Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

Abstract:A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the countrys online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

For those accustomed to posting broker reviews, sharing referral links, or urging followers to open accounts with overseas platforms, this is no longer a harmless hustle, as it could soon become a criminal offence.

The SCs move aims to protect retail investors from scams and significant losses often linked to unregulated platforms. The principle mirrors licensing in medicine, just as only certified doctors may provide medical advice, only licensed financial intermediaries should promote investment products in Malaysia. By enforcing this law, the SC ensures promoters are both accountable and subject to regulatory oversight.

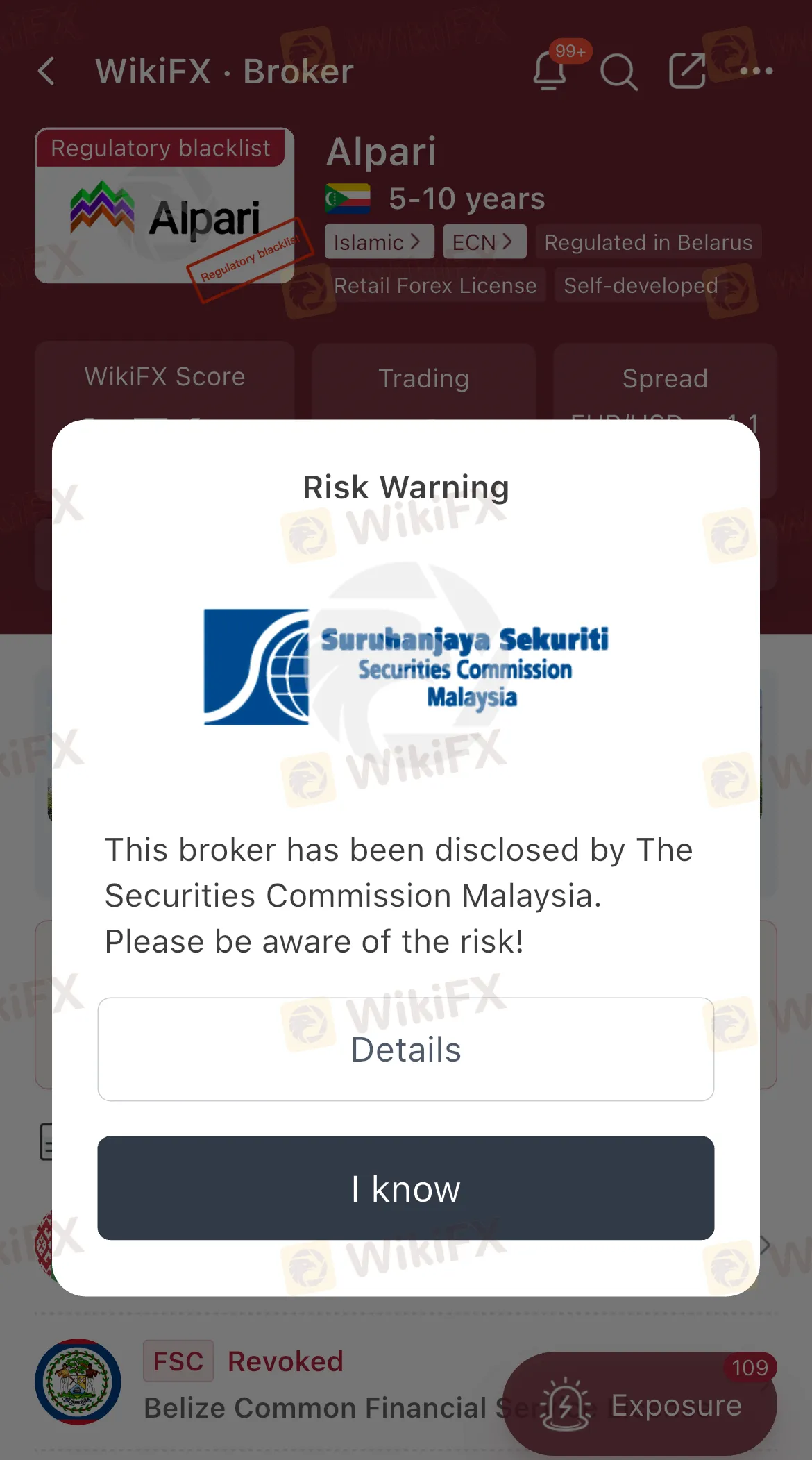

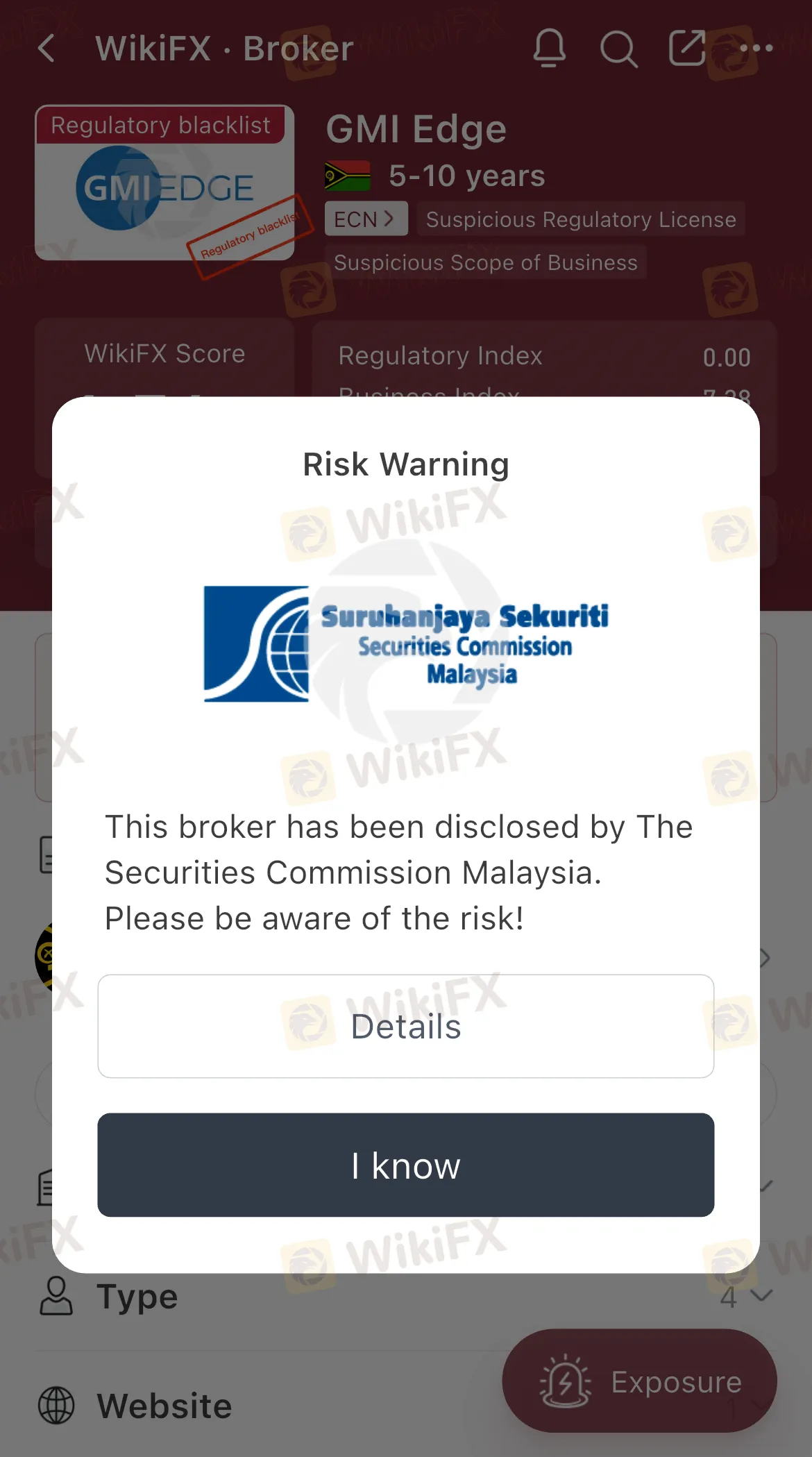

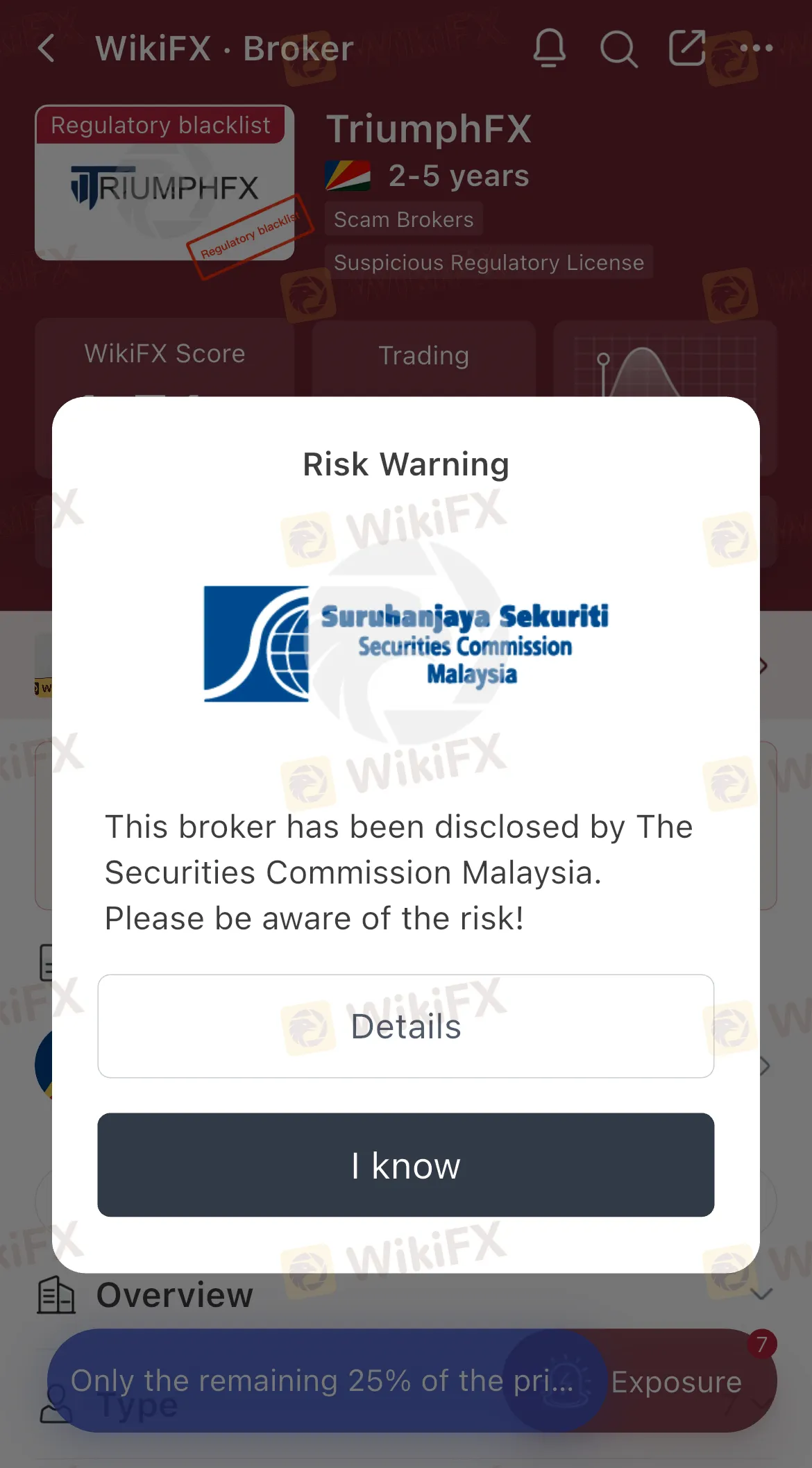

Currently, many Malaysian traders and “finfluencers” openly promote foreign brokers, often using affiliate codes to earn commissions. The problem is that many of these brokers are not licensed to operate in Malaysia, with several already named on the SCs Investor Alert List.

In practice, this list functions as a scam alert for investors, warning them about brokers that may be operating without authorisation. Up until now, such promotions were common, but under the new framework, promoting unlicensed financial products will be treated as a serious violation of securities law.

The SCs definition of promotion is broad, and the scope includes:

- Posting videos on social media with sign-up or referral links.

- Publishing blogs or Facebook posts endorsing an unlicensed broker.

- Hosting webinars explaining how to deposit into an overseas trading account.

Even if the promoter never handles investor funds directly, the act of promotion alone is enough to be considered an offence.

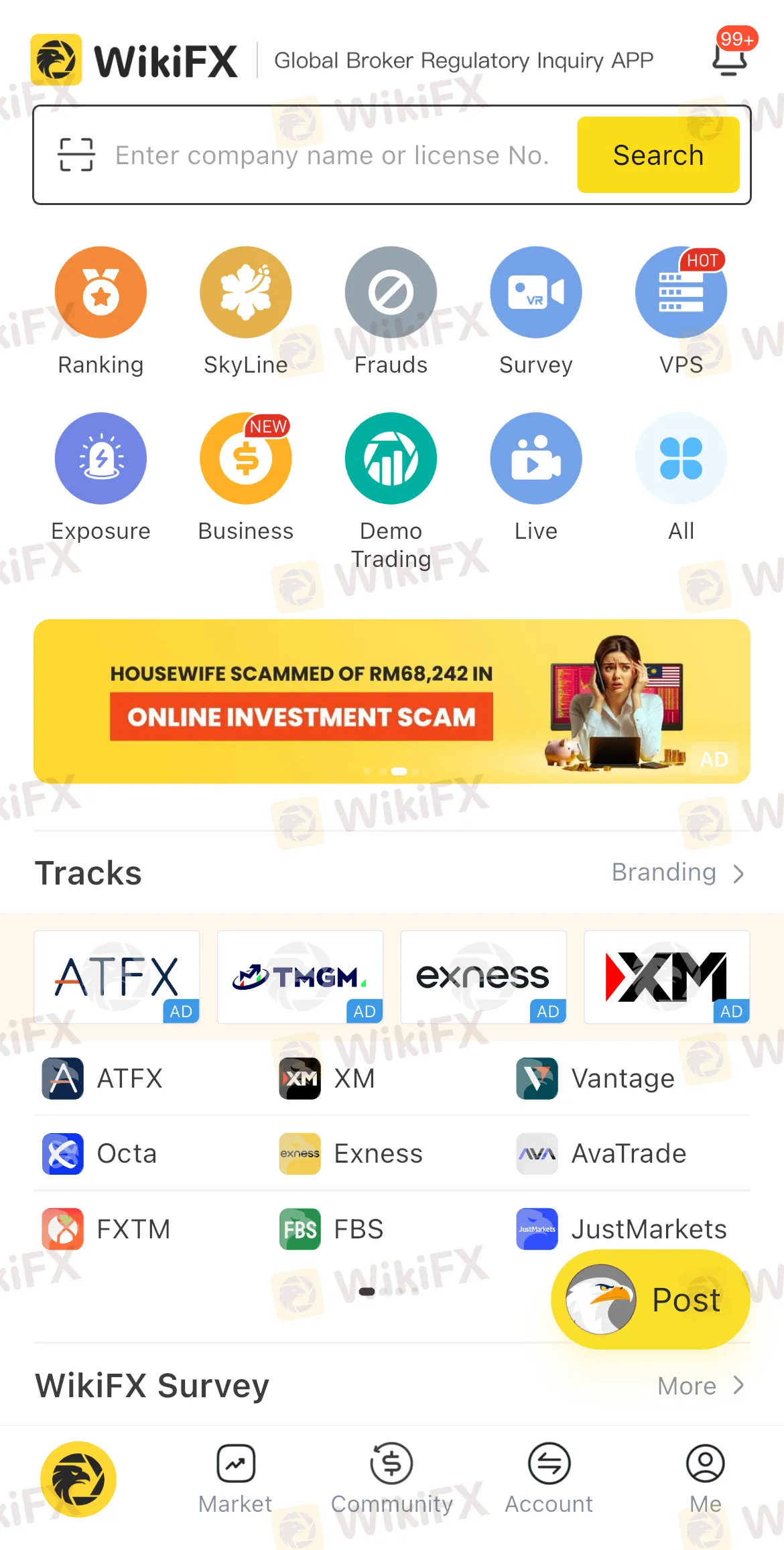

On this note, traders and investors can also use a free mobile application called WikiFX, which serves as a valuable tool for verifying the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, helping users make informed decisions before committing to any investment. Its risk ratings and alerts on unlicensed or suspicious entities can highlight potential red flags, including brokers flagged by the SC. With just a few clicks, investors can see a brokers background in full transparency, which is an important step that could save both money and peace of mind.

The bottom line: after 1 November 2025, one social media post could be all it takes to land you in legal trouble. The days of casually promoting unlicensed brokers for quick commissions are about to end.

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Complaints Against Weltrade | Traders Can’t Get Their Money Back

Opening a trading account and watching your capital grow can feel exciting and full of promise until the moment you realise you cannot get your money back. That’s when the dream turns into a nightmare. Recent complaints submitted to WikiFX reveal an unsettling pattern seen at Weltrade where deposits vanish, withdrawals stall for days or even months, and support channels lead nowhere.

Top 5 Cent Account Brokers for 2025: Best Choices for Beginners and Pros

Discover the top 5 cent account brokers for 2025 and learn how cent account trading works. Explore benefits, broker comparisons, and practical tips for beginners and pros to trade forex with low risk and minimal deposits.

WikiFX Broker

Latest News

Join WikiFX’s Agent Growth Event | Turn Your Success into a Global Achievement

Do Kwon Faces 130-Year Prison Sentence After Guilty Plea in $40B Crypto Collapse

Best 5 Low-Spread FX Brokers in India 2025

SEC Settles California Trader with Over $234,000 Spoofing Scheme

Major Pairs in Forex: Top Traded Currency Insights

Forex Trends Explained for Your Successful Trading Experience

What is ECN in Trading? A Simple Guide

Scam Alert: Know the Risky Side of InstaForex in India

Going to Invest in FXCL? Move Back to Avoid Scams & Losses

What Is Forex Trading Fee? A Beginner’s Guide

Rate Calc