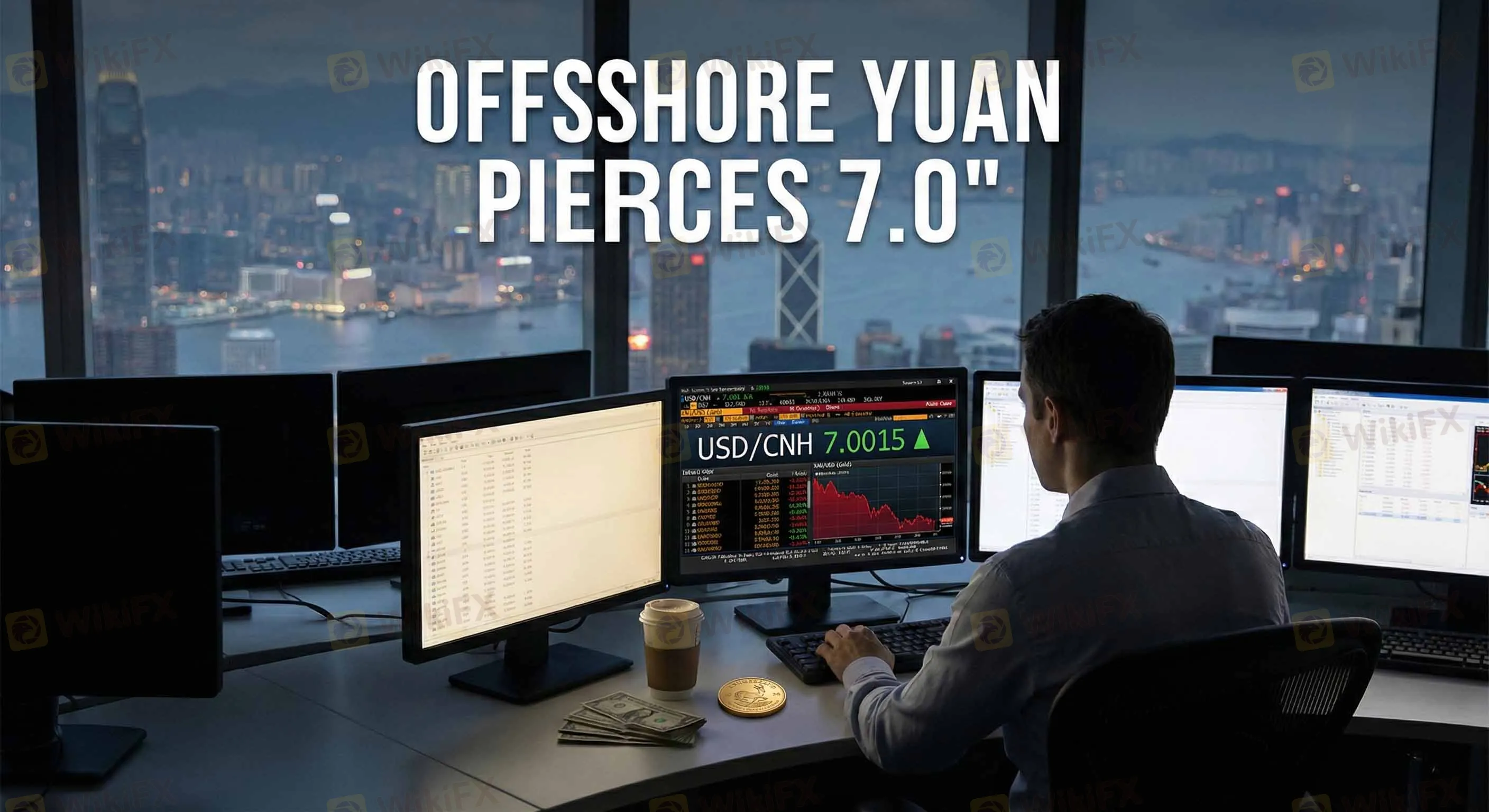

Offshore Yuan Pierces 7.0 as Gold Corrects in Holiday Trade

Abstract:Thin holiday liquidity amplified moves in global markets this week, with the Chinese Yuan staging a significant rally against the Dollar, while precious metals retreated from record valuations.

Thin holiday liquidity amplified moves in global markets this week, with the Chinese Yuan staging a significant rally against the Dollar, while precious metals retreated from record valuations.

RMB Breaks Key Psychological Barrier

The offshore Yuan (CNH) strengthened past the 7.0 per Dollar mark for the first time since late 2024, driven by robust export data and a seasonal surge in corporate settlement demand.

Despite looming headwinds—including the US announcement of new Section 301 tariffs on Chinese semiconductor products—market sentiment remains buoyed by China's strong trade surplus. However, analysts caution that the pace of appreciation may be tempered by the People's Bank of China (PBOC), which continues to use the daily fixing and swap market tools to manage volatility. Deutsche Bank forecasts the RMB could appreciate further to 6.7 by late 2026, though short-term fluctuations depend heavily on the evolving liquidity environment and US trade policy implementation.

Commodities: Gold Slips, Silver Shines

In the commodities sector, Gold (XAU/USD) underwent a technical correction, slipping below the $4,500/oz handle after touching fresh highs. The pullback is attributed to profit-taking amidst lighter volume. Conversely, Silver maintained its bullish momentum, trading firmly above $71/oz, supported by industrial demand and a massive 149% year-to-date rally that has significantly outperformed the yellow metal.

Market Outlook

With major exchanges in the US, Europe, and South Korea closed for Christmas, volatility in open Asian markets highlights the sensitivity of asset prices to order flow. Investors are now positioning for 2026, weighing the resilience of the US “soft landing” narrative against the resurgence of inflation risks in Japan and trade fragmentation in Asia.

Read more

Spring Rally in Chinese Equities Signals Potential Lift for AUS and NZD

Amidst a gloomy global trade outlook, China's equity markets are flashing green, potentially offering support to the Chinese Yuan (CNY) and its liquid proxies, the Australian Dollar (AUD) and New Zealand Dollar (NZD).

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Despite looming tariff threats and Western protectionism, China’s export engine is defying expectations, posting record highs in trade surplus figures through November. A deep dive into the trade data reveals a massive structural pivot: China is successfully substituting stalling Western demand with aggressive growth in Emerging Markets.

Asia FX Outlook: Japan's Rate Hike "Trust Vote" and the Reality of Yuan Strength

Barriers in Asian currency markets are shifting as Japan embraces monetary normalization and China navigates a complex valuation recovery.

Stay Cautious Trading Despite Strong CNY & Steady USD

The exchange rate of onshore and offshore RMB against US dollar (CNY and CNH) both headed higher to over 6.90 in yesterday’s trading. As of press time, CNY and CNH record 6.8897 and 6.8851, respectively.

WikiFX Broker

Latest News

China’s Export Resilience: A Structural Pivot Towards the 'Global South'

Silver Smashes $70: Is the "Forced Central Bank Buying" Thesis Playing Out?

JPY Forecast: Japan Raises Debt Cost Assumption to 30-Year High

Copper Smashes $12,000 Barrier in Commodity Super-Cycle Surge

Trump Intensifies Fed Pressure as Strong GDP Complicates Rate Cut Path

Credit Suisse Hit With $7.1M Fine Over Supervisory Failures

Brokers or Prop Firms, or both...

Trading.com Launches Zero-Commission Investment Account

Quotex Review 2025: Safety, Features, and Reliability

Government Officer Lost RM12,000 to Non-Existent Forex Scheme

Rate Calc