ThinkMarkets Review 2025: Safety, Features, and Reliability

Abstract:ThinkMarkets is a well-established brokerage firm headquartered in Australia, operating since 2012. It currently holds a

ThinkMarkets is a well-established brokerage firm headquartered in Australia, operating since 2012. It currently holds a WikiFX Score of 7.84, indicating a generally high level of regulatory compliance and historical reliability. The broker operates under a hybrid regulatory framework, possessing licenses from top-tier authorities like the UK's FCA and Australia's ASIC. However, despite the strong regulatory background and an “AA” Trade Environment rating, prospective traders should be aware that the platform has received a significant volume of user complaints (78 in the last 3 months) regarding withdrawals and execution.

Pros and Cons of ThinkMarkets

- ✅ Top-Tier Regulation: Regulated by major authorities including the FCA (UK) and ASIC (Australia).

- ✅ Competitive Spreads: Offers raw spreads from 0.0 pips on the ThinkZero account and from 0.4 pips on Standard accounts.

- ✅ Platform Variety: Supports MT4, MT5, and a proprietary mobile app.

- ✅ High Leverage: Offers leverage up to 1:500 for eligible clients/regions.

- ❌ High Complaint Volume: 78 complaints received recently, primarily focusing on withdrawal delays.

- ❌ Regulatory Irregularities: The license in South Africa (FSCA) is listed as “Overrun,” and the status in Japan is “Unverified.”

- ❌ Customer Service Delays: Users report difficulties reaching support when facing account issues.

Is ThinkMarkets Safe? Regulatory Analysis

ThinkMarkets operates under a multi-jurisdictional regulatory structure. This allows them to offer different trading conditions depending on the client's location, but it also means safety levels vary by entity.

Tier-1 and Tier-2 Licenses

The broker holds valid licenses from two of the world's most respected financial regulators, ensuring strict adherence to capital requirements and client fund segregation in those specific jurisdictions:

- FCA (United Kingdom): Regulated as TF Global Markets (UK) Limited.

- ASIC (Australia): Regulated as TF GLOBAL MARKETS (AUST) PTY LTD.

- CySEC (Cyprus): Regulated as TF Global Markets (Europe) Ltd, covering European clients.

Offshore and Regulatory Warnings

- FSA (Seychelles): The broker holds an offshore license, which typically allows for higher leverage but offers fewer protections than FCA or ASIC.

- Risk Warning: The WikiFX database flags the South African (FSCA) license as “Overrun” (exceeding business scope) and the Japanese (FSA) status as “Unverified.” Traders falling under these entities should exercise additional caution.

Real User Feedback and Complaints

While the regulatory framework is strong, recent user feedback paints a concerning picture regarding operational efficiency. In the past 3 months alone, 78 complaints have been logged.

Withdrawal Delays and Denials

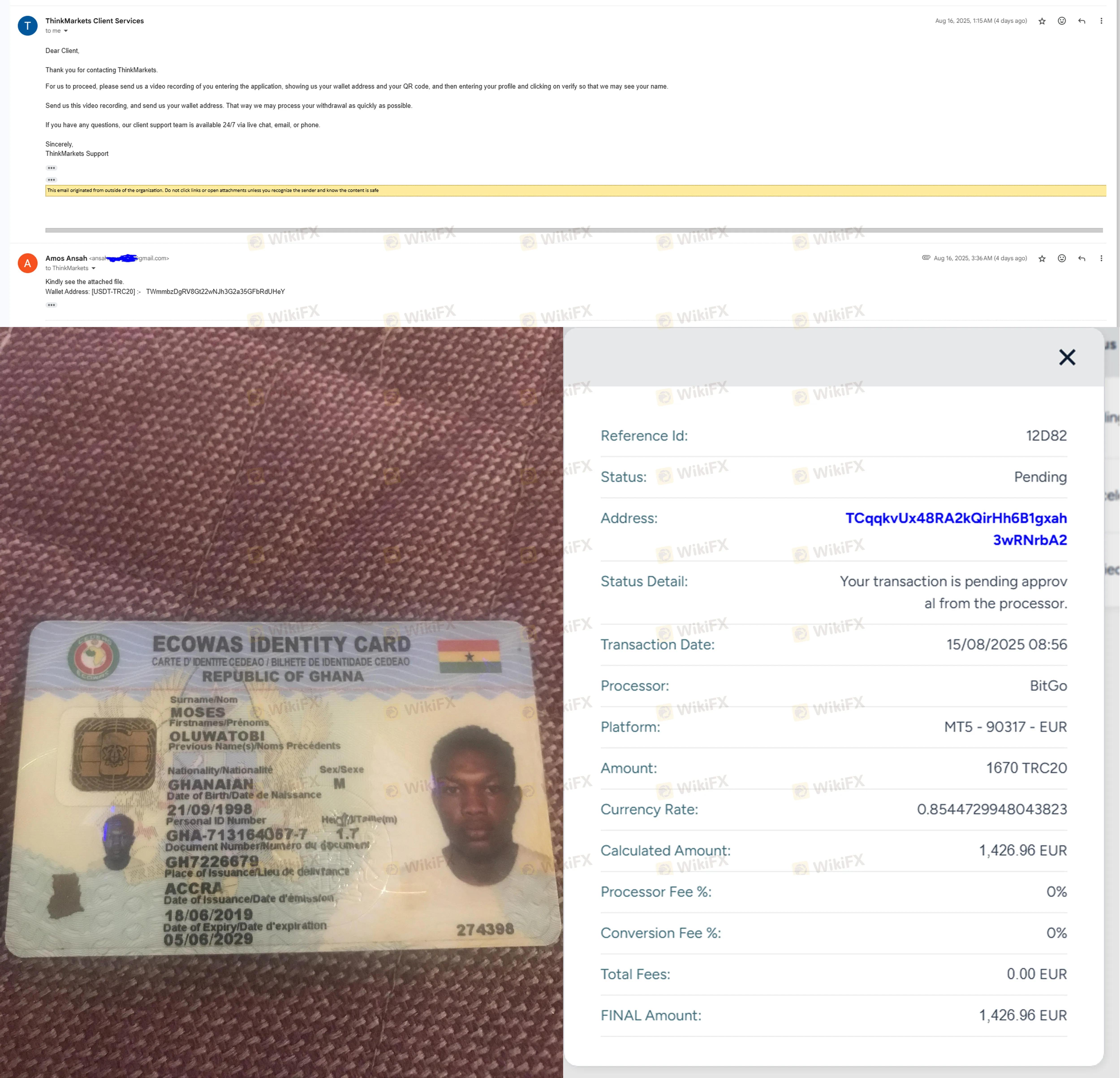

A large portion of the recent complaints (dating into late 2024 and 2025) cite an inability to withdraw funds. Users from various regions, including Taiwan, China, and Ghana, have reported that withdrawal requests remain “processing” for weeks without resolution.

- User Experience: One user reported, “I applied for a withdrawal on September 3rd, and the platform has delayed it for over a month.”

Another user noted that after depositing $200 and attempting to withdraw $188, the funds never arrived after 22 days.

- Communication Breakdown: Multiple cases mention that finance teams are unresponsive to emails regarding these missing funds.

Platform Execution and Slippage

Traders have reported issues with trade execution that resulted in losses.

- Slippage: Users have documented severe slippage, with one case citing a 1.6 pip slippage and another claiming a trade opened with a 100-pip loss due to lagging.

- Closing Trades: Some traders reported being unable to close positions during volatile markets, leading to account liquidation or massive losses. One user stated, “I tried to close the trade but I can't... the system refused until my account margin call.”

Trading Conditions and Fees

ThinkMarkets receives an “AA” rating for its trading environment, suggesting competitive technical specifications despite the user complaints.

Accounts and Spreads

The broker offers three main account types to suit different traders:

- ThinkZero Account: Designed for active traders, featuring spreads from 0.0 pips with a $500 minimum deposit.

- Standard Account: Commission-free trading with spreads starting from 0.4 pips (wider than the ThinkZero but with no separate commission).

- ThinkTrader Account: Tailored for their proprietary app users with spreads from 0.4 pips.

Leverage

ThinkMarkets offers high leverage up to 1:500. While this allows for significant market exposure with a smaller deposit ($50 minimum generally), it also amplifies the risk of rapid capital loss.

Platforms

Clients have access to a robust suite of software:

- MetaTrader 4 (MT4) & MetaTrader 5 (MT5): The industry standards for automated trading and charting.

- Proprietary App: The broker offers its own mobile and web platforms.

Final Verdict

ThinkMarkets presents a complex case for traders in 2025. On paper, it is a highly credible broker with Tier-1 regulation (FCA, ASIC) and a high WikiFX Score of 7.84. The trading conditions, including low spreads and diverse platforms, are objectively competitive.

However, the recent surge in complaints (78 in 3 months) regarding withdrawal blocking and severe slippage cannot be ignored. While the entity continues to hold valid regulations, the disconnect between its legal status and the reported user experience suggests operational friction. Traders should prioritize entities under the FCA or ASIC jurisdiction and test withdrawals with small amounts before committing significant capital.

To stay safe and view the latest regulatory certificates, check ThinkMarkets on the WikiFX App.

WikiFX Broker

Latest News

Labuan Forex Scam Costs Investors RM104 Million | Authorities Pressed to Act

ThinkMarkets Review 2025: Safety, Features, and Reliability

LMS Forex Broker Review (2026): Is LMS Legit or a Scam?

RockwellHalal User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

FXNovus Review: Traders Report Fund Scams & Illegitimate Tax Payment Demands on Withdrawals

Profit Wipeout: Why AccuIndex Traders Are losing Their Hard-Earned Money

Inside the Elite Committee: Talk with LadyChiun

US Imposes 25% Tariff on AI Chips, Elevating Tech Trade Tensions

Is DRW Legit or a Scam? 5 Key Questions Answered (2026)

Are You Trading Against the Central Banks? Know Your Competition

Rate Calc