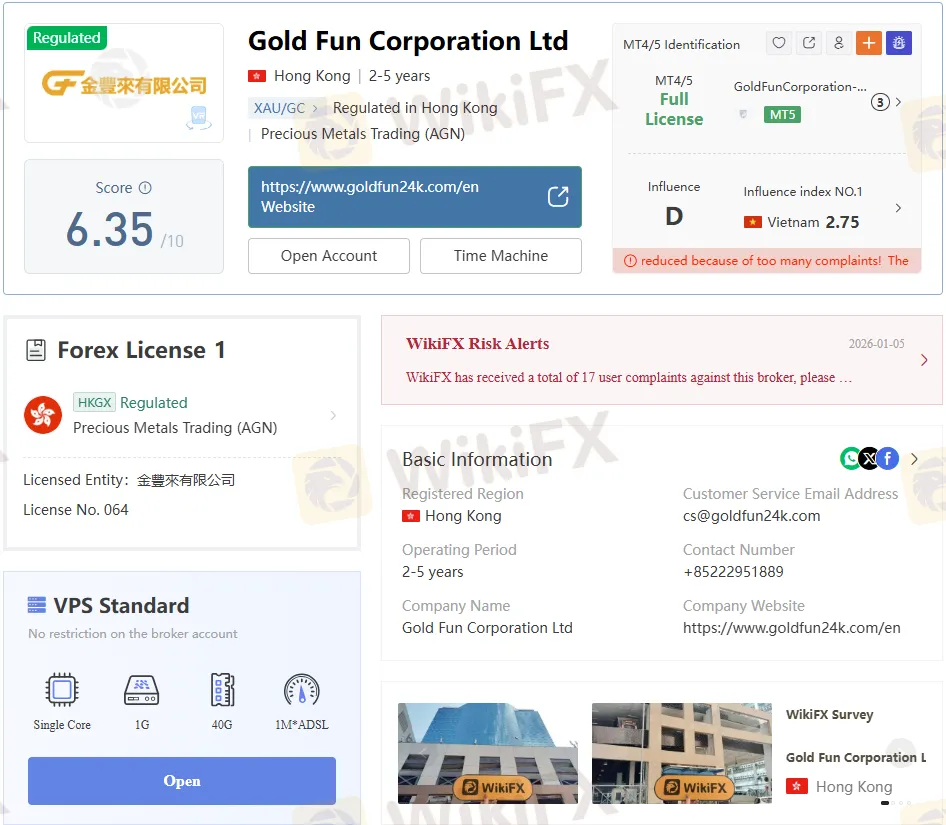

Gold Fun Corporation Ltd operates under CGSE oversight, with a Type A1 license (No. 064). The licensed entity is 金豐來有限公司, headquartered in Kowloon, Hong Kong.

- Regulatory Authority: Chinese Gold and Silver Exchange Society (CGSE)

- License Type: Type A1 Precious Metals Trading

- License Number: 064

- Jurisdiction: Hong Kong, China

- Office Address: Room 1508, 15/F, Peninsula Square, 18 Sung On Street, Hunghom, Kowloon

While regulation under CGSE provides legitimacy, investor complaints suggest oversight has not prevented questionable practices. This gap between licensing and investor experience is critical in assessing the brokers credibility.

Services and Offerings

Gold Fun markets itself as more than a trading platform, offering a broad suite of gold‑related services:

- Remelting service

- Diamond jewelry sales

- 12kg gold dore and pure gold bars

- Real-time trading software

- Gold futures contracts

- Storage services

- Tailor‑made trading solutions

- GF Gold Trading and investment packages

- Direct access to gold ore from mines

This breadth of services positions Gold Fun as a vertically integrated provider. However, the lack of transparency on fees, spreads, and account structures raises concerns about accessibility for retail traders.

Trading Platforms and Accounts

Gold Fun claims to support MT4/MT5 platforms, but documentation shows inconsistencies:

- Platform Availability: MT5 confirmed; MT4 references unclear.

- Demo Accounts: Not offered, limiting risk‑free testing.

- Account Types: Multiple MT5 accounts mentioned in complaints, but no public disclosure of tiers or fees.

Competitor brokers typically provide transparent account comparisons and demo access. Gold Funs opacity is a red flag for cautious investors.

Pros and Cons

Pros:

- Licensed under CGSE in Hong Kong

- Wide range of gold‑related services

- Operational office verified in Hong Kong

Cons:

- No demo accounts available

- Limited disclosure on trading rules and fees

- Numerous investor reports of frozen funds

- Allegations of collusion with AGA to defraud investors

Investor Complaints and Reported Cases

The most damaging aspect of Gold Funs reputation comes from investor experiences, particularly in Vietnam:

- Frozen Funds: Deposits made but withdrawals blocked; balances reduced to zero.

- Collusion Allegations: Reports of cooperation with AGA (Angel Guardian Alliance) to defraud thousands of investors.

- Fraud Indicators: Unauthorized fund transfers, unfulfilled interest promises, suspected money laundering.

- Abandonment of Responsibility: Claims that Gold Fun abandoned MT5 accounts, creating new brands to continue operations.

These cases paint a picture of systemic misconduct that overshadows the brokers regulatory credentials.

Competitor Comparison

Against established Hong Kong brokers, Gold Fun falls short:

- Demo Accounts: Competitors offer demo accounts; Gold Fun does not.

- Fee Transparency: Competitors disclose spreads and commissions; Gold Fun remains vague.

- Reputation: Competitors maintain clean records; Gold Fun faces widespread fraud allegations.

This comparative lens underscores the risks of choosing Gold Fun over more transparent alternatives.

Domain and Contact Information

- Website: https://www.goldfun24k.com/en

- Email: cs@goldfun24k.com

- Phone: +852 2295 1889

- Headquarters: Peninsula Square, Hunghom, Kowloon, Hong Kong

While the domain and contact details appear legitimate, investor reports suggest communication channels often fail to resolve disputes.

Bottom Line

Gold Fun Corporation Ltd presents itself as a regulated Hong Kong broker under CGSE, offering diverse gold services. On paper, its licensing and office verification lend credibility. In practice, however, the sheer volume of investor complaints—frozen funds, collusion allegations, and suspected fraud—casts serious doubt on its legitimacy.

Editorial Verdict: Despite its regulatory status, Gold Fun Corporation Ltd cannot be considered a safe choice. Competitor brokers with transparent practices and clean reputations remain far more reliable alternatives for traders seeking exposure to precious metals markets.

Read more

Is SGFX Legit? A 2026 Deep Dive Investigation

Finding a trustworthy forex and CFD broker can be overwhelming, especially with new platforms constantly appearing. One name that has raised questions from traders is SGFX, also known as Spectra Global. With promises of advanced trading technology and competitive conditions, it might seem appealing. However, the important question remains: Is SGFX legit? This complete 2026 review looks beyond the marketing materials to provide a thorough, fact-based analysis. We will examine SGFX's company structure, check its regulatory claims, review its fee structure, and look at recent user feedback. Our goal is to give you the information needed to make a safe and smart decision about your trading capital.

SGFX Review 2026: A Trader's Warning on Spectra Global

If you are looking for an "SGFX Review" or want to know the "SGFX Pros and Cons," you have found an important resource. You probably want to know, "Is SGFX a safe and trustworthy broker?" Based on our detailed research, the answer is clearly no. While SGFX (also called Spectra Global) looks modern and professional, we have found serious warning signs that every potential investor needs to know about before investing. This review will get straight to the point. We will immediately discuss the main problems that make this broker extremely risky. These include weak and misleading regulation from offshore locations, questionable trading rules designed to get large deposits, and a worrying pattern of serious complaints from users, especially about not being able to withdraw. This article will give you a complete, fact-based analysis of how SGFX operates to help you make a smart and safe decision.

ZFX Review 2026: A Complete Guide to Trading Conditions, Costs & Safety

When traders look for trustworthy brokers in today's busy market, ZFX stands out as a major global company backed by the Zeal Group. The main question for anyone thinking about using them is simple: What is ZFX, and can you trust it? This broker has an interesting but important split personality. It works under a parent company that follows strict UK financial rules, but most regular customers actually sign up through a different offshore company. This creates a gap between how safe people think it is and how much protection traders actually get. The goal of this 2026 review is to give you a complete, fair look at ZFX's safety, costs, and features. We'll give you an honest view of what's good and bad about it, so you can make a smart choice based on facts, not advertising. Our analysis will look at its regulations, trading conditions, fees, and the important risks you need to know about.

TotalFX Regulation Review: Compliance and Trading Safety

TotalFX review reveals FSCA oversight with license No. 51105, proving compliance and secure trading safety across forex, crypto, and CFDs.

WikiFX Broker

Latest News

Bull Waves Regulation Uncovered: A Deep Look into Their FSA License and Safety

OPEC+ Stands Pat: Output Steady Amidst Geopolitical Storm

XTRADE Broker Analysis: Understanding XTRADE Regulation & Verified XTRADE Review

Oil Markets on Edge: OPEC+ Holds Firm Amid Venezuelan Turmoil

Geopolitical Shock: Trump's Venezuela Raid Sparks Oil Volatility & Impeachment Threats

One Click, RM1 Million Gone: Penang Retiree’s Social Media Scam Nightmare

Fed Watch: Paulson See 'Bending' Jobs Market; Yellen Warns of Debt Spirals

Global Crypto Launch Tax Network to 48 Nations

Spanish Regulator Raises Concerns Over Unlicensed Trading Platforms and Messaging-Based Apps

OneRoyal Review: A Complete Look at How This Broker Performs

Rate Calc