WikiFX Deep Dive Review: ExpertOption

Abstract:Reference to WikiFX records shows that **ExpertOption is a high-risk broker.** While the company has been operating since 2017 and has a popular trading app, the safety foundations are weak.

Broker Name: ExpertOption

WikiFX Score: 1.69 / 10 (High Risk)

Region: St. Vincent and the Grenadines

Regulation Status:Unregulated / Official Warning Issued

1. Quick Summary: Is ExpertOption Safe?

Reference to WikiFX records shows that ExpertOption is a high-risk broker. While the company has been operating since 2017 and has a popular trading app, the safety foundations are weak.

The WikiFX system gives ExpertOption a low score of 1.69 out of 10. This score indicates that the broker does not have valid protection for your money. Furthermore, financial regulators in Malaysia have issued a specific warning against this company.

Key Takeaways

- No Valid License: ExpertOption is not regulated by a major authority (like the FCA or ASIC).

- Official Warning: The Securities Commission of Malaysia (SCM) flagged this broker as “Unauthorized.”

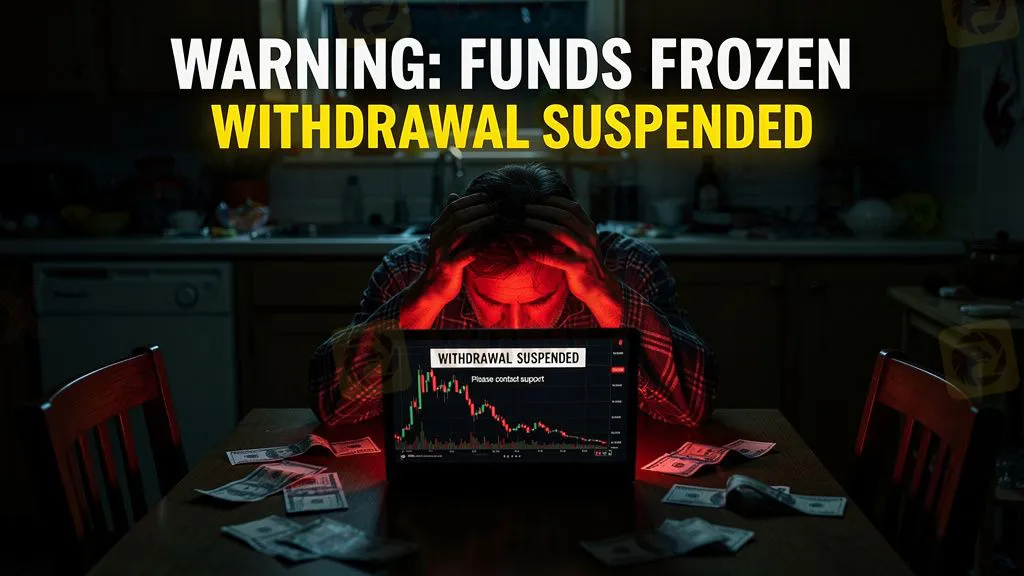

- Withdrawal Issues: Users report waiting months for payments that never arrive.

- Support Silence: Traders claim customer support ignores emails once problems begin.

2. Is the License Real? (Regulatory Check)

The most important step in choosing a broker is checking their license. A license means a government watches the broker to ensure they do not steal your money.

According to WikiFX database records, ExpertOption fails this test.

| Regulatory Authority | Country | License Type | Status |

|---|---|---|---|

| No Regulator | St. Vincent & the Grenadines | N/A | No License |

| Securities Commission Malaysia (SCM) | Malaysia | Investor Alert | Unauthorized / Warning |

What This Means For You

ExpertOption is registered in St. Vincent and the Grenadines. This is an offshore location that does not strictly regulate Forex or Option trading brokers. If the broker closes down or refuses to pay you, St. Vincent authorities cannot help you get your money back.

Additionally, the Malaysian Securities Commission (SCM) placed ExpertOption on its “Investor Alert List” in 2023. They stated the company is carrying out capital market activities without a license. This is a major red flag for investors globally, not just in Malaysia.

3. The Hidden Risk: Software

Most professional brokers use standard software like MetaTrader 4 (MT4) or MetaTrader 5 (MT5). These are trusted global systems.

ExpertOption uses “Self-Developed” (Proprietary) Software.

- The Risk: When a broker builds its own trading software, they control the data. It is difficult for an outside auditor to prove if the price charts are fair or if they are manipulated to make you lose.

- User Feedback: While some users find the app “easy to use” because it is simple, simplicity does not equal safety.

4. What Traders Say (Fact Check)

WikiFX has collected recent user reviews from 2024. While there are some positive comments about the app being “friendly,” there is a worrying pattern of serious financial complaints.

Problem 1: Unpaid Withdrawals

The biggest risk reported by traders is the inability to get money out of the platform. When users try to withdraw profits or their own capital, the process often stops.

Case Evidence: A user from Kazakhstan reported waiting three months for a payout. Wait times this long are highly unusual for a legitimate broker.

(User complaint: “I've been waiting for my money... for three months now... messages consistently ignored.”)

Problem 2: Account Access and Support

Other users report technical issues where they cannot even log in after registering. When they contact support for help, they receive no reply.

Case Evidence: Another trader recently reported being unable to receive login credentials after registration, with no help from the support team.

(User complaint: “Registration Puzzle... Silence from Support.”)

The “Positive” Reviews

It is fair to note that some users (specifically from Brazil and Malaysia) posted positive reviews in early 2024, praising the “easy interface.” However, investors should be careful. Scammers often pay for good experience in the beginning (small deposits) to encourage larger deposits later. A good app design does not excuse the failure to pay withdrawals.

5. Conclusion

Based on the evidence from the WikiFX database and recent user complaints, our analysis is clear.

Is ExpertOption Safe?NO.

- The broker has no valid regulation.

- They are on a government Warning List (Malaysia).

- Users are ignored when asking for their money.

The score of 1.69 suggests that your capital is at extreme risk. WikiFX advises investors to avoid ExpertOption and choose a broker with a score above 7.0 and a valid regulatory license.

WikiFX Risk Warning: Online trading involves significant risk and you may lose all of your invested capital. Please ensure that you understand the risks involved and take into account your level of experience and investment objectives.

Identities in complaints have been hidden for privacy.

Read more

Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

An in-depth look at a scalable fraud method in the forex sector, built on reusing the same website structure under different brand names.

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Singapore vs Malaysia: Who’s Winning the Scam War?

Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

TradingPro: Regulation, Licences and WikiScore Analysis

Weltrade Review: Safety, Regulation & Forex Trading Details

Pepperstone Analysis Report

Rate Calc