Copy-Paste Broker Scams: How Template Websites Are Used to Impersonate Regulated FX Firms

Abstract:An in-depth look at a scalable fraud method in the forex sector, built on reusing the same website structure under different brand names.

In the global forex industry, new trading websites appear almost daily. Many present themselves as established brokers, offering familiar products such as forex, CFDs, metals, and cryptocurrencies. At first glance, these platforms often look professional, complete with trading dashboards, market tables, and well-structured product pages.

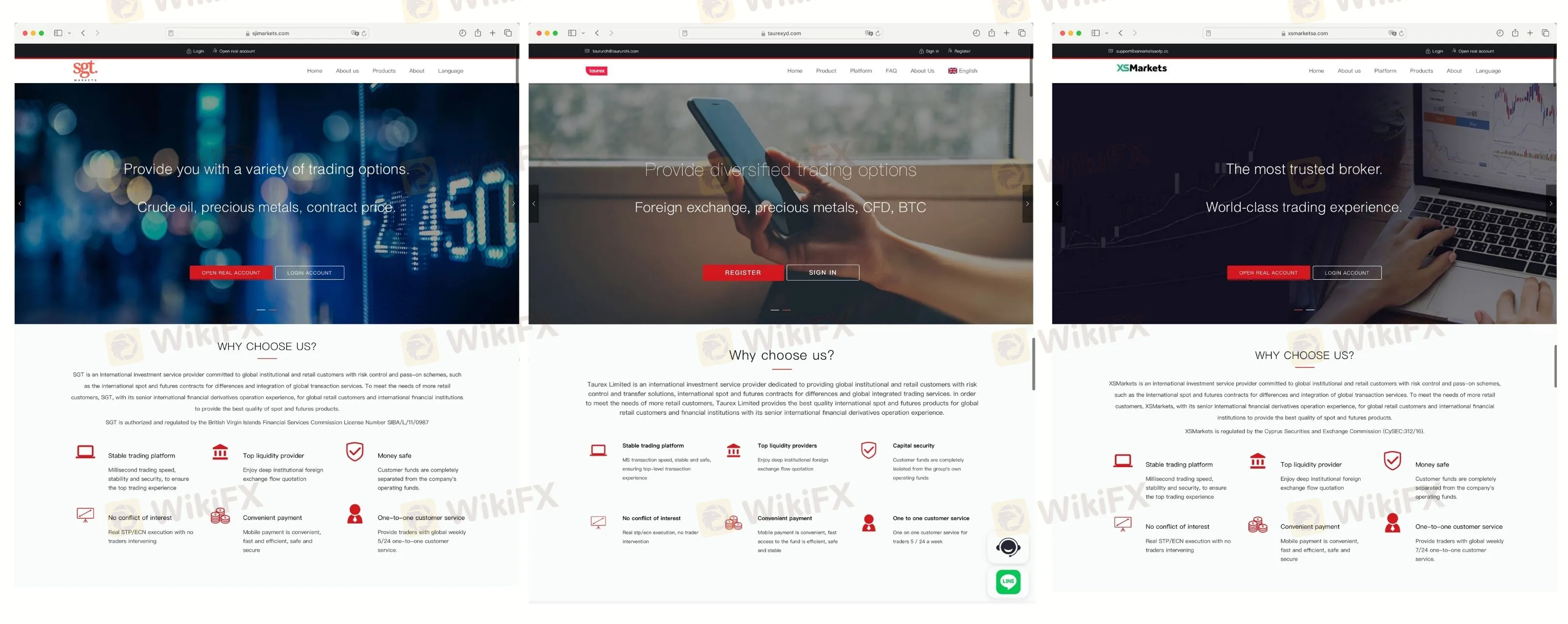

However, a closer comparison of several recently identified websites reveals a recurring and highly concerning pattern: the use of a single, reusable website template combined with borrowed broker logos and look-alike domain names.

Rather than building independent brokerage platforms, operators are deploying the same front-end structure again and again, swapping only the branding elements to create the illusion of legitimacy.

Three Websites, One Template

An examination of the following domains highlights this pattern clearly:

- sjimarkets.com, impersonating SGT Markets

- taurexyd.com, impersonating Taurex

- xsmarketsa.com, impersonating XSMarkets

Although each site claims to represent a different broker, their page layout, wording, and functional structure are almost identical.

Key similarities include:

- The same homepage layout and section order

- Identical promotional headlines and descriptive text

- Matching “Why Choose Us” sections with the same icons and copy

- The same product categories listed in the same sequence

- Reused stock imagery and trading screenshots

The only meaningful differences are the logo displayed at the top of the page and the domain name, which is designed to resemble that of a well-known, regulated broker.

Not High-Quality Imitation, but High-Efficiency Fraud

Importantly, these sites are not attempting to faithfully replicate the official websites of SGT Markets, Taurex, or XSMarkets.

Instead, they rely on a generic, widely reused forex website template that has appeared across many unlicensed platforms. This template already contains all the elements a retail trader expects to see — platform descriptions, product lists, account opening flows, and market tables.

Once the template is in place, the process becomes extremely simple:

- Insert a recognizable broker logo

- Choose a domain name that looks plausibly related

- Publish the site and begin promotion

Because the same structure can be reused endlessly, this method allows fraudulent operators to launch multiple “broker” brands quickly and at very low cost.

Why This Model Works in the FX Industry

The forex industry is particularly vulnerable to this approach.

Retail traders are accustomed to seeing similar website structures across legitimate brokers, as many regulated firms also rely on standardized design patterns and white-label solutions. This makes it harder for users to distinguish between a licensed broker and a cloned front-end at a glance.

For scammers, this creates a powerful advantage:

- No need for proprietary technology

- No need for licensed trading infrastructure

- No need for long-term brand building

The goal is not longevity, but speed — acquiring users before complaints or regulatory action catch up.

A Scalable, Repeatable Scam Pattern

What makes this tactic especially dangerous is its scalability.

Once one site is flagged or taken down, the same operators can simply:

- Register a new domain

- Replace the logo

- Relaunch the identical website under a new “broker” name

This cycle has already been documented repeatedly in the forex sector, where clusters of nearly identical platforms emerge within short timeframes, often targeting different regions simultaneously.

Why Structural Analysis Matters More Than Branding

Individually, a professional-looking website, a familiar logo, or a forex product list may not raise immediate suspicion. But when multiple platforms share:

- The same page architecture

- The same marketing language

- The same visual hierarchy

the risk becomes systemic rather than isolated.

In such cases, pattern recognition — comparing structure, text, and deployment timelines across platforms — becomes far more effective than evaluating any single site in isolation.

Final Observations

The cases of sjimarkets.com, taurexyd.com, and xsmarketsa.com illustrate a broader issue facing the forex industry: template-driven broker impersonation.

This is not about sophisticated one-off scams. It is about an industrialized process designed for rapid deployment, easy replacement, and minimal upfront cost.

As long as professional-looking templates and recognizable broker brands can be combined so easily, surface-level appearance will remain an unreliable indicator of legitimacy. Understanding how these platforms are built — not just how they look — is increasingly essential for anyone navigating todays online forex landscape.

Read more

Fidelity Exposure: Examining the Latest User Reviews on Withdrawal Denials & Trade Manipulation

Fidelity Investments has been grabbing attention of late for negative reasons. These include complaints concerning withdrawals, account closure without notice, technical glitches in trade order processing, and inept customer support service. As the complaints continue to grow, we prepared a Fidelity review article showcasing some of them. Read on as we share details.

ICE FX Review: Are Traders Raising Red Flags Over Withdrawal Fees & Regulation Status?

Does ICE FX ask you to pay taxes for fund withdrawal access? Were you made to pay a hefty fee on a verification failure? Does the broker deliberately cancel your profitable trades? Have you failed to receive assistance from the ICE FX customer support team on your fund deposit and withdrawal queries? These issues have become common for its traders. Many of them have highlighted these issues online. In this ICE FX review article, we have investigated some of their complaints. Read on as we dive deep.

Singapore vs Malaysia: Who’s Winning the Scam War?

Scams aren’t getting smarter — they’re getting more human. Even experienced investors are losing big money. Why does this keep happening in Malaysia while Singapore takes a different path?

VPS Review: Do Clients Face Trading Issues Due to Constant Login Errors?

Do you face numerous login errors with VPS, a Vietnam-based forex broker? Did these errors lead to missed opportunities or losses? Does your trading account often have an insufficient balance despite numerous trades on the VPS login? Does the broker compel you to renew your subscription even if it’s not required? These issues have become synonymous with many of its traders. They have highlighted these online. In this VPS review article, we have investigated these issues. Read on!

WikiFX Broker

Latest News

FxPro Broker Analysis Report

ACY SECURITIES Regulatory Status: A Complete Guide to Licenses, Warnings and Trader Issues

FBS Forex Scam Alert: High Complaint Ratio

ThinkMarkets Scam Alert: 83/93 Negative Cases Exposed

Exchange Rate Fluctuations: Key Facts Every Forex Trader Should Know

ACY Securities Deposit and Withdrawal: The Complete 2025 Guide (Fees, Methods & User Warnings)

US Industrial Production Surged In January

80% Plunge In Immigration Is Reshaping Labor Market Math, But AI Wildcard Looms: Goldman

MultiBank Group Analysis Report

Pepperstone Analysis Report

Rate Calc