OW Markets Review 2026: Is this Broker Safe?

Abstract:OW Markets is a Seychelles-regulated entity offering high leverage on MT5, but its low safety score and unresolved complaints about profit deletion raise significant risks. This 2026 assessment highlights critical concerns regarding fund safety and offshore regulatory standards.

Executive Summary

In this in-depth review, we analyze the key metrics and safety profile of OW Markets. The broker was established in 2024 and operates under the jurisdiction of the Seychelles. As an offshore broker entity, it provides access to global markets via the MetaTrader 5 platform. However, despite its modern infrastructure, the entity currently holds a WikiFX score of 4.05 out of 10, reflecting a “C” influence rank and specific concerns regarding client satisfaction and regulatory depth. While the broker offers diverse account types like “ZERO” and “CLASSIC,” our review indicates that caution is necessary due to recent operational friction.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation OW Markets operates under. The broker is authorized by the Seychelles Financial Services Authority (FSA) with license number SD187, registered to One World Markets LTD.

While the firm is legally registered, traders must understand that Seychelles FSA is considered an offshore regulator. Unlike Tier-1 authorities (such as the UK's FCA or Australia's ASIC), offshore regulation often entails looser requirements regarding capital adequacy and client fund segregation. In the event of insolvency, the compensation schemes standard in Europe or Australia are generally not applicable here. Consequently, the regulation status implies a higher risk profile for deposited funds compared to top-tier jurisdictions.

2. Forex Trading Conditions

For traders focusing on Forex instruments, OW Markets offers aggressive trading conditions characterized by high leverage. The “CLASSIC” account provides leverage up to 1:1000, while the “ZERO” account caps it at 1:500. While high leverage can amplify potential gains, it significantly increases the risk of rapid capital loss, especially in volatile Forex markets.

In terms of pricing, the broker attempts to compete with major providers. The “ZERO” account boasts spreads as low as 0 pips, likely with a commission structure, while the “CLASSIC” account starts from 1.6 pips. Does this Forex pricing compete with top-tier providers? While the raw numbers are attractive, the overall trade environment is rated as average, and the lack of robust negative balance protection under offshore rules remains a factor for Forex traders to consider.

3. User Feedback & Complaints

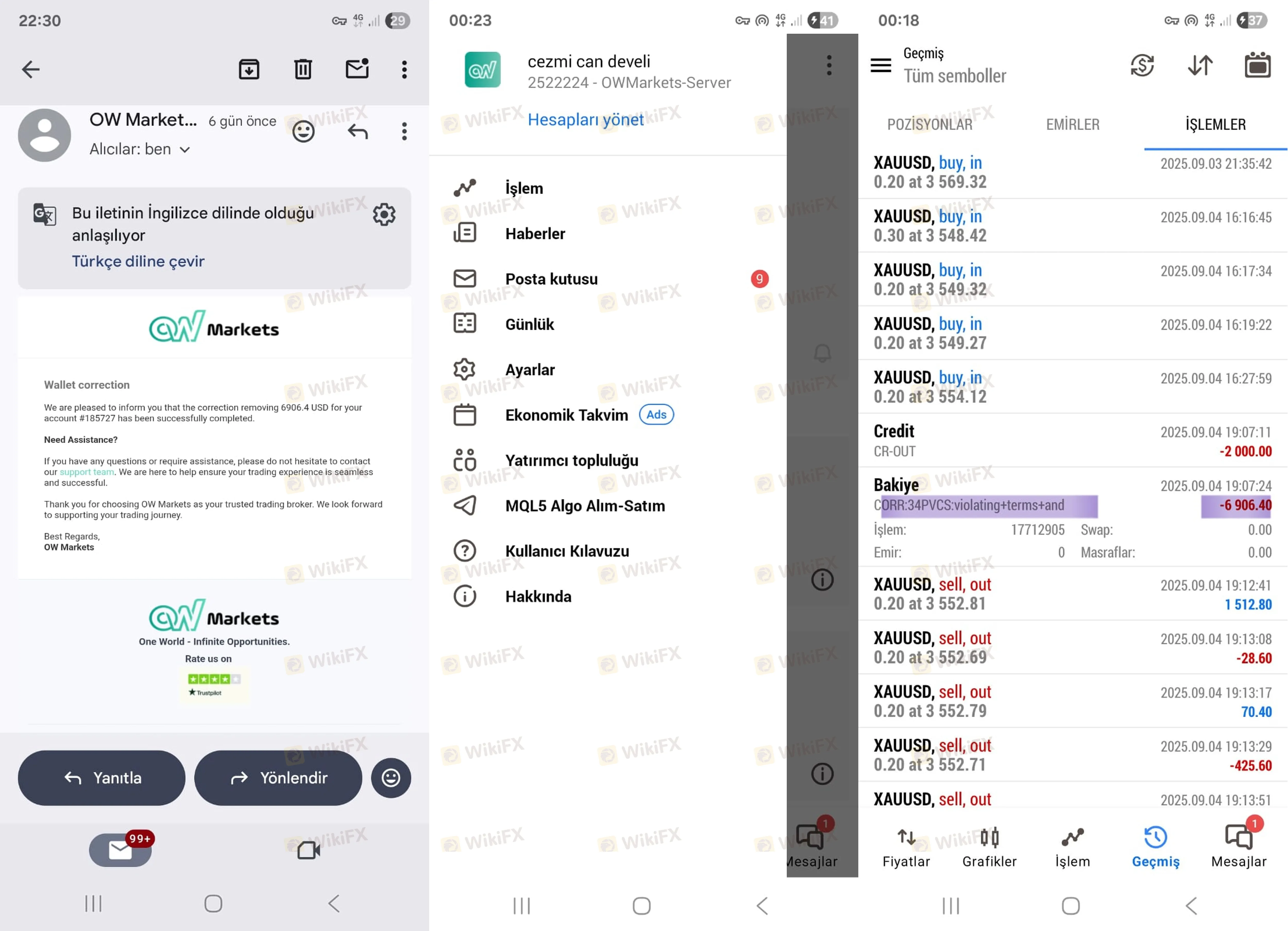

Our analysis of recent user activity highlights concerning patterns. Specifically, in September 2025, verified users from Turkey reported severe issues. One specific case alleged that the broker is a “deceptive organization” after profits totaling $6,906 were reportedly deleted from their MetaTrader 5 account following a withdrawal request.

Such complaints about profit nullification are critical red flags. While the login stability was not the primary complaint, users essentially lost access to their funds despite being able to access the platform. These reports suggest that successful trading strategies might be met with administrative cancellations, a behavior often associated with low-trust entities. The evidence provided included screenshots of the account history, reinforcing the need for skepticism.

4. Software & Access

OW Markets utilizes the industry-standard MetaTrader 5 (MT5) platform, known for its advanced charting and algorithmic trading capabilities. The platform supports a wide range of assets including Indices, Futures, and Crypto.

To access the platform, traders must complete the login security steps. However, our technical audit reveals a gap in security protocols: the broker's implementation of MT5 lacks support for two-factor authentication (2FA) or biometric verification. A secure login process is vital for protecting trading accounts from unauthorized access, particularly in an offshore environment where fund recovery is difficult. Traders are advised to use strong, unique passwords to mitigate this vulnerability.

Final Verdict

OW Markets presents a mixed picture in our 2026 assessment. While it offers a modern MT5 environment and high leverage, the offshore regulation and serious allegations regarding profit deletion in 2025 significantly drag down its safety rating. The WikiFX Score of 4.05 suggests it is not currently in the safe tier of brokerages.

Pros:

- Regulated by Seychelles FSA.

- High leverage options (up to 1:1000).

- Access to MT5 platform.

Cons:

- Offshore regulation offers limited investor protection.

- Serious complaints regarding deleted profits and withdrawal refusals.

- Lack of advanced authentication for the login process.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Pinnacle Pips Forex Fraud Exposed

Grand Capital Review 2026: Is this Broker Safe?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc