What Licenses Does ActivTrades Hold and Where Are Its Offices?

Abstract:A detailed review of ActivTrades' licenses, regulatory bodies, and office locations worldwide for informed broker compliance and transparency.

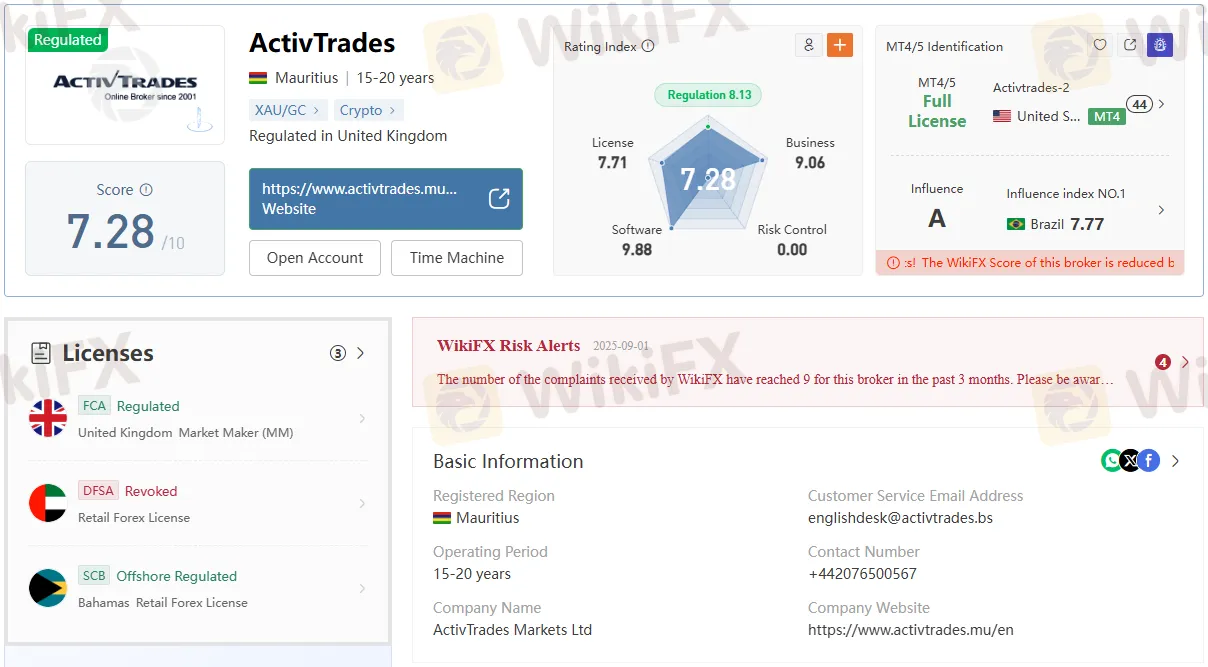

ActivTrades Licenses: Regulated, Revoked, and Offshore Status

ActivTrades, recognized as a leading provider in the forex brokerage industry, operates under multiple legal entities with distinct regulatory licenses covering various regions. The broker currently holds a valid Market Maker (MM) license issued by the Financial Conduct Authority (FCA) in the United Kingdom. This license (No. 434413) has been effective since October 27, 2005, demonstrating strong regulatory compliance and long-standing credibility in the UK. FCA regulation means ActivTrades Plcs operations are subject to rigorous oversight and consumer protection standards expected of global financial institutions. Their FCA license remains active and regulated.

However, not all licenses and office registrations of ActivTrades are equally robust. The company once held a retail forex license through the Dubai Financial Services Authority (DFSA) in the United Arab Emirates, under license number F003511. This license was granted to ActivTrades Plc on November 22, 2016, but was officially revoked as of December 5, 2018 (as per DFSA records). The Dubai office address is listed as N1702A & N1702F, Level 17, EMiraTes Financial Towers, but its operational status does not comply with current regulatory standards.

In the Bahamas, ActivTrades Corp is classified as “Offshore Regulated” under a retail forex license by the Securities Commission of the Bahamas. Despite the presence of an office at 209/210 Church Street, Sandyport Plaza, there is no active sharing or confirmation of compliance, and the license details remain unreleased. This offshore status provides less investor security compared to FCA regulation, a notable point for clients considering brokerage services in this jurisdiction.

Recent investigative reports and WikiFX (as of September 2025) confirm that ActivTrades does not operate offices at East Smithfield or Belvedere Road in London, nor maintain an active physical office in Dubai. The current global headquarters for ActivTrades is verified in London at The Loom, Office 2.6, 14 Gowers Walk, according to their FCA filing.

Regulatory Bodies and Global Offices: Current Verification

- United Kingdom: Regulated by FCA; headquarters located in London with full license compliance.

- Bahamas: Offshore regulated by SCB; an active office is present, but investor protections are less stringent.

- Dubai/UAE: Past license by DFSA (revoked); no confirmed active office.

Many brokers globally list multiple office addresses, yet official filings or inspections may reveal a discrepancy between registered and actual operating sites. Recent findings highlight no valid offices at East Smithfield or Belvedere Road in London, nor in Dubai, as claimed previously.

ActivTrades Compliance, Regulatory Bodies, and Recent Updates

ActivTrades maintains its regulatory edge mainly through its FCA credentials, considered among the strictest for broker compliance worldwide. While the Bahamas registration supports international reach, clients are urged to assess the reduced investor protections of offshore frameworks versus the FCA's robust standards. The Mauritius FSC registration is rumored but not evidenced in primary sources within this review, thus requiring further independent verification.

Before trading, prospective clients must verify licenses for each ActivTrades legal entity and location. Regulatory bodies such as the FCA and SCB designate different compliance levels, making license verification vital for risk management. Always check the brokers negative cases on the WikiFX app before trading. Scan the QR code below to download and install the app on your smartphone.

Read more

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

NinjaTrader Review: Platforms & Risks (2026)

NinjaTrader offers strong futures/forex platforms but faced a $250K NFA fine for AML lapses. Regulated status holds. Read the full 2026 review.

Swissquote Scam Alert: 53/64 Negative Cases Exposed

Swissquote has 53/64 negative cases on WikiFX despite regulation (FINMA/FCA). Reports cite deposit delays & withdrawals. Avoid scams, read exposure now!

Money Plant FX Review: High-Risk Forex Broker Warning

Money Plant FX is offshore, unregulated, and flagged high risk, with traders alleging zeroed balances. Check the facts before you open an account.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc