ACU Bullion-1069179172

摘要:ACU Bullion Limited is a member of the Hong Kong Gold Exchange (HKGX) (Member No. 015), mainly providing precious metal margin trading and gold bar retail services. The company offers clients 24-hour online trading services and technical support, with its business covering spot gold, silver, and other varieties. It supports the international MT5 trading platform and has compliant industry qualifications.

| ACUReview Summary | |

| Registered | 2020 |

| Registered Country/Region | Hong Kong |

| Regulation | HKGX |

| Market Instruments | Gold, Silver |

| Demo Account | / |

| Leverage | Up to 1:100 |

| Spread | Gold: $0.50; Silver: $0.05 |

| Trading Platform | MT5 |

| Minimum Deposit | / |

| Customer Support | Tel: (852)2808 0003 |

| Fax: 3114 7474 | |

| Email: info@acughk.com | |

| Address: Room 1-10, 1st Floor, ACU Building, 88 Bonham East Street, Sheung Wan, Hong Kong | |

ACU Information

ACU Bullion Limited is a member of the Hong Kong Gold Exchange (HKGX) (Member No. 015), mainly providing precious metal margin trading and gold bar retail services. The company offers clients 24-hour online trading services and technical support, with its business covering spot gold, silver, and other varieties. It supports the international MT5 trading platform and has compliant industry qualifications.

Pros and Cons

| Pros | Cons |

| Regulated | No MT4 |

| MT5 available | Inactive account fee |

| Hedging position margin as low as 1% | Withdrawal service fee of $5 |

| 24-hour online service | Limited payment options |

Is ACU Legit?

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Hong Kong Gold Exchange (HKGX) | Regulated | 亞數金業有限公司 | China (Hong Kong) | Type AA License | 015 |

What Can I Trade on ACU?

| Tradable Instruments | Supported |

| Gold | ✔ |

| Silver | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Bonds | ❌ |

| Mutual Funds | ❌ |

Account Type

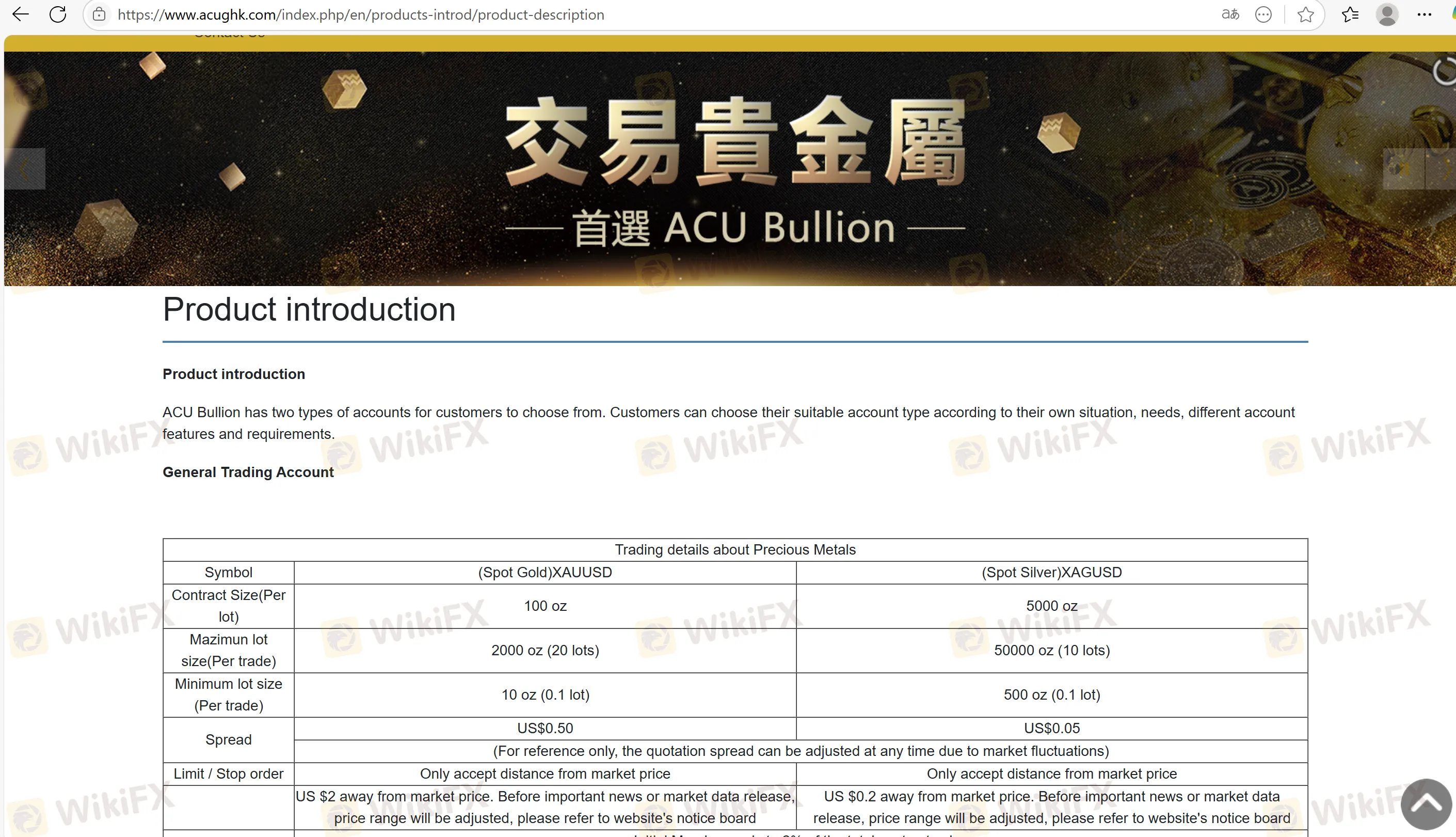

ACU provides a General Trading Account.

| Symbol | (Spot Gold)XAUUSD | (Spot Silver)XAGUSD |

| Contract Size(Per lot) | 100 oz | 5000 oz |

| Mazimun lot size(Per trade) | 2000 oz (20 lots) | 50000 oz (10 lots) |

| Minimum lot size (Per trade) | 10 oz (0.1 lot) | 500 oz (0.1 lot) |

| Spread | $0.50 | $0.05 |

| (For reference only, the quotation spread can be adjusted at any time due to market fluctuations.) | ||

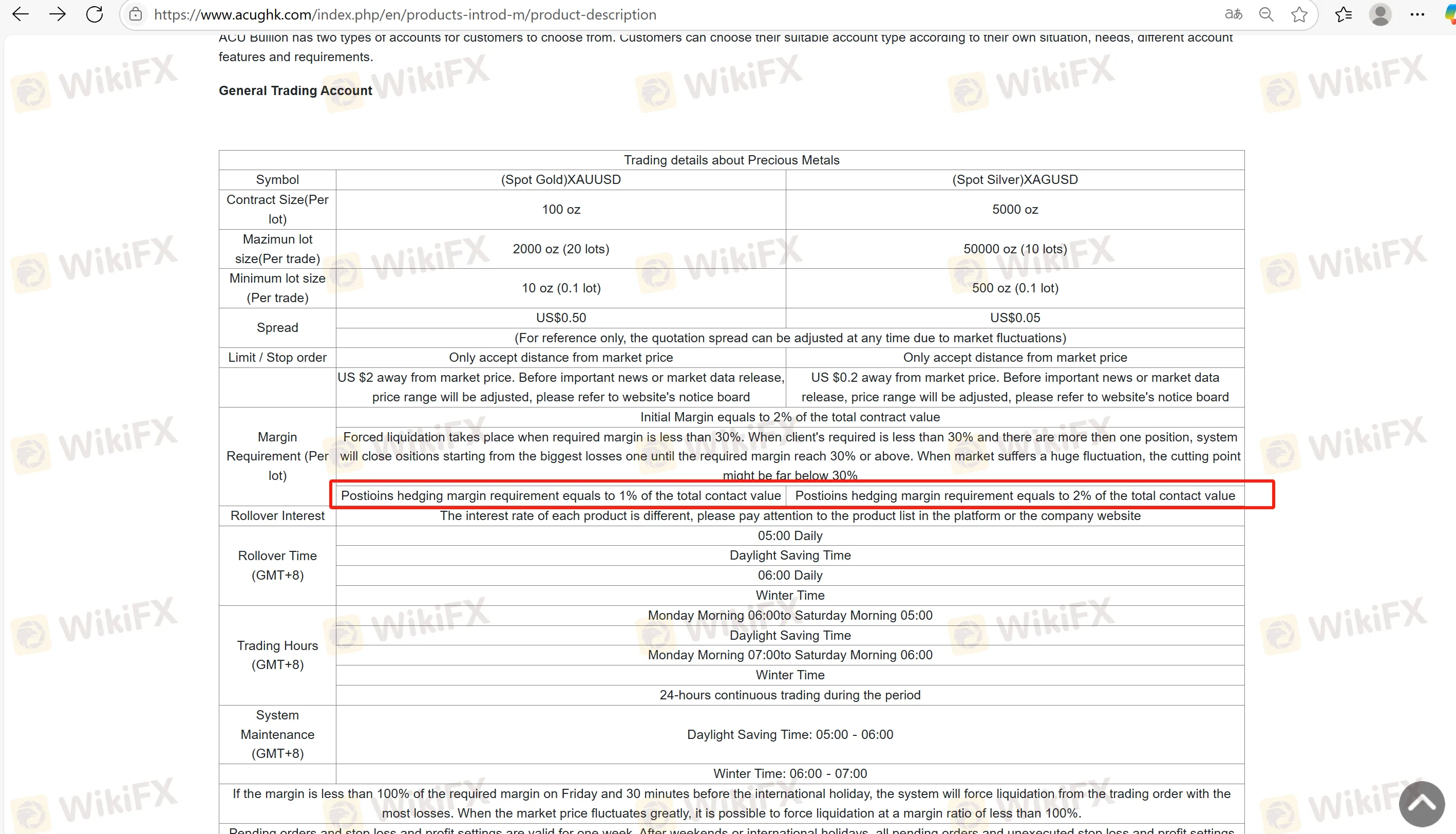

Leverage

ACU adopts a margin trading model, with the leverage ratio implied in the margin requirements:

The initial margin is 2% of the total contract value, equivalent to 50x leverage (1/2% = 50).

The margin for hedging positions is 1% for gold (100x leverage) and 2% for silver (50x leverage).

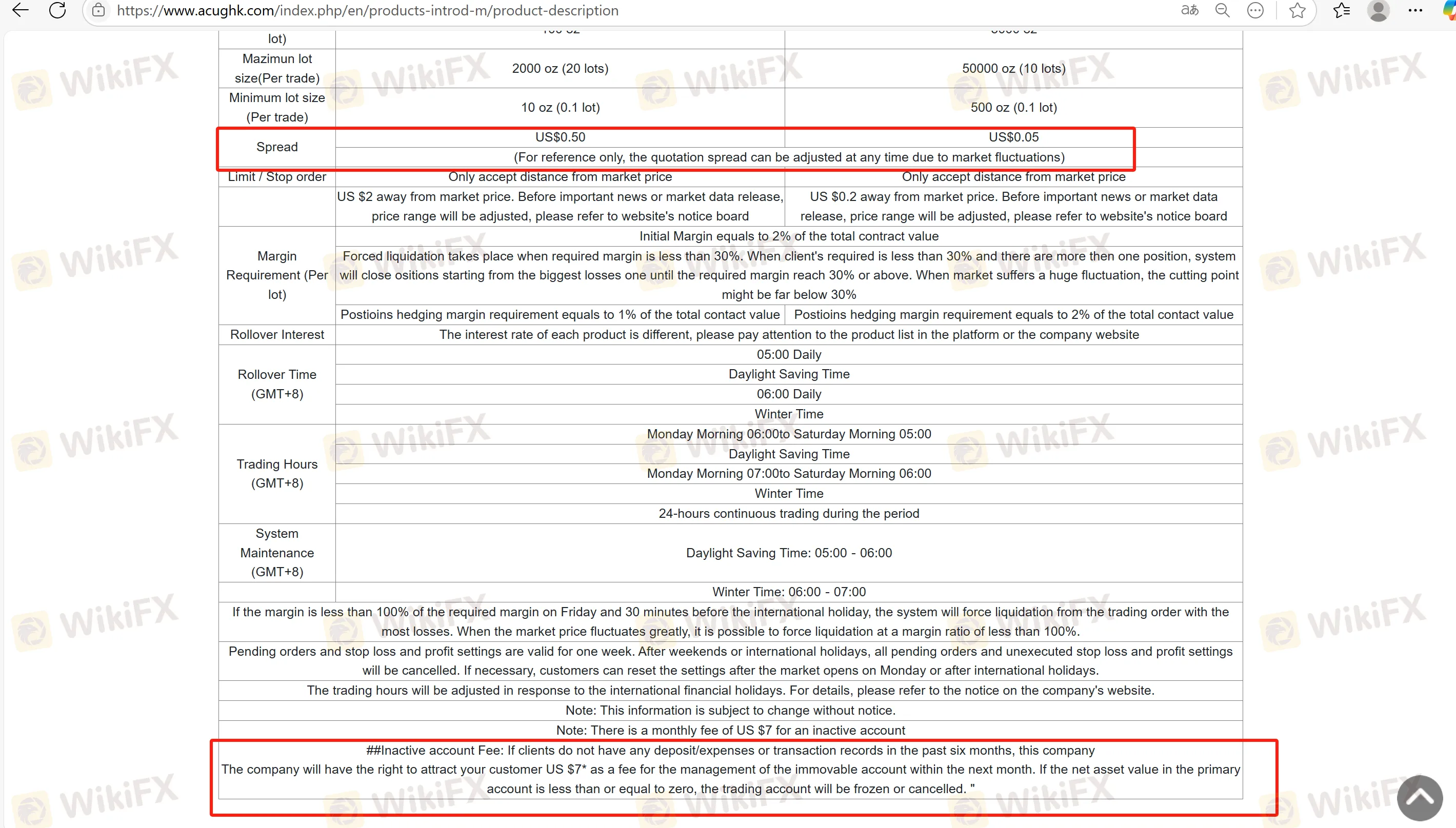

ACU Fees

Trading Fees:

Spread: $0.5 per ounce for gold, $0.05 per ounce for silver (subject to adjustment during market fluctuations).

Overnight Interest: Calculated based on contract value, interest rate, and holding days (formula: opening price × contract unit × lot size × interest rate × 1/360), with the interest rate varying according to market conditions.

Non-trading Fees:

Inactive Account Fee: $7 per month if there is no trading activity for 6 months; the account will be frozen or closed if net assets ≤ 0.

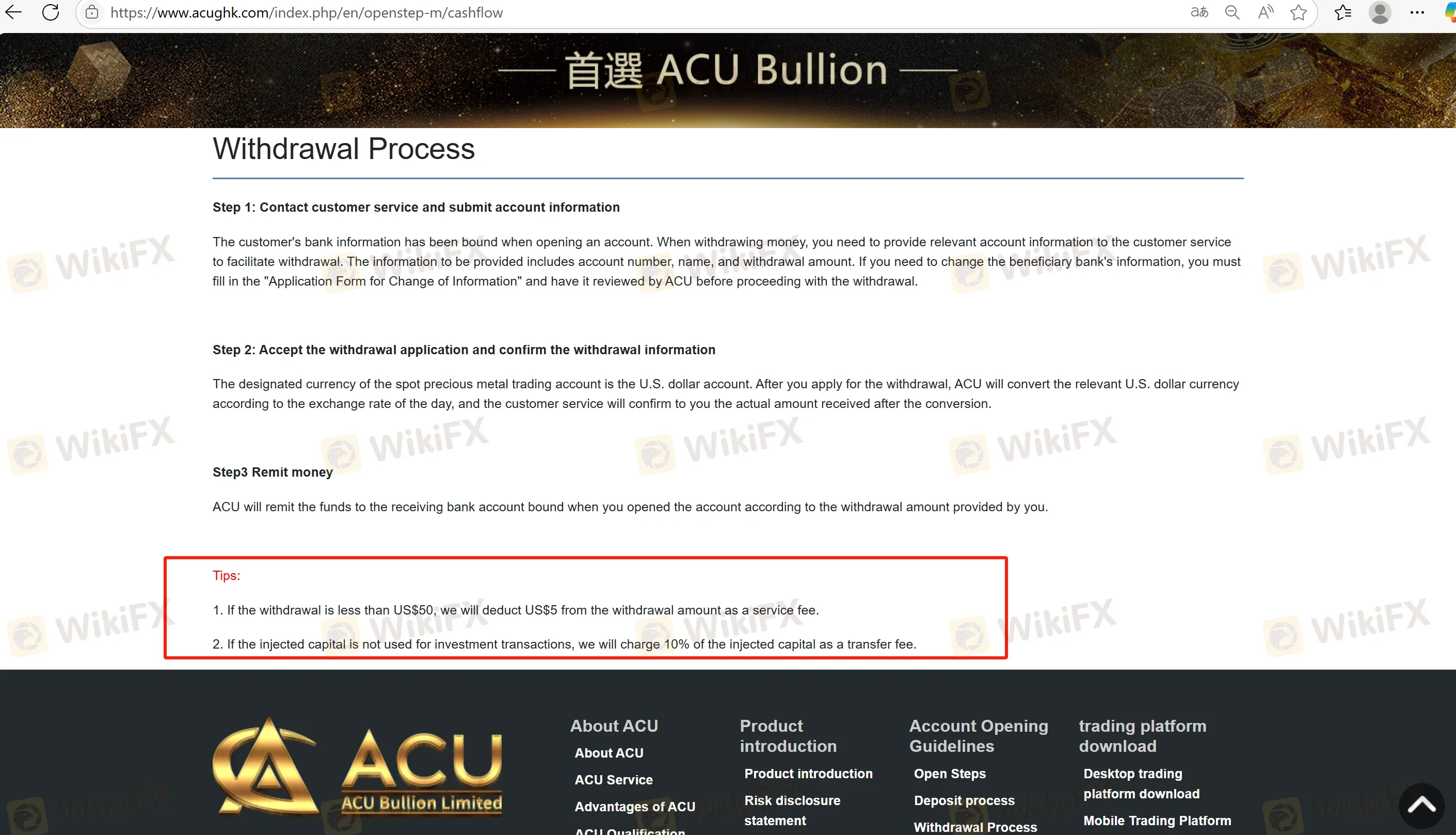

Withdrawal Fee: A $5 service fee is deducted for withdrawals < $50; a 10% transfer fee is charged for withdrawing funds that have not been used for trading.

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT5 | ✔ | Desktop, Mobile | Experienced Traders |

| MT4 | ❌ | / | Beginners |

Deposit and Withdrawal

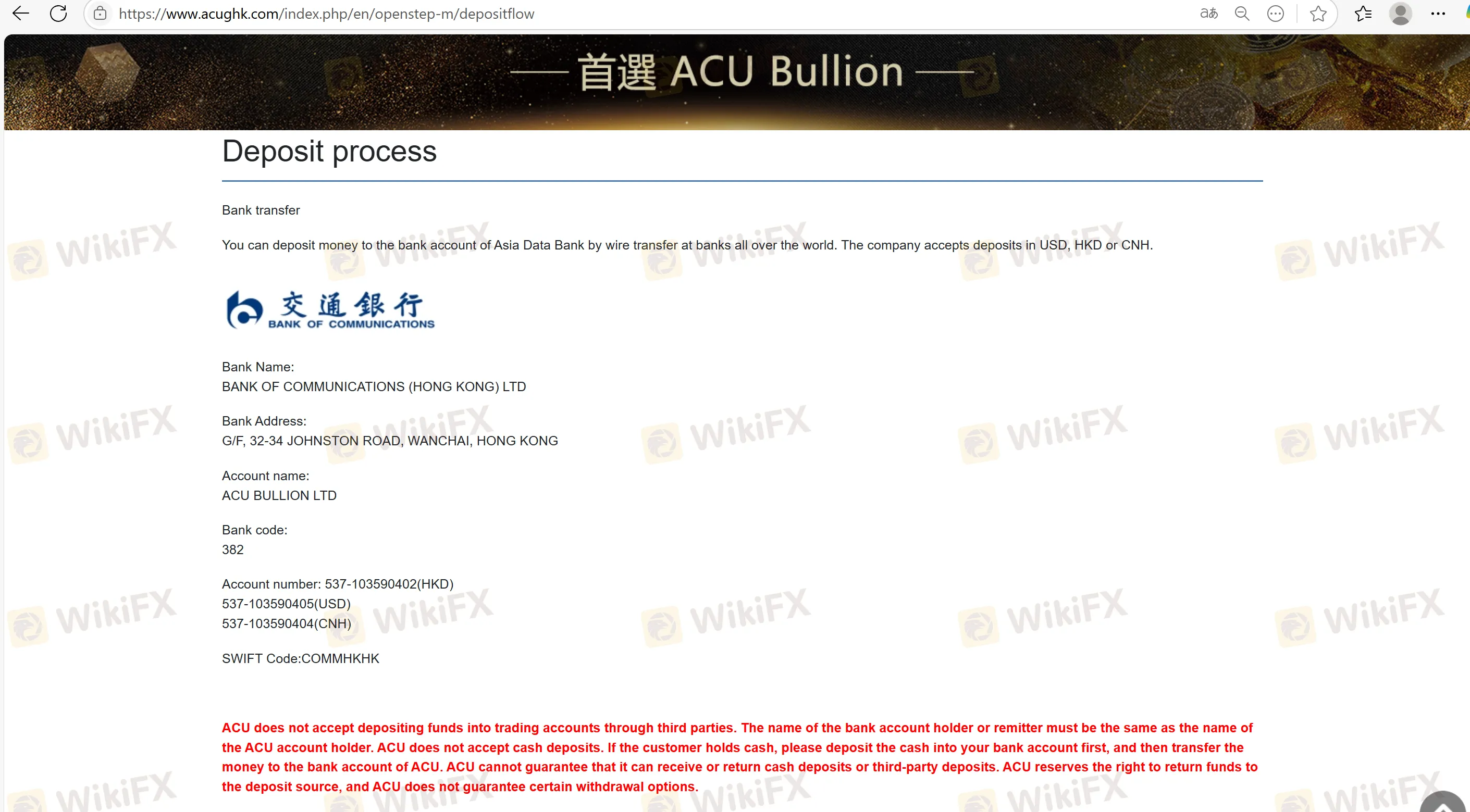

Deposit is only supported via telegraphic transfer to the Bank of Communications (Hong Kong) account. The acceptable currencies are USD, HKD, and CNH, with the account numbers being 537-103590405 (USD), 537-103590402 (HKD), and 537-103590404 (CNH), respectively. The SWIFT Code is COMMHKHK. Third-party deposits are prohibited, and the remitter's name must match the account holder's name. Direct cash deposits are not accepted.

天眼交易商

热点资讯

重磅官宣!EC Markets 成为英超冠军球队利物浦全球官方合作伙伴

灭霸响指|非农王炸、美联储利率核弹 外汇市场即将腥风血雨

出金8次、等了两个月均杳无音讯 离岸监管有什么问题?

外汇投资骗局卷土重来:跨国团伙以合法平台为幌,骗走大马逾590万令吉

“高回酬”投资骗局再现网络平台 马来西亚男子痛失逾26万令吉

炒外汇却被当猴耍 为啥这个国家的平台专门收割中国人?

汇率计算