RIF-CAPITAL

摘要:RIF-CAPITAL, an international brokerage firm headquartered in AUSTRALIA, provides a broad selection of financial instruments including Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF and Cryptocurrency. However, it currently operates without anyvalid regulatory oversight, which raises great concerns about its legitimacy and commitment to customer safety.

| RIF-CAPITAL Review Summary in 10 Points | |

| Registered Country/Region | AUSTRALIA |

| Founded Year | 2023 |

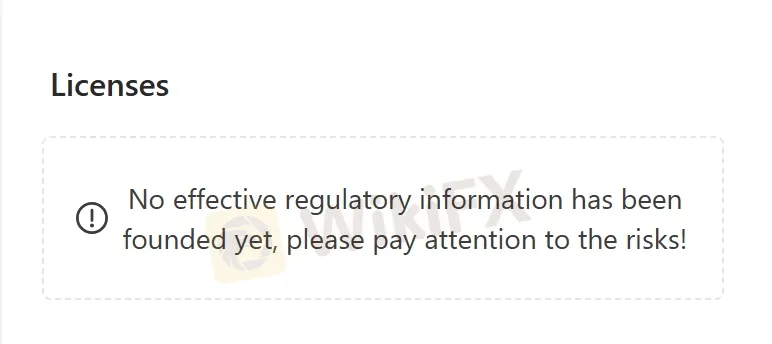

| Regulation | Unregulated |

| Market Instruments | Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF, Cryptocurrency |

| Demo Account | Available |

| Leverage | Up to 1:1000 |

| EUR/USD Spread | 0.1 pips |

| Trading Platforms | WEBTRADER |

| Minimum Deposit | $100 |

| Customer Support | Email, address, contact us form, live chat |

What is RIF-CAPITAL?

RIF-CAPITAL, an international brokerage firm headquartered in AUSTRALIA, provides a broad selection of financial instruments including Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF and Cryptocurrency. However, it currently operates without anyvalid regulatory oversight, which raises great concerns about its legitimacy and commitment to customer safety.

In our upcoming article, we will present a comprehensive and well-structured evaluation of the broker's services and offerings. We encourage interested readers to delve further into the article for valuable insights. In conclusion, we will provide a concise summary that highlights the distinct characteristics of the broker for a clear understanding.

Pros & Cons

| Pros | Cons |

| • Demo account available | • Unregulated |

| • Acceptable minimum deposit | • No MT4/5 trading platform |

| • Wide range of market instruments | • Relatively new in the market |

| • Zero commission | |

| • No deposit/withdrawal fees |

Pros:

Demo Account Available: RIF Capital offers a Demo Account with virtual funds. This allows you to practice trading strategies and get comfortable with the Webtrader platform before risking real capital.

Acceptable Minimum Deposit: The minimum deposit to open an account with RIF Capital is $100. This is a relatively low barrier to entry for new traders who want to start small.

Wide Range of Market Instruments: RIF Capital allows you to trade various market instruments, including Forex, indices etc., which diversifies your investment portfolios for better opportunities within the market.

Zero Commission: RIF Capital does not charge commissions on trades. This can save you money on transaction fees compared to brokers who charge commissions.

No Deposit/Withdrawal Fees: RIF Capital claims they don't charge any fees for depositing or withdrawing funds using any of their available methods. This can be advantageous for traders seeking a cost-effective way to manage their accounts.

Cons:

Unregulated: RIF Capital is not subject to the same level of oversight and investor protection as brokers regulated by established financial authorities. This could be a concern for some traders seeking additional security.

No MT4/5 Trading Platform: RIF Capital only offers the Webtrader platform for accessing the markets. This platform might lack the features and customization options found in popular platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Relatively New in the Market: RIF Capital was established on 2023, which is a relatively new company compared to established brokers. This means they have a limited track record, which could be a concern for some traders.

Is RIF-CAPITAL Safe or Scam?

When considering the safety of a brokerage like RIF-CAPITAL or any other platform, it's important to conduct thorough research and consider various factors.

Regulatory sight: Currently, this broker operates without any legitimate regulatory oversight, raising concerns about transparency and accountability.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms..

Security measures: RIF-CAPITAL uses segregated accounts to secure client assets which means client funds are kept separate from the company's own money, reducing the risk of misuse.

In the end, choosing whether or not to engage in trading with RIF-CAPITAL is an individual decision. It is advised that you carefully balance the risks and returns before committing to any actual trading activities.

Market Instruments

RIF-CAPITAL provides a vast playground for investors with over 3500 instruments at their fingertips.

You can dive into the world of foreign exchange (Forex) trading with major, minor, and exotic currency pairs. Speculate on price fluctuations of precious metals like Gold and Silver, or tap into the energy sector with instruments like Crude Oil and Natural Gas.

If you prefer broader market exposure, trade Indices that track leading stock exchanges, or take a more focused approach with CFD Stocks, replicating the price movements of individual companies. Exploring the world of commodities like agricultural products and industrial metals is also an option.

For income-oriented investors, RIF-CAPITAL offers Bonds, representing debt issued by governments and corporations. Take ETFs (Exchange Traded Funds) that track specific market segments into consideration if you are looking for diversified basket of asset. And for crypto enthusiasts, RIF-CAPITAL allows trading in popular digital currencies.

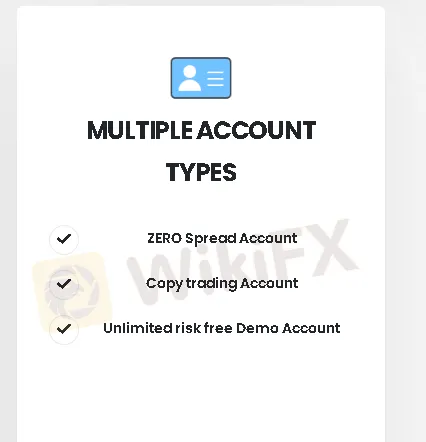

Account Types

RIF Capital offers three account types to suit your trading needs:

Risk-Free Demo Account: This account is a great way to practice trading without risking any real money. You can test out different trading strategies and get a feel for the markets before you start trading with real capital. The Demo Account comes with virtual funds and allows you to simulate real-world trading conditions.

ZERO Spread Account: This account is ideal for beginners or those who want to trade with tight spreads. There is a minimum deposit of $100 to open this account.

Copy Trading Account: This account allows you to automatically copy the trades of successful traders. This can be a great way to learn from experienced traders and potentially generate profits. The minimum deposit for a Copy Trading Account is also set at $100.

How to Open an Account?

To open an account with RIF-CAPITAL, you have to follow below steps:

Visit the RIF-CAPITAL website, locate and click on the 'Register Now.

Fill in the necessary personal details required.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

RIF Capital offers aggressive leverage options of up to 1:1000. This means you can control a position much larger than your initial deposit, potentially multiplying your returns. However, you should also be aware at the same time that it also amplifies losses. Always use leverage cautiouly and understand the risks before utilizing high leverage.

Spreads & Commissions

RIF Capital boasts competitive pricing for EUR/USD trading. Spreads are tight at 0.1 pips, and they don't charge commission fees on trades. This translates to lower trading costs compared to brokers with wider spreads or commission structures.

However, it's important to consider the overall package offered by RIF Capital. Factor in other features like available markets, margin requirements, and platform functionality when making your decision.

Trading Platforms

RIF Capital utilizes a Webtrader platform for accessing the Forex market and other assets. This web-based platform eliminates the need for software downloads, offering convenience for traders who prefer browser-based solutions.

Compatibility with various operating systems, including Windows, macOS, and Android, the platform allows accessibility across different devices.

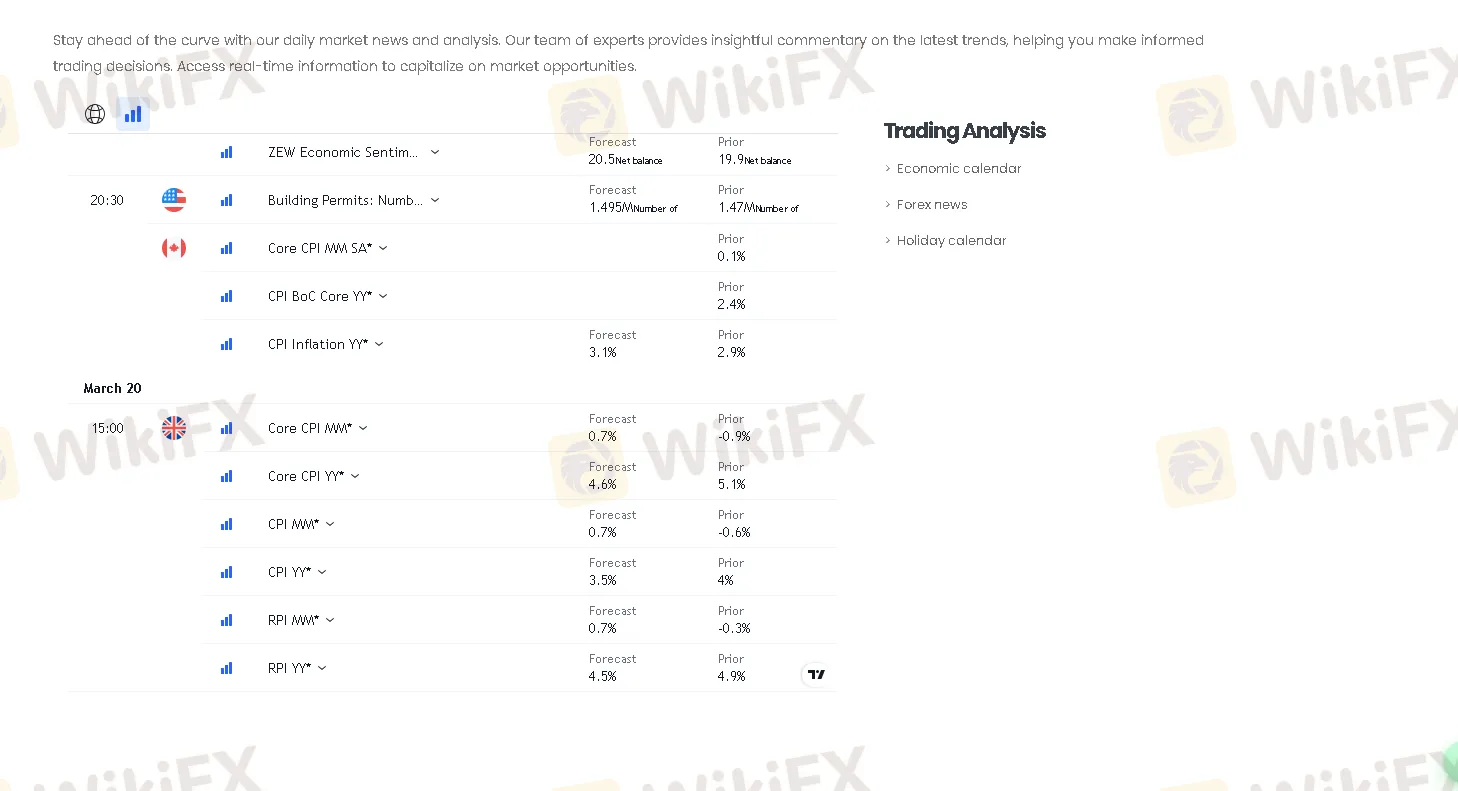

Trading Tools

RIF-CAPITAL equips traders with a comprehensive suite of trading tools, including an economic calendar, to enhance their trading experience. The economic calendar provides real-time updates on key economic events, such as interest rate decisions, GDP releases, and employment reports, allowing traders to stay informed about potential market-moving events.

By leveraging this tool, traders can make well-informed decisions, anticipate market volatility, and adjust their trading strategies accordingly.

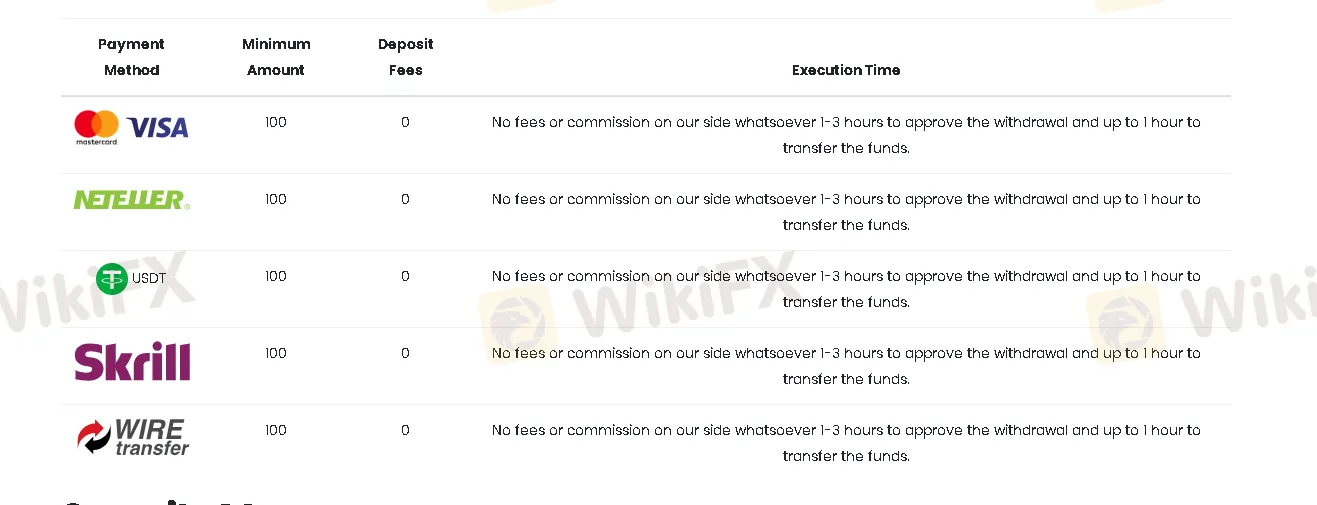

Deposit & Withdrawal

RIF Capital caters to various funding preferences with options like Mastercard/Visa, Neteller, Tether (USDT), Skrill, and wire transfer. The minimum deposit and withdrawal amount is set at $100, and RIF Capital itself doesn't charge any fees for deposits or withdrawals using any of these methods.

Processing times are efficient, with deposits and withdrawals typically approved within 1-3 hours and transfers completed within an hour.

This combination of multiple funding options, low minimums, and zero fees can be advantageous for traders seeking a convenient and cost-effective way to manage their accounts.

Customer Service

RIF-CAPITAL offers a range of customer service channels for trader support, including email assistance, a physical address for in-person visits, a convenient contact us form on their website, and live chat for immediate support. This multi-channel approach ensures timely and accessible support for traders' queries and concerns.

Address: 98, Forrest Street, COTTESLOE WA 6011, AUSTRALIA.

Email: cs@rif-capital.com.

Education

RIF Capital claims to offer educational resources to cater to both new and experienced traders.

For beginners, they provide a course covering the fundamental aspects of trading, equipping you with the foundational knowledge to navigate the markets.

Additionally, RIF Capital hosts regular webinars and live trading sessions. These sessions can be a valuable tool for further developing your trading skills, regardless of your experience level. By attending live sessions, you can observe experienced traders navigate the markets and glean valuable insights to inform your own trading strategies.

Conclusion

In summary, RIF-CAPITAL is an online brokerage firm located in AUSTRALIA, offering a wide range of trading instruments, including Forex, Metals, Energies, Indices, CFD Stocks, Commodities, Bond, ETF and Cryptocurrency. However, RIF-CAPITAL currently operates without valid regulations, raising concerns about its accountability and commitment to client safety.

Frequently Asked Questions (FAQs)

| Q 1: | Is RIF-CAPITAL regulated? |

| A 1: | No, it‘s been confirmed that the broker is currently under no valid regulation. |

| Q 2: | Is RIF-CAPITAL a good broker for beginners? |

| A 2: | No, it’s not a good broker because its not regulated by any authorities. |

| Q 3: | Does RIF-CAPITAL offer the industry leading MT4 & MT5? |

| A 3: | No. |

| Q 4: | Does RIF-CAPITAL offer demo accounts? |

| A 4: | Yes. |

| Q 5: | What is the minimum deposit for RIF-CAPITAL? |

| A 5: | The minimum initial deposit to open an account is $100. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

天眼交易商

熱點資訊

澳洲ASIC監管升級:管理牌照更便捷,糾正券商更及時!

勿因利小而不為,勿因損大而持之

SkylineInvesthub疑似免洗詐騙站!英國FCA示警無牌經營,投資人慎防高風險陷阱

Fxcess遭控操縱交易、惡意爆倉!平台詐騙風險高,建議投資人盡速遠離

近期備受關注的券商TrioMarkets安全可靠嗎?這些優缺點你該知道!

匯率計算