IFX Brokers 7981454865

摘要:IFX Brokers is a South Africa-registered forex broker that offers a range of trading instruments, including forex pairs, commodities, stocks, indices, and cryptocurrencies. The company provides various account types to cater to traders of different experience levels and preferences. Traders can choose between the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for their trading activities. With a low minimum initial deposit requirement and options for Islamic accounts, IFX Brokers aims to provide accessibility and flexibility to traders. However, it is important to note that the company currently operates without effective regulation, which may be a consideration for potential traders.

| Registered in | South Africa |

| Regulated by | No effective regulation at this time |

| Year(s) of establishment | 2-5 years |

| Trading instruments | Forex pairs, commodities, stocks, indices, cryptos |

| Minimum Initial Deposit | $10 |

| Maximum Leverage | 1:500 |

| Minimum spread | Information not available |

| Trading platform | MT4, MT5 |

| Deposit and withdrawal method | Payfast, VISA, OZOW, MasterCard, wire transfer, bitcoin, skrill, neteller and other cryptos |

| Customer Service | Email, phone number, address, live chat |

| Fraud Complaints Exposure | Yes |

| Negative balance protection | Yes |

It is important to note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

Pros and cons of IFX Brokers

Pros of IFX Brokers:

1. Diverse range of trading instruments: IFX Brokers offers a wide selection of trading instruments, including forex pairs, commodities, stocks, indices, and cryptocurrencies. Traders have the opportunity to diversify their portfolios and explore various market opportunities.

2. Multiple account types: IFX Brokers provides different account types, catering to traders of various experience levels and preferences. From the beginner-friendly IFX Cent account to the advanced IFX VIP account, traders can choose an account that aligns with their trading needs.

3. Access to popular trading platforms: The availability of both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms gives traders a choice in selecting a platform that suits their trading strategies and preferences.

4. Low minimum initial deposit: With a minimum initial deposit requirement as low as USD $10 for some account types, IFX Brokers offers accessibility to traders with different budget sizes.

5. Islamic account option: IFX Brokers offers an Islamic account that is swap-free and compliant with Islamic principles, allowing Muslim traders to participate in the financial markets without accruing interest.

6. Instant deposits and fast withdrawals: IFX Brokers facilitates convenient and timely fund transfers, offering instant deposits with zero fees for many deposit methods. Withdrawals for South African clients are typically processed within 2-4 hours.

Cons of IFX Brokers:

1. Lack of effective regulation: IFX Brokers operates without effective regulation at this time, which may raise concerns for some traders who prioritize trading with regulated entities.

2. Limited information on spreads and commissions: The lack of transparency regarding spreads, commissions, and other costs makes it difficult for traders to evaluate the overall cost of trading with IFX Brokers.

3. Limited customer support hours: The customer support provided by IFX Brokers is available during specific hours, which may limit immediate assistance for traders in different time zones or those requiring support outside of the designated hours.

4. Unknown trading conditions: Without detailed information on spreads, commissions, and other trading conditions, traders may find it challenging to assess the competitiveness of IFX Brokers' offerings compared to other brokers.

What type of broker is IFX Brokers?

| Advantages | Disadvantages |

| IFX Brokers offers tight spreads and fast execution due to its Market Making model. | As a counterparty to its clients' trades, IFX Brokers has a potential conflict of interest that may lead to decisions that are not in the best interest of its clients. |

IFX Brokers is a Market Making (MM) broker, which means that it acts as a counterparty to its clients in trading operations. That is, instead of connecting directly to the market, IFX Brokers acts as an intermediary and takes the opposite position to its clients. As such, it can offer faster order execution speed, tighter spreads and greater flexibility in terms of the leverage offered. However, this also means that IFX Brokers has a certain conflict of interest with their clients, as their profits come from the difference between the bid and ask price of assets, which could lead to them making decisions that are not necessarily in the best interests of their clients. It is important for traders to be aware of this dynamic when trading with IFX Brokers or any other MM broker.

General information and regulation of IFX Brokers

IFX Brokers is a South Africa-registered forex broker that offers a range of trading instruments, including forex pairs, commodities, stocks, indices, and cryptocurrencies. The company provides various account types to cater to traders of different experience levels and preferences. Traders can choose between the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for their trading activities. With a low minimum initial deposit requirement and options for Islamic accounts, IFX Brokers aims to provide accessibility and flexibility to traders. However, it is important to note that the company currently operates without effective regulation, which may be a consideration for potential traders.

In the following article, we will analyze the characteristics of this broker in all its dimensions, providing you with easy and well-organized information. If you are interested, read on.

Market instruments

| Advantages | Disadvantages |

| Diverse Market Exposure | Market Volatility |

| Opportunity for Hedging | Complex Market Analysis |

| Access to Global Markets | Regulatory Risks |

| Potential for High Returns | Trading Risk |

| Liquidity and Accessibility | Potential for Losses |

IFX Brokers offers a wide range of trading instruments, covering over 200 options including forex pairs, commodities, stocks, indices, and cryptocurrencies. This diverse selection of instruments provides traders with various opportunities to explore different markets and diversify their portfolios. By offering forex pairs, traders can engage in the largest financial market globally, enjoying high liquidity and potential for profits. Commodities allow traders to access popular assets like gold, oil, and agricultural products, enabling them to benefit from price movements in these markets. Stocks and indices provide exposure to specific industries and markets, allowing traders to capitalize on the performance of individual companies or broader market trends. Cryptocurrencies offer opportunities to participate in the rapidly growing digital currency market. While these instruments present advantages such as diverse market exposure, hedging opportunities, and potential for high returns, they also carry risks such as market volatility, complex analysis requirements, and regulatory uncertainties. Traders should be mindful of these factors and employ appropriate risk management strategies when trading these instruments.

Spreads and commissions for trading with IFX Brokers

| Advantages | Disadvantages |

| Unknown Spreads | Lack of Transparency |

| Unknown Commissions | Difficulty in Cost Assessment |

| Potential Competitive Pricing | Uncertainty in Trading Costs |

| Flexible Cost Structures | Limited Information for Decision Making |

One of the limitations of the information provided is the lack of clarity regarding spreads, commissions, and other costs associated with trading at IFX Brokers. While the advantages of this dimension are that there may be potential for competitive pricing and flexible cost structures, the main disadvantage is the lack of transparency and available information. Without knowing the specific spreads and commissions, traders may find it challenging to accurately assess the costs associated with their trades and make informed decisions. Transparent pricing is crucial for traders to understand and manage their trading expenses effectively. Additionally, the absence of detailed information on costs may result in uncertainty and hinder the ability to compare IFX Brokers with other brokers in terms of trading expenses. Therefore, traders should consider these limitations and evaluate whether the unknown spreads, commissions, and other costs align with their trading strategies and preferences.

Trading accounts available in IFX Brokers

| Advantages | Disadvantages |

| Multiple Account Options | Trading Bonus Limitations |

| Flexible Deposit Amounts | Higher Deposit Requirements |

| Choice of MT4 and MT5 | Account Type Limitations |

| Islamic Account Option | Limited to MT5 for Cent Account |

| High Leverage Options | Limited Access to VIP Account |

IFX Brokers offers a variety of trading account types to cater to different trader preferences and needs. The IFX Standard account allows traders to start with a minimum deposit of just $10, providing access to all markets and the choice of using the popular MT4 or MT5 platforms. Traders can also opt for the IFX Premium account with a higher opening deposit of $250, which offers attractive trading conditions without a trading bonus. For traders looking for enhanced trading features, the IFX VIP account is available with a minimum deposit of $1000, providing access to raw spreads, competitive commission structures, and the best trading conditions. The IFX Islamic account is a swap-free account that eliminates swap charges for positions held overnight, making it suitable for traders adhering to Islamic principles. Additionally, the IFX Cent account is designed for beginners, allowing them to trade with real funds at lower risk. Each account type offers advantages such as multiple options, flexible deposit amounts, and the availability of MT4 and MT5 platforms. However, there are certain limitations to consider, such as trading bonus restrictions, higher deposit requirements for certain accounts, and specific platform limitations for the Cent account. Traders should carefully evaluate their trading preferences and requirements before selecting an account type that aligns with their goals and strategies.

Trading platform(s) that IFX Brokers offers

| Advantages | Disadvantages |

| Popular and widely used platforms | Limited customization options |

| Advanced charting and analysis tools | Steep learning curve for beginners |

| Support for automated trading and expert advisors | Higher system requirements |

| Wide range of indicators and technical tools | Potential for platform instability |

| Compatibility with various operating systems | Limited integration with third-party platforms |

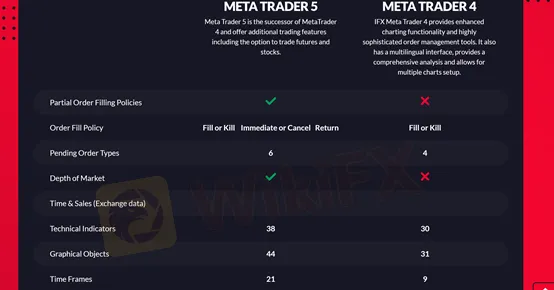

MT4 and MT5 are popular and widely used trading platforms offered by IFX Brokers. They provide a range of advantages to traders, such as advanced charting and analysis tools, support for automated trading through expert advisors, and a wide selection of indicators and technical tools for comprehensive market analysis. These platforms are also compatible with various operating systems, allowing traders to access their accounts from different devices. However, there are certain limitations to consider. Customization options are relatively limited compared to some other platforms, which may not cater to traders with specific preferences. Additionally, beginners may find the learning curve steep when first starting with MT4 or MT5 due to their extensive features and functionalities. Furthermore, these platforms require higher system requirements, which could be a drawback for traders with older or less powerful devices. Lastly, while rare, there is a potential for platform instability, which may disrupt trading activities. Overall, MT4 and MT5 offer a robust set of features but traders should evaluate their individual needs and consider these advantages and disadvantages when choosing a trading platform.

Maximum leverage of IFX Brokers

| Advantages | Disadvantages |

| Higher potential for profit | Increased risk of losses |

| Ability to control larger positions | Magnifies the impact of market fluctuations |

| Flexibility in trading strategies | Requires proper risk management |

| Opportunity to diversify trading portfolio | Limited suitability for inexperienced traders |

| Potential for higher returns on investment | Increased margin requirements |

The maximum leverage of up to 1:500 offered by IFX Brokers provides traders with several advantages. Firstly, it allows for higher potential profits as traders can control larger positions in the market with a relatively smaller amount of capital. This flexibility in trading size enables traders to take advantage of various market opportunities. Additionally, high leverage offers the opportunity to diversify a trading portfolio by allocating smaller portions of capital to multiple positions. This can help spread risk and potentially enhance overall returns on investment. However, it's important to consider the disadvantages as well. Higher leverage significantly increases the risk of losses, as even small market fluctuations can have a magnified impact on the trading account. Traders need to exercise proper risk management techniques and have a thorough understanding of leverage before engaging in high leverage trading. Furthermore, inexperienced traders may find it challenging to manage the increased margin requirements and handle the potential risks associated with high leverage trading. It is crucial to assess individual risk tolerance and trading experience when utilizing maximum leverage offered by IFX Brokers.

Deposit and Withdrawal: methods and fees

| Advantages | Disadvantages |

| Instant deposits for quick trading access | Withdrawal processing time for international clients |

| No deposit fees, reducing transaction costs | Withdrawal processing time for South African clients |

| Wide variety of funding options | Funds deposited only in the bank account aligned with IFX trading account |

| Convenient 24/7 availability | Potential delays in bank transfers (24-48 business hours) |

| Fast withdrawals for South African clients | |

| Multiple currency options for trading accounts |

Deposits and withdrawals at IFX Brokers offer several advantages to traders. Firstly, instant deposits allow for quick access to funds, enabling traders to start trading without delay. Moreover, the absence of deposit fees reduces transaction costs, allowing traders to allocate their funds more efficiently. IFX Brokers provides a wide variety of funding options, catering to different preferences and needs. The convenience of 24/7 availability ensures that traders can deposit or withdraw funds at any time, enhancing flexibility and accessibility. Fast withdrawals for South African clients within 2-4 hours further add to the positive experience. Additionally, IFX Brokers supports multiple currency options for trading accounts, accommodating traders who prefer to trade in currencies other than the local ZAR.

However, there are a few disadvantages to consider. Withdrawal processing time for international clients can take up to 5 working days to reach their bank accounts, potentially causing delays in accessing funds. Similarly, South African clients may also experience longer withdrawal processing times compared to their quick deposit processing. It's important to note that funds can only be deposited into the bank account aligned with the IFX trading account due to third-party regulations. Additionally, bank transfers may have a processing time of 24-48 business hours, which may result in potential delays in fund transfers. Traders should be mindful of these factors when managing their deposits and withdrawals with IFX Brokers.

How to deposit

Simply login to your secure Client Area

Instant payment options to get you trading faster

Select your preferred payment option to proceed

How to withdraw

When you wish to undertake a withdrawal, simply login to your myIFXBrokers (Secure client area)

Add your bank account detail for verification (Bank accounts are only verified in banking hours and can take up to 24 business hours to complete)

On approval, you are ready to process your withdrawal

Educational resources in IFX Brokers

| Advantages | Disadvantages |

| Access to economic calendar for informed trading | Limited range of educational resources |

| Trading hours information for market visibility | |

| Opportunity to stay updated with market events | |

| Enhanced understanding of economic indicators | |

| Availability of real-time market data |

IFX Brokers offers a range of educational resources to support traders in their journey. One of the key advantages is access to an economic calendar, which provides valuable information about upcoming economic events, announcements, and data releases. By staying informed about these events, traders can make more informed trading decisions and take advantage of potential market opportunities. Additionally, IFX Brokers provides trading hours information, allowing traders to know the opening and closing times of different markets worldwide. This knowledge is crucial for understanding market liquidity and optimizing trading strategies. The availability of real-time market data further enhances traders' ability to analyze and interpret market trends. While the specific range of educational resources is not specified, these features provide traders with the essential tools to enhance their understanding of the financial markets.

Customer service of IFX Brokers

| Advantages | Disadvantages |

| Dedicated customer support for trading and account-related queries | Limited customer support hours (08:00-16:00 GMT, Monday-Friday) |

| Availability of support via email and support ticket system | No mention of live chat or phone support outside of specific phone number |

| Specialized support for Introducing Brokers | |

| Convenient channels for submitting KYC documentation | |

| Prompt assistance for proof of payments and manual allocations |

IFX Brokers prioritizes customer care and offers various channels for assistance. Traders can reach out to the customer support team via email or by logging a support ticket from the secure client portal, ensuring prompt responses to trading and account-specific enquiries. Additionally, IFX Brokers provides dedicated support for Introducing Brokers, catering to their unique needs and requirements during specific support hours. The company also offers separate channels for submitting KYC documentation and proof of payments, streamlining the process for account verification and manual allocations. While customer support is available via email and the support ticket system, it is important to note that the support hours are limited to 08:00-16:00 GMT from Monday to Friday. However, the availability of specialized support and convenient channels for different inquiries contributes to an overall satisfactory customer care experience.

Conclusion

In conclusion, IFX Brokers is a South Africa-registered forex broker that offers a range of trading instruments and account types to cater to the needs of different traders. With a low minimum initial deposit requirement and the availability of Islamic accounts, the company strives to provide accessibility and flexibility to its clients. The use of popular trading platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5) enhances the trading experience for users. However, it is important to note that IFX Brokers currently operates without effective regulation, which may be a concern for some traders seeking a higher level of oversight and investor protection. Additionally, the lack of transparency regarding spreads, commissions, and other costs is a potential drawback. Nevertheless, the company offers a variety of deposit and withdrawal methods, along with fast processing times, providing convenience to its clients. The availability of educational resources and customer support channels further demonstrates IFX Brokers' commitment to assisting traders. Ultimately, individuals should carefully consider their own trading needs, risk tolerance, and preferences before deciding to engage with IFX Brokers.

Frequently asked questions about IFX Brokers

Question: How can I open a trading account with IFX Brokers?

Answer: To open a trading account with IFX Brokers, you can visit their website and click on the “Open Account” button. Fill in the required information, including personal details and account preferences. Once you submit the form, your account will be created, and you will receive further instructions via email.

Question: What are the available trading platforms at IFX Brokers?

Answer: IFX Brokers offers two popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are renowned for their advanced charting tools, comprehensive analysis capabilities, and user-friendly interfaces. Traders can choose the platform that best suits their trading style and preferences.

Question: What is the minimum initial deposit required to start trading with IFX Brokers?

Answer: IFX Brokers has different account types with varying minimum deposit requirements. The IFX Standard and Islamic accounts have a minimum initial deposit of USD $10, while the IFX Premium account requires a deposit of USD $250. The IFX VIP account has a higher minimum deposit of USD $1000. The IFX Cent account, designed for beginners, also has a minimum deposit of USD $10.

Question: What trading instruments can I access with IFX Brokers?

Answer: IFX Brokers offers a wide range of trading instruments, including forex pairs, commodities, stocks, indices, and cryptocurrencies. Traders can diversify their portfolios and take advantage of various market opportunities across different asset classes.

Question: How can I contact IFX Brokers' customer support?

Answer: IFX Brokers provides multiple channels for customer support. For trading and account-specific enquiries, you can reach out to their support team via email at support@ifxbrokers.com or by logging a support ticket from the secure client portal. Different departments, such as Introducing Brokers support and KYC documentation, have their respective email addresses for specialized inquiries.

Question: Is IFX Brokers regulated?

Answer: IFX Brokers is currently not regulated. As a South Africa-registered company, it operates without effective regulation at this time. It is essential to consider this aspect when making a decision to trade with them.

Question: What deposit and withdrawal methods are available at IFX Brokers?

Answer: IFX Brokers offers a variety of deposit and withdrawal methods, including OZOW, Payfast, MasterCard, Visa, wire transfer, Skrill, Neteller, and various cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Tether (USDT), and XRP. Traders have the flexibility to choose the payment method that suits their preferences and convenience.

天眼交易商

熱點資訊

市場解析:OANDA安達曾以傳承自豪,如今成為 FTMO 收購戰利品

外匯牌價怎麼看?

LION獅子國際遭投資人實名爆料!惡意喊單導致大幅虧損,指控用戶違約拒絕出金

Valetax受模里西斯FSC監管、低點差、高槓桿,獲97%用戶好評

1/20-2/2外匯詐騙高風險平台曝光

Emar Markets安全疑慮大!遭馬來西亞SC示警,多位投資人爆料無法出金

Magic Compass寶匯是否值得信賴?全面解讀平台監管資訊、交易環境、用戶評價、營運概況

匯率計算