BANKINTER

摘要:BANKINTER is a financial services platform founded in 1999, registered in Spain. It offers access to a range of market instruments, including actions (stocks), ETFs, derivatives, listed securities, fixed income products, and credit operations. In addition to trading services, BANKINTER provides banking solutions such as Smart Digital Accounts and Interest-Bearing Salary Accounts. The platform operates without regulatory oversight.

| BANKINTERReview Summary | |

| Founded | 1999 |

| Registered Country/Region | Spain |

| Regulation | No regulation |

| Market Instruments | Actions, ETFs, Derivatives, Fixed Income, Listed Securities, Credit Operations |

| Demo Account | / |

| Leverage | / |

| Spread | / |

| Trading Platform | Web Broker, Graphic Broker, Plus Broker, Bankinter APP |

| Minimum Deposit | / |

| Customer Support | Contact Form |

| Email: incidencias_sac.bankinter@bankinter.com | |

| Phone: 900 80 20 81 | |

| Social Media: Instagram, YouTube, Facebook, LinkedIn, Telegram, Twitter, TikTok | |

| Address: C/ Pico San Pedro, 1. 28760 Tres Cantos (Madrid) | |

BANKINTER Information

BANKINTER is a financial services platform founded in 1999, registered in Spain. It offers access to a range of market instruments, including actions (stocks), ETFs, derivatives, listed securities, fixed income products, and credit operations. In addition to trading services, BANKINTER provides banking solutions such as Smart Digital Accounts and Interest-Bearing Salary Accounts. The platform operates without regulatory oversight.

Pros & Cons

| Pros | Cons |

| Multiple customer support channels | Not regulated |

| Various tradable products | |

| Long operation history | |

| Four trading platforms |

Is BANKINTER Legit?

BANKINTER operates as an unregulated platform. Trading activities on this platform may not be safe for you.

What Can I Trade on BANKINTER?

BANKINTER's investment products include Actions, ETFs, Derivatives, Fixed income, Listed Securities, and Credit Operations.

| Tradable Instruments | Supported |

| Actions | ✔ |

| Derivatives | ✔ |

| Listed Securities | ✔ |

| Fixed Income | ✔ |

| Credit Operations | ✔ |

| ETFs | ✔ |

Account Types

BANKINTER offers two types of accounts, neither of which requires a maintenance fee.

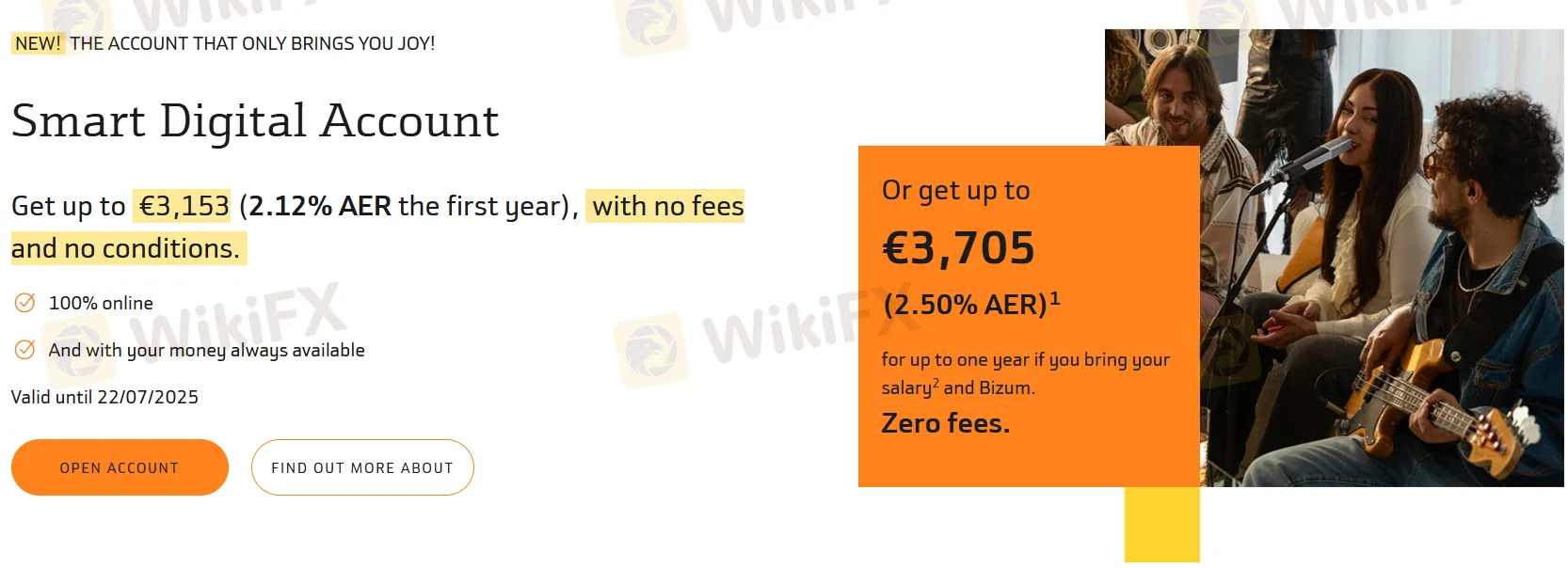

One account is a Smart Digital Account with the following key features:

Interest Rates:

- Up to €3,153 (2.12% Annual Equivalent Rate (AER) for the first year), with no fees and no conditions.

- Alternatively, up to €3,705 (2.50% AER) for one year if you bring your salary and use Bizum.

Key Benefits:

- No Fees

- 100% Online

- Money is Always Available

- Valid Until 22/07/2025

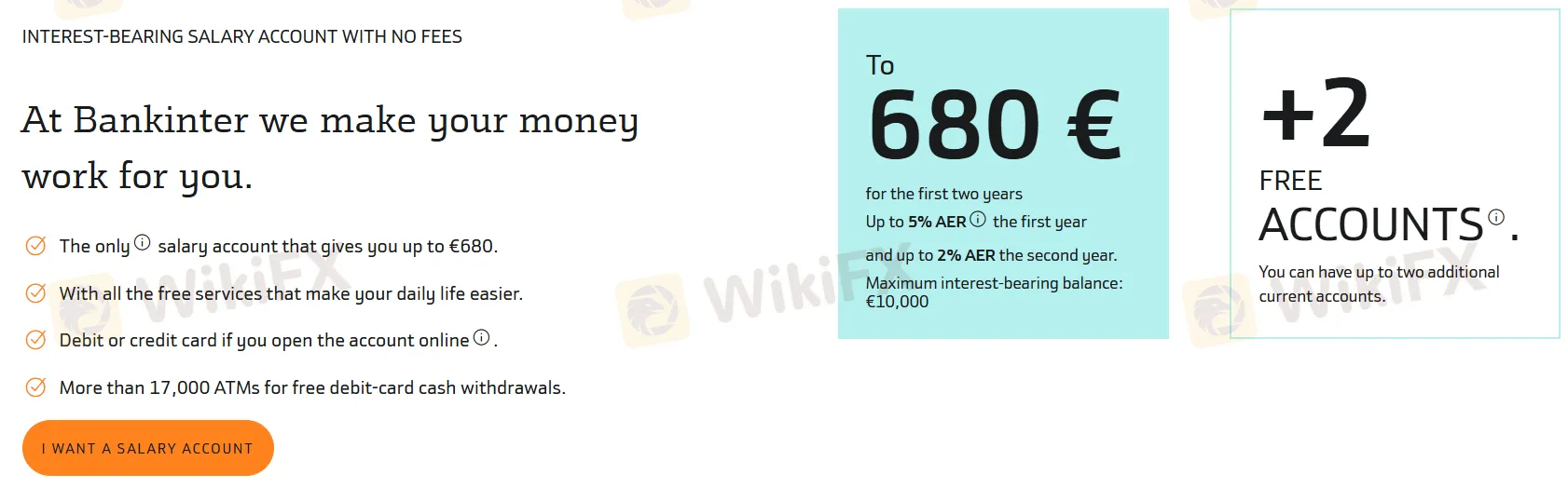

Furthermore, Bankinter offers an Interest-Bearing Salary Account with no fees. Here are the key features:

Interest Rates:

- Up to €680 in Interest: Earn up to €680 over the first two years.

- Year 1: Up to 5% Annual Equivalent Rate (AER).

- Year 2: Up to 2% AER.

- Maximum Interest-Bearing Balance: €10,000.

Key Benefits:

- Free Services

- Debit or Credit Card

- ATM Access

- +2 Free Accounts

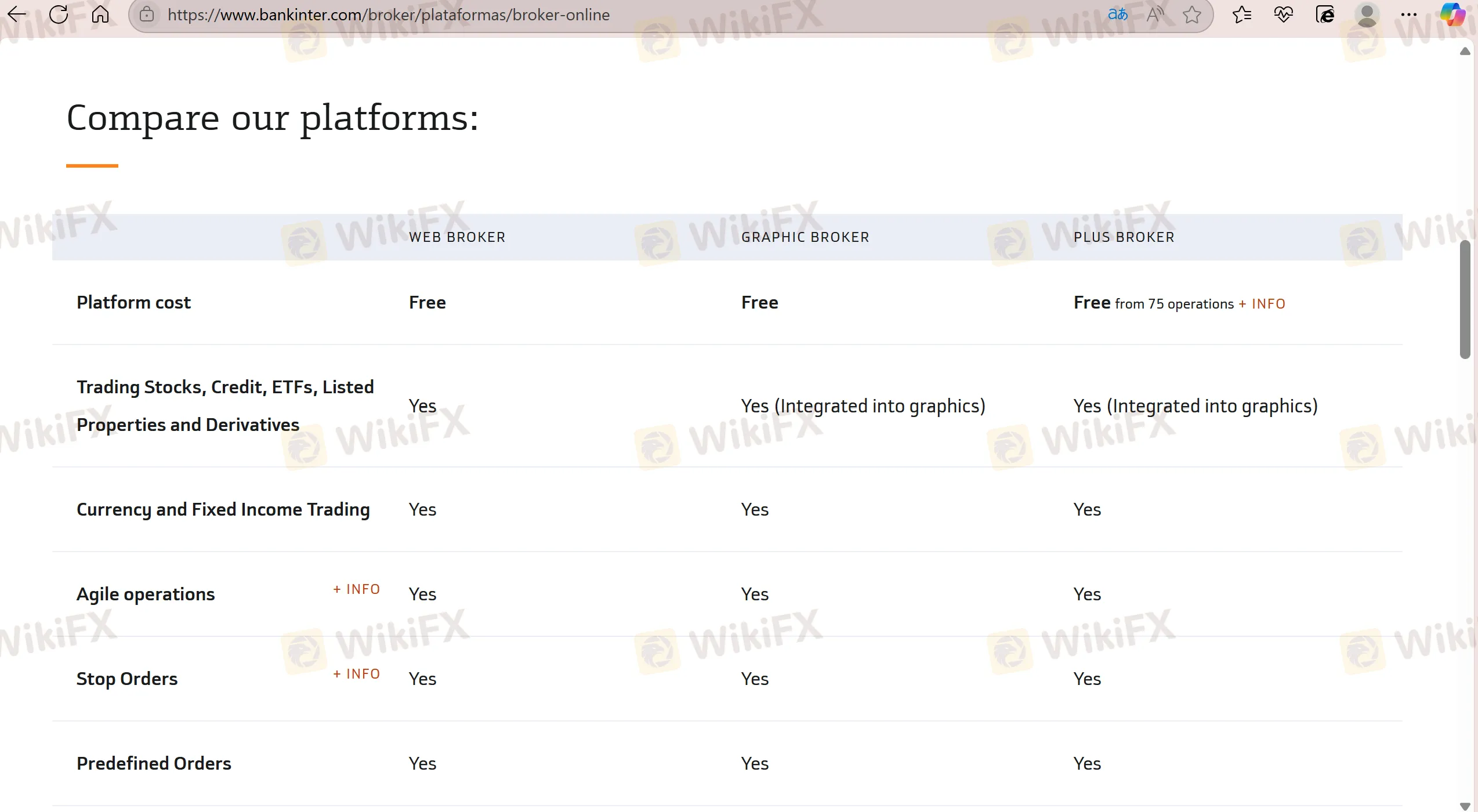

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| Web Broker | ✔ | PC, web | / |

| Graphic Broker | ✔ | PC | / |

| Plus Broker | ✔ | PC | / |

| Bankinter APP | ✔ | Mobile | / |

天眼交易商

热点资讯

WikiEXPO 2025 塞浦路斯站开幕在即!邀您共话交易安全,把握无限商机

外汇投资骗局卷土重来:跨国团伙以合法平台为幌,骗走大马逾590万令吉

“高回酬”投资骗局再现网络平台 马来西亚男子痛失逾26万令吉

高危预警 | BDSWISS“要噶”?出金难、欠工资、监管成谜……你的钱还好吗?

黑客劫持证券账户专买中国股票图啥?乐天证券频发系统故障

汇率计算