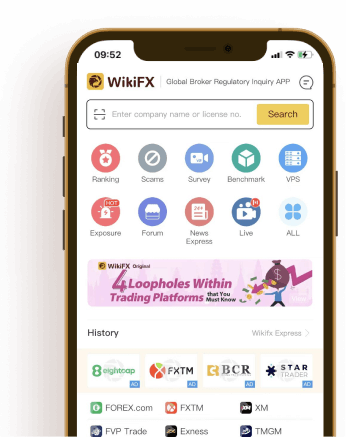

Global Forex Broker Regulatory Inquiry APP!

History

WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

This Valentine’s Day, WikiFX wants to say: A truly lasting relationship is built on mutual care.

WikiFX Elite Club Focus | Lance: Trust Is the Result of Long-Term Actions Accumulated Over Time

WikiFX Elite Club Focus is a monthly publication specially created by the WikiFX Club for its members. It highlights the key individuals, perspectives, and actions that are truly driving the forex industry toward greater transparency, professionalism, and sustainable development.

Jetafx Regulation Explained: A Complete Guide to Their Licenses and Company Registration

Is Jetafx a regulated broker? This is the main question for any trader thinking about using their services. When examining Jetafx Regulation, the findings raise serious concerns. Based on detailed information from the global broker research platform WikiFX, the answer is clear: Jetafx operates without a valid, recognized financial license. The platform gives the broker a very low score and marks it with serious warnings that potential users must understand.

FXTM

eightcap

ACCM

FOREX.com

AVATRADE

FXCM

DBG MARKETS

XM

EC markets

IC Markets Global

GTCFX

STARTRADER

CPT Markets

Finalto

BCR

Blueberry Markets

Latest

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

IQ Option maintains a high-gloss facade through its CySEC status, but the underlying data reveals a systemic failure in capital repatriation and a mounting pile of verified trader complaints. While they tout a custom-built environment, the reality for many is a one-way street where deposits enter smoothly but withdrawals vanish into a 'permanent review' void.

Unable to Withdraw

Unable to Withdraw totally scam fraud broker.not

totally scam fraud broker.not giving withdrawals . now blocked my meta trade 5 account and web login page

sanju verma sirsa

sanju verma sirsa

Kraken Review 2025: Is This Forex Broker Safe?

A critical review of Kraken (Score 1.58), highlighting its lack of regulation, numerous user complaints regarding 'task scams' and withdrawal restrictions, and warnings from Indonesian regulators.

WikiFX Valentine's Message | Trade Safely, Together Every Step of the Way

In the Forex Market, Trust Is Not a Promise — It’s Verified Through Safety, Transparency, and Support

datian Review: Examining Slippage and Forced Liquidation Allegations Against the Broker

Did you face losses due to a sudden change in the trading price on the datian platform? Were your transaction records deleted by the Hong Kong-based forex broker? Did the broker liquidate your trading account multiple times despite not reaching the stage where it mandated this move? Have you experienced heavy slippage on the trading platform? Concerned by these issues, traders have complained about the broker online. We will let you know of these with attached screenshots in this datian review article. Keep reading!

TopstepFX Review: Investigating Fund Withdrawal Denial Claims & Other Trading Issues

Did you face constant rejections of your fund withdrawal applications by TopstepFX? Have you been denied withdrawals in the name of hedging? Did you witness an account block without any clear explanation from the forex broker? There have been numerous user claims against TopstepFX regarding its withdrawals, payout delays and other issues. In the TopstepFX review article, we have investigated the top complaints against the US-based forex broker. Keep reading!

Mazi Finance Regulatory Status: A Complete Guide to Its Licenses and High-Risk Warnings

When choosing a broker, the first question is always about safety and legitimacy. Is my capital safe? For Mazi Finance, the answer is clear and worrying: Mazi Finance is an unregulated broker. While the company, MaziMatic Financial Services LTD, is registered in the offshore location of Saint Lucia, this business registration does not replace strong financial regulation from a top-level authority. Independent analysis from regulatory watchdogs shows a very low trust score, made worse by official warnings from government financial bodies and many user complaints about serious problems. This article provides a clear, fact-based analysis of the Mazi Finance regulation status. Our goal is to break down the facts and present the risks clearly, helping you make an informed decision and protect your capital.

Checking if Mazi Finance is Real: Is This a Fake Broker or a Real Trading Company?

If you're wondering, "Is Mazi Finance legit?" or worried about a possible Mazi Finance scam, you are asking the right questions. These are the important first steps every trader must take to protect their capital. In a market full of chances to make money, there are just as many traps. Our goal is to give you a clear, fact-based answer. We have done a complete investigation into Mazi Finance, looking at its legal status, company structure, user experiences, and trading conditions. This is not a review based on marketing claims; it is a check for legitimacy based on facts we can prove. To be direct, our findings show that Mazi Finance operates with serious warning signs that should worry any trader. The biggest problem is its complete lack of proper regulation from any respected financial authority. This fact alone puts it in a high-risk category. This article will explain exactly what that means for you and your money.

Mazi Finance User Reviews: Looking at Real User Feedback to Check if it's Trustworthy

When traders look up things like "Is Mazi Finance Safe or Scam" or "Mazi Finance Complaints", they want to know something basic about capital safety. Can this broker be trusted with their capital? Answering this question needs more than just saying yes or no. Check this out for more updates about the broker.

Is Stonefort Legit Company? Understanding the Risks

When traders look up terms like "Is Stonefort Legit" or "Stonefort Scam", they want a clear answer to an important question: is my money safe? This article provides a fact-based look into Stonefort Securities Limited, using reliable information from regulatory tracking websites like WikiFX. Our research shows a broker that sends mixed signals. While Stonefort does have a license, it also has serious warning signs that any careful trader should think about. We will give you an honest, detailed breakdown of the facts, examining the broker's regulatory status, customer feedback, and business setup. This thorough review goes beyond marketing promises to give you the information you need to understand the real risks and make a smart decision.

DeltaFX Broker: No Regulation Exposed

DeltaFX Broker: No Regulation Exposed risks, scams & blocked withdrawals with zero oversight. High fraud exposure—read full review now!

Rights Protection Center

RG Group

RG Group

RG Group

RG GroupThe fraudulent platform arbitrarily locks customer accounts.

The fraudulent platform arbitrarily locks customer accounts.

Errante

Errante

Errante

Errantehi yesterday they manipulated

hi yesterday they manipulated my stoploss in position eurusd in vip account and i got 40 pip stop then support said cause slippage!!! plz leave this fraud broker ⛔️⛔️❌️❌️️️

FlipTrade Group

FlipTrade Group

FlipTrade Group

FlipTrade GroupWarning: Flip Trade

Warning: Flip Trade Group is a scam! They're unregulated and stole my $611USD on Feb 2nd. They're running fake trading competitions to lure traders. Demo and live contests are rigged, winners are fixed, and they'll steal your deposits and earnings if you try to withdraw. Don't fall victim like me ♂️.

BRIDGE MARKETS

BRIDGE MARKETS

BRIDGE MARKETS

BRIDGE MARKETSRobbery of $13,800 by Lion Mode Club and Bridge Markets

I am reporting Lion Mode Club Academy and Broker Bridge Markets for fraud. I won their trading tournament ($10,000 USD) and, instead of paying, they expelled and blocked me. Furthermore, on Broker Bridge Markets, they confiscated my legitimate profits of $3,800 USD. The excuse from Broker was that I made "many trades\" (600+), qualifying it as \"gambling" to avoid paying my profits. It is a coordinated scam: the academy attracts traders and the Broker confiscates the money from profitable ones. I have proof from emails, chats, and MetaTrader screenshots. Do not invest here!

DeltaFX

DeltaFX

DeltaFX

DeltaFXLock account crm+mt5 while trades was running

Its scam broker they lock my account mt5 and crm account while my trades was opened .

Pinnacle Pips

Pinnacle Pips

Pinnacle Pips

Pinnacle Pipsrefusing to withdraw

The profit was $20,000, but they are refusing to withdraw it for other reasons. All transactions https://pinnaclepips.com fraudulent exchange take place here. There are still many victims coming forward.

Upway

Upway

Upway

UpwayAfter making profits on fraudulent platforms, users are unable to withdraw their funds.

On the 10th, I requested a withdrawal of $1,650. Initially, they said it would arrive within one business day. On the 11th, the customer mentioned it could take one to three business days. Then today, the 12th, when I asked customer service again, they said they couldn't confirm the arrival date at this time.

Amillex

Amillex

Amillex

AmillexA completely standard black platform, with severe slippage after depositing funds

A completely standard black platform, with severe slippage after depositing funds. There's slippage on opening positions and also on closing positions. After trading a few lots, I found the trading environment to be extremely poor. When I wanted to withdraw funds, I was informed that the trading volume must not be less than 0.4% of the deposited amount, otherwise 2% of the deposited amount would be deducted from the withdrawal. Essentially, they force you to lose money on the platform; if you don't lose enough, they forcibly deduct it. In short, you can't expect to withdraw your full principal or any profits.

UltraTFX

UltraTFX

UltraTFX

UltraTFXtotally scam fraud broker.not

totally scam fraud broker.not giving withdrawals . now blocked my meta trade 5 account and web login page

OnsaFX

OnsaFX

OnsaFX

OnsaFXBLOCK MY ACCOUNT

They intentionally blocked my account and didn't pay my money when they withdrew it. They were thieves. I asked for proof of transaction ID, but they kept quiet. They didn't reply to my email, and they didn't reply to my account.

MORFIN FX

MORFIN FX

MORFIN FX

MORFIN FXBroker doesn't allow to withdaw

Broker doesn't allow to withdraw the amount... they said our trade execution not connecting to teir LP. already they saying hold trade above 3 minutes they have scalping policy, we hold every trades above five minutes and they saying our trades not connecting with the broker LP. We contacted the broker they don't have a proper LP for connection. They blocked our account.

MEGA FUSION

MEGA FUSION

MEGA FUSION

MEGA FUSIONIntentional Order Blocking

One of my clients below had a withdrawal request rejected by Anhui, accused of violating rules, and over $2000 was deducted! Because this client also had another account that deposited into my PAMM account for trading, when Anhui reviewed my PAMM account and found that my account was making profits every day, they then started targeting my PAMM account with various types of lag, ultimately causing my account to be liquidated! Multiple negotiations were unsuccessful; they kept insisting their servers had no issues, blaming it on my port or network problems! My account was logged in simultaneously on a local computer and a remote VPS. It's impossible for networks in two different regions to have problems at the same time, yet my account experienced lag simultaneously on these two different ports. At that time, no one else on the Anhui platform complained about server issues; only my account experienced lag alone. This is blatant tampering with my account! I hope the relevant authorities can help me seek justice!

USK MARKETS GROUP LTD

USK MARKETS GROUP LTD

USK MARKETS GROUP LTD

USK MARKETS GROUP LTDThey scammed us out of over $1,000,000—cannot withdraw!

We are now taking this to the police. They keep feeding us lies about “interest arbitrage”—it's all fraud, plain and simple. Stay alert. Don not fall for it.

Centinary

Centinary

Centinary

CentinaryCentinary, a large fraud company

I have invested and have completed a withdrawal of 20000 yuan. However, I have been unable to withdraw 5000 yuan from two pending confirmations. Carefully planned and professionally deceived clients, and requested everyone not to invest in this century fraud company.

BAAZEX

BAAZEX

BAAZEX

BAAZEXstay far away from this fraudulent broker

This trader is completely a fraud and is not trustworthy under any circumstances. I deposited funds out of goodwill, but when I started making profits, they suddenly deleted all of my earnings and wrongly accused me of violating their policies. This is just a cheap excuse to steal customer funds. Even worse, I lost - $5940.69 and - $75.88. If you value your funds, please stay away from this fraudulent trader. Don't make the same mistakes as me.

GANN MARKETS

GANN MARKETS

GANN MARKETS

GANN MARKETSThis firm is fraudulent.

I conducted forex transactions through a brokerage firm called Gann Markets. I deposited over $10,000, and after trading, I earned approximately $20,000 in profit, bringing my total account balance to around $25,000. Previously, they unjustly deducted $6,040 from my account, claiming I engaged in “scalp trading.” I repeatedly told them this was completely unwarranted—they cannot simply seize a client’s funds under such a pretext. As a result, I believe I am owed a total of $31,500. When I submitted a request to withdraw all my funds, they told me they could pay me in installments of $5,000 every two weeks. I accepted this arrangement. However, today they came back with a new ultimatum, claiming I had committed “arbitrage” and that my trades were irregular. They now say: “We will not pay your $20,000 profit. Just take your principal and leave.” On top of that, they are demanding that I sign a statement declaring “I have no further claims” before they will even return my original deposit. In short: they have refused to pay both my profits and my principal.

EA

Trend type PeakTaker

Income in last year +433.46%

This strategy primarily focuses on breakout trading for cryptocurrencies BTC/ETH

USD 0.99 USD 280.00PurchaseTools CopyTrading-MT5

This EA is an MT5 Copy Trading EA that enables copy trading between signal-providing and follower accounts on MT5

USD 0.99 USD 280.00PurchaseTrend type TurtleBooster

Income in last year +177.96%

This strategy is a trend-following and position-adding strategy, mainly used for interval position adding in major trending markets.

USD 0.99 USD 280.00PurchaseTrend type TrendRiser

Income in last year +775.69%

This EA is compatible with both ranging and trending markets

USD 0.99 USD 280.00Purchase

Forum

Neex

2026-02-14 12:08

Happy Valentine's Day

Love is about timing and trust — just like trading — so this Valentine’s Day, let every candle tell a story driven by precision and passion.#HappyValentineDay Trading in financial markets involves significant risks, including the potential loss of all or part of the invested capital. This may not be suitable for all traders.

FX1524519625

2026-02-13 12:04

Payment partnership for Forex operators – LATAM

Channel type:

Commission rate (USD):

Hustler001

2026-02-13 02:07

GBPUSD

And of course we are bearish 💪🏽

Trading Fellows

2026-02-12 22:17

Bot Trading.

Is bot trading safe or not ? how many brokers allowed bot trading ......

Trading Fellows

2026-02-12 22:14

guess the time ...

when gold was 1700 #LearningCenter #WikiFXECInvestimentDiscovery #MyFirstTrade

Hustler001

2026-02-12 22:04

GBP/USD

my thoughts on GU is gonna be bearish

Ranking List

- Total Margin

- Active Trading Ranking

- Total lots

- Stop Out

- Profit Order

- Brokers' Profitability

- New User

- Spread Cost

- Rollover Cost

- Net Deposit Ranking

- Net Withdrawal Ranking

- Active Funds Ranking

Total Margin

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Asset%

- Ranking

- 1

Exness

Exness- 21.93

- 1

- 2

XM

XM- 21.28

- 1

- 3

Vantage

Vantage- 17.46

- --

- 4

D prime

D prime- 10.15

- 1

- 5

VT Markets

VT Markets- 6.81

- 2

- 6

FBS

FBS- 6.47

- --

- 7

IC Markets Global

IC Markets Global- 5.06

- 1

- 8

STARTRADER

STARTRADER- 4.18

- 1

- 9

TMGM

TMGM- 3.75

- 5

- 10

Anzo Capital

Anzo Capital- 2.21

- --

Active Trading Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

XM

XM- 21.80

- --

- 2

Exness

Exness- 19.95

- --

- 3

TMGM

TMGM- 9.41

- --

- 4

D prime

D prime- 8.12

- --

- 5

IC Markets Global

IC Markets Global- 6.20

- --

- 6

VT Markets

VT Markets- 3.10

- --

- 7

ATFX

ATFX- 2.34

- 4

- 8

FBS

FBS- 2.28

- 1

- 9

Vantage

Vantage- 2.10

- 1

- 10

RockGlobal

RockGlobal- 1.93

- 4

Total lots

- 30 days

- 90 days

- 6 months

- Brokerage

- Trading Volume%

- Ranking

- 1

FBS

FBS- 19.41

- --

- 2

IC Markets Global

IC Markets Global- 4.41

- 1

- 3

Anzo Capital

Anzo Capital- 1.57

- 5

- 4

VT Markets

VT Markets- 1.51

- 20

- 5

Exness

Exness- 1.37

- 1

- 6

XM

XM- 0.96

- 1

- 7

Vantage

Vantage- 0.85

- 3

- 8

FXTM

FXTM- 0.84

- 4

- 9

KVB

KVB- 0.22

- 4

- 10

TMGM

TMGM- 0.20

- 8

Stop Out

- 30 days

- 90 days

- 6 months

- Brokerage

- Stop Out%

- Ranking

- 1

ATFX

ATFX- 9.06

- 1

- 2

INFINOX

INFINOX- 5.78

- 5

- 3

FXTM

FXTM- 4.01

- 2

- 4

VALUTRADES

VALUTRADES- 2.76

- 33

- 5

FBS

FBS- 2.17

- 9

- 6

KVB

KVB- 2.03

- 5

- 7

Pepperstone

Pepperstone- 1.83

- 5

- 8

AVATRADE

AVATRADE- 1.50

- 2

- 9

ACY SECURITIES

ACY SECURITIES- 1.24

- 4

- 10

XM

XM- 1.18

- 6

Profit Order

- 30 days

- 90 days

- 6 months

- Brokerage

- Win rate%

- Ranking

- 1

XM

XM- 12.79

- --

- 2

FBS

FBS- 1.89

- 32

- 3

VT Markets

VT Markets- 1.62

- --

- 4

ZFX

ZFX- 1.12

- 1

- 5

IC Markets Global

IC Markets Global- 0.97

- 3

- 6

CPT Markets

CPT Markets- 0.37

- 11

- 7

INFINOX

INFINOX- 0.23

- 24

- 8

ATFX

ATFX- 0.21

- 3

- 9

FOREX.com

FOREX.com- 0.11

- 17

- 10

FXCM

FXCM- 0.08

- 1

Brokers' Profitability

- 30 days

- 90 days

- 6 months

- Brokerage

- Total Profit%

- Ranking

- 1

CXM

CXM- 18.10

- 2

- 2

Anzo Capital

Anzo Capital- 3.75

- --

- 3

TMGM

TMGM- 3.56

- 33

- 4

InterStellar

InterStellar- 3.26

- 2

- 5

D prime

D prime- 2.63

- 2

- 6

RockGlobal

RockGlobal- 2.21

- 33

- 7

STARTRADER

STARTRADER- 1.56

- 1

- 8

Vantage

Vantage- 1.23

- --

- 9

AVATRADE

AVATRADE- 0.23

- 22

- 10

KVB

KVB- 0.06

- 26

New User

- 30 days

- 90 days

- 6 months

- Brokerage

- Growth value%

- Ranking

- 1

XM

XM- 11.41

- --

- 2

Exness

Exness- 4.92

- --

- 3

IC Markets Global

IC Markets Global- 4.73

- --

- 4

Vantage

Vantage- 3.20

- --

- 5

D prime

D prime- 2.84

- --

- 6

TMGM

TMGM- 2.75

- --

- 7

VT Markets

VT Markets- 1.97

- 1

- 8

FBS

FBS- 1.92

- 1

- 9

FXTM

FXTM- 1.07

- --

- 10

STARTRADER

STARTRADER- 0.91

- --

Spread Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average Spread

- Ranking

- 1

XM

XM- 11.17

- --

- 2

IC Markets Global

IC Markets Global- 3.61

- --

- 3

Exness

Exness- 3.45

- --

- 4

Vantage

Vantage- 3.21

- 2

- 5

D prime

D prime- 2.83

- 2

- 6

TMGM

TMGM- 2.81

- 2

- 7

VT Markets

VT Markets- 2.45

- 2

- 8

STARTRADER

STARTRADER- 1.37

- 1

- 9

ATFX

ATFX- 1.14

- 1

- 10

FBS

FBS- 0.99

- 2

Rollover Cost

- 30 days

- 90 days

- 6 months

- Brokerage

- Average rollover

- Ranking

- 1

FXTRADING.com

FXTRADING.com- 17.26

- --

- 2

VT Markets

VT Markets- 5.13

- --

- 3

Anzo Capital

Anzo Capital- 1.68

- 25

- 4

CWG Markets

CWG Markets- 1.51

- 20

- 5

CPT Markets

CPT Markets- 1.44

- 17

- 6

FXTM

FXTM- 0.81

- 23

- 7

FXCM

FXCM- 0.36

- 23

- 8

AVATRADE

AVATRADE- 0.31

- 2

- 9

CXM

CXM- 0.31

- 26

- 10

VALUTRADES

VALUTRADES- 0.11

- 8

Net Deposit Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Deposit%

- Ranking

- 1

Axitrader

Axitrader- 89.51

- 29

- 2

MultiBank Group

MultiBank Group- 88.79

- 1

- 3

ATFX

ATFX- 71.59

- 17

- 4

AUS GLOBAL

AUS GLOBAL- 71.24

- 2

- 5

TICKMILL

TICKMILL- 70.26

- 1

- 6

FXTRADING.com

FXTRADING.com- 69.96

- --

- 7

GO Markets

GO Markets- 69.73

- 30

- 8

Pepperstone

Pepperstone- 68.65

- 13

- 9

CPT Markets

CPT Markets- 68.55

- --

- 10

RockGlobal

RockGlobal- 66.73

- 13

Net Withdrawal Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Net Withdraw%

- Ranking

- 1

Exness

Exness- 7.00

- 1

- 2

D prime

D prime- 7.00

- 13

- 3

TICKMILL

TICKMILL- 7.00

- 2

- 4

AVATRADE

AVATRADE- 8.00

- 2

- 5

FXTM

FXTM- 10.00

- 5

- 6

IC Markets Global

IC Markets Global- 10.00

- 2

- 7

FxPro

FxPro- 11.00

- 3

- 8

TMGM

TMGM- 11.00

- 2

- 9

INFINOX

INFINOX- 12.00

- 1

- 10

Swissquote

Swissquote- 13.00

- 28

Active Funds Ranking

- 30 days

- 90 days

- 6 months

- Brokerage

- Activation rate%

- Ranking

- 1

FXCM

FXCM- -0.50

- --

- 2

HYCM

HYCM- -0.90

- 2

- 3

AUS GLOBAL

AUS GLOBAL- -1.01

- 3

- 4

Alpari

Alpari- -1.70

- --

- 5

Just2Trade

Just2Trade- -1.70

- --

- 6

FOREX.com

FOREX.com- -2.20

- 4

- 7

MultiBank Group

MultiBank Group- -2.80

- 29

- 8

AVATRADE

AVATRADE- -3.05

- 1

- 9

D prime

D prime- -4.58

- --

- 10

CWG Markets

CWG Markets- -5.04

- 2

Real-time spread comparison EURUSD

- Brokers

- Accounts

- Buy

- Sell

- Spread

- Average spread/day

- Long Position Swap USD/Lot

- Short Position Swap USD/Lot

To view more

Please download WikiFX APP

Know More and Enjoy more