OneRoyal Review 2025: Is This Broker Legit or a Scam?

Abstract:OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

OneRoyal is an Australian-based brokerage established in 2012 that offers trading services across global markets. With over a decade of operation, the broker has established a significant presence, holding licenses from top-tier regulators like ASIC and CySEC. However, despite its strong regulatory framework, recent user feedback paints a conflicting picture involving withdrawal struggles and severe slippage.

With a WikiFX score of 6.42 and an “AA” trading environment ranking, OneRoyal appears solid on paper. However, a recent surge in complaints requires a closer look at whether this broker is truly safe for retail investors.

Is OneRoyal Safe? Regulatory Status and Licenses

The primary indicator of a broker's safety is its regulatory oversight. OneRoyal operates under a complex structure involving multiple legal entities, ranging from top-tier protection to offshore regulation.

Regulatory Licenses:

| Regulator | Country | License Type | Status |

|---|---|---|---|

| ASIC | Australia | Tier 1 (High Safety) | Regulating |

| CySEC | Cyprus | Tier 2 (Europe) | Regulating |

| AMF | France | Tier 1 (Europe) | Regulating |

| VFSC | Vanuatu | Offshore | Offshore Regulation |

Regulatory Analysis:

OneRoyal holds highly respected licenses from the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulators enforce strict capital requirements and segregation of client funds.

However, many international clients are onboarded through the Vanuatu (VFSC) entity. This offshore license allows for higher leverage (up to 1:1000) but offers significantly less protection than Australian or European standards. Additionally, investors should be aware that the Securities Commission of Malaysia (SC) has issued a warning regarding OneRoyal for carrying out unauthorized capital market activities.

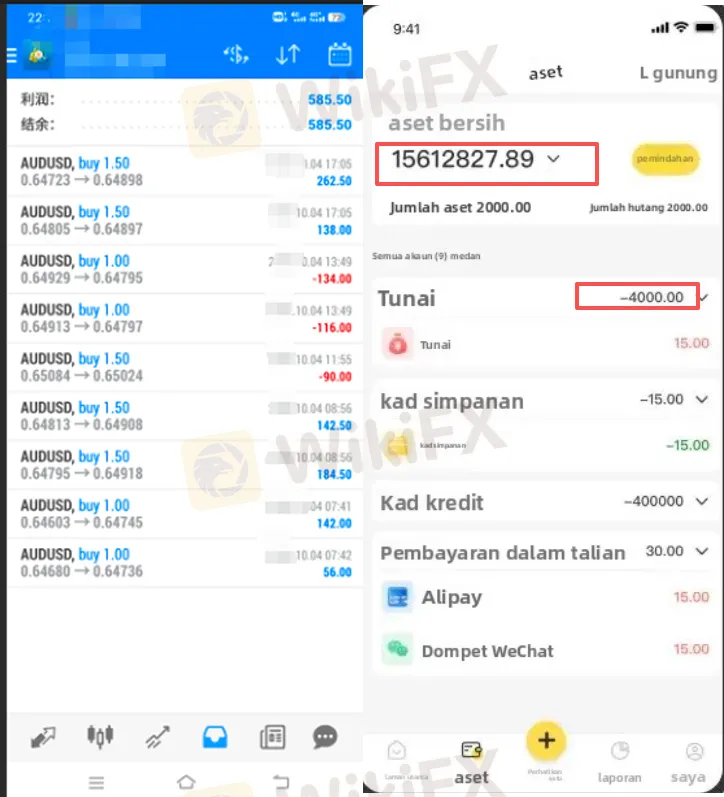

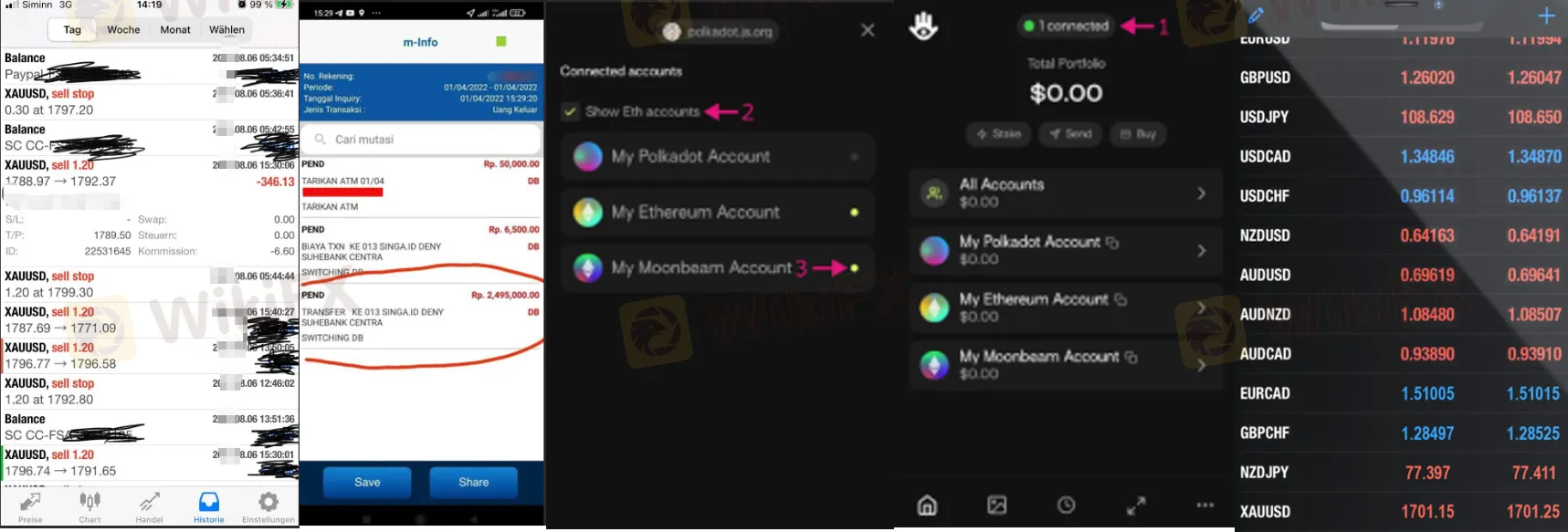

OneRoyal Scam Exposure: Withdrawal Complaints and Slippage

While the regulatory background is strong, the practical user experience has raised red flags. In the last three months alone, there have been 23 formal complaints lodged against the broker. The allegations fall into three alarming categories: withdrawal failures, platform dominance, and bonus traps.

Withdrawal Issues

A significant number of traders have reported being unable to access their funds. Reports from users in Malaysia and other regions detail instances where withdrawal requests are rejected without clear justification or remain “under review” for over 15 days.

- Documentation Delays: Users report being asked for excessive documentation, such as “tax clearance certificates”—documents not standard for standard withdrawals—essentially stalling the process.

Deducted Profits: Some traders claimed their profits were deducted under accusations of “illegal trading” or “abnormal market fluctuations,” even when they believed they traded legitimately.

Severe Slippage and Data Manipulation

Multiple case studies highlight massive slippage, where the price a trade is executed at differs vastly from the requested price.

- Stop-Loss Failures: One user reported a 160-point slippage on a GBP/USD trade, which wiped out their principal. Another user noted a gold trade was closed $30 below their stop-loss price.

Price Discrepancies: Traders have accused the platform of showing price feeds that differ from the international market rate, specifically fluctuating wildly during attempts to close positions to force losses.

“AI” Trading and Bonus Schemes

Several complaints mention an “AI Intelligent Trading System” promoted by the broker (or affiliates) guaranteeing high returns (e.g., 20% monthly). Users reported that backtest data was manipulated to look profitable, but real trading resulted in rapid losses.

Additionally, one user reported a 50% deposit bonus trap where funds were locked until a trading volume turnover of 30 times the bonus amount was achieved—a requirement often impossible to meet without losing the principal.

Trading Conditions: Fees, Spreads, and Accounts

For users who do not encounter these operational issues, OneRoyal offers a robust technical environment with flexible account options.

Trading Platforms

OneRoyal supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These are the industry standards, offering advanced charting and automated trading capabilities (EAs). The platform availability is rated “Perfect,” though it lacks proprietary mobile apps for smoother account management.

Account Types

The broker offers five distinct account types to suit different traders:

- ECN / VIP Accounts: These accounts feature raw spreads starting as low as 0.0 pips. The VIP account requires a deposit of $10,000, while the standard ECN account requires only $50.

- Classic Account: Designed for beginners with a $50 entry, but spreads are higher, starting from 1.4 pips.

- Swap-Free: Available for Islamic traders or those holding long-term positions.

Leverage

OneRoyal offers extremely high leverage up to 1:1000. While this allows for maximizing small deposits, it also increases the risk of rapid liquidation, especially given the slippage reports mentioned in user reviews.

Pros and Cons of OneRoyal

Pros:

- Regulated by top-tier authorities (ASIC, CySEC).

- Access to MT4 and MT5 trading platforms.

- Tight spreads (0.0 pips) on ECN accounts.

- Multiple account types with low entry barriers ($50 minimum deposit).

Cons:

- High volume of recent complaints regarding withdrawals.

- Regulatory Warning from the Securities Commission of Malaysia.

- Reports of severe slippage and stop-loss failures.

- Offshore entity (Vanuatu) offers lower client protection.

- Allegations of misleading bonus terms and AI trading “scams.”

Final Verdict: Is OneRoyal Safe?

The verdict on OneRoyal is complicated. Legally, it is a legitimate broker with valid licenses from top-tier regulators like ASIC and CySEC. However, the operational reality reported by recent users contradicts this safety. The accumulation of complaints regarding denied withdrawals, price manipulation, and misleading bonus schemes suggests significant risk, particularly for clients registered under the offshore (Vanuatu) entity.

While the trading conditions (spreads and platforms) are competitive, the risk of capital being locked or lost to “technical errors” currently outweighs the benefits for many retail traders. Caution is strongly advised.

To ensure you stay protected and avoid brokers with withdrawal issues, verify the specific entity you are registering with. Use the WikiFX app to check the latest regulatory warnings and real-time user reviews before making any deposit.

Read more

Is WisunoFX Trustworthy? A Complete 2025 Review for Traders

Picking a reliable forex broker is the most important decision any trader will make. It's like choosing the foundation for your house - everything else depends on it. With so many brokers out there, WisunoFX often catches traders' attention, making them wonder: "Is WisunoFX trustworthy?" and "Is WisunoFX reliable?" To answer these questions properly, you need more than just a quick look at its website - you need a complete, fact-based review. This detailed 2025 review will provide you with the clarity you need. We'll take an honest look at WisunoFX by examining the key factors that make a broker reliable. We'll verify its licenses and regulations, examine its actual trading conditions, compare its various account types, assess its platform performance, and review what other traders are saying. Our goal is to give you all the information you need to make a smart decision.

Change Review: The Broker Faces Massive Complaints on KYC Goof-ups and Fund Blocks

Investors have called out Change, a China-based forex broker, for allegedly carrying out illegitimate forex trading activities. These include the poor handling of the Know Your Customer (KYC) process, fund blocks, and inappropriate customer support service. Traders have openly criticized the broker for these alleged wrongdoings. In this Change review article, we have highlighted trader comments. Take a look!

LQH Markets Broker and Regulation Review

LQH Markets is unregulated, with claims of offshore licenses in Comoros and St. Lucia that do not provide valid forex regulatory oversight.

MultiBank Group Review 2025: Regulatory Analysis and Withdrawal Complaints

MultiBank Group, established in 2012, presents itself as a global financial derivatives broker with headquarters in Cyprus. While the broker boasts a significant influence index and holds licenses from top-tier regulators like ASIC and BaFin, its current market reputation is heavily impacted by a surge in client complaints and regulatory warnings.

WikiFX Broker

Latest News

Deriv Review: Is This Popular Broker Legit or Risky?

Libertex Investigation: When "Expert Advice" Leads to Total Ruin

EZINVEST Exposure: When a "Personal Advisor" Becomes Your Portfolio’s Worst Enemy

Is CICC Broker Safe? CICC Regulation Check & In-Depth Review

A Collapse In Germany's Chemical Sector Is A Bad Omen

Change Review: The Broker Faces Massive Complaints on KYC Goof-ups and Fund Blocks

FINRA Imposes $150,000 Fine on Kingswood Capital Partners Over Supervisory Failures

Why Smart People Still Get Scammed | The Danger of Hope and Greed

IQ Option Review: Regulated Global Broker or Withdrawal Trap?

Inside the Elite Committee: Talk with Ayu Nur Permana

Rate Calc