What Is a Good Spread in Forex? A Complete Guide

Abstract:A good forex spread is typically under 1 pip on major pairs in liquid hours; learn definitions, benchmarks, costs, and how to pick low‑spread brokers.

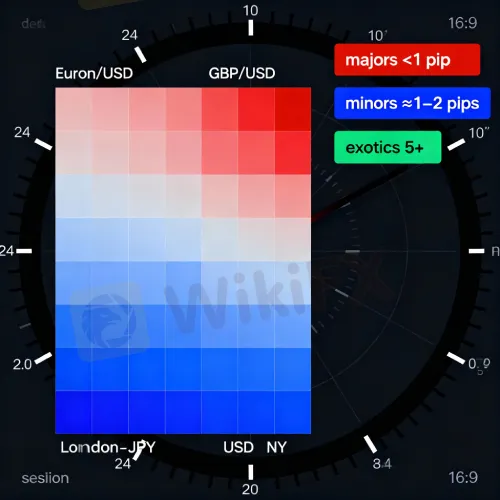

A good spread in forex is generally sub‑1 pip all‑in on liquid major pairs during the London–New York overlap, with raw ECN quotes often near 0.0–0.3 pips plus commission and standard accounts around 0.6–1.2 pips, while minors run 1–2 pips and exotics 5+ pips depending on liquidity and volatility.

Definition and core concepts

The forex spread is the difference between the bid and ask price on a currency pair, representing an immediate, embedded cost each time a trade is opened, and it is measured in pips, the standard unit for price movement in FX. Spreads tend to be tightest on major pairs due to high liquidity, wider on minors with moderate depth, and widest on exotics where volatility and thinner order books increase market‑making risk. Because pip value scales with lot size, the same quoted spread translates into different monetary costs across micro, mini, and standard lots, so understanding notional exposure is fundamental to cost control.

Why it matters in education

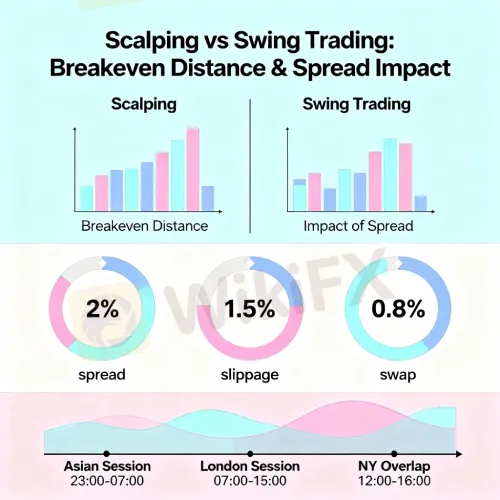

In an educational and practical context, spread size directly affects breakeven distance, execution consistency, and the viability of high‑frequency approaches like scalping, where a few tenths of a pip can determine profitability. Day traders and scalpers prioritize the tightest possible spreads during peak liquidity, while swing and position traders weigh spreads against holding time, swap, and slippage, treating spreads as one part of total trading costs. Teaching spread dynamics helps learners compare brokers, account types, and sessions with a cost‑aware mindset that reduces avoidable friction over thousands of trades.

Key theories and models

From market microstructure, spreads reflect order‑processing costs, inventory risk, and adverse selection; higher liquidity compresses spreads, while event risk and thin markets widen them as liquidity providers manage uncertainty. Fixed spreads provide price predictability but are typically higher on average, whereas variable spreads can be extremely tight in calm, liquid hours and expand during news or off‑hours, aligning with changing risk conditions. Account models matter: standard or market‑maker pricing embeds cost primarily in spread (“no commission”), while ECN/raw models display interbank‑like quotes with a separate commission, shifting evaluation toward all‑in cost.

Real‑world applications

Across liquid majors like EUR/USD, GBP/USD, and USD/JPY, a “good” spread is sub‑1 pip all‑in during liquid sessions, commonly 0.6–1.2 pips on standard accounts or 0.0–0.3 raw plus commission on ECN accounts; minors often land near 1–2 pips, and exotics can be 5+ pips. Practical timing improves outcomes: London and New York hours, particularly their overlap, typically offer the tightest pricing, whereas Asian late‑session or pre‑event windows often see widening that penalizes frequent entries. Broker selection should evaluate average spread by pair, typical spread during both peak and off‑peak hours, per‑lot commission where applicable, and execution reliability under volatility, since slippage can rival spread in realized cost.

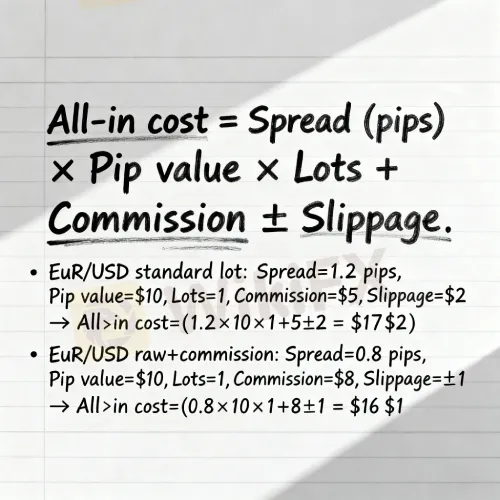

Calculating cost in pips and cash

Traders can translate spread into currency cost by multiplying the spread in pips by the pip value per lot and the number of lots, reinforcing why lot size discipline is a core component of cost control. For most non‑JPY pairs, one pip equals 0.0001; for JPY pairs, one pip equals 0.01, and differences in quote conventions should be taught early to prevent miscalculations. Educators should emphasize that the “all‑in” per‑trade cost equals spread plus any commission and expected slippage, ensuring apples‑to‑apples broker comparisons and more realistic strategy back‑tests.

Fixed vs variable spreads

Fixed spreads are simple to plan around and can suit strategies that prioritize cost stability over the tightest possible quotes, but they can be less competitive in high‑liquidity periods. Variable spreads better reflect live market conditions, often collapsing toward zero during peak liquidity yet widening in volatile or thin markets, demanding risk buffers around macro releases. A pedagogical best practice is to teach both models, then guide learners to choose based on trading frequency, time‑of‑day patterns, and tolerance for variability versus average cost efficiency.

Benchmarks: what is “good” by pair

- Majors: Sub‑1 pip all‑in is a practical benchmark during London/NY overlap; raw accounts may show 0.0–0.3 pips plus commission, while standard accounts cluster around 0.6–1.2 pips when liquidity is highest.

- Minors: Expect roughly 1–2 pips in normal conditions, with occasional compression on raw accounts for pairs benefiting from strong cross‑flows or session alignment.

- Exotics: Spreads of 5 pips or more are common, reflecting lower liquidity and higher volatility; traders should plan for wider breakeven thresholds.

Session effects and event risk

Spreads typically compress during London and the London–New York overlap when depth is greatest, improving entry quality for intraday strategies and reducing breakeven distance. They often widen late in the U.S. session through the early Asian hours and around high‑impact economic releases, Non‑Farm Payrolls, rate decisions, or unexpected geopolitical developments. Instruction should include a calendar discipline for learners, encouraging them to avoid initiating trades immediately before scheduled releases unless the strategy explicitly incorporates event‑driven spread dynamics.

Broker models and execution quality

Market‑maker/standard accounts present simplicity and “no commission” marketing, but spreads typically run wider; ECN/raw accounts shift cost to commission with tighter quotes, often preferred by active traders. Execution policies, liquidity aggregation, and infrastructure (ping to matching engines, smart order routing) materially influence realized cost through slippage and partial fills, not just headline spread. A robust evaluation rubric compares average spreads by pair and time, commissions per side, typical and worst‑case slippage, and any requote or last‑look practices disclosed in broker documentation.

Cost control for different strategies

- Scalping/day trading: Prioritize raw accounts, overlap hours, and low‑latency execution; aim for sub‑1 pip all‑in and avoid trading through event spikes to limit slippage.

- Swing/position trading: Spreads matter less than for scalpers, but all‑in cost still compounds; weigh spreads against swap, roll, and wider stops that reduce the relative impact of entry costs.

- News/event trading: Account for spread blowouts and potential negative slippage; risk limits and protective order types are critical, and pre‑defined no‑trade windows may be prudent.

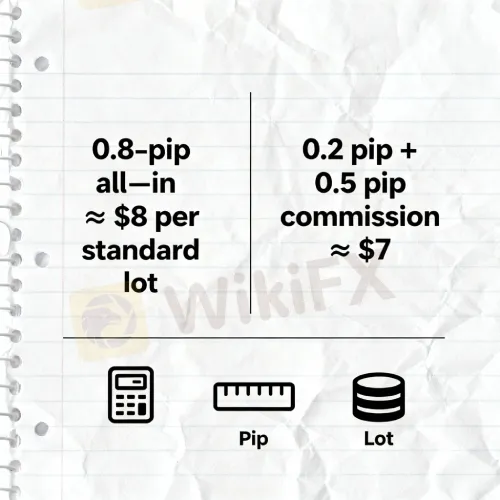

Educational formulas and examples

A concise teaching formula: All‑in cost per trade = Spread (pips) × Pip value × Lots + Commission ± Slippage. Example: On EUR/USD, a 0.8‑pip standard account spread on one standard lot implies roughly 0.8 pips × $10 ≈ $8, excluding any commission and slippage; on a raw account at 0.2 pips plus a commission equivalent to 0.5 pips, all‑in is about 0.7 pips ≈ $7 on the same notional. Embedding these conversions in practice drills helps learners internalize cost differences and make evidence‑based broker and session choices.

Common misconceptions to address

One misconception is equating “0.0 pip” marketing with zero cost; raw quotes still incur commission and potential slippage, so only the combined metric is meaningful. Another is over‑focusing on the tightest screenshot, rather than averages across time and conditions; education should emphasize typical and worst‑case spreads. Finally, spreads alone do not define trading costs; swaps, market impact, and rejected/partial fills can materially alter outcomes for certain strategies.

Practical checklist for “good” spreads

- Confirm typical spreads by pair during the intended trading hours, not just advertised minimums.

- Compute all‑in cost per trade using spread, commission, and typical slippage for an apples‑to‑apples comparison.

- Align account type with trade frequency: raw for frequent trades, standard for simplicity where micro‑differences are less material.

- Avoid initiating trades just before scheduled high‑impact releases unless specifically strategy‑driven.

- Reassess quarterly as liquidity regimes, volatility, and broker routing can shift realized spreads.

Funnel alignment and SEO coverage

Top‑of‑funnel readers seeking “what is spread in forex” receive a clear definition, pip basics, and session effects to build foundational literacy. Mid‑funnel learners comparing “average forex spread” and “fixed vs variable spreads” get practical benchmarks, microstructure context, and model trade‑offs. Decision‑stage readers evaluating “low spread forex brokers” and “tight spread forex accounts” are guided to compute all‑in costs and assess execution quality beyond headline quotes.

Final insights

A “good” forex spread is context‑dependent, but sub‑1 pip all‑in on majors during London/NY hours is a practical, educational anchor for evaluating pricing quality. The most reliable edge comes from combining tight spreads with consistent execution, thoughtful timing, and right‑sized positions that respect pip value and volatility. Educators and practitioners alike should reinforce an all‑in mindset—spread, commission, and slippage—so decisions reflect the true cost of trading rather than marketing minima.

Read more

Angel One Review: Regulation, Fees, Platforms, and Risks Explained

Angel One review: An India-based broker with low fees and slick apps but no SEBI or global regulation, raising material investor risk concerns.

Allianz Review: Regulation, License, and Hong Kong Presence

SFC‑regulated Allianz Global Investors Asia Pacific holds license BFE699 in Hong Kong, offering institutional, retail, insurance, and retirement solutions.

Vietnam “Elites’ View” Event Highlights: Key Insights - Confidence, Discipline

In the current global financial environment full of uncertainty, Vietnamese investors urgently need answers: How to build confidence? How to find balance between risk and mindset? Which new tools can truly protect them? WikiFX launched the “Vietnam Elites’ View” event in its community, where 12 distinguished guests shared their in-depth insights from the perspectives of trading practice, education and training, investment research analysis, and platform operations.

Taurex mobile trading app unveils upgrades, hits 250k downloads

Taurex mobile trading app rolls out curated news, TradingView charts, and refreshed UI as downloads cross 250,000, with Taurex 2.0 on the way.

WikiFX Broker

Latest News

Beware: Fake Emails Are Posing as IOSCO to Extract Upfront Fees

Scam Warning: Be Aware of Those Brokers That May Endanger Your Funds

WikiFX 2025 Content Creator Contest

WikiFX Golden Insight Award Unveils New Judging Panel

PU Prime Joins MoneyShow Toronto 2025 as Sponsor

Tickmill UAE Expansion: Mashreq Bank Partnership to Ease Local Payments

PU Prime Review: Launch of Gold Trading by the Gram (GAUUSD)

Taurex mobile trading app unveils upgrades, hits 250k downloads

SEC halts QMMM trading after 959% surge

Angel One Review: Regulation, Fees, Platforms, and Risks Explained

Rate Calc