AssetsFX Scam Alert: 5 Warning Signs Traders Should Know

Abstract:AssetsFX exposure reveals 5 scam‑like warning signs: unregulated operations, shaky fund safety, and alarming trader complaints you can’t afford to ignore.

AssetsFX shows a pattern of red flags that make it a high‑risk choice for traders, especially when you look closely at its WikiFX broker page and related exposure cases. From regulatory warnings to complaints about missing funds, the warning signs resemble those of typical forex scams that traders should not ignore.

Unclear Regulation And Offshore Setup

According to information linked from the AssetsFX WikiFX page, the broker operates through an offshore entity registered in Saint Vincent and the Grenadines. In this jurisdiction, forex and CFD brokers can work without a strict local license. In practice, this means AssetsFX can accept global clients while avoiding the tight supervision enforced in major markets such as the EU, the UK, and Australia.

For you as a trader, this setup matters because Saint Vincent and the Grenadines does not actively license or monitor forex brokers, and its own Financial Services Authority has publicly reminded investors that unlicensed companies there are effectively used “at your own risk.” When a broker controls your deposits but is not accountable to a strong regulator in your country, your chances of recovering money in a dispute or proving misconduct become very slim.

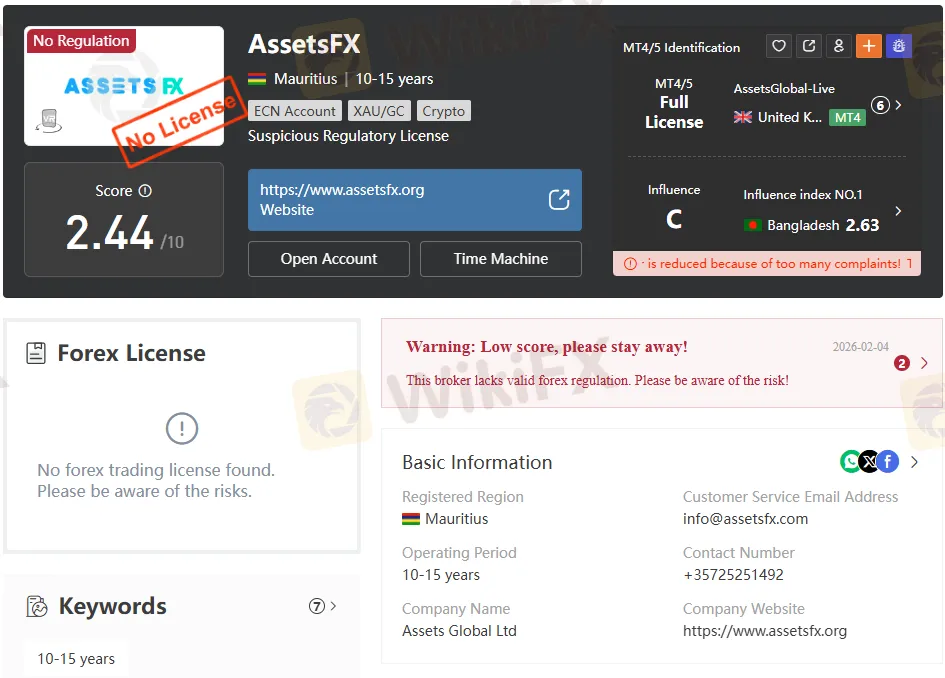

Low WikiFX Score And Explicit Risk Warnings

On the AssetsFX broker profile and the exposure article linked from it, WikiFX assigns the company a very low overall score of around 2.49 out of 10, signalling high risk. That score reflects a combination of factors, including opaque regulatory status, offshore registration, and a growing list of negative user experiences submitted through the platform.

WikiFX‘s written assessment goes beyond a simple rating and directly questions whether AssetsFX is a safe broker or a red flag for retail investors. When a specialist broker‑review platform describes a company using this kind of language while highlighting unresolved complaints, it is effectively warning you that the broker’s behaviour does not match what you would expect from a transparent, well‑regulated provider.

Serious Complaints About Missing Funds And Blocked Withdrawals

The most alarming part of the AssetsFX picture is the series of exposure cases involving delayed withdrawals, frozen accounts, and balances that allegedly disappeared without a clear explanation. These are not isolated gripes about slow processing; they are detailed stories from traders who say they could not get their money back despite multiple attempts and long waiting periods.

From the exposures connected with the AssetsFX WikiFX page and other linked reports, traders describe situations such as:

- A withdrawal request was delayed for more than 50 days; after that, the account status was changed to “invalid,” and the transfer failed.

- An MT4 account was blocked without warning, leaving a trader unable to log in, while roughly 20,000 euros allegedly remained on the platform, and support stopped responding.

- A client claims that after requesting a withdrawal, three abnormal trades were posted to the account, wiping out about 10,000 dollars in profits, and that the broker refused to correct the issue.

- Investors reported that after profits grew, their access to the client area was restricted or their emails were ignored, turning what appeared to be a normal broker relationship into a complete communication blackout.

For any trader considering AssetsFX, repeated stories of vanished profits and blocked withdrawals are a powerful warning sign that fund safety may be compromised, even if the trading platform looks professional on the surface.

Signs Of Account And Trade Manipulation

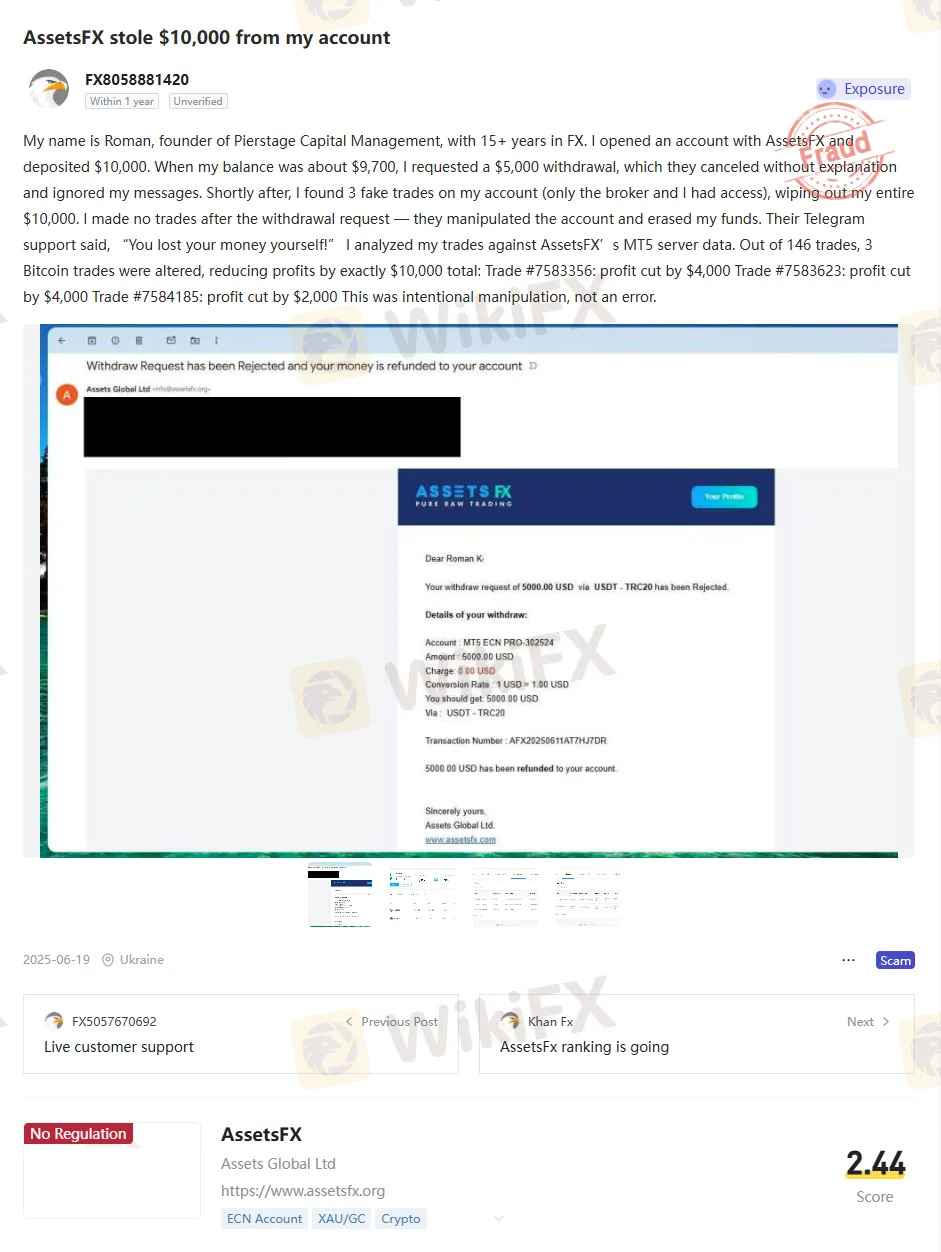

One of the most disturbing allegations tied to AssetsFX involves suspected manipulation of trade history and profit figures on the brokers own servers. In a widely cited case, a seasoned trader with over 15 years of experience claims he used a professional data‑auditing system to compare his independent trade records with the MT5 logs from AssetsFX and discovered three Bitcoin trades in which profits were allegedly reduced by a combined $10,000.

This complaint highlights several red‑flag behaviours that you need to be aware of:

- Profitable trades allegedly involved only changes to profit values, not the overall structure of the transactions, making the loss appear natural.

- The modifications reportedly targeted only winning trades, which is consistent with deliberate profit shaving rather than a random technical error.

- When confronted, the broker is said to have blamed the traders strategy rather than conducting a transparent technical investigation.

If a broker can alter trade history on its server without your consent and then dismiss your complaints, every position you open becomes vulnerable to after‑the‑fact changes that you have little power to challenge. That is not normal slippage or spread widening; it is a structural risk that undermines the very idea of fair trading.

External Warnings And “Scam” Designations

Beyond WikiFX, external reviews and investigative articles linked to the broker profile report that many investors now openly describe AssetsFX as a scam after experiencing locked accounts and vanishing funds. Some watchdog‑style sites summarise dozens or even hundreds of complaints, noting the same pattern: generous trading conditions at the beginning, followed by blocked withdrawals once profits grow, and then silence from support.

At the same time, legal and regulatory commentary on Saint Vincent and the Grenadines stresses that forex brokers registered there typically operate without a formal investment license and that investors dealing with unregulated offshore entities do so entirely at their own risk. When you combine these structural weaknesses with exposure stories of missing funds and manipulated trades, the risk profile of AssetsFX starts to look very similar to that of other offshore brokers that later collapsed or were widely recognised as scams.

How Traders Can Protect Themselves

If you already have an account with AssetsFX or any similar offshore broker, you need to act as if you might have to prove every transaction and balance in the future. Practical steps that can reduce the damage if something goes wrong include:

- Keep complete documentation: Regularly export account statements, take screenshots of balances and withdrawal requests, and save all emails or chat transcripts with the broker.

- Test withdrawals early and often: Before committing larger capital, withdraw a small amount multiple times to see if the broker pays out quickly and consistently.

- Limit your exposure: Avoid leaving more money on the platform than you can afford to lose, especially when the broker is offshore and not regulated by a strong authority.

- Check independent exposure pages: Revisit WikiFX and similar monitoring sites periodically to see whether new complaints or regulatory actions have been posted about AssetsFX.

- Consider moving to a safer broker: Look for companies licensed in well‑known jurisdictions with clear compensation schemes and a solid record of honouring withdrawals.

Given the combination of offshore registration, weak regulatory backing, low independent scores, and persistent exposure reports, many traders will conclude that keeping funds with AssetsFX is an unnecessary gamble and that shifting to a genuinely regulated broker is the safer long‑term decision.

Read more

LONG ASIA Exposure: Traders Report Fund Losses & Long Withdrawal Blocks

Long Asia Group, a Saint Vincent and the Grenadines-based forex broker, has come under increasing scrutiny as a growing number of traders report troubling experiences with the broker’s operations. User feedback highlights recurring issues such as delayed or blocked withdrawals, sudden communication breakdowns, and a lack of clear accountability once funds are deposited. Several traders claim that while small withdrawals may initially go through, larger payout requests often face unexplained obstacles. More concerning are allegations suggesting that the broker may no longer be operating transparently, with users reporting prolonged silence, unresolved complaints and suspected fund mishandling. These patterns have raised serious questions about Long Asia Group’s reliability and overall legitimacy, prompting traders to exercise extreme caution before engaging with the broker. For more details, keep reading this LONG ASIA review article, where we have elaborated on the traders’ pain wit

MY MAA MARKETS Review: Are Withdrawal Blocks and Regulation Gaps Real?

Has your MY MAA MARKETS forex trading experience been nothing short of a financial misery? Do you fail to gain the forex broker’s approval for fund withdrawals? Were you denied withdrawals on the grounds of fake accusations concerning system abuse and hedging? Does the broker deliberately cause you unwarranted slippage as you start executing winning trades? Do you feel the broker is unregulated? Your concerns seem genuine, as many traders have accused the broker of serious financial misconduct. In this MY MAA MARKETS review article, we have investigated some trader complaints. Take a look!

PRCBroker Exposed: Hong Kong Traders Say Profits Blocked, Withdrawals Refused

PRCBroker is accused of withholding $1.13M in profits and freezing withdrawals. Read the details and decide if this broker is right for you.

Kudotrade Exposed: A Risky, Unregulated Broker Targeting New Traders

Kudotrade’s flashy promises hide real risks for new traders. Learn why this unregulated broker isn’t safe before you invest—protect your funds today.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Rate Calc