Danger Ahead: Why Fintrix Markets Is Unsafe for Traders

Abstract:In forex and CFD trading, trust and regulation are everything. A broker may promise great returns, but without a licence, there is no real protection for traders. Fintrix Markets is one of these risky names. Both its very poor WikiScore and lack of licence make it a dangerous option. For Malaysians exploring online trading, this is a serious warning sign.

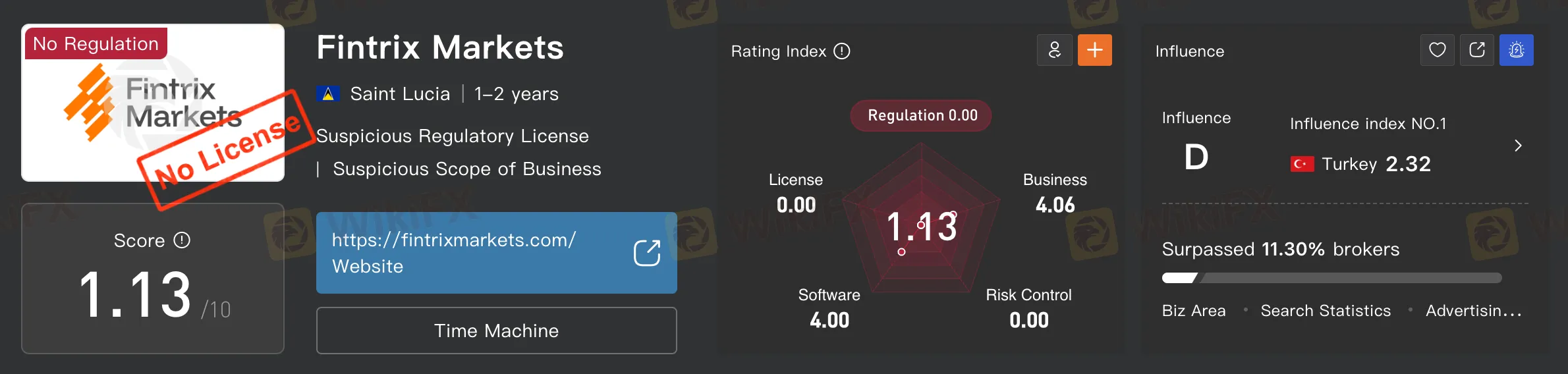

Fintrixs WikiScore and Licence Issues

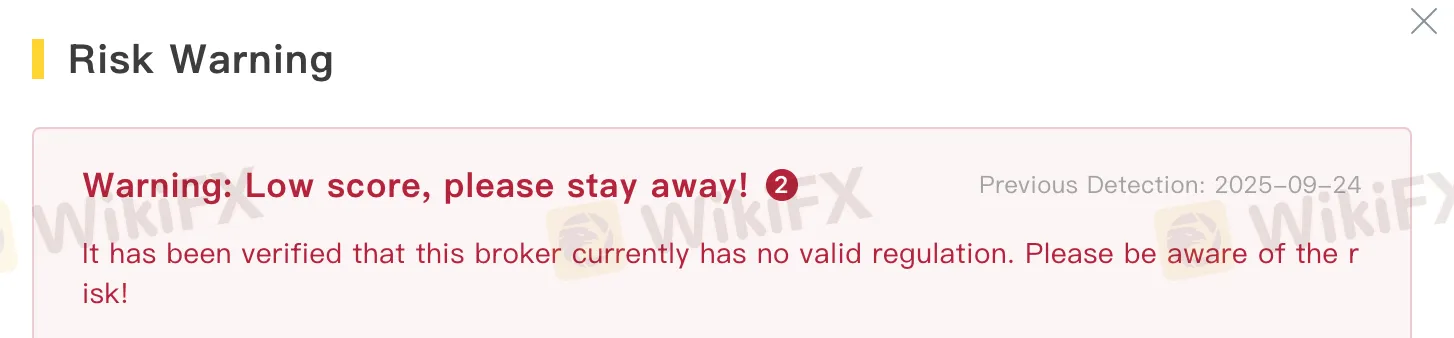

On WikiFX, Fintrix Markets scores just 1.13 out of 10. This extremely low score signals poor transparency and weak reliability. Most importantly, Fintrix has no valid licence from any financial authority.

View WikiFXs review on Fintrix Markets here: https://www.wikifx.com/en/dealer/2923640629.html

Licences matter because regulators enforce strict rules, including protecting client money, ensuring financial stability, and providing channels for complaints. Without regulation, there are no such guarantees. Traders who use unregulated brokers like Fintrix put their funds and rights at risk from the start.

Why “Not on the Alert List” Doesnt Equal Safety

It is true that Fintrix Markets is not listed on the Securities Commission Malaysias Investor Alert list. WikiFX has also not received direct complaints from Malaysian traders. But this does not make it safe. Many unlicensed brokers remain unnoticed until traders report major losses. By then, investors often cannot recover their money.

Malaysian traders must remember: a clean record today does not guarantee safety tomorrow. Regulators act only when clear evidence emerges, and that delay often costs investors dearly.

What This Means for Malaysian Traders

Malaysia has a growing number of retail traders who are eager to enter forex and CFD markets. Unfortunately, unregulated brokers often target new traders with attractive offers. The case of Fintrix Markets shows how dangerous this can be. Despite no official warnings yet, the risks are real and significant.

The main lesson is clear: only use brokers licensed by trusted regulators such as the FCA in the UK, ASIC in Australia, or MAS in Singapore. If a broker cannot prove it holds such a licence, it should be avoided.

Staying Safe as a Trader

At WikiFX, our mission is to empower investors with the knowledge and tools required to make safe, informed decisions. When selecting an overseas broker, we strongly advise exercising due diligence and, wherever possible, choosing one regulated by a reputable authority such as Australia‘s ASIC, the United Kingdom’s FCA, or other recognised regulators.

Should you fall victim to fraudulent activity, it is essential that you act without delay. We recommend reporting the matter to the police or consulting a qualified solicitor, as well as contacting your local consumer affairs office.

To further support investors, the WikiFX app delivers daily push notifications highlighting brokers identified as posing withdrawal risks. For timely updates and reliable protection, we encourage you to download the app.

Rising Threat of Investment Scams

Investment fraud is on the rise globally, affecting traders of all experience levels. WikiFX serves as an independent, international third-party platform dedicated to evaluating and verifying the safety and reliability of FX brokers. Our comprehensive database covers more than 70,000 brokers, enabling investors to research broker profiles, regulatory agencies, financial licences, and safety indicators with confidence.

If you encounter suspicious activity or fall victim to an investment scam, WikiFX is here to help. Our team analyses each case thoroughly, offering personalised guidance and practical solutions to help minimise potential losses.

WikiFX Exposure Service: Share and Protect

Transparency is central to investor protection. The WikiFX Exposure Service allows traders to report suspected scams and share critical risk information with the wider community. Every report is carefully investigated, and, where appropriate, WikiFX updates broker ratings and reliability scores to reflect the latest findings.

By contributing to this collective knowledge, you are not only protecting yourself but also helping to safeguard other investors. Importantly, WikiFX ensures that all personal data is kept strictly confidential, employing advanced security measures to prevent leaks and unauthorised access.

Important Notes for Investors

- Beware of social media solicitations: A growing number of fraud cases involve invitations to invest from individuals met through social media platforms, dating apps, or messaging groups such as WhatsApp, Telegram, Line or Facebook. Always verify the legitimacy of any broker introduced to you by using the WikiFX app.

- Exercise caution with new brokers: Brokers operating for only one to two years often lack sufficient performance history or user data. Even if they hold a high rating, there remains a heightened risk of withdrawal issues. Approach such investments with particular care.

WikiFX is your trusted partner in navigating the global FX landscape. With our tools, insights, and unwavering commitment to investor safety, we are dedicated to building a secure and transparent trading environment for all.

Final Word

Fintrix Markets has no regulation and a poor WikiScore. This is not a sign of progress but a warning of even greater risk. For Malaysians, the message is simple: if a broker has no licence, do not invest. This one rule can protect hard-earned money and prevent devastating losses.

Read more

Angel One Review: Regulation, Fees, Platforms, and Risks Explained

Angel One review: An India-based broker with low fees and slick apps but no SEBI or global regulation, raising material investor risk concerns.

Allianz Review: Regulation, License, and Hong Kong Presence

SFC‑regulated Allianz Global Investors Asia Pacific holds license BFE699 in Hong Kong, offering institutional, retail, insurance, and retirement solutions.

What Is a Good Spread in Forex? A Complete Guide

A good forex spread is typically under 1 pip on major pairs in liquid hours; learn definitions, benchmarks, costs, and how to pick low‑spread brokers.

Taurex mobile trading app unveils upgrades, hits 250k downloads

Taurex mobile trading app rolls out curated news, TradingView charts, and refreshed UI as downloads cross 250,000, with Taurex 2.0 on the way.

WikiFX Broker

Latest News

WikiFX 2025 Content Creator Contest

WikiFX Golden Insight Award Unveils New Judging Panel

PU Prime Joins MoneyShow Toronto 2025 as Sponsor

Tickmill UAE Expansion: Mashreq Bank Partnership to Ease Local Payments

PU Prime Review: Launch of Gold Trading by the Gram (GAUUSD)

Taurex mobile trading app unveils upgrades, hits 250k downloads

SEC halts QMMM trading after 959% surge

Angel One Review: Regulation, Fees, Platforms, and Risks Explained

MT5 Build 5320: What Traders Need to Know?

He Lost His Entire Life Savings in Just 1 Month!

Rate Calc