Best 5 Low-Spread FX Brokers in India 2025

Abstract:Forex trading has grown rapidly in India, and choosing the right broker is critical—especially when it comes to spreads. A low spread broker means lower trading costs and higher potential profits, especially for active traders and scalpers. In this article, we list the top 5 low-spread forex brokers in India for 2025, trusted for their tight spreads, fast execution, and strong global reputation.

Forex trading has grown rapidly in India, and choosing the right broker is critical—especially when it comes to spreads. A low spread broker means lower trading costs and higher potential profits, especially for active traders and scalpers. In this article, we list the top 5 low-spread forex brokers in India for 2025, trusted for their tight spreads, fast execution, and strong global reputation.

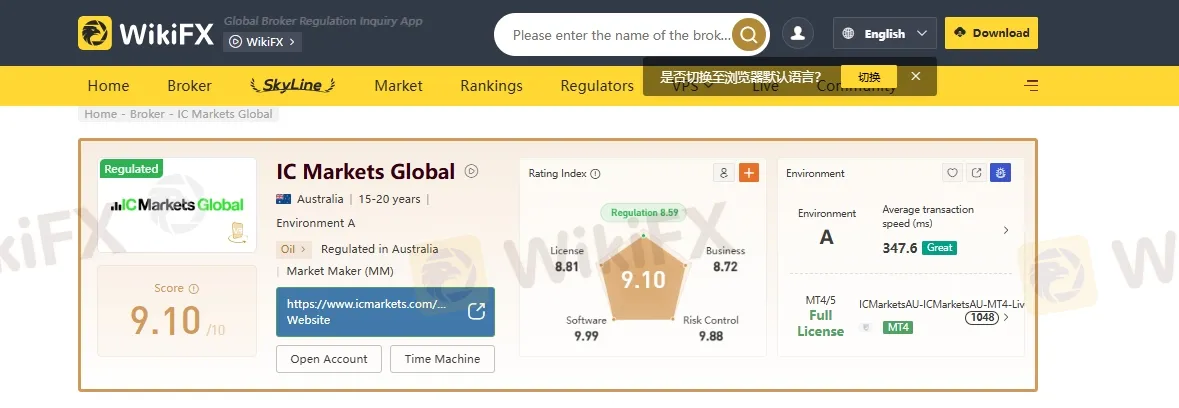

1. IC Markets Global – The Choice of Professional Traders

• Spreads: From 0.0 pips (Raw Spread Account)

• Regulated by: ASIC, FSA (Seychelles), CySEC

• Leverage: Up to 1:500

• Minimum Deposit: $200

• Best For: Scalpers, Algo Traders, High-Frequency Traders

IC Markets is a globally recognized ECN forex broker offering ultra-low spreads and lightning-fast execution. Popular for automated trading via MetaTrader 4/5 and cTrader, it's a top pick for serious traders in India looking for reliable execution and institutional-grade liquidity.

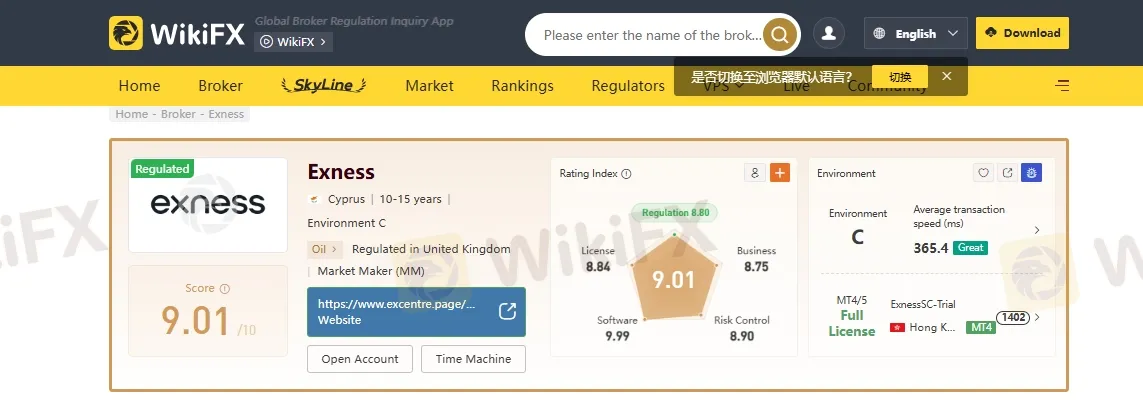

2. Exness – Transparent, Flexible & Trader-Friendly

• Spreads: From 0.1 pips (Standard & Raw Accounts)

• Regulated by: FCA (UK), CySEC, FSCA

• Leverage: Up to 1:Unlimited (Based on margin conditions)

• Minimum Deposit: Starts from $10

• Best For: Beginners and experienced traders

Exness has gained popularity in India due to its super low spreads, instant withdrawal options, and flexible leverage. Their intuitive interface, mobile app, and transparent pricing model make it a top choice for both new and experienced forex traders.

3. XM – Reliable, Regulated, and Rewarding

• Spreads: From 0.6 pips (Ultra Low Account)

• Regulated by: ASIC, CySEC, IFSC

• Leverage: Up to 1:1000

• Minimum Deposit: $5

• Best For: Traders looking for bonuses, tight spreads, and educational support

XM offers tight spreads, commission-free trading on most accounts, and frequent bonuses/promotions. Their strong focus on trader education, with free webinars and analysis tools, makes them ideal for Indian traders looking to learn and grow.

4. FBS – Flexible and Bonus-Focused Trading

• Spreads: From 0.3 pips (Zero Spread Account)

• Regulated by: CySEC, IFSC, FSCA

• Leverage: Up to 1:3000

• Minimum Deposit: $1

• Best For: Traders who prefer bonuses, low deposits, and high leverage

FBS stands out for its variety of account types, including zero spread and cent accounts. It also offers attractive trading bonuses, making it a great platform for Indian traders who want to start small and scale up.

5. FP Markets – ECN Precision with Low Spreads

• Spreads: From 0.0 pips (Raw ECN Account)

• Regulated by: ASIC, CySEC, FSCA

• Leverage: Up to 1:500

• Minimum Deposit: $100

• Best For: ECN trading with advanced tools

FP Markets is an ECN forex broker known for low spreads, fast execution, and support for MT4, MT5, and IRESS platforms. Indian traders value their transparent fee structure and professional trading environment.

Final Thoughts- All five brokers—IC Markets, Exness, XM, FBS, and FP Markets—offer competitive spreads, robust platforms, and global reliability. The best choice depends on your:

• Trading style (scalping, swing, long-term)

• Preferred platform (MT4/MT5/cTrader)

• Initial deposit

• Bonus preferences

Before choosing, always check the broker's regulatory status, customer support, and withdrawal options for Indian residents.

Frequently Asked Questions

Q1. Is forex trading legal in India?

Forex trading is legal when done through Indian exchanges for INR-based pairs. However, many Indian traders use global brokers at their own discretion for broader market access.

Q2. Which forex broker offers the lowest spreads?

IC Markets and FP Markets offer spreads starting from 0.0 pips on Raw ECN accounts.

Q3. Can Indian traders open accounts with these brokers?

Yes, Indian residents can register with these brokers, but it's essential to verify terms, regulations, and compliance with Indian laws.

Related broker

Read more

Inside the Elite Committee: Talk with Nguyễn Viết Hải

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

eFX Markets Review: Check Out Reported Trade Manipulation & Withdrawal Denial Cases

Has eFX Markets taken away your deposited capital? Faced losses due to manipulative ‘stop loss and take profit’ orders? Were you denied fund withdrawals because you did not finish your trading lot? Did the broker lure you into trading through a fake welcome bonus and scam you later? Traders have accused the Virgin Islands-based forex broker of driving these fraudulent practices. In this eFX Markets review article, we have shared some complaints against the broker. Take a look!

Otet Markets Exposed: Withdrawal Denials, Hidden Trading Rules & Scam Allegations

Has OTET Markets scammed you by freezing your forex trading account? Were you caught off guard by hidden trading rules diminishing your trading gains? Is the Otet Markets withdrawal process too slow or negligent? Don’t you receive adequate support from the broker’s customer care department? You are not alone! Many traders have opposed the Saint Lucia-based forex broker for their alleged malicious tactics. In this Otet Markets review article, we have covered a series of complaints against the broker. Read on!

E-Global Review: Order Closure Issues, Alleged Trade Manipulation & Fund Scams

Have you witnessed a failure of order closure by the E-Global Forex executive? Did you see an unprecedented rise in a forex pair not available on platforms other than that of this broker? Did the slow trading server prevent you from closing your trade at a favorable price? Has the broker scammed you after earning you from your investment? Many traders have expressed disappointment over the unfair forex trading practices at the US-based forex broker. In this E-Global Forex review article, we have shared some complaints against the broker. Take a look!

WikiFX Broker

Latest News

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

Merin Review (2025): Is it Safe or a Scam?

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc