Vida Markets Review: Are Traders Facing Fund Scams & Heavy Price Manipulation?

Abstract:Have you witnessed illegitimate profit cancellation by Vida Markets, an Anguilla-based forex broker? Did you encounter trading losses due to inappropriate automatic stops by the broker? Were your trades closed minutes after the price changed in your favor? Did your forex trading account get blocked despite submitting the required KYC documents? Failed to get your deposit reflected in your account? These are more than just issues; they are alleged forex scams that have hit many traders. Some of them have highlighted these bad experiences while sharing the Vida Markets review. In this article, we have shared some of them. Keep reading!

Have you witnessed illegitimate profit cancellation by Vida Markets, an Anguilla-based forex broker? Did you encounter trading losses due to inappropriate automatic stops by the broker? Were your trades closed minutes after the price changed in your favor? Did your forex trading account get blocked despite submitting the required KYC documents? Failed to get your deposit reflected in your account? These are more than just issues; they are alleged forex scams that have hit many traders. Some of them have highlighted these bad experiences while sharing the Vida Markets review. In this article, we have shared some of them. Keep reading!

Elaborating on the Top Forex Trading Complaints Against Vida Markets

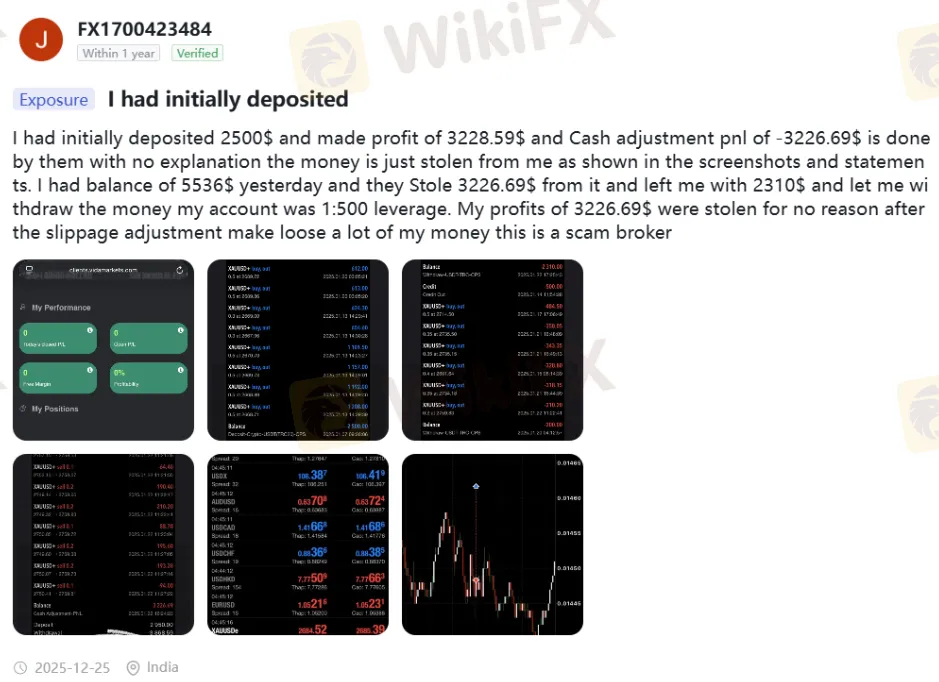

The Profit Cancellation Complaint Against Vida Markets

A trader made a stunning revelation on WikiFX, a leading global forex regulation inquiry app, about the brokers alleged profit cancellation tactic. As per the complaint, the trader deposited USD 2500 and made profits of USD 3,228.59, raising the account balance to USD 5,536. However, the trader alleged that the broker applied an inexplicable profit & loss adjustment of -USD 3,226.69, leading to the removal of most of the profits. With no prior intimation, it only created chaos for the trader, who shared a negative Vida Markets review. Take a look!

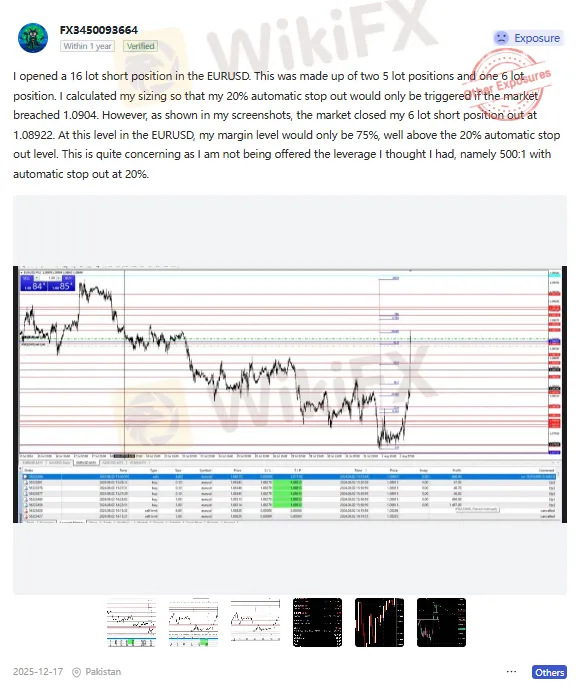

Unexpected Stop-Out Despite Adequate Margin Level

A trader revealed issues regarding stop-outs while trading via Vida Markets. The trader began by opening a 16-lot short position on EUR/USD, comprising two 5-lot trades and one six-lot trade. The position size was calculated to ensure the triggering of the automatic stop only when the price touched 1.0904. However, on the Vida Markets login, the trader saw the broker closing the lot position prematurely at 1.08922. According to the user, the margin level was 75% at this level, significantly above the 20% stop-out threshold. The unfair trade execution made the trader share this explosive Vida Markets review.

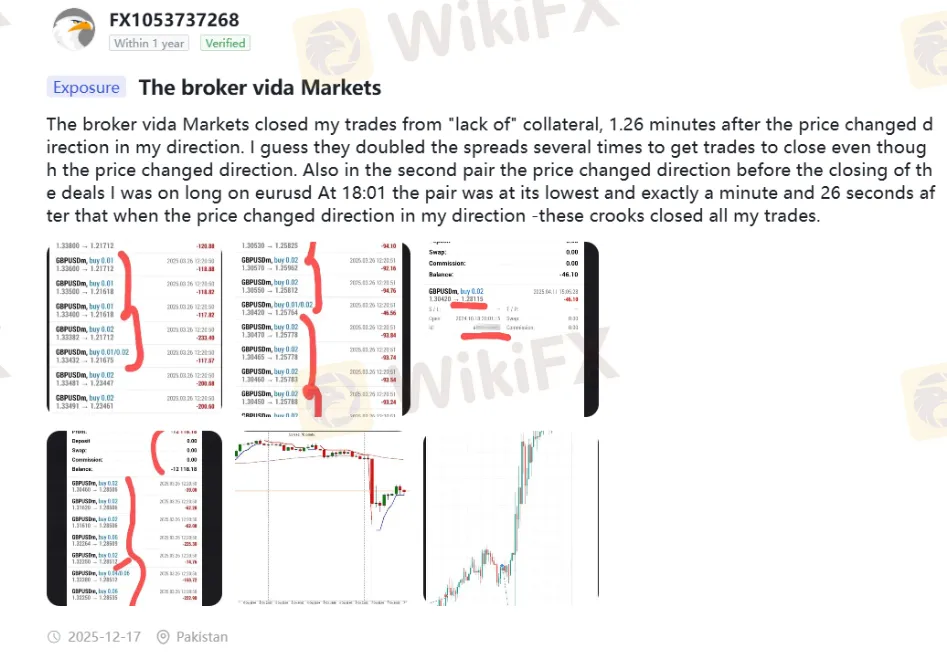

Illegitimate Trade Closure Made the Trader Sit on Losses

Sharing an explosive complaint against Vida Markets, the trader exposed that the broker allegedly closed trades 1.26 minutes after the price changed in favor of the first currency pair. The trader estimated multiple inflated spreads charged by the broker to close trades despite prices moving in a favorable direction. Further, in the second pair, the price changed direction before the trade closure. Disappointed by the wrong trade calls by the broker, the trader added to the long list of negative reviews. Take a look at what the trader said.

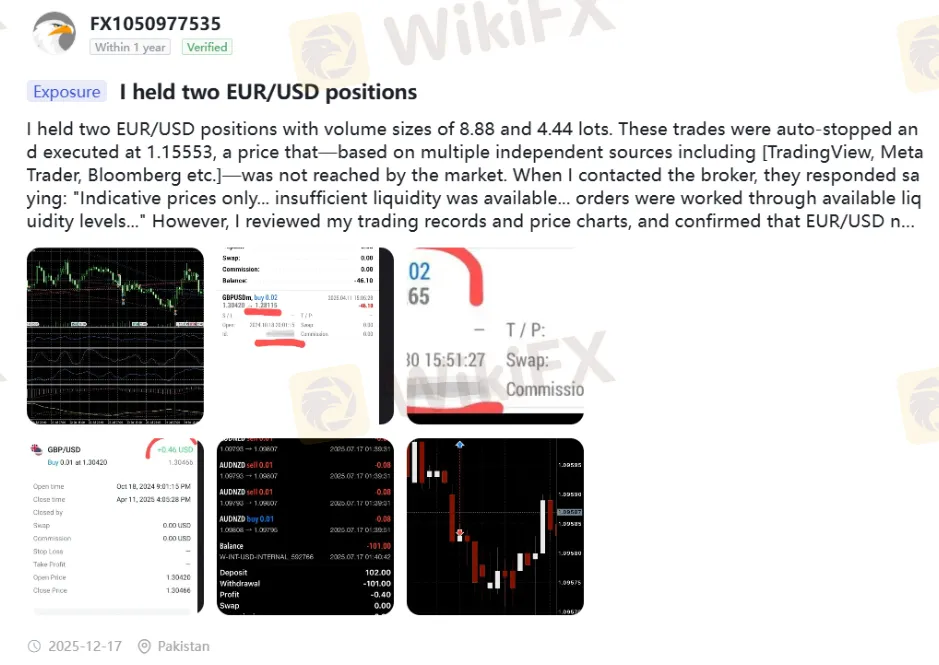

Trades Closed at Non-Market Prices Despite NO Price Breach

A trader reportedly held two EUR/USD positions of 8.88 lots and 4.44 lots, which were automatically stopped and executed by Vida Markets at 1.5553. According to the trader, the market never reached this price as per the data available on multiple independent forex platforms such as TradingView, MetaTrader and Bloomberg. On this, the trader questioned Vida Markets, which responded by citing indicative prices, low liquidity, and trade order execution through available liquidity levels. However, a thorough review of trade history and price charts did not find the EUR/USD trade at a price of 1.5553 during the execution period. Annoyed by the overall trading experience, the trader shared a bad Vida Markets review. Check out the complaint screenshot below to know more.

Investigating the Illegal Profit Declaration by Vida Markets

A trader recounted a series of losses made on the Vida Markets trading platform. Once the trader earned profits, the same was declared illegal by the broker. Shattered by this awful response, the trader vented out by sharing this negative review of Vida Markets. Take a look!

Multiple Fund Deposit-related Complaints

Several traders have highlighted the discrepancies associated with fund deposits on the Vida Markets platform. The complaints suggest that the capital deposited does not show on the trading platform. Here are multiple screenshots covering the critical deposit complaints.

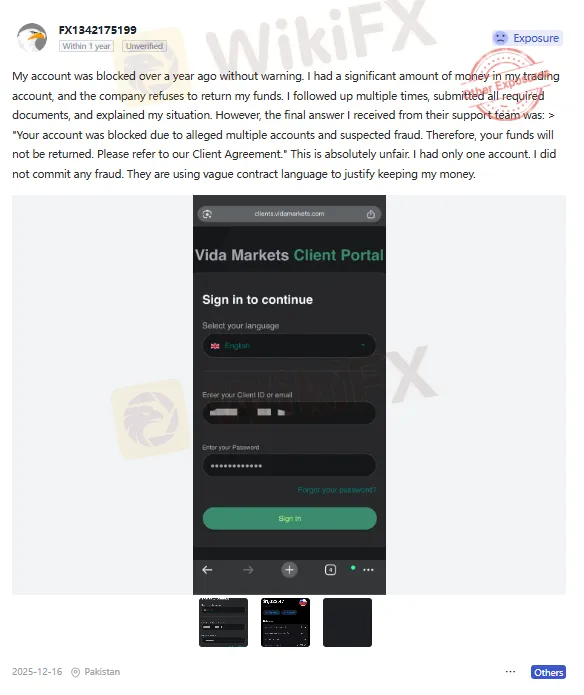

The Account Block Claim Against Vida Markets

A trader disclosed a tragic account block case after failing to receive refunds by Vida Markets. As per the complaint, the trader held a significant trading account balance and applied for unsuccessful refunds despite submitting the required documents. The customer support team replied by saying that the traders account was blocked due to suspected fraud and multiple accounts, making him ineligible for refunds. However, the trader admitted having just one account and cleared him of fraudulent charges. Check out the Vida Markets review, where this matter is highlighted.

Vida Markets MT4 Issue

A trader pointed out the fund scam due to the alleged MT4 platform shutdown. As per the complaint, Vida Markets responded to the traders email on this issue by saying that, due to server maintenance, traders cannot access MT4 accounts. Even the new traders seeking the Vida Markets MT4 download would have been hurt by this. The trader expressed frustration by sharing a negative review of Vida Markets online.

Vida Markets Review by WikiFX: Checking the Broker‘s Regulation and Score Status

The complaints above are surely a point of concern for traders seeking to build a forex portfolio through Vida Markets. It was imperative for the WikiFX team to conduct a thorough investigation into the broker’s regulatory status amid growing complaints. Upon investigation, the team found that the broker was regulated in South Africa. However, in light of several complaints, the team could only give the broker a score of 2.15 out of 10.

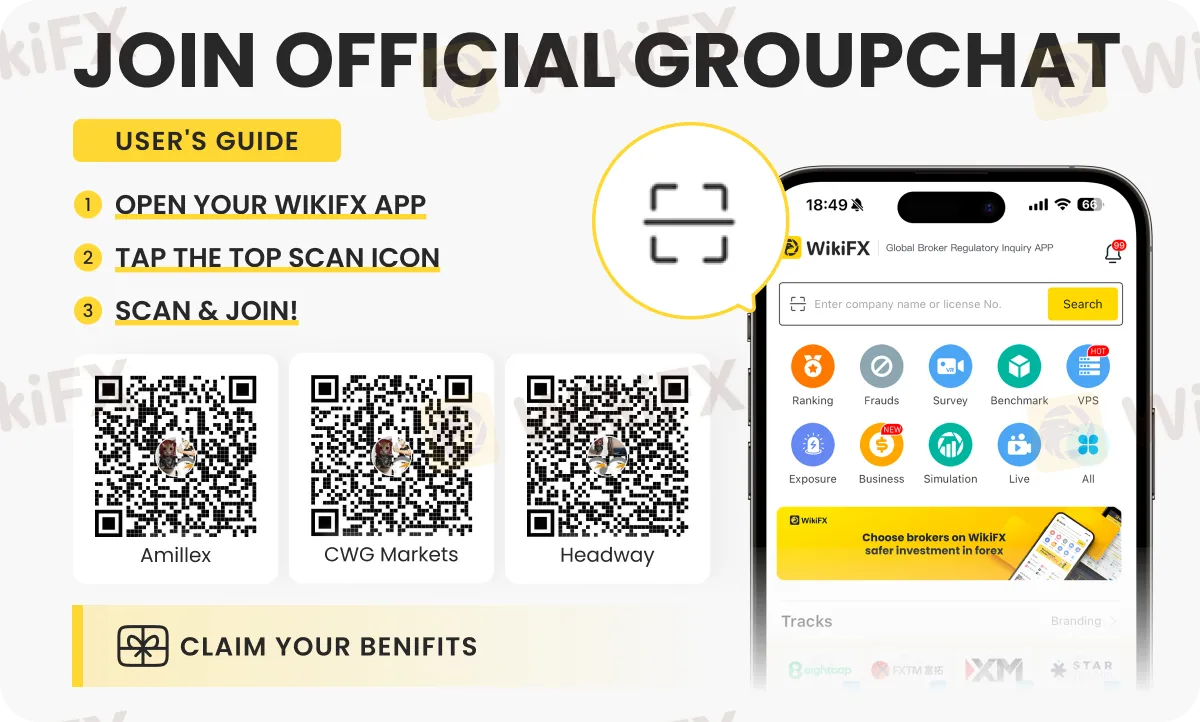

Get the latest forex updates, insights and strategies on these expert-guided special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G. Join by following the instructions shown below.

Read more

The Investment Trap: Key Suspect Identified

A Malaysian man was charged in Singapore for allegedly acting as a cash collector in a cross-border investment scam, after a victim lost substantial funds through a fake platform promoted via social media and WhatsApp. The case underscores the growing sophistication of scam networks and the importance of caution when dealing with unsolicited investment offers.

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

WikiFX Broker

Latest News

Capital.com Review: Is Your Money Locked Inside this Broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Rate Calc