What WikiFX Found When It Looked Into Exnova

Abstract:Choosing a reliable broker is essential in online trading, and understanding how a broker is regulated, or if it is regulated at all, plays a major role in that decision. Exnova is a trading platform that has drawn attention due to the absence of proper regulation and concerns about its business practices.

Choosing a reliable broker is essential in online trading, and understanding how a broker is regulated, or if it is regulated at all, plays a major role in that decision. Exnova is a trading platform that has drawn attention due to the absence of proper regulation and concerns about its business practices.

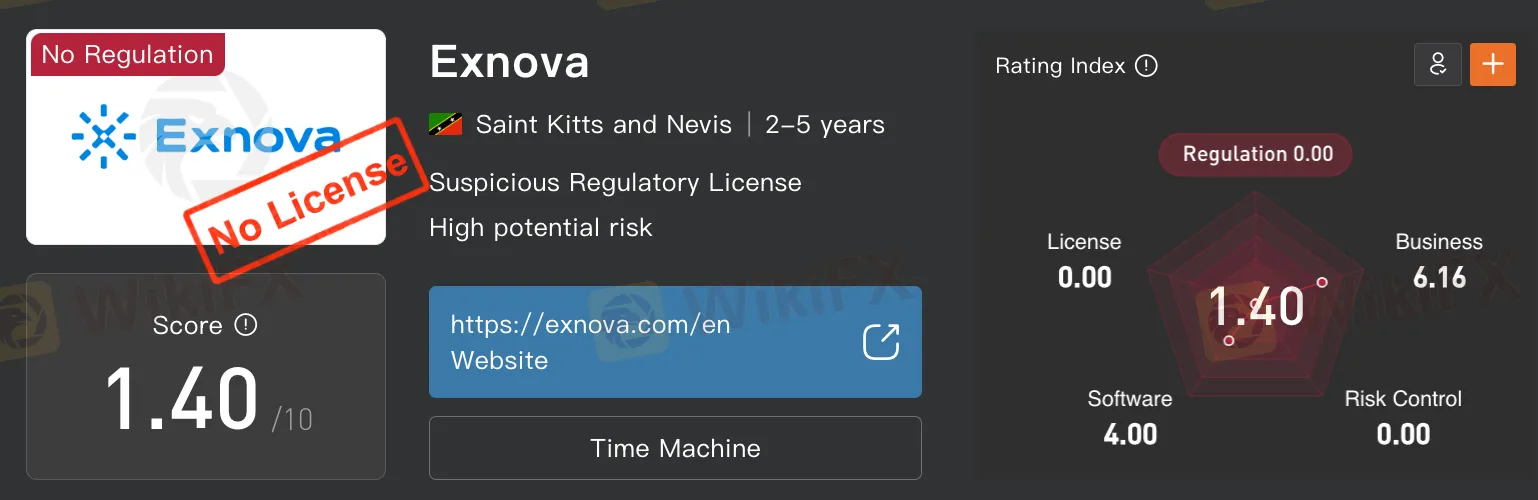

On WikiFX, a global broker regulatory query platform, Exnova has a significantly low WikiScore of 1.4/10. This score reflects various factors, such as regulatory status, platform operations, risk management, and user feedback. A score this low suggests that the broker falls short in several important areas and may not meet the standards that many traders expect from a trusted trading provider.

Exnova currently does not hold any valid financial regulation, according to verification conducted by WikiFX. This means there is no official regulatory authority monitoring its activities or ensuring that client funds are protected. Brokers that are unregulated operate outside of the rules and oversight required in many countries, which can increase risk for traders.

Additionally, Exnova is registered in Saint Kitts and Nevis, a jurisdiction known for its minimal regulatory oversight of forex and trading firms. While it is legal to form a business in this country, it does not have a dedicated financial regulatory body for overseeing trading brokers. Being based in such a location often means that the broker can operate with limited transparency and fewer protections for its users.

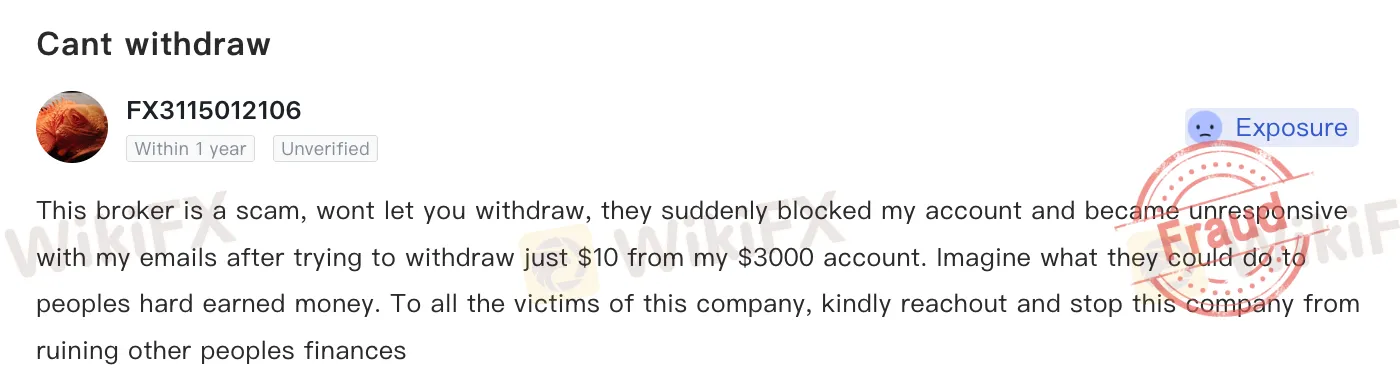

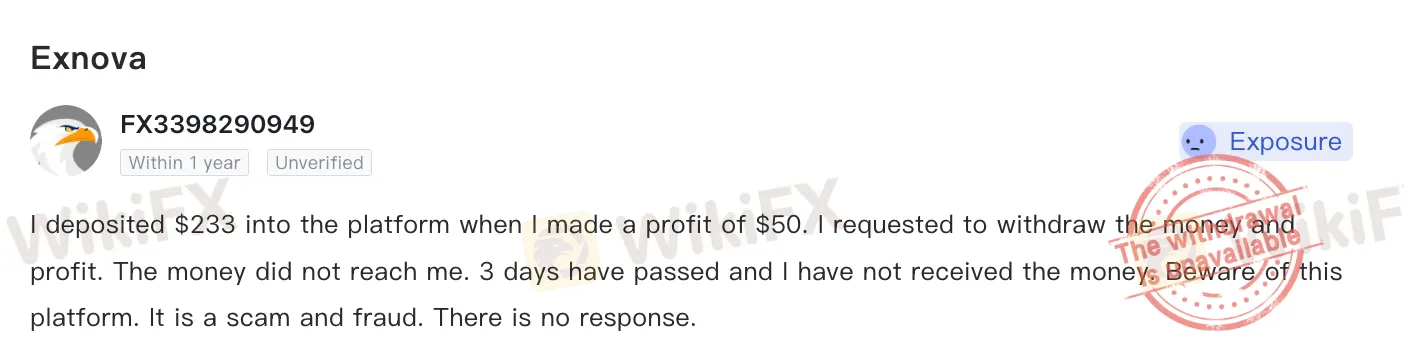

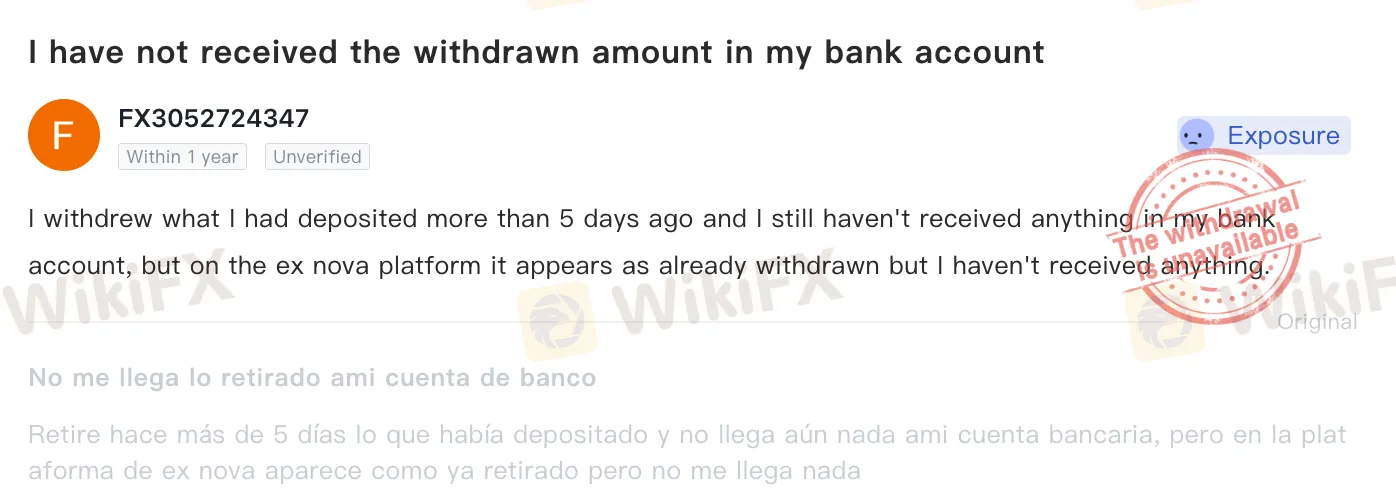

Several complaints have also been reported by Exnova users. A number of traders have shared concerns that they were unable to withdraw their funds from the platform. These kinds of complaints are serious and may indicate operational or customer service issues. When multiple traders report similar problems, it is worth taking the time to investigate further before making any deposits or trading commitments.

Exnova‘s lack of regulation, its offshore registration in a loosely supervised jurisdiction, and the number of unresolved user complaints raise important concerns. These factors may affect the level of safety, reliability, and accountability users can expect when using the platform. While every trader must make their own decisions, it's important not to ignore these red flags. Taking time to review a broker’s regulatory status and track record can help reduce the risk of encountering issues later on.

Read more

Exnova Exposed: Reports of Failed Deposits & Withheld Withdrawals from Traders

Does your deposit amount fail to reflect in your Exnova forex trading account? Does the same thing happen even when withdrawing? Does the Exnova bonus lure lead to a NIL account balance? Has the broker terminated your account without any explanation? These trading issues have become synonymous with traders here. Some traders have openly criticized the broker on several review platforms online. In this Exnova review article, we have highlighted the miserable forex trading experiences.

FXCM Broker ASIC Stop Order Halts CFD Sales

FXCM Broker ASIC Stop Order blocks new CFD trading for retail clients in Australia due to TMD flaws. Explore FXCM Broker CFD Trading Ban Australia impacts, retail client restrictions, and next steps for traders.

FortuixAgent Review: A Tale of Account Restrictions & Withdrawal Denials

Has your FortuixAgent app for forex trading been restricted? Does the broker not allow you to withdraw your initial deposits? Does the UK-based forex broker demand payment out of your earnings to allow withdrawals? These issues refuse to leave traders, as they come out expressing their frustration on broker review platforms. In this Fortuixagent review article, we have shared many complaints made against the broker.

Is Tiger Brokers Regulated? Investor Protection Guide

Tiger Brokers offers regulated trading in US, HK, SG stocks & futures. SFC-approved in HK (BMU940), FMA in NZ. No min deposit, competitive fees.

WikiFX Broker

Latest News

Identity Theft in FX: FCA Flags New 'Clone' Broker Mimicking Fortrade

Oron Limited Regulation: A Complete 2025 Review of Its License and Safety

The Problem With GDP

Plus500 Allegations Exposed in Real Trader Cases

November private payrolls unexpectedly fell by 32,000, led by steep small business job cuts, ADP reports

US Industrial Production Sees Biggest Annual Gain In 3 Years Despite Slowing Capacity Utilization

HEADWAY: The Fast Track to Financial Dead-Ends?

Polymarket Launches First U.S. Mobile App After Securing CFTC Approval

Thailand Seizes $318 Million in Assets, Issues 42 Arrest Warrants in Major Scams Crackdown

RM460,000 Gone: TikTok Scam Wipes Out Ex-Accountant’s Savings

Rate Calc