What is Scalping in Forex? A Complete Guide for Traders

Abstract:We have journeyed from the core definition of what is scalping in forex to the detailed aspects of its strategies, psychology, and operational requirements. Scalping is a highly specialized discipline. It is not a path to easy money but a demanding profession that requires immense discipline, sharp analytical skills, and unwavering emotional control. It offers the thrill of high-frequency action and the potential for steady gains but comes at the cost of high stress and the need for absolute precision. For the right type of trader—one who is decisive, disciplined, and can thrive under pressure—scalping can be a viable path. For everyone else, it is a quick route to frustration and financial loss. The final, most crucial piece of advice is this: start on a demo account. Master one strategy, prove you can be consistently profitable on paper, and develop strong mindset. Only then should you consider risking real capital in the fast-paced world of forex scalping.

Have you ever watched a currency chart and noticed the constant, tiny price movements happening every second? While most traders look for larger trends, some traders do really well in this fast-moving world. They are called scalpers. So, what is scalping in forex? Simply put, it is a trading style that focuses on making money from small price changes, with trades that open and close within minutes or even seconds. This guide will teach you everything about forex scalping, from the basic ideas and strategies to the mental challenges and important tools you need to succeed. We will break down how it works, compare it to other trading styles, and give you an honest look at whether this challenging approach is right for you.

Understanding Forex Scalping

To really understand scalping, you need to go beyond the simple definition and understand the thinking behind it. It is a game of accuracy, speed, and trading many times, which is very different from almost any other way to trade in the markets.

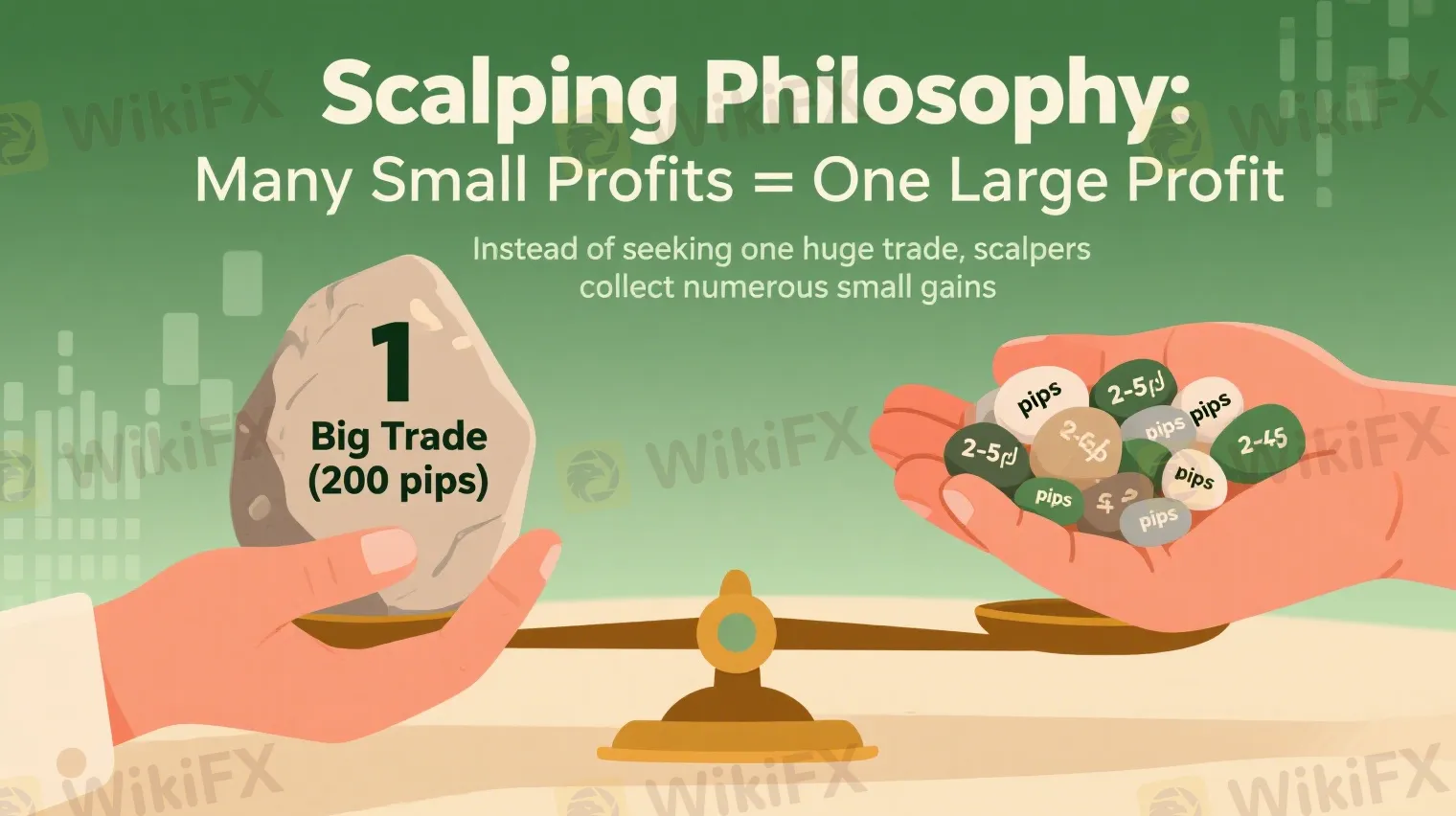

The Scalper's Way of Thinking

The main idea behind scalping is collecting many small, steady profits. A scalper is not looking for one huge trade that makes hundreds of pips. Instead, they work like someone collecting many small stones, knowing that together they will weigh more than one big rock. The goal is to take advantage of the small, predictable price changes that happen all the time during the trading day. A typical profit goal for one scalping trade is often between 5 to 10 pips, and the average trade lasts less than five minutes. The strategy depends on winning most trades, where many small gains add up to more than the small losses that will happen.

Important Parts of Scalping

Three main parts support every successful scalping operation. Without all three working together, the strategy quickly becomes unprofitable.

- Speed: Fast entry and exit are absolutely necessary. The price windows for profitable scalps don't last long. Waiting even one second can turn a winning trade into a losing one. This requires both a fast trading platform and a trader who can make quick decisions.

- Volume: Since the profit per trade is small (a few pips), scalpers must trade larger position sizes to make these small movements worth money. A 5-pip profit on a micro lot is very small, but on several standard lots, it becomes a good amount. This is how small price moves become big returns.

- Spreads: The spread is the difference between the bid (sell) price and the ask (buy) price of a currency pair. It is the broker's main fee and the cost of opening a trade. For a scalper targeting a 5-pip profit, a 1.5-pip spread means they are already 30% down the moment they enter the trade. Therefore, finding a broker with very low, or almost zero, spreads is absolutely critical for success.

Scalping in Action

Theory is one thing; practice is another. To make the concept clear, let's walk through how a typical scalping trade works from the moment an opportunity is found to its end seconds or minutes later.

Finding the Opportunity

A scalper doesn't trade randomly. They look for specific conditions: high liquidity and predictable volatility. This is why they focus on major currency pairs like EUR/USD, GBP/USD, and USD/JPY, especially during the overlap of major market sessions, such as the London and New York overlap (8:00 AM to 12:00 PM EST). During these peak hours, volume is at its highest, and spreads are at their tightest. The scalper uses technical indicators on very short time frames, like the 1-minute or 5-minute charts, to create signals for a potential entry.

The Process

Once a good setup is found, execution is immediate. The scalper places the trade and, at the same time, sets a very tight stop-loss order and a close take-profit order. For example, a scalper might enter a trade with a stop-loss set just 4 pips away and a take-profit target 6 pips away. This defines the risk and reward from the start. However, this is not a “set and forget” strategy. The scalper stays glued to the screen, watching the price action tick-by-tick, ready to manually close the trade if the market momentum suddenly moves against them.

A Real Example

Let's show this with a realistic scenario:

1. Time: 8:30 AM EST. The US Non-Farm Payrolls (NFP) report, a major economic data release, has just been published.

2. Pair: EUR/USD. This pair is known for its high liquidity and reaction to US economic news.

3. Observation: The data is better than expected, causing the US dollar to strengthen. The EUR/USD price immediately drops 10 pips in a single one-minute candle. The scalper sees this strong downward momentum.

4. Action: The scalper enters a short (sell) order at 1.0850. At the same time, they place a stop-loss at 1.0855 (5 pips risk) and a take-profit order at 1.0842 (8 pips profit).

5. Outcome: The downward momentum continues. The price hits the 1.0842 take-profit level 75 seconds after the trade was opened. The broker automatically closes the position.

6. Result: An 8-pip profit is secured. The scalper immediately begins looking at the charts for the next opportunity.

Scalping vs. Other Styles

To truly understand scalping, it helps to see where it fits compared to other trading methods. New traders often confuse it with day trading, but they are different approaches with different demands.

The Key Differences

We can compare trading styles across several important factors: the time a trade is held, the number of trades taken, the average profit target, and the time commitment required from the trader.

A Comparison Table

This table provides a clear breakdown of the differences between the three most common short-to-medium-term trading styles.

| Feature | Scalping | Day Trading | Swing Trading |

| Trade Holding Time | Seconds to a few minutes | Minutes to a few hours (closed within the day) | A few days to several weeks |

| Number of Trades | Dozens to hundreds per day | A few trades per day (1-5) | A few trades per month |

| Typical Profit Target | 5-15 pips | 20-100 pips | 100+ pips |

| Required Screen Time | Intense, continuous focus for 2-4 hours | High, requires monitoring during a session | Low, check charts once or twice a day |

| Impact of Spreads | Extremely high; can determine profitability | Moderate; a key consideration | Low; a minor factor in the overall trade |

| Psychological Stress | Very High; requires rapid, emotionless decisions | High; involves managing intraday risk | Moderate; requires patience to hold through swings |

The Scalper's Tools

Successful scalping is not about guessing. It is a systematic process that relies on a specific set of strategies and technical indicators designed for high-speed analysis.

Popular Scalping Strategies

While there are many variations, most scalping strategies fall into a few main categories. Here are three popular approaches.

The 1-Minute Strategy

This is one of the most common methods. Traders use a 1-minute chart and apply fast-acting indicators like two Exponential Moving Averages (EMAs), for example, a 13-period EMA and a 26-period EMA. A buy signal might be created when the faster EMA (13) crosses above the slower EMA (26), showing upward momentum. A sell signal occurs with the opposite crossover. The Stochastic Oscillator is often added to confirm the signal by showing if the market is overbought or oversold.

Trend Following Scalping

Even on a 5-minute chart, mini-trends can form. A trend-following scalper will first identify a clear, short-term directional move. For instance, if the price is consistently making higher highs and higher lows on the 5-minute chart, they will only look for buy signals. They might use pullbacks to a key moving average as an entry point, placing multiple small trades in the direction of the current mini-trend, aiming to capture 5-10 pips on each push.

Range-Bound Scalping

When a market is not trending but is instead bouncing between clear levels of support and resistance, a range-bound strategy works well. On a 5-minute or 15-minute chart, a scalper will identify a “channel.” They will then place sell orders near the top of the range (resistance) and buy orders near the bottom (support), aiming to profit from the back-and-forth movement. Indicators like Bollinger Bands are excellent for this, as trades can be taken when the price touches the upper or lower band in a low-volatility environment.

Must-Have Indicators

Scalpers rely on indicators that provide immediate, clear signals. Their toolkit is optimized for speed.

- Moving Averages (EMAs): Exponential Moving Averages are preferred over Simple Moving Averages because they give more weight to recent price data, making them more responsive to the rapid changes needed for scalping.

- Stochastic Oscillator or RSI: The Relative Strength Index (RSI) and the Stochastic Oscillator are momentum indicators that help a scalper identify overbought (>70 or >80) and oversold (<30 or <20) conditions. This can signal a potential reversal or pullback, providing an entry opportunity.

- Bollinger Bands: These consist of a middle band (a simple moving average) and two outer bands that represent standard deviations. They are excellent for measuring volatility. When the bands are tight, volatility is low. When they expand, volatility is increasing. Scalpers can trade breakouts when price closes outside the bands or trade reversals when price returns inside.

- Volume Profile: This advanced indicator shows how much volume has been traded at specific price levels. A scalper uses it to identify high-liquidity zones, which often act as strong support or resistance, making them reliable areas for placing trades and setting profit targets.

A Day in the Life

To truly understand the reality of scalping, let's move beyond theory and walk through a typical trading day. It is a routine built on discipline, focus, and precision.

The Pre-Market Routine (7:00 AM EST)

The day begins long before the first trade is placed. The scalper sits down at their trading station, often equipped with multiple monitors. The first task is a pre-market analysis. This involves:

1. Checking the economic calendar for any high-impact news releases scheduled for the day (e.g., central bank announcements, inflation data). These events create volatility, which is both an opportunity and a threat.

2. Analyzing the charts of the primary watch-list pairs (EUR/USD, GBP/USD). What was the price action during the Asian and early London sessions? Where are the key intraday support and resistance levels?

3. Defining the trading plan. This is critical. The scalper sets a maximum daily loss limit—a hard stop that, if hit, means trading is over for the day, no exceptions. They also mentally prepare for the intense focus required, ensuring their environment is free from distractions.

The Trading Session (8:00 AM - 11:00 AM)

This is the peak performance window, typically the London-New York session overlap. The scalper is in a state of deep focus. Let's describe a hypothetical 3-hour period:

- 8:15 AM: A setup appears on the EUR/USD 1-minute chart. A small pullback to the 21-period EMA in an established uptrend. The scalper enters a buy order. The price quickly moves in their favor, and the 7-pip take-profit is hit in under two minutes. A good start.

- 8:45 AM: Another potential setup, this time a short. The scalper enters, but the market suddenly reverses. The price moves against the position and hits the 5-pip stop-loss. The loss is accepted immediately and without emotion. It is part of the plan.

- 9:30 AM: The market becomes choppy. The scalper identifies a range and waits patiently. A trade is taken at the bottom of the range, but momentum is weak. The price moves around for several minutes without hitting the profit target or stop-loss. Sensing the lack of strength, the scalper manually closes the trade for a small 1-pip profit (a “break-even” trade) to avoid unnecessary risk.

- 10:15 AM: A strong trend develops. The scalper executes two more quick trades in the direction of the trend, both hitting their 6-pip profit targets.

Post-Session Analysis (11:30 AM)

Whether the day was profitable or not, the work isn't over. The scalper stops trading to avoid fatigue and over-trading. Now comes the crucial review process. They open their trading journal and log every single trade: the entry/exit points, the strategy used, and the reason for the trade. Most importantly, they note their psychological state during each trade. What went right? What went wrong? Why did the losing trade fail? This objective self-assessment is essential for long-term improvement. After calculating the net P/L for the day, the computer is shut down. The discipline to stop is as important as the discipline to trade.

Is Scalping Right for You?

Scalping has a powerful appeal, but its demanding nature makes it unsuitable for many. An honest assessment of its advantages and disadvantages is crucial before you even consider placing your first scalp trade.

The Advantages

1. High Number of Opportunities: Because scalpers focus on tiny movements, there are countless potential trading opportunities every single day, unlike swing trading where one might wait days for a single setup.

2. Reduced Overnight Risk: All positions are closed by the end of the trading session. This completely eliminates the risk of being caught on the wrong side of a major news event or market gap that occurs overnight.

3. Potential for Quick Gains: While each profit is small, they can add up quickly throughout a session. A successful scalping day is built on a steady stream of small wins.

4. Less Reliance on Fundamentals: Long-term economic forecasts and fundamental analysis are largely irrelevant. The focus is almost purely on short-term price action and technical patterns.

The Significant Disadvantages

1. Extremely High Stress: The need for constant focus and split-second decision-making under financial pressure is mentally exhausting. It is one of the most psychologically demanding forms of trading.

2. Requires Intense Screen Time: You cannot scalp effectively while doing other things. It requires your undivided attention for a dedicated 2-4 hour block during peak market hours.

3. Transaction Costs Are Magnified: Spreads and commissions are a scalper's biggest enemy. Because profit targets are so small, these costs can easily eat up a significant portion of your winnings, or even make a winning strategy unprofitable.

4. A Single Large Loss Can Wipe Out Wins: Discipline is extremely important. A single mistake, like failing to honor a stop-loss and letting a loser run, can wipe out the profits from dozens of successful trades.

5. Not Suitable for a 9-to-5 Job: Unless your job is flexible, it's nearly impossible to scalp effectively, as the best opportunities occur during specific market hours that often conflict with standard work schedules.

The Scalper's Mindset

Technical strategy is only half the battle in scalping. The other, more difficult half is mastering high-speed psychology. The rapid pace of scalping acts as an amplifier for the most destructive trading emotions.

The Enemy Within

In scalping, there is little time for thinking, which makes you highly susceptible to emotional reactions.

- Greed: Shows up as holding a winning trade for too long, hoping for a few extra pips. This often results in the price reversing and turning a small win into a loss.

- Fear: Causes you to close a good trade too early at the slightest hint of a pullback, missing your profit target. It can also cause hesitation, making you miss the optimal entry point altogether.

- Revenge Trading: This is the most dangerous. After a loss, the urge to immediately jump back into the market to “make the money back” is immense. This leads to impulsive, unplanned trades that almost always result in further losses.

Building Strong Discipline

Developing the mental strength for scalping is a process. It requires building a framework of rules to protect you from yourself.

- The “One-and-Done” Rule: Your stop-loss and take-profit levels are decided before you enter the trade. You must build the discipline to let the trade play out and hit one of those two points, without interference.

- Set a Daily Loss Limit: Before you start, determine the maximum amount of money (or number of losing trades) you are willing to lose in a day. If you hit that limit, you stop. Period. This one rule prevents catastrophic losses.

- Use a Trading Journal for Emotions: Your journal shouldn't just record technicals. After each trade, write down how you felt. Were you anxious? Greedy? Fearful? Recognizing these patterns is the first step to controlling them.

- Practice on a Demo Account: Use a demo account not just to test strategies, but to build mechanical consistency. Practice executing your plan flawlessly hundreds of times without financial pressure. This builds the muscle memory and discipline needed for a live environment.

Choosing the Right Broker

For a swing trader, most brokers will work. For a scalper, the choice of broker is arguably the most important decision you will make. The wrong broker can make a profitable strategy impossible to execute.

Non-Negotiable Features

When evaluating a broker for scalping, your checklist must be strict. Look for these non-negotiable features:

- Ultra-Low Spreads & Commissions: This is the top priority. Look for brokers that offer ECN (Electronic Communication Network) or STP (Straight Through Processing) accounts. These models provide direct market access with very tight spreads, often aiming for less than 0.5 pips on major pairs like EUR/USD during peak hours. You will pay a small commission per trade, but this is usually more cost-effective than a wide, fixed spread.

- Lightning-Fast Execution Speed: The broker's servers must be fast and reliable. Slow execution leads to “slippage,” where your trade is filled at a worse price than you intended. In scalping, a slippage of even half a pip can be the difference between profit and loss.

- High-Quality Charting Platform: You need a platform that is stable and built for speed. MetaTrader 4/5 (MT4/MT5) and cTrader are industry standards that offer 1-minute charts, a full suite of technical indicators, and support for one-click trading.

- Reliable Regulation: Never compromise on safety. Ensure your broker is regulated by a top-tier financial authority like the FCA (UK), ASIC (Australia), or CySEC (Cyprus). This provides a layer of protection for your funds.

- No Trading Restrictions: Some brokers explicitly prohibit or discourage scalping in their terms of service. You must confirm that the broker you choose fully allows high-frequency trading strategies.

Is Scalping Your Path?

We have journeyed from the core definition of what is scalping in forex to the detailed aspects of its strategies, psychology, and operational requirements. Scalping is a highly specialized discipline. It is not a path to easy money but a demanding profession that requires immense discipline, sharp analytical skills, and unwavering emotional control. It offers the thrill of high-frequency action and the potential for steady gains but comes at the cost of high stress and the need for absolute precision.

For the right type of trader—one who is decisive, disciplined, and can thrive under pressure—scalping can be a viable path. For everyone else, it is a quick route to frustration and financial loss. The final, most crucial piece of advice is this: start on a demo account. Master one strategy, prove you can be consistently profitable on paper, and develop strong mindset. Only then should you consider risking real capital in the fast-paced world of forex scalping.

Read more

Upstox Scam Alert! What Every Investor Needs to Know

It’s possible you’ve seen ads for Upstox on your phone. The platform has been heavily promoting itself through various digital channels. Just seeing ads isn’t enough to truly understand how a broker operates or whether it's the right choice for you.

Fintokei Exposed: Profit Capping & Harsh Account Rules Frustrate Traders

Earning profits from your trade made through Fintokei, but getting blocked by the broker? Is Profit capping regular at Fintokei? Facing harsh trading conditions and not getting the right customer support service? It seems you are heading toward a potential forex trading scam. Our fear stems from numerous complaints made against this broker on several review platforms. Take a look at some reviews shared in this article.

Top Red Flags That Haunt Traders at Bitget

Winning trading challenges but failing to receive the prize money from Bitget? Are you forced to pay exorbitant fees for fund withdrawal access? Failing to cash out reward points? Have you been at the receiving end of the price manipulation activity carried out by Bitget? Well, look out for ways to recover your funds and search for a regulated broker instead.

Warning: Is TradingPro Setting a Trap for Malaysian Traders?

Don’t be fooled by TradingPro’s low entry cost as global traders report withdrawal nightmares, hidden risks, and regulatory red flags that Malaysians must recognize before it’s too late!

WikiFX Broker

Latest News

What Is a Contract Size in Forex? A Complete Guide for Traders

Ultima Markets Joins Inter Milan as Asia Partner

Forex MT4 Indicators: What Do They Reveal About Currency Trading?

The Essential Guide to Stop-Limit Orders in Forex: Price, Strategy & Execution

Why Forex Reviews and Feedback Really Matter

AETOS Shuts Down Offshore CFDs Broker Operations

Warning: MultiBank Group – User Reviews Highlight Slow Withdrawals and Hidden Risks

Investors Beware! MultiBank Group and the Truth About Its Regulation

FCA Exposed 10 Brokers — Are You Trading with One of Them?

What Licenses Does ActivTrades Hold and Where Are Its Offices?

Rate Calc