Coronavirus investing strategy, how to trade next stock market crash - Business Insider

Abstract:History shows that stocks are likely to return to their lows before a full recovery kicks in, the strategists said.

The Cboe Volatility Index — or VIX, also known as the market's fear gauge — has retreated from a record high in recent weeks as stocks have recovered from their recent lows. Bank of America derivatives strategists found that this commonly cited index does not paint the full picture of what to expect in the months ahead. They believe stocks are likely to retest the lows, and recommend a hedge that bets on lower equities and a higher gold price.Click here for more BI Prime stories.

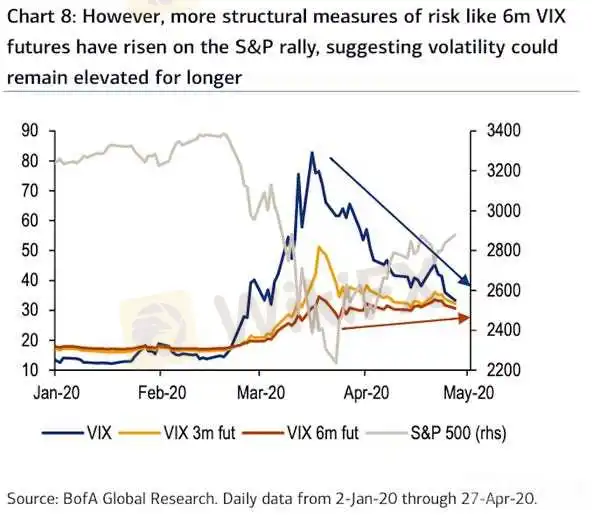

The fastest bear market in history still has more drama up its sleeve, according to derivatives strategists at Bank of America. A counterpoint can be found in the CBOE Volatility Index, or VIX, which reflects traders' future expectations for stock fluctuations. It is widely known as the market's fear gauge and tends to move in the opposite direction to the S&P 500. When the benchmark index experienced its fastest drop in record mid-March, the VIX mirrored it with a spike above 82, its highest level since November 2008. It has since rolled back to near 34, and the decline from the March 16 peak through April 27 was one of the fastest in history, according to data compiled by Bank of America.But this decline is masking other indicators that suggest the coronavirus crisis will trigger more volatility, the bank's strategists including Gonzalo Asis said in a recent note. They found that longer-dated volatility futures, including contracts that expire in six months, were rallying even as the popular spot-dated VIX was declining.

This suggests traders are betting that elevated volatility will persist.

Bank of America

A closer look into the historical relationship between the spot VIX and six-month futures adds more heft to their conclusion. There have been 105 days since 1990 when the VIX closed above 30 six months after it first crossed that level. However, only three of those days were outside of bear markets, indicating that an elevated VIX — like the one we have now — is historically more prevalent during bear markets. “Assuming VIX futures markets are pricing in this fact, the 6th VIX future trading above 30 suggests the expectation is that the bear market is likely not over,” Asis said.

He added, “our view remains that US equities are in a bear market rally and that they are likely to retest the lows before a full recovery, a view supported by strong historical evidence.”Hedge a sell-off with goldIt is prudent for investors to hedge the downside risk in stocks, Asis said. His recommendation to add portfolio protection by executing trades that wager on a rise in the price of gold, via the SPDR Gold Trust exchange-traded fund. “To cheapen equity hedges, we like trades that are both short equities and long gold, such as SPX puts contingent on gold higher and SPX down/gold up dual digitals,” he said. Investors who had counted on gold as a hedge during the recent plunge in stocks may be surprised at this recommendation since the precious metal also fell 13%.

Asis explained that gold sold off with stocks in an environment of “peak panic” — and it was not the first time. During the initial meltdowns of 1987, 2002, and 2008, gold also failed as a hedge in the early rush to sell. But during subsequent declines that were driven less by panic, gold was bid up as a safe-haven asset. “Our commodity strategists expect substantially more upside over the near- and medium-term as 'the Fed can't print gold', raising last week their 2020YE average price to $1,800/oz. and their 18-month gold target from $2,000 to $3,000/oz,” Asis added.With that in mind, his two trade recommendations are listed below verbatim:1. (Hybrid): Buy SPX Sep 2500 put (87%) contingent on GLD /> 180 (111%) for 0.75% (80% disc., ref. 2878.48, 161.56)

Best for a more bearish equity view. The 2500 SPX strike is 11% above Mar lows. The 180 GLD strike corresponds to ~$1,900/oz., near all-time highs & in line with our commodity strategists' $1,800 $/oz. avg. price by year end2. (Dual digital): Buy Sep SPX 105% for a 10-to-1 payout (ref. 2878.48, 161.56)Best for a moderately bearish equity view. Roughly corresponds to SPX 2675 and gold at $1,800/oz.

Read more

Gold crashes 21%!!!

For the past few years, gold has been riding a seemingly never-ending trend, and recently silver has decided to join the race, and both of these assets made headlines across the world because of how well they were performing.

Historic Breakout! Gold Price Smashes RM700 Mark

Malaysia’s retail gold prices have hit record highs, with 999 fine gold reaching RM700 per gram and 916 gold rising to RM650, driven by surging global gold prices, geopolitical tensions, and growing expectations of further US interest rate cuts.

Gold Makes New All Time Highs, But Nobody Cares?

Gold has made yet another all-time high, but this time, nobody is talking about it.

Gold and Silver Plummet from Record Highs as Profit-Taking Sweeps the Market

The spectacular year-end rally in precious metals hit a wall on Monday, as gold and silver prices collapsed from fresh all-time highs. Traders aggressively booked profits in a market thinning out for the holidays, amplifying volatility and triggering a sharp technical correction.

WikiFX Broker

Latest News

9Cents Review 2026: Is this Broker Safe?

Titan Capital Markets Review 2026: Comprehensive Safety Assessment

Plus500 Scam Alert: Withdrawal Issues Exposed

PXBT Review: A Seychelles-Based Trap for Your Capital

JRJR Review: The Anatomy of a Hong Kong Liquidity Trap

Here are the five key takeaways from the January jobs report

Is Alpari safe or scam? What You Need to Know

Pemaxx Review: A Deep Look into Serious User Problems and Safety Concerns

SkyLine Guide 2026 Thailand — Official Launch of the Judge Panel Formation!

South Africa Macro: Mining Policy Risks Cloud GNU Economic Optimism

Rate Calc