Warning: Is TradingPro Setting a Trap for Malaysian Traders?

Abstract:Don’t be fooled by TradingPro’s low entry cost as global traders report withdrawal nightmares, hidden risks, and regulatory red flags that Malaysians must recognize before it’s too late!

TradingPro has been actively promoted across Southeast Asia, particularly in Thailand, branding itself as a beginner-friendly broker. With a minimum deposit as low as $1, tight spreads, and support for popular platforms like MT4 and MT5, the broker appears to offer attractive entry points for new traders.

But beneath this polished image lies a trail of serious complaints from real users, especially around withdrawals and platform stability.

Alarming User Complaints: Withdrawals Delayed or Denied

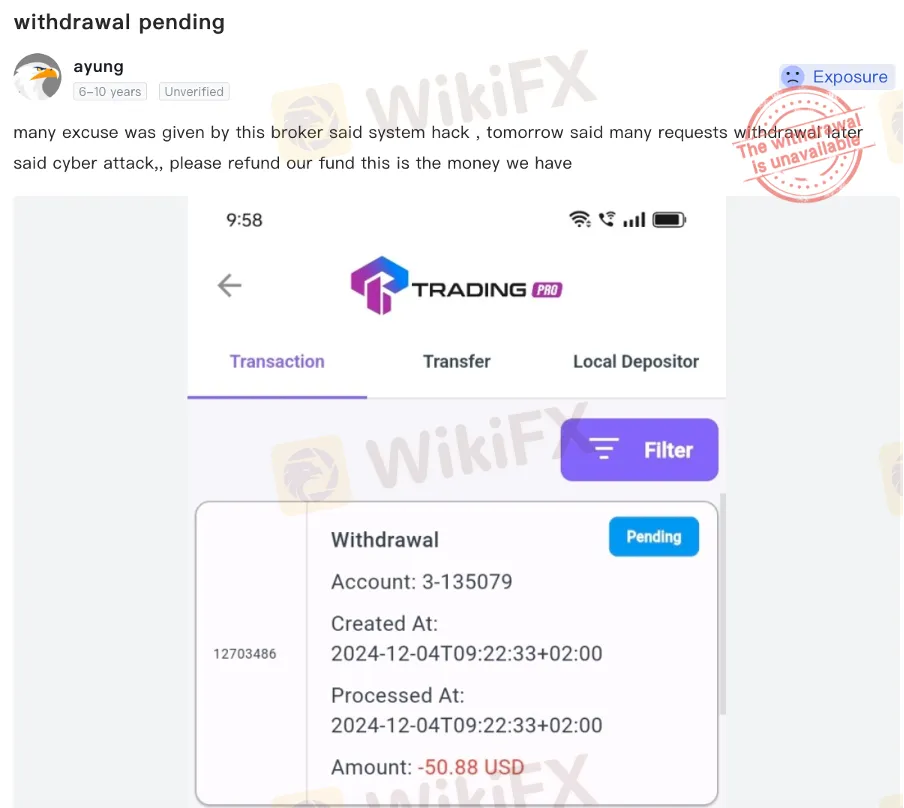

Across Thailand, Malaysia, and Indonesia, traders have reported serious issues when trying to withdraw their money. Many users claim that withdrawals take far longer than normal, with some saying they waited several days or even up to a week for their requests to be processed. Others describe more alarming experiences, where funds were deducted from their trading accounts but never arrived in their bank accounts at all.

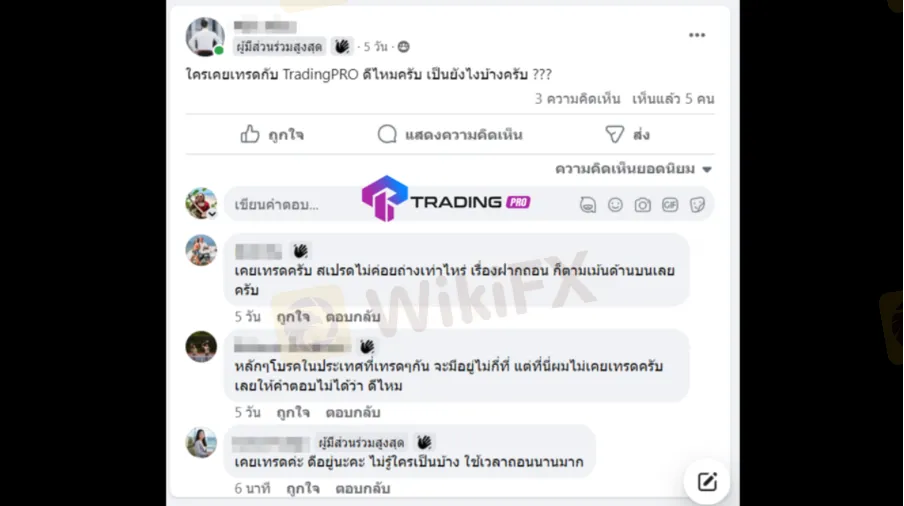

The broker has allegedly provided excuses such as “system failures,” “technical issues,” or even “hacker attacks” to explain missing or delayed withdrawals. One frustrated trader shared on Facebook:

“Withdrawals take at least two days, sometimes up to a week and in some cases, the money never arrives.”

On WikiFXs Exposure page, similar stories have been documented. A Malaysian user reported that the broker blamed hackers for withdrawal issues, claiming the system had been compromised just as many clients attempted to withdraw at the same time.

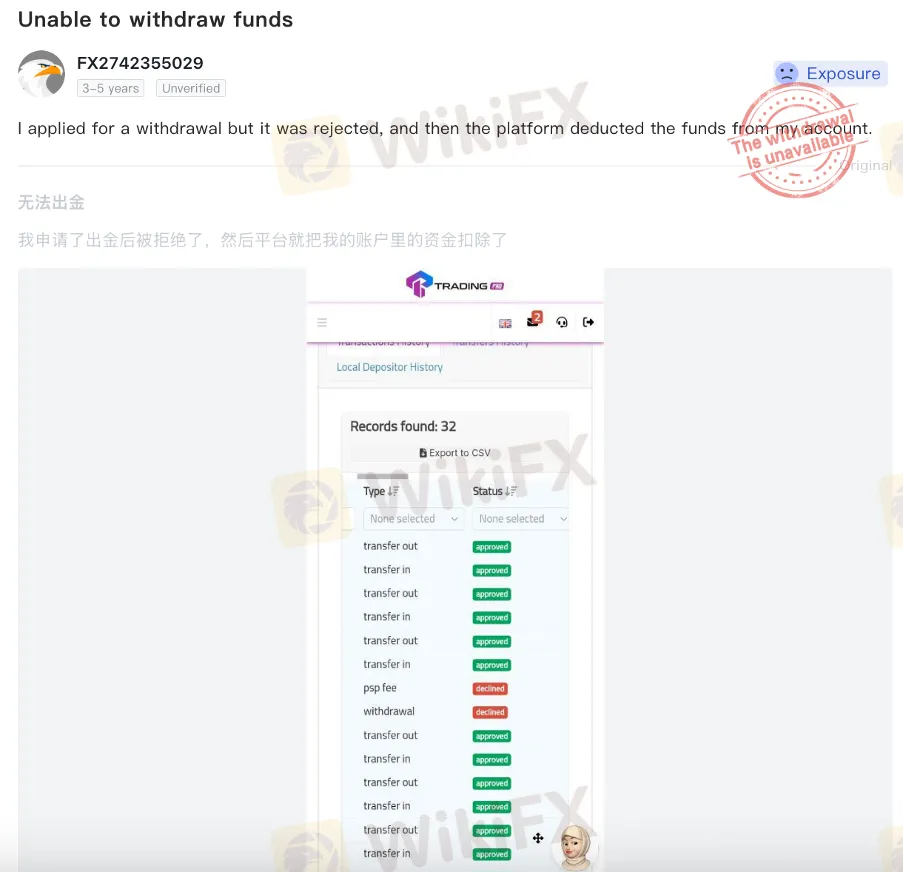

Another Malaysian user described a more shocking case: their withdrawal request was outright rejected, and the requested funds were directly deducted from their account without explanation.

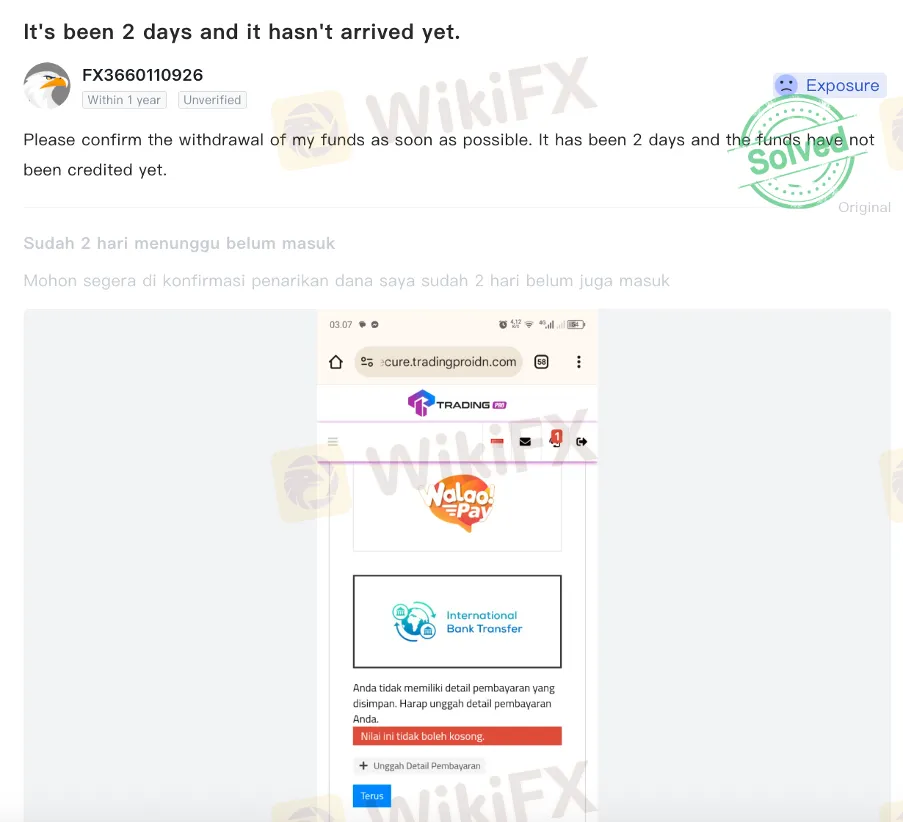

An Indonesian trader complained that even after two days, their withdrawal had not been confirmed or processed.

Regulatory Grey Zones and Shady Licensing

Another major red flag is TradingPros unclear regulatory background. Despite being promoted heavily in Thailand, the broker does not maintain a physical office in the country and has no local representatives who can provide accountability.

View WikiFXs TradingPro full review here: https://www.wikifx.com/en/dealer/3965540222.html

TradingPro claims to be registered under the South African Financial Sector Conduct Authority (FSCA), but WikiFXs close assessment has found that this license exceeds the business scope regulated by the FSCA (license number: 49624), indicating that the broker is currently operating without a valid license.

Most concerning of all, the actual headquarters of TradingPro remain unclear. Without transparency about where the company truly operates, traders face additional uncertainty regarding who they are really entrusting with their money.

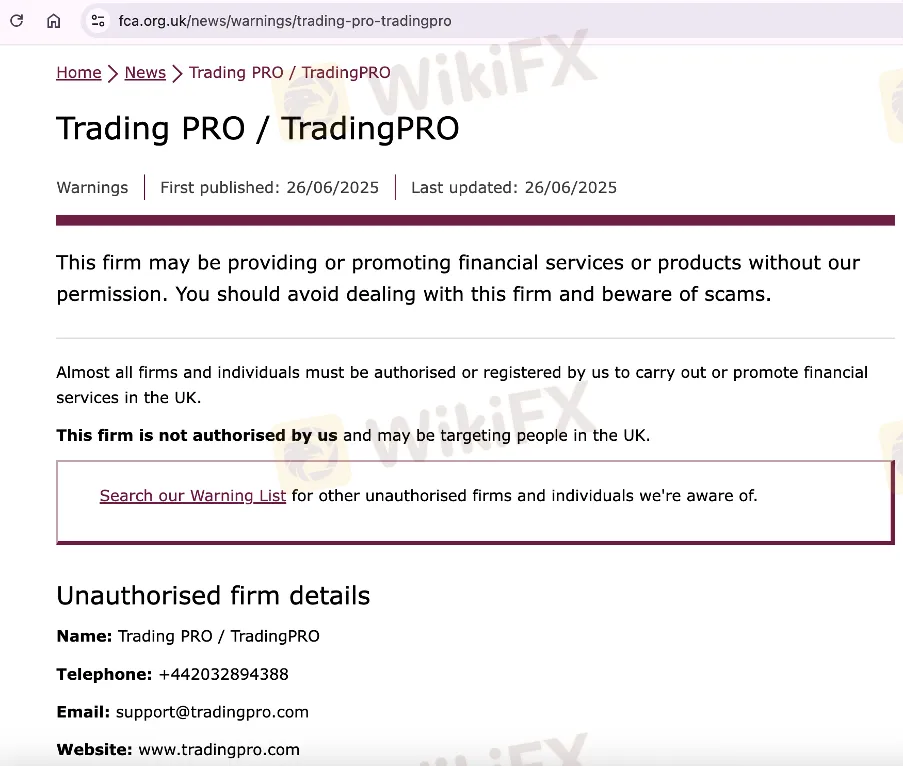

Adding to these concerns, the UK Financial Conduct Authority (FCA) has already issued a formal warning against TradingPro. The FCA clearly stated that TradingPro is not authorized to provide financial services in the United Kingdom and that any investors dealing with the company would not be protected by legal safeguards or compensation schemes. This warning from one of the strictest regulators in the world is a strong signal that the broker poses a serious risk to traders everywhere, including in Malaysia.

New office in Malaysia?

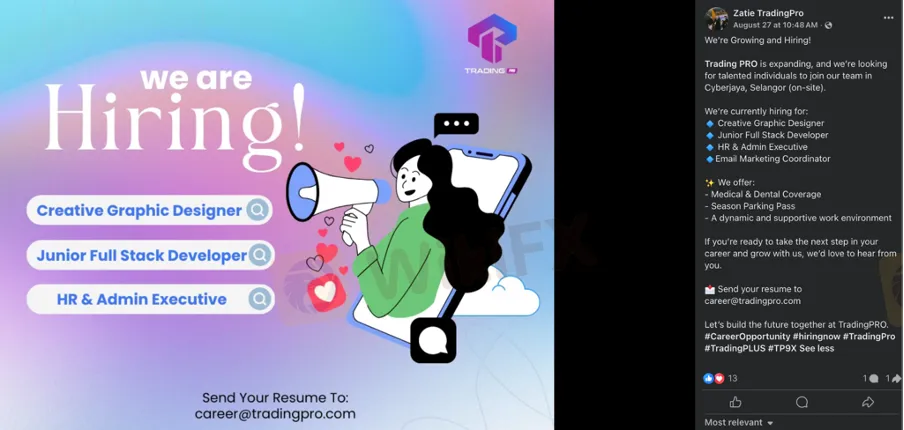

Although TradingPro is being marketed in Southeast Asia, it does not maintain an office in Thailand, and there is no evidence of any genuine legal representation in the region. More recently, some recruitment posts on Facebook suggest that the company may be preparing to establish an office in Malaysia. However, traders must not confuse this move with legitimacy. Setting up an office does not mean that the broker is regulated or trustworthy. Without official licensing from Malaysias regulators, an office presence could just be little more than a marketing tactic.

Final Word of Caution for Malaysian Traders

For Malaysian traders, the situation demands caution. Just because TradingPro appears to be expanding into the country and may even establish an office locally, it does not mean it is regulated or trustworthy. Regulatory approval is the true measure of a brokers reliability, not its marketing presence or promises.

The experiences of other traders as documented in detail on WikiFXs Exposure page suggest a consistent pattern of withdrawal failures, unstable trading systems, and opaque company practices. Depositing may be fast and simple, but withdrawing your hard-earned money could easily become a nightmare with no way out.

If you value your capital and your peace of mind, approach TradingPro with extreme caution, and always verify a brokers regulatory status with credible authorities before making any financial commitments.

Read more

Upstox Scam Alert! What Every Investor Needs to Know

It’s possible you’ve seen ads for Upstox on your phone. The platform has been heavily promoting itself through various digital channels. Just seeing ads isn’t enough to truly understand how a broker operates or whether it's the right choice for you.

Fintokei Exposed: Profit Capping & Harsh Account Rules Frustrate Traders

Earning profits from your trade made through Fintokei, but getting blocked by the broker? Is Profit capping regular at Fintokei? Facing harsh trading conditions and not getting the right customer support service? It seems you are heading toward a potential forex trading scam. Our fear stems from numerous complaints made against this broker on several review platforms. Take a look at some reviews shared in this article.

Top Red Flags That Haunt Traders at Bitget

Winning trading challenges but failing to receive the prize money from Bitget? Are you forced to pay exorbitant fees for fund withdrawal access? Failing to cash out reward points? Have you been at the receiving end of the price manipulation activity carried out by Bitget? Well, look out for ways to recover your funds and search for a regulated broker instead.

Tips for Muslim Traders: Staying Halal While Trading Forex

Forex trading has become increasingly popular among Muslim traders seeking financial freedom and global investment opportunities. It’s essential to ensure that trading activities remain halal (permissible) and comply with Shariah law. This article offers tips for Muslim traders to stay halal while trading in the forex market.

WikiFX Broker

Latest News

Forex MT4 Indicators: What Do They Reveal About Currency Trading?

Ultima Markets Joins Inter Milan as Asia Partner

What Is a Contract Size in Forex? A Complete Guide for Traders

The Essential Guide to Stop-Limit Orders in Forex: Price, Strategy & Execution

FCA Exposed 10 Brokers — Are You Trading with One of Them?

What Licenses Does ActivTrades Hold and Where Are Its Offices?

6 Truth About Fortex: Don’t Fall for the Hype

Why Forex Reviews and Feedback Really Matter

Warning: MultiBank Group – User Reviews Highlight Slow Withdrawals and Hidden Risks

AETOS Shuts Down Offshore CFDs Broker Operations

Rate Calc