dbinvesting Review (2025): Is it Safe or a Scam?

Abstract:When evaluating a forex broker, the most critical metric is its safety score. In the case of dbinvesting, the indicators are currently flashing red. With a low WikiFX Score of 2.13 (out of 10), this platform falls well below the safety threshold recommended for retail traders.

When evaluating a forex broker, the most critical metric is its safety score. In the case of dbinvesting, the indicators are currently flashing red. With a low WikiFX Score of 2.13 (out of 10), this platform falls well below the safety threshold recommended for retail traders.

While the broker boasts a modern website and access to the MT5 platform, a deep dive into their regulatory status and a surge of recent user complaints suggests significant risks. Is dbinvesting a legitimate path to financial freedom, or is it a trap for unwary investors? This review analyzes the evidence to help you decide.

Regulatory Status and License Check

The primary reason for dbinvesting's low score is its regulatory environment. While the broker is not entirely unregulated, the quality of its license offers minimal protection for international clients.

The Offshore License Risk

dbinvesting (operated by DB Invest LIMITED) holds a license from the Seychelles Financial Services Authority (FSA) under regulation number SD053.

It is crucial to understand what “FSA Seychelles” regulation entails compared to top-tier regulators like the FCA (UK) or ASIC (Australia):

- Offshore Jurisdiction: The Seychelles is an offshore zone. Regulations there are generally looser, with lower capital requirements for brokers.

- Lack of Compensation Schemes: Unlike European regulators that mandate compensation funds (protecting client money if the broker goes bankrupt), offshore licenses rarely offer this safety net. If dbinvesting were to become insolvent, clients would likely have no recourse to recover their funds.

- Negative Balance Protection: Tier-1 regulators strictly enforce negative balance protection, ensuring you cannot lose more than you deposit. Offshore brokers often lack this mandatory enforcement, though dbinvesting claims to offer it, it is not strictly audited by a third party in the same way.

Because of this “Tier 2/3” regulatory status, the WikiFX system penalizes the score significantly. For a trader, this means you are trusting the company's goodwill rather than a strict legal framework.

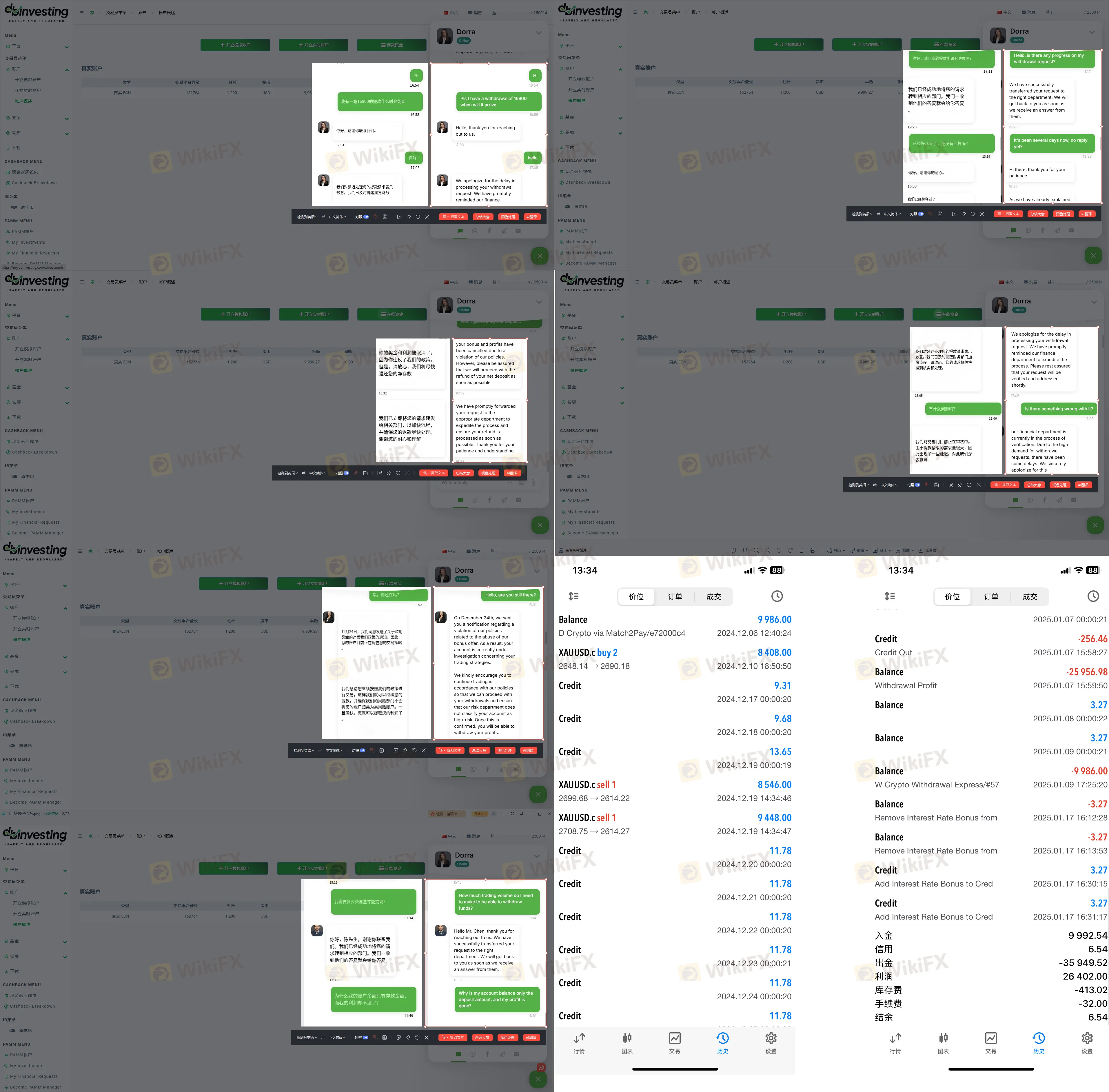

Exposure: What Users Are Saying

The most alarming aspect of dbinvesting is the recent influx of severe complaints in the WikiFX Exposure Center. While the broker has been established since 2020, reports from 2024 and 2025 paint a troubling picture of withdrawal obstructions and profit erasures.

The “Profit Erasure” Pattern

Multiple users have reported that dbinvesting allows deposits and trading, but when the account becomes profitable, the broker allegedly refuses withdrawals citing “policy violations.”

- The Hong Kong Case (January 2025): A user from Hong Kong reported depositing $9,986 and making profits. When they attempted to withdraw $16,900, the request was stalled. Eventually, the broker accused the user of “bonus abuse”—despite the user claiming standard trading behavior. The broker allegedly confiscated the profits and forced the user to settle for the initial deposit only.

The Jordan Case (July 2025): Another user reported that after funding their account and recovering from losses to earn a profit, large withdrawal requests were rejected. The broker cited vague reasons such as “AML reviews,” “scalping,” and “swap abuse,” eventually restricting the account without providing clear evidence of the violations.

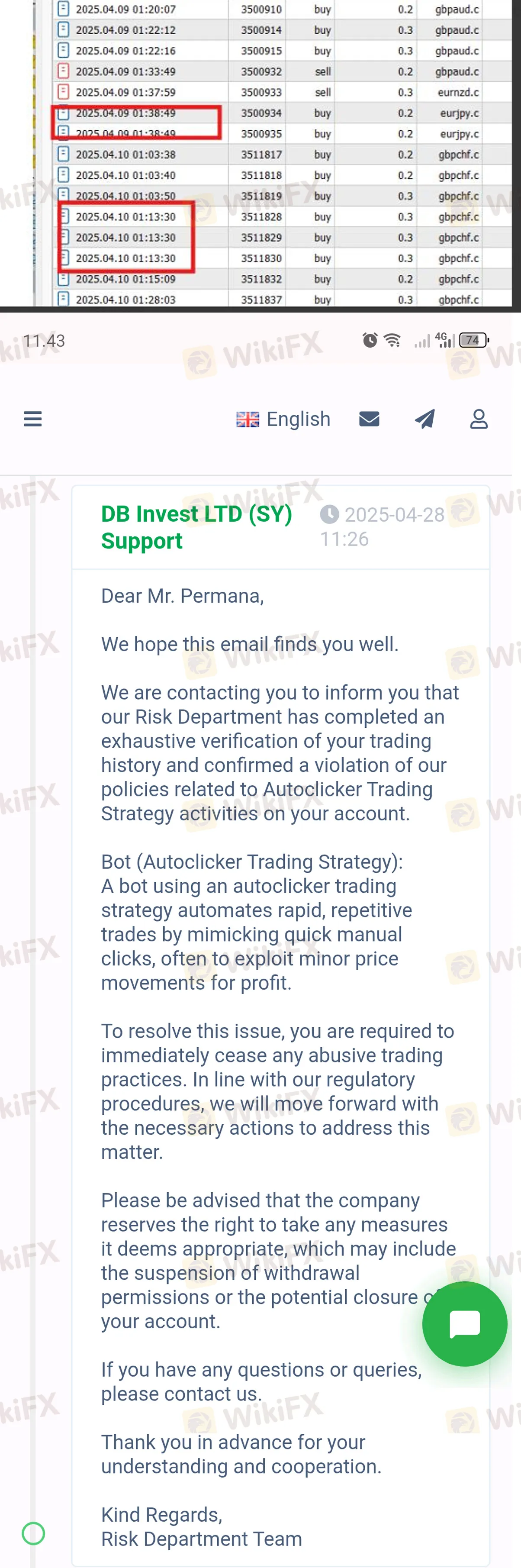

Usage of Bots and “Scalping” as Excuses

A complaint from Indonesia (May 2025) highlights a common tactic used by problematic brokers. The user was accused of using an “autoclicker bot” to trade. The user argued that common sense dictates a bot would drain a balance if not monitored, yet they were profitable. The broker used this accusation to wipe out all profits.

When a broker holds an offshore license, they are often the judge, jury, and executioner regarding these “trading violations.” There is no external ombudsman to verify if the user actually used a bot or if the personalized accusation was simply an excuse to deny a payout.

The Problem with “Positive” Reviews

It is worth noting that dbinvesting has some positive reviews online. However, Case 37 (March 2024) and Case 47 (January 2024) allege that the company incentivizes users to write positive reviews on platforms like Trustpilot and WikiFX in exchange for bonuses. This behavior casts doubt on the legitimacy of the praise the broker receives, suggesting the reputation may be artificially inflated.

Trading Conditions: Fees and Leverage

Aside from safety concerns, the trading conditions at dbinvesting are designed for high-risk trading, which often works against beginners.

- Excessive Leverage (1:1000): dbinvesting offers leverage up to 1:1000. While this allows traders to control large positions with small capital, it is mathematically dangerous. A tiny market movement against your position can wipe out your entire balance instantly. Top-tier regulators usually cap leverage at 1:30 to protect retail traders; 1:1000 is often a sign of a broker looking to profit from client losses (B-Book execution).

- Spreads: The broker advertises spreads “as low as 0.0” on raw accounts, but standard accounts see spreads starting around 1.0 pips. While competitive on paper, these conditions are irrelevant if withdrawals are not processed reliably.

- Platform: The broker uses MT5, which is excellent software. However, scams often use legitimate software to appear credible. The software itself is safe, but the backend administration is controlled by the broker.

Conclusion: Is dbinvesting Recommended?

Based on the data, the verdict is clear: dbinvesting involves a high level of risk and is NOT recommended.

The combination of a low WikiFX Score (2.13), an offshore regulatory license that offers weak protection, and a consistent pattern of complaints regarding “profit deduction” and “withdrawal blocking” makes this platform unsafe for your funds. The specific allegations regarding the fabrication of trading violations (like scalping or bot use) to deny withdrawals are classic warning signs of a “dealing desk” broker that does not intend to pay out successful traders.

Safety Verdict: High Risk / Avoid

Top-tier regulated brokers do not confiscate profits based on vague accusations of “bonus abuse.” To protect your capital, we strongly advise actively trading only with brokers regulated by authorities like the FCA (UK) or ASIC (Australia), where your rights are legally protected.

To check the live regulatory status of any broker and avoid potential scams, download the WikiFX App and search for the broker's current score before depositing.

WikiFX Broker

Latest News

Geopolitical Risk Spikes: Trump Floats 'Military Option' for Greenland Amid Venezuela Fallout

Is FXEM Legit or a Scam? 5 Key Questions Answered (2025)

Is USTmarkets Legit or a Scam? 5 Key Questions Answered (2025)

GMG Regulation: A Critical Warning on the Scam vs. the Regulated Broker

Commodity Super-Spike: Gold Nears $4,500 and Silver Tops $80 on Venezuela Shock and Tariff Fears

Merin Review (2025): Is it Safe or a Scam?

Oil Slide Deepens: Trump Secures 50M Barrels from Venezuela Following Regime Change

IG Boosts Cash Interest, Drops Account Fees for UK Investors

Revolutfx Review 2025: Institutional Audit & Risk Assessment

Gold Eyes $4,500 Milestone While Yen Crumbles Under Rate Disparity

Rate Calc