DCFX-Overview of Minimum Deposit, Leverage, Spreads

摘要:DCFX is a financial broker registered in Indonesia in 1997. It offers access to a wide range of products, including Forex pairs, Commodities, Shares, Indices, and Cryptocurrencies. It has a minimum deposit requirement of $30, with leverage capped at 1:1000. Additionally, DCFX holds a regulated license from JFX (Indonesia) and possesses three cloned licenses from other regulatory bodies.

Note: DCFXs official website - https://www.dcfx.com/ is currently inaccessible normally.

| DCFX Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Indonesia |

| Regulation | JFX |

| Market Instruments | Forex pairs, Commodities, Shares, Indices, and Cryptocurrencies |

| Demo Account | ✅ |

| Leverage | 1:1000 |

| EUR/USD Spread | From 1.2 pips (Standard account) |

| Trading Platform | MT5 |

| Min Deposit | $30 |

| Customer Support | Live chat |

| Email: cs@dcfx.com | |

| Facebook and YouTube | |

| Physical address: Noble House, Level 38, Unit 38.01, Mega Kuningan No. 2, Jl. Dr. Ide Anak Agung Gde Agung Kav. E 4.2, Kuningan Timur, Setiabudi, Jakarta Selatan, DKI Jakarta - 12950 | |

DCFX is a financial broker registered in Indonesia in 1997. It offers access to a wide range of products, including Forex pairs, Commodities, Shares, Indices, and Cryptocurrencies. It has a minimum deposit requirement of $30, with leverage capped at 1:1000. Additionally, DCFX holds a regulated license from JFX (Indonesia) and possesses three cloned licenses from other regulatory bodies.

Pros and Cons

| Pros | Cons |

| Long history of operation | Unavailable website |

| Regulated by Jakarta Futures Exchange (JFX) | Suspicious clone licenses |

| Various trading choices | Unknown payment options |

| Demo accounts | Limited contact channels |

| Commission-free accounts offered | |

| MT5 support | |

| Low minimum deposit ($30) |

Is DCFX Legit?

DCFX claims to hold four regulatory licenses. However, upon investigation, we found that only one of these licenses is legal and official, while the other three are suspicious clones of other legitimate companies' licenses.

The legitimate license issued by the Jakarta Futures Exchange (JFX) is a retail forex license with the license number SPAB-064/BBJ/04/04.

| Regulated Country | Current Status | Regulated Authority | Regulated Entity | License Type | License Number |

| Regulated | Jakarta Futures Exchange (JFX) | PT DEU CALION FUTURES | Retail Forex License | SPAB-064/BBJ/04/04 |

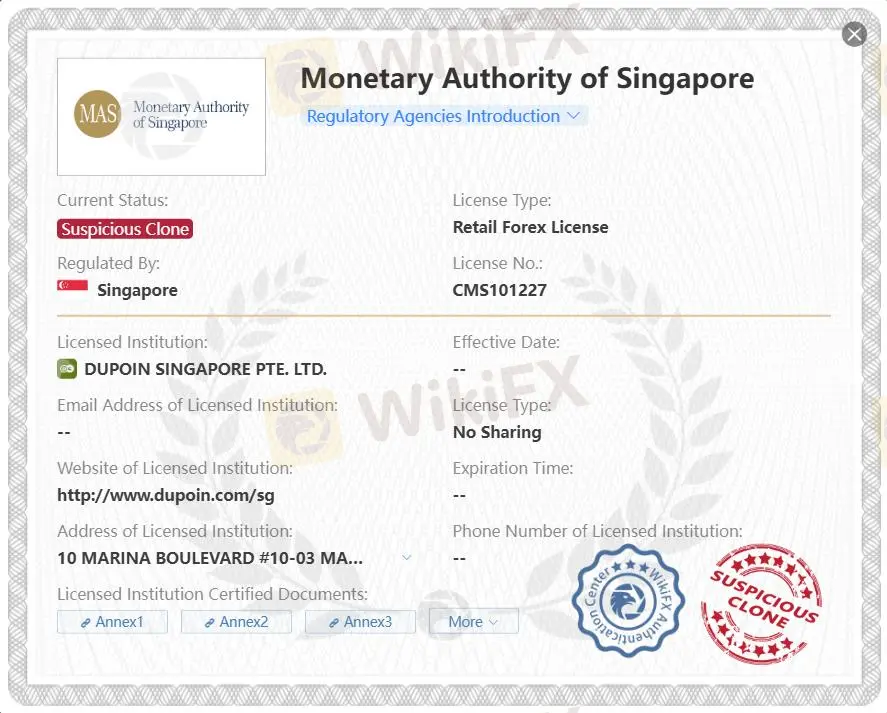

The other three licenses are all cloned from other companies: the Straight Through Processing (STP) license issued by the Financial Conduct Authority is cloned from Dupoin UK Ltd., the Retail Forex License issued by Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan is cloned from PT DUPOIN FUTURES INDONESIA, and the last license from the Monetary Authority of Singapore is cloned from DUPOIN SINGAPORE PTE. LTD.

In conclusion, the regulatory status of DCFX is quite suspicious, and caution should be exercised.

| Regulatory Status | Suspicious Clone |

| Regulated by | Financial Conduct Authority (FCA) |

| Licensed Institution | Dupoin UK Ltd |

| Licensed Type | Straight Through Processing (STP) |

| Licensed Number | 622574 |

| Regulatory Status | Suspicious Clone |

| Regulated by | Badan Pengawas Perdagangan Berjangka Komoditi Kementerian Perdagangan (BAPPEBTI) |

| Licensed Institution | PT DUPOIN FUTURES INDONESIA d/h PT DEU CALION FUTURES d/h PT. KRESNA OPTIMUS FUTURES d/h PT. OPTIMUS GLOBAL BERJANGKA |

| Licensed Type | Retail Forex License |

| Licensed Number | 423/BAPPEBTI/SI/VII/2004 |

| Regulatory Status | Suspicious Clone |

| Regulated by | Monetary Authority of Singapore (MAS) |

| Licensed Institution | DUPOIN SINGAPORE PTE. LTD. |

| Licensed Type | Retail Forex License |

| Licensed Number | CMS101227 |

What Can I Trade on DCFX?

DCFX offers various types of tradable instruments, including stocks, indices, forex, commodities, and cryptocurrencies. DCFX provides opportunities to trade over 25 major and minor currency pairs, commodities like gold and silver, international stocks such as Facebook, Amazon, and Apple, as well as CFDs on Bitcoin, Ethereum, and other leading cryptocurrencies.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Cryptocurrencies | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

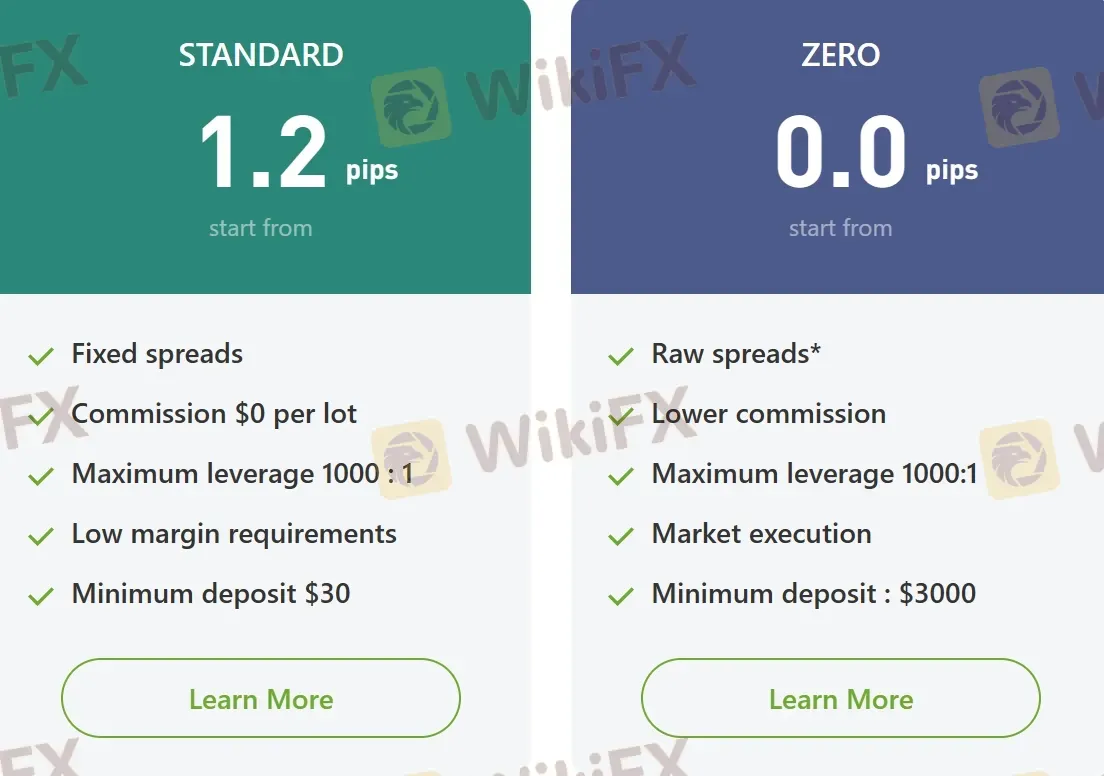

There are two real trading accounts offered by DCFX, namely Standard and Zero accounts. To open a Standard account, you need to fund at least $30. While traders who want to try Zero accounts need to fund at least $3,000. The broker also offers demo accounts.

| Account Type | Min Deposit |

| Standard | $30 |

| Zero | $3,000 |

Leverage

The leverage offered by DCFX is limited to a maximum of 1:1000 for both account types, which is considered quite high and poses a significant risk to you. Many countries have already banned such high levels of leverage due to the associated risks.

Spread and Commission

Spreads are influenced by what type of accounts traders are holding. The Standard account offers spreads from 1.2 pips, with no commissions charged on forex, commodities, and indices, 0.4% per lot on stocks and cryptos trading. The Zero Accounts provides raw spread from 0 pips on forex, with a commission of $7 per lot on forex and commodities, indices, and 0.4% per lot on stock and cryptos trading.

| Account Type | Spread | Commission (forex/commodities/indices) | Commission (stocks/cryptos) |

| Standard | From 1.2 pips | ❌ | 0.4% per lot |

| Zero | From 0 pips | $7 per lot |

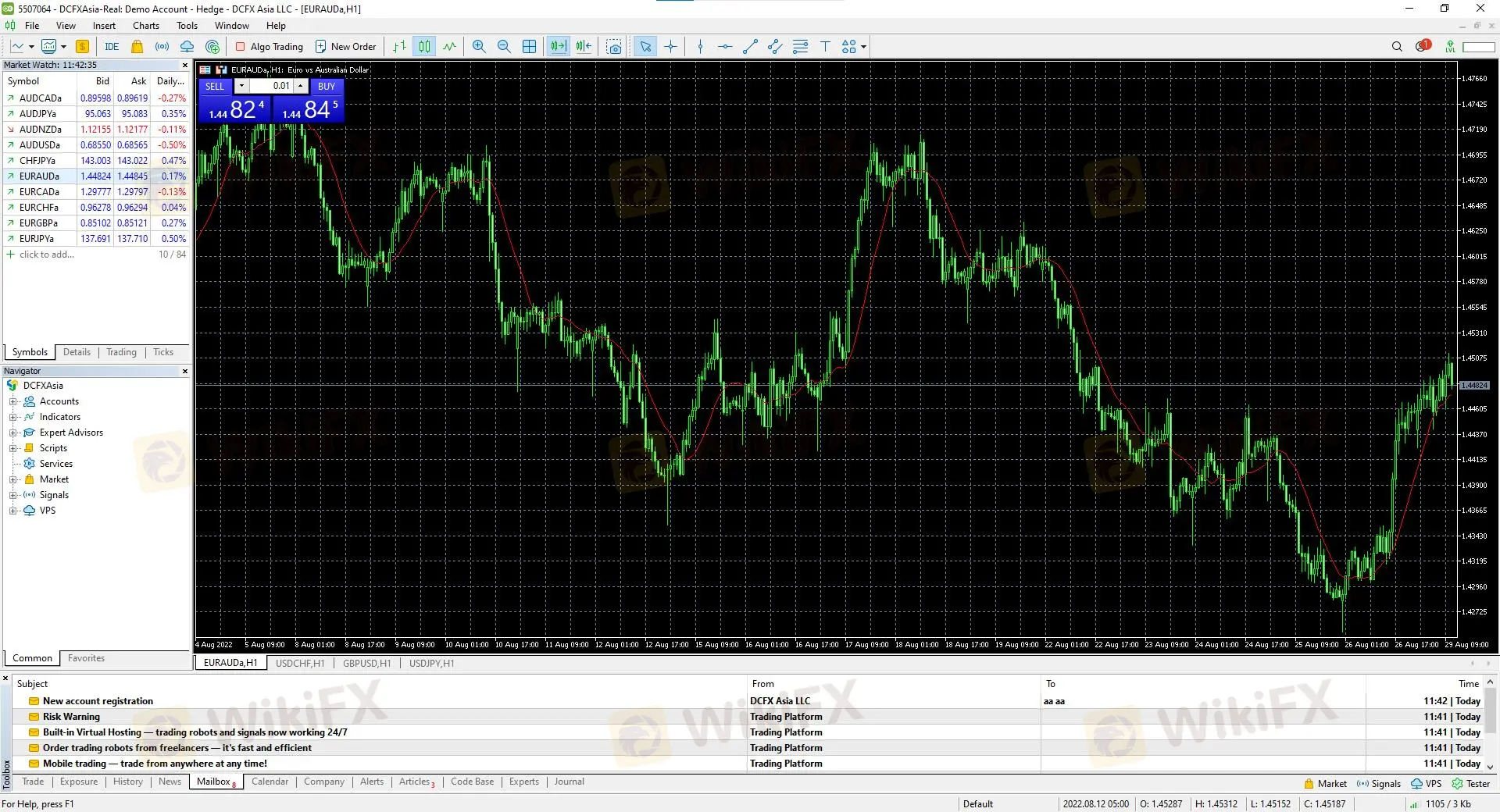

Trading Platform

When it comes to trading platforms available, DCFX gives traders two choices: DCFX Mobile App and MetaTrader5. The MT5 is known as the most successful, efficient, and competent forex trading software, offering automated trading through the use of Expert Advisors and a selection of order types, allowing traders to execute trades on different financial markets through a single account and there is a hedging option. While with the mobile app, trading can be done on the go through the right terminals.

| Trading Platform | Supported | Available Devices | Suitable for |

| DCFX Mobile App | ✔ | Mobile | / |

| MT5 | ✔ | Web | Experienced traders |

| MT4 | ❌ | / | Beginners |

相關交易商

相關閱讀

殺死MT4,邁達克強推MT5的“帝國”隱憂!

无论你选择哪个平台,喜欢交易什么品种,都离不开MT4平台的支持。而诞生近20年之后,随着MT5的出现,MT4的命运和迈达克的前程,正在经历一次深刻的变革。

Daily Market Recap - Bitcoin continues to attract attention

Denigrated by its opponents for its volatility and speculative nature, Bitcoin, which keeps breaking records, can have its uses within a multi-asset portfolio, says Robeco.

Daily Market Recap - Bitcoin Reaches All Time High Above 50,000 USD

Bitcoin, the world's largest cryptocurrency, has been booming since the end of 2020, with BTCUSD showing no signs of slowing down on the charts.

Daily Market Recap - Tesla's Bitcoin Purchases Leaked On Reddit A Month Before They Were Made Official

A member of the Reddit community posing as a developer at Tesla revealed a month ago that the Californian company had started buying bitcoin.

天眼交易商

熱點資訊

澳洲ASIC監管升級:管理牌照更便捷,糾正券商更及時!

勿因利小而不為,勿因損大而持之

SkylineInvesthub疑似免洗詐騙站!英國FCA示警無牌經營,投資人慎防高風險陷阱

Fxcess遭控操縱交易、惡意爆倉!平台詐騙風險高,建議投資人盡速遠離

近期備受關注的券商TrioMarkets安全可靠嗎?這些優缺點你該知道!

匯率計算