Capitalix Review: Revealing the Latest Fund Scam Allegations Against the Broker

Abstract:Has Capitalix imposed a fine on your trading inactivity? Did you still lose your capital despite paying the fine amount? Have you had multiple instances of fund scams at Capitalix? Does your forex trading account balance often become negative? Failed to receive a response to the Capitalix withdrawal application? Did you face a prolonged drawdown issue on the broker’s trading platform? You are not alone! Many traders have reported these issues on broker review platforms such as WikiFX. We have uncovered all these alleged trading activities in this Capitalix review article. Take a look!

Has Capitalix imposed a fine on your trading inactivity? Did you still lose your capital despite paying the fine amount? Have you had multiple instances of fund scams at Capitalix? Does your forex trading account balance often become negative? Failed to receive a response to the Capitalix withdrawal application? Did you face a prolonged drawdown issue on the brokers trading platform? You are not alone! Many traders have reported these issues on broker review platforms such as WikiFX. We have uncovered all these alleged trading activities in this Capitalix review article. Take a look!

Highlighting the Top Forex Trading Complaints Against Capitalix

Inactivity Fine Paid, Trading Instructions Followed, Yet Encountered Losses

This stunning complaint against Capitalix appeared on WikiFX, the world‘s leading forex regulation inquiry app, a few months ago. The complaint stated that the broker charged a Mexico-based trader an inactivity fee, which the latter paid. As per the trader’s admission, the broker stipulated a trading volume of $60,000 to be able to receive the entire deposit worth $12,500. The trader also followed the advice of opening a new position, which led to a loss of $2,800. Shocked by the incident, the trader shared this negative Capitalix review.

A Reported USD 5,00,000 Scam Case Against Capitalix

A trader witnessed a mammoth loss of approximately USD 5,00,000 on the Capitalix login, a few years ago. To recover the entire investment, including the profits, the trader contacted the broker. Capitalix, this time, reportedly convinced the trader to deposit further to recover the amount. However, the situation did not change as the trader continued to face losses. Sharing a screenshot that captures the sufferings the trader had with these suspicious trading activities.

The Negative Trading Account Balance Complaint Against Capitalix

Capitalix is also accused of luring traders with massive profit potentials on the forex trading platform. It allegedly remains a deliberate strategy to defraud investors, who are further told to deposit by the broker to get their balance positive. However, it does not happen. Reportedly scammed by the incident, the trader had no hesitation in sharing this negative Capitalix review.

The Constant Change in Required Margin Amount for Withdrawals

This complaint is not only painful for the trader but also showcases a comedy of errors on the part of Capitalix withdrawal management. The trader complained that the initial margin requirement of $12,500 kept changing with each fund withdrawal negotiation. Firstly, it changed to $4,000, moved up to $10,000, fell to $2,500, and moved up to $7,000. Check out the changing margin demands and the chaos that followed for the trader in this Capitalix review.

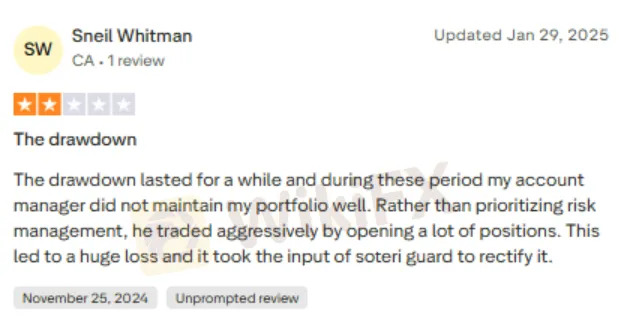

Investigating the Fund Loss Claim Due to Poor Drawdown Management

A Canada-based trader alleged that the drawdown in his forex trading account and the subsequent poor portfolio management by the brokers official led to a huge loss. Here is the complaint screenshot.

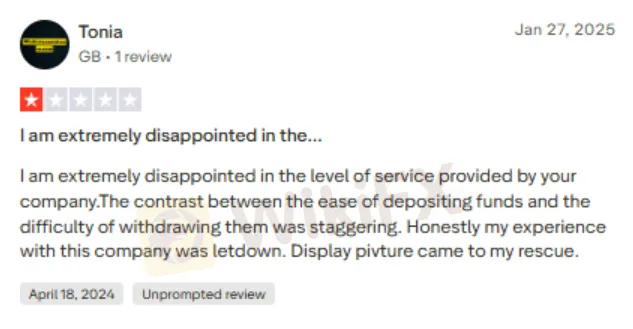

Depositing is Seamless, Withdrawing is Harrowing, the Trader Alleged

A trader reported the contradictions between the two aspects of trading - deposits and withdrawals. As per the complaint, the trader acknowledged no issue with depositing. However, as the focus shifts to Capitalix withdrawals, it becomes difficult for the trader. Disappointed by the overall trading experience, the trader shared this review of Capitalix.

Capitalix Review by WikiFX: Investigating the Broker‘s Regulation Status

The growing number of complaints demanded a thorough probe into the broker’s regulatory details by the WikiFX team. While investigating, the team did not have a valid regulatory license for the broker. This is despite over five years in the forex business. Keeping in mind the growing risks for traders, the team gave the broker a poor score of 2.19 out of 10.

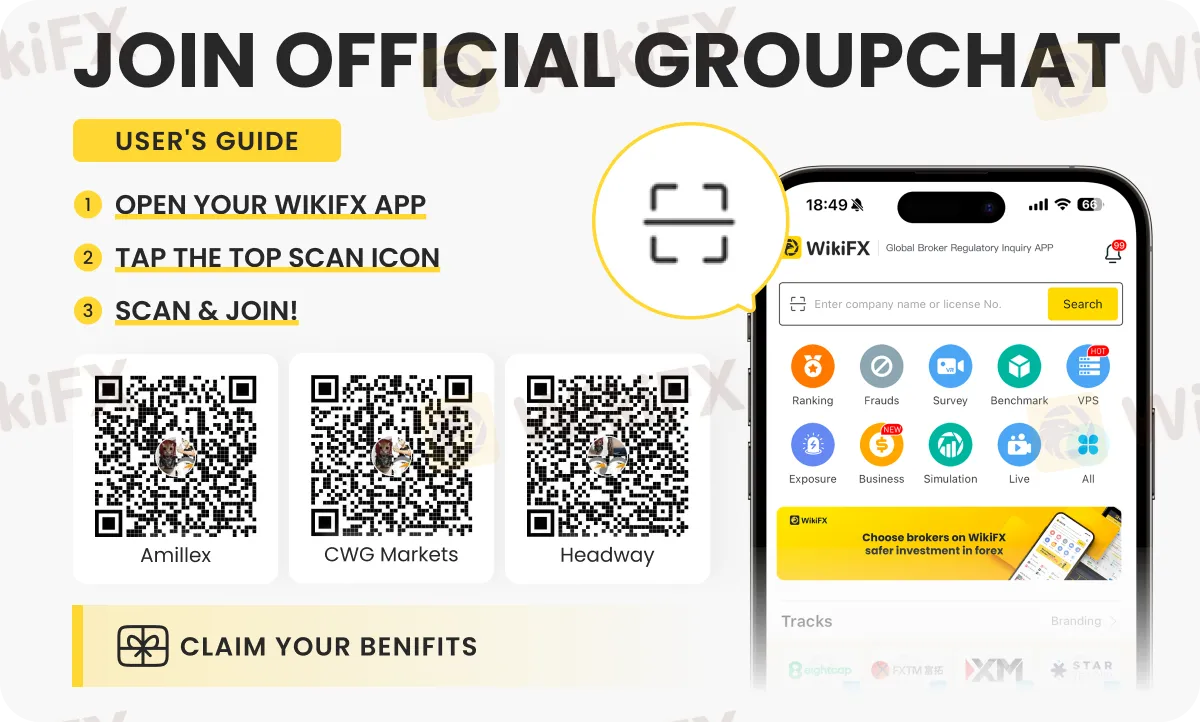

Explore in-depth trading insights every day on these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - and implement them in real-time for a robust portfolio. Sign up today by following the instructions shown below.

Read more

The Investment Trap: Key Suspect Identified

A Malaysian man was charged in Singapore for allegedly acting as a cash collector in a cross-border investment scam, after a victim lost substantial funds through a fake platform promoted via social media and WhatsApp. The case underscores the growing sophistication of scam networks and the importance of caution when dealing with unsolicited investment offers.

Fake FP Markets Exposure: Allegations of Fund Withdrawal Denials & Trade Manipulation

Did you experience a surprise cancellation of the profits made on the Fake FP Markets trading platform? Did you face more losses than what’s mentioned on your stop-loss order? Did you lose all your capital invested through a supposedly introducing broker? Failed to receive access to the FP Markets withdrawal despite a long delay from the application date? You are not alone! In this Fake FP Markets review article, we have investigated some complaints concerning withdrawal denials and trade manipulation. Read on as we share updates below.

CMTrading Review: Is It Legit or a Scam? Check It Out Now!

Did you experience a difference in the CMTrading withdrawal experience when requesting a small and a large amount? Did the Cyprus-based forex broker accept your requests when the withdrawal amount was small and deny when it was high? Were you told to pay a processing fee that seemed illegitimate in your context? Did the broker scam you by prompting you to deposit more after showing your initial profits? In this CMTrading review article, we have investigated the broker in light of the complaints. Check them out.

Sheer Markets Review: Broker Legit or Not?

CySEC #395/20 regulates Sheer Markets as a Market Maker for MT5 CFDs, but 1:30 leverage, inactivity fees, and the lack of e-wallets raise questions about reliability. Read a neutral review before depositing $/€200.

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc