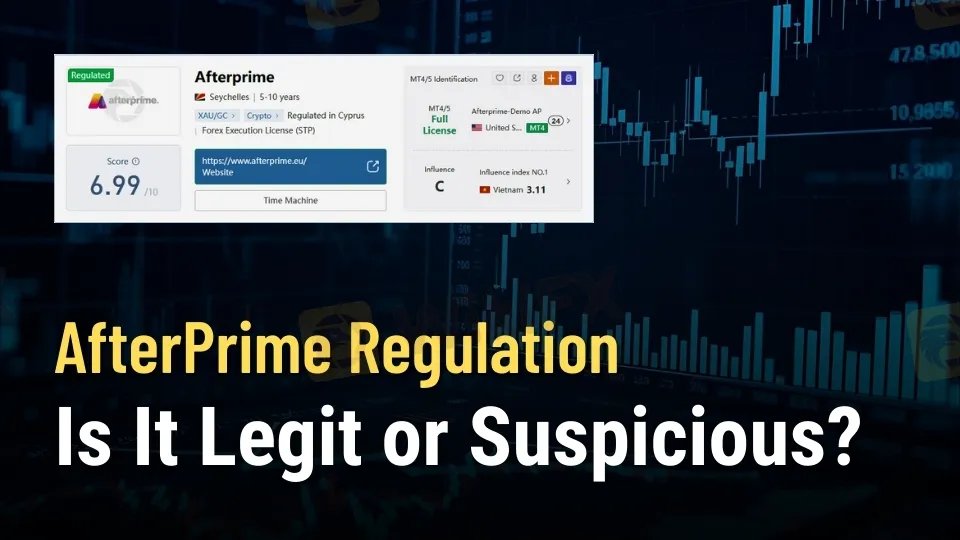

AfterPrime Regulation: Is It Legit or Suspicious?

Abstract:AfterPrime Regulation: CySEC regulation adds credibility, but ASIC clone and offshore risks make traders cautious.

Introduction: Why Regulation Matters in Brokerage

In the world of online trading, regulation is the dividing line between credibility and risk. Brokers operating under recognized authorities are expected to meet strict standards of transparency, capital adequacy, and client protection. Those relying on offshore or suspicious licenses often raise questions about legitimacy. AfterPrime, a broker founded in 2018, sits at the intersection of these two realities. Its dual licensing structure—one under the Cyprus Securities and Exchange Commission (CySEC) and another under the Seychelles Financial Services Authority (FSA)—offers both credibility and concern. Adding to the complexity is a dubious ASIC clone license that has been flagged as suspicious. This investigative review examines AfterPrime Regulation, its licenses, trading conditions, and whether traders should consider it a legitimate option or approach with caution.

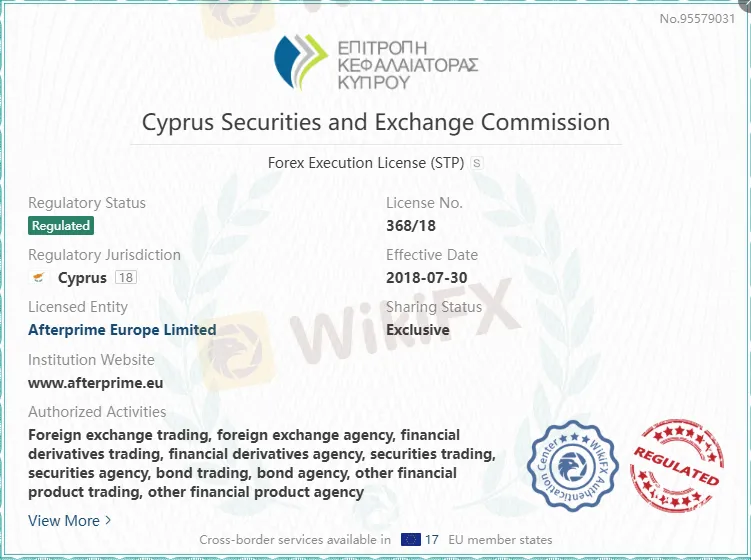

CySEC License: The Core of AfterPrime Regulation

The most credible aspect of AfterPrime Regulation is its CySEC license. Under license number 368/18, AfterPrime Europe Limited has been authorized since July 30, 2018, to provide Straight Through Processing (STP) brokerage services. CySEC is a respected European regulator, enforcing compliance with EU financial directives such as MiFID II.

- Jurisdiction: Cyprus

- Effective Date: July 30, 2018

- Entity: AfterPrime Europe Limited

- Authorized Activities: Foreign exchange trading, derivatives trading, securities trading, bond trading, and other financial product services.

CySEC oversight ensures that AfterPrime‘s European operations adhere to capital requirements, segregation of client funds, and transparent reporting. This license is the broker’s strongest regulatory anchor and the primary reason traders view it as legitimate within the EU.

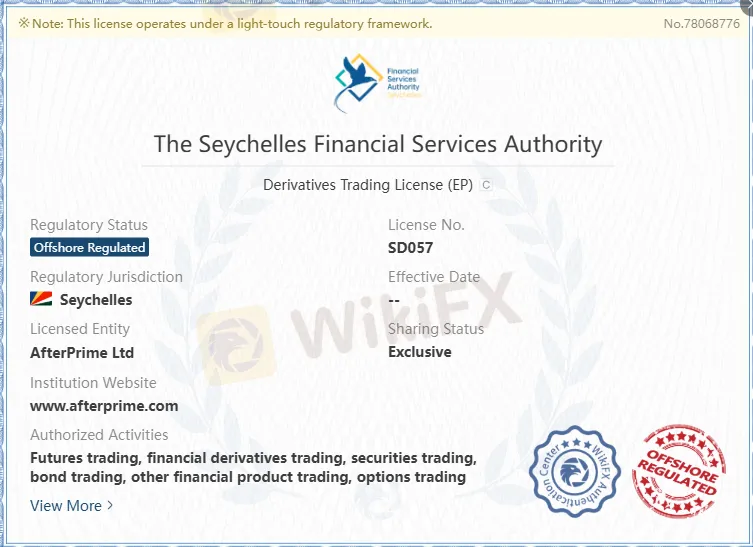

Offshore Licensing: Seychelles FSA and Its Implications

Beyond Europe, AfterPrime holds a license from the Seychelles Financial Services Authority (FSA) under license number SD057. This offshore license covers derivatives and futures trading.

- Jurisdiction: Seychelles

- Entity: AfterPrime Ltd

- Status: Offshore regulated

While technically valid, the Seychelles FSA operates under a lighter regulatory framework compared to CySEC. Offshore regulation often lacks the stringent investor protections found in European jurisdictions. For traders, this means fewer safeguards in case of disputes or insolvency. Offshore licenses are common among brokers seeking flexibility in leverage and product offerings, but they inevitably raise questions about reliability.

ASIC Clone License: A Red Flag in AfterPrime Regulation

Perhaps the most concerning element of AfterPrime Regulation is the presence of a suspicious ASIC clone license. Listed under license number 404300, this purported Australian authorization has been identified as fraudulent. The license references ARGAMON MARKETS PTY LTD, not AfterPrime, and has been flagged as a deceptive attempt to mislead traders.

This discovery underscores the importance of verifying regulatory claims directly with official authorities. Traders should avoid placing trust in brokers associated with clone licenses, as these often signal attempts to exploit regulatory credibility without actual oversight.

Pros and Cons of AfterPrime Regulation

| Pros | Cons |

| Regulated by CySEC (EU credibility) | Suspicious ASIC clone license |

| Low spreads and commission fees | Offshore Seychelles license less stringent |

| Advanced trading platforms with multi-device support | No Islamic account support |

| No deposit or withdrawal fees | Limited leverage for crypto assets (2:1) |

The dual nature of AfterPrimes licensing creates a mixed picture. On one hand, CySEC regulation provides legitimacy. On the other, offshore and clone licenses introduce risk.

Trading Instruments: Broad Market Access

AfterPrime offers a wide range of tradable instruments, appealing to both retail and professional traders.

- Forex: Major and minor currency pairs with leverage up to 30:1.

- Cryptocurrencies: Bitcoin, Ethereum, and other assets, capped at 2:1 leverage.

- Commodities: Gold, oil, and other raw materials.

- Indices: Global benchmarks such as NAS100 and GER30.

- Stocks: Individual equities with leverage up to 5:1.

This breadth of instruments positions AfterPrime competitively against brokers like IC Markets or Pepperstone, which also emphasize multi-asset access. However, the leverage restrictions on crypto assets may deter traders seeking higher exposure.

Account Types: Live and Demo Options

AfterPrime provides both live trading accounts and demo accounts.

- Live Accounts: Real-money trading with exposure to CFD markets.

- Demo Accounts: Risk-free practice environment for testing strategies.

Notably, AfterPrime does not offer Islamic accounts, which limits accessibility for traders requiring Sharia-compliant services. Competitors such as XM and FXTM provide Islamic accounts, giving them an advantage in markets where this is a critical requirement.

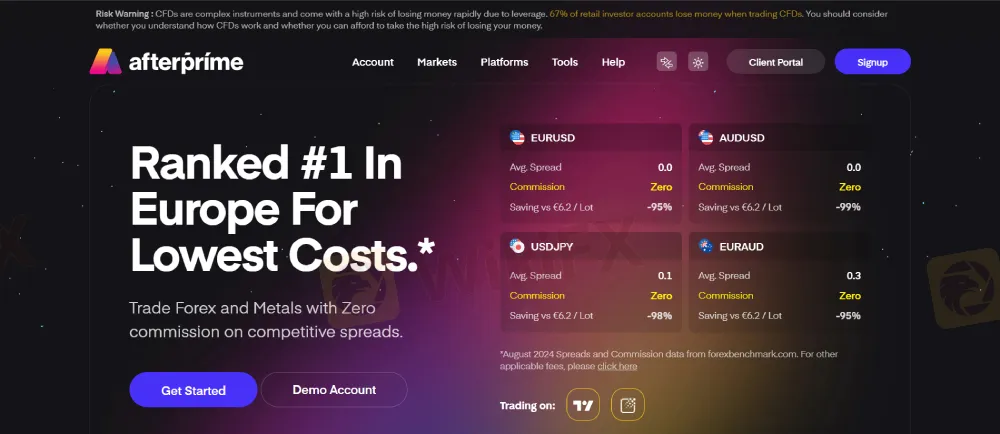

Fees and Spreads: Competitive but Variable

AfterPrimes fee structure is designed to attract cost-conscious traders.

- Spreads: EUR/USD at 0.7 pips, GBP/JPY at 0.03 pips, BTC/USD at 0.1, ETH/USD at 0.01, and Gold at 0.32.

- Commissions: Zero commission for forex, metals, indices, and commodities. Cryptocurrencies incur 0.05% per notional USD traded per side, while stocks cost $0.02 per share per side.

- Swaps: Overnight financing rates vary significantly, with USD/JPY showing -25.91 short and 14.25 long.

Compared to competitors, AfterPrimes spreads are tight, rivaling brokers like Tickmill and Exness. The absence of deposit and withdrawal fees further strengthens its appeal.

Leverage: Tiered by Asset Class

Leverage is a defining feature of AfterPrime Regulation, particularly under CySEC rules.

- Major Currency Pairs: Up to 30:1

- Non-Major Currencies, Gold, Major Indices: Up to 20:1

- Commodities (excluding gold): Up to 10:1

- Individual Equities: Up to 5:1

- Crypto Assets: Up to 2:1

This tiered structure reflects regulatory requirements in Europe, where leverage caps are designed to protect retail traders from excessive risk. Offshore brokers often advertise higher leverage, but AfterPrimes adherence to CySEC limits demonstrates compliance with EU standards.

Platforms: Multi-Device Functionality

AfterPrime supports four major trading platforms:

- TradingView: Advanced charting and community-driven analysis.

- MetaTrader 4 (MT4): Robust technical analysis and algorithmic trading.

- TraderEvolution: Professional-grade interface with deep market insights.

- FIX API: Direct market access for institutional traders.

Availability across web, iPhone, Android, Windows, and Mac ensures accessibility for diverse trading styles. Competitors like Saxo Bank and Interactive Brokers also emphasize multi-platform support, but AfterPrimes inclusion of TradingView adds a social dimension that appeals to modern traders.

Deposits and Withdrawals: Transparent and Free

AfterPrime distinguishes itself by offering free deposits and withdrawals, with only potential bank or conversion fees applying.

- Payment Methods: VISA, Neteller, Skrill, and bank transfer.

- Minimum Deposit: Recommended 200 EUR.

- Processing Time: Instant for cards and e-wallets; 1–3 business days for bank transfers.

This policy aligns with industry leaders such as OANDA and CMC Markets, which also minimize transaction costs. The absence of inactivity fees further enhances AfterPrimes appeal for casual traders.

Reported Cases: Zero Negative Incidents

According to the available data, AfterPrime has no reported negative cases under its CySEC license. This clean record strengthens its credibility in Europe. However, the presence of a suspicious ASIC clone license remains a reputational risk.

Transparency: Domain and Authority Details

- European Website: www.afterprime.eu

- Offshore Website: www.afterprime.com

- CySEC License: 368/18

- Seychelles FSA License: SD057

- ASIC Clone License: 404300 (suspicious)

The dual-domain structure reflects its split operations between Europe and offshore jurisdictions. Traders should prioritize the EU-regulated entity for maximum protection.

Bottom Line: AfterPrimes Value Proposition

AfterPrime Regulation presents a dual narrative. On one side, CySEC oversight provides legitimacy, ensuring compliance with EU standards and offering traders confidence in fund safety. On the other, the offshore Seychelles license and suspicious ASIC clone raise cautionary flags.

For traders seeking low spreads, zero commissions, and advanced platforms, AfterPrime offers competitive conditions. However, those prioritizing regulatory certainty should focus exclusively on its CySEC-regulated entity. The ASIC clone license is a red flag that cannot be ignored.

Final Verdict: AfterPrime is legitimate under CySEC regulation, but traders must remain cautious of its offshore and clone associations. The brokers value

Read more

EO Broker Exposed: Allegations of Withdrawal Denials, Unfair Trade Execution & Account Blocks

Do you have to constantly witness trade delays on the EO Broker trading platform? Have you encountered cases of unfair trade executions where you have recorded heavy losses? Are inconsistent spreads eating into your trading gains? Is the EO Broker withdrawal process too slow? Is the customer support team incompetent in resolving all these trading queries? You are not alone! Many traders have vehemently opposed the broker’s tactics on review platforms. We have highlighted different EO Broker reviews in this article. Read on!

Achiever FX Review 2026: Do Traders Face Slow Trade Execution and Hidden Fees?

Achiever FX has been receiving flak for numerous reasons, including slow-paced trade execution, lack of transparency, and, importantly, alleged attempts to defraud traders. With its customer support team not able to resolve these issues, traders have allegedly been left alone! They have rightly reviewed the Saint Lucia-based forex broker negatively online. In this Achiever FX review article, we have explored complaints against the forex broker. Keep reading to know the same.

Alpari艾福瑞 Analysis Report

Alpari艾福瑞's notably low overall rating of 2.52 out of 10 raises immediate red flags for traders seeking a reliable forex broker. While the broker has generated sufficient market presence to accumulate 218 documented reviews, the available data presents an unusually opaque picture of their operational strengths and weaknesses. This lack of clear performance metrics across key service areas makes it challenging to provide specific insights into their trading conditions, platform reliability, or customer service quality. Read on for more information.

AXI Analysis Report

AXI stands out as a solid mid-tier forex broker, earning a respectable 8.12 out of 10 rating in our comprehensive analysis. The broker has caught our attention for maintaining a remarkably clean record, with no negative reviews surfacing across the 218 trader experiences we examined. This perfect complaint-free track record suggests AXI takes customer satisfaction seriously and manages potential issues effectively before they escalate into public grievances. Read on to know more about the broker.

WikiFX Broker

Latest News

8xTrade Review 2025: Safety, Features, and Reliability

AfterPrime Regulation: Is It Legit or Suspicious?

Seacrest Markets Under Fire Over Withholding Salaries and IB Payments

TopWealth Trading User Reviews: A Complete Look at Real Feedback and Warning Signs

ehamarkets Review 2026: Regulation, Score and Reliability

Commodities Focus: Gold Pulls Back & Silver targets Retail Traders

Fed Holds Firm: January Rate Cut Hopes Fade Despite Cooling CPI

A Complete 2026 Review: Is RockwellHalal Legit or a Scam to Stay Away From?

One Message, RM600K Gone: WhatsApp Investment Scam Exposed

Big Boss Review 2025: Safety Warning and Regulatory Analysis

Rate Calc