Complaints Against Weltrade | Traders Can’t Get Their Money Back

Abstract:Opening a trading account and watching your capital grow can feel exciting and full of promise until the moment you realise you cannot get your money back. That’s when the dream turns into a nightmare. Recent complaints submitted to WikiFX reveal an unsettling pattern seen at Weltrade where deposits vanish, withdrawals stall for days or even months, and support channels lead nowhere.

Opening a trading account and watching your capital grow can feel exciting and full of promise until the moment you realise you cannot get your money back. Thats when the dream turns into a nightmare. Recent complaints submitted to WikiFX reveal an unsettling pattern seen at Weltrade where deposits vanish, withdrawals stall for days or even months, and support channels lead nowhere.

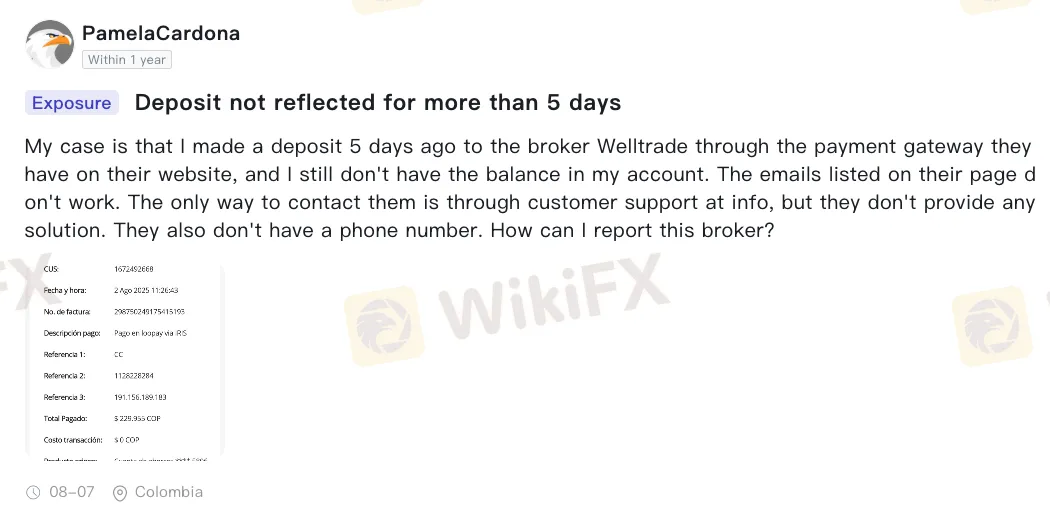

A trader made a deposit through Weltrades official payment gateway, expecting it to be credited within hours. Five days later, the balance had still not appeared. Multiple attempts to reach the broker failed as the email addresses listed on the website bounced back, and the only working contact was a generic support email that provided no resolution. No telephone number was available. The trader was left asking a question no investor wants to face: “How do I report this broker?”

Another trader requested a withdrawal on a Saturday, expecting to receive the funds within a few working days. Instead, the payment never materialised. Describing the customer service as ineffective, the trader reported that no meaningful assistance was offered and no timeframe for resolution was given.

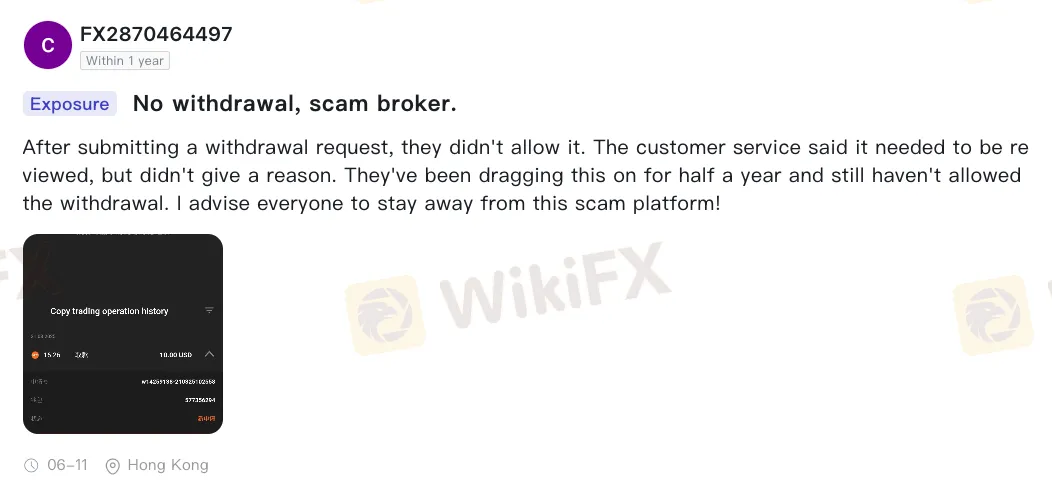

Perhaps the most concerning case involved a trader whose withdrawal request had been “under review” for more than half a year. No explanation was provided. Each follow-up with customer service produced the same response, that is, “forever pending”. For the trader, the experience turned into a drawn-out battle to reclaim their own capital, leading them to label the platform a “scam” and warn others to avoid it altogether.

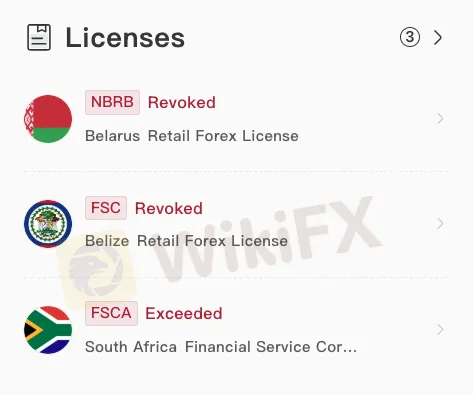

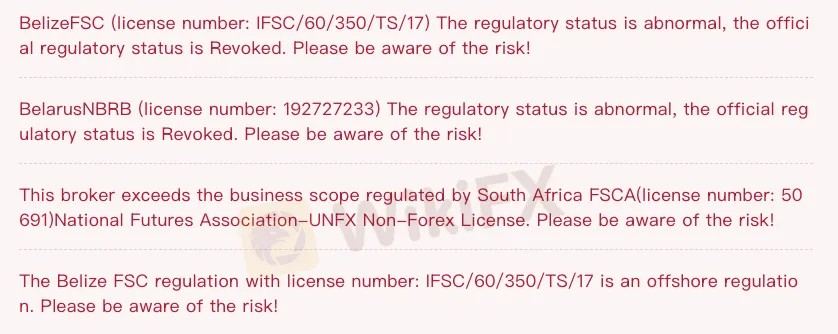

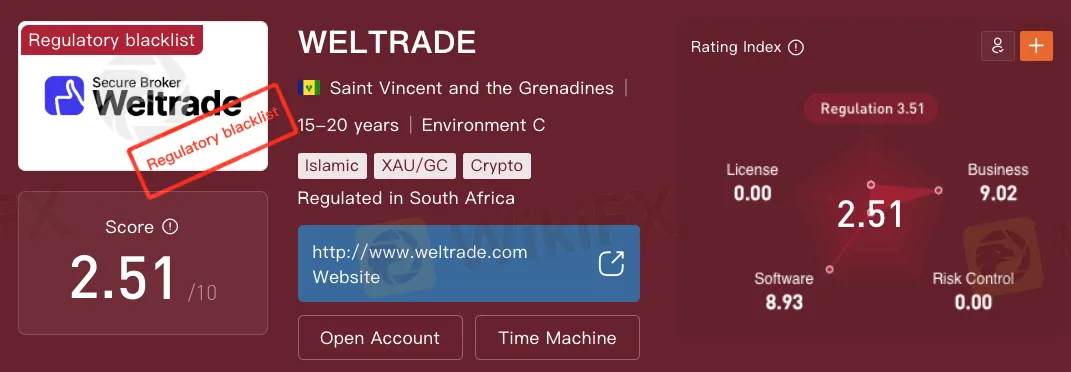

These personal accounts are troubling enough, but the regulatory picture surrounding Weltrade adds further cause for concern. The broker, originally registered in Saint Vincent and the Grenadines, claims to be regulated by the Belarusian NBRB, Belize FSC, and South Africa‘s FSCA. Yet official records show that both the Belarus NBRB and the Belize FSC have revoked Weltrade’s licences.

The Belize FSC had granted licence number IFSC/60/350/TS/17 before revoking it, which is a significant development given that Belize‘s oversight is already considered weaker by international standards. Similarly, the Belarus NBRB’s withdrawal of licence number 192727233 points to serious compliance issues. In South Africa, while the broker holds FSCA licence number 50691, its activities reportedly exceed what is authorised under that licence.

In Malaysia, the Securities Commission has placed Weltrade on its Investor Alert List, a public warning typically reserved for entities that pose potential risks to investors.

In summary, the customer accounts and regulatory findings suggest more than isolated disputes as they hint at systemic issues. With a WikiScore of just 2.50 out of 10, Weltrade is a broker that represents a high-risk choice for traders.

Read more

What Is Indices in Forex? A Beginner’s Guide to Trading Forex Indices

Understand what indices in forex are, how DXY works, key differences vs pairs, pros/cons, and where to trade CFDs—beginner-friendly, expert-backed guide.

Malaysian Finfluencers Could Face RM10 Million Fine or 10 Years in Prison!

A new regulatory measure by the Securities Commission Malaysia (SC) is set to change the country’s online trading and financial influencer landscape. Starting 1 November 2025, any trader or influencer caught promoting an unlicensed broker could face a fine of up to RM10 million, a prison sentence of up to 10 years, or both.

Juno Markets: A Closer Look at Its Licenses

When selecting a broker, understanding its regulatory standing is an important part of assessing overall reliability. For traders seeking to protect their capital, ensuring that a platform operates under recognised and stringent oversight can make all the difference. Keep reading to learn more about Juno Markets and its licenses.

Top 5 Cent Account Brokers for 2025: Best Choices for Beginners and Pros

Discover the top 5 cent account brokers for 2025 and learn how cent account trading works. Explore benefits, broker comparisons, and practical tips for beginners and pros to trade forex with low risk and minimal deposits.

WikiFX Broker

Latest News

Join WikiFX’s Agent Growth Event | Turn Your Success into a Global Achievement

Forex Trends Explained for Your Successful Trading Experience

Do Kwon Faces 130-Year Prison Sentence After Guilty Plea in $40B Crypto Collapse

Best 5 Low-Spread FX Brokers in India 2025

Major Pairs in Forex: Top Traded Currency Insights

What is ECN in Trading? A Simple Guide

SEC Settles California Trader with Over $234,000 Spoofing Scheme

What Is Forex Trading Fee? A Beginner’s Guide

Understanding UAE’s Financial Market Regulation: SCA and DFSA

Scam Alert: Know the Risky Side of InstaForex in India

Rate Calc